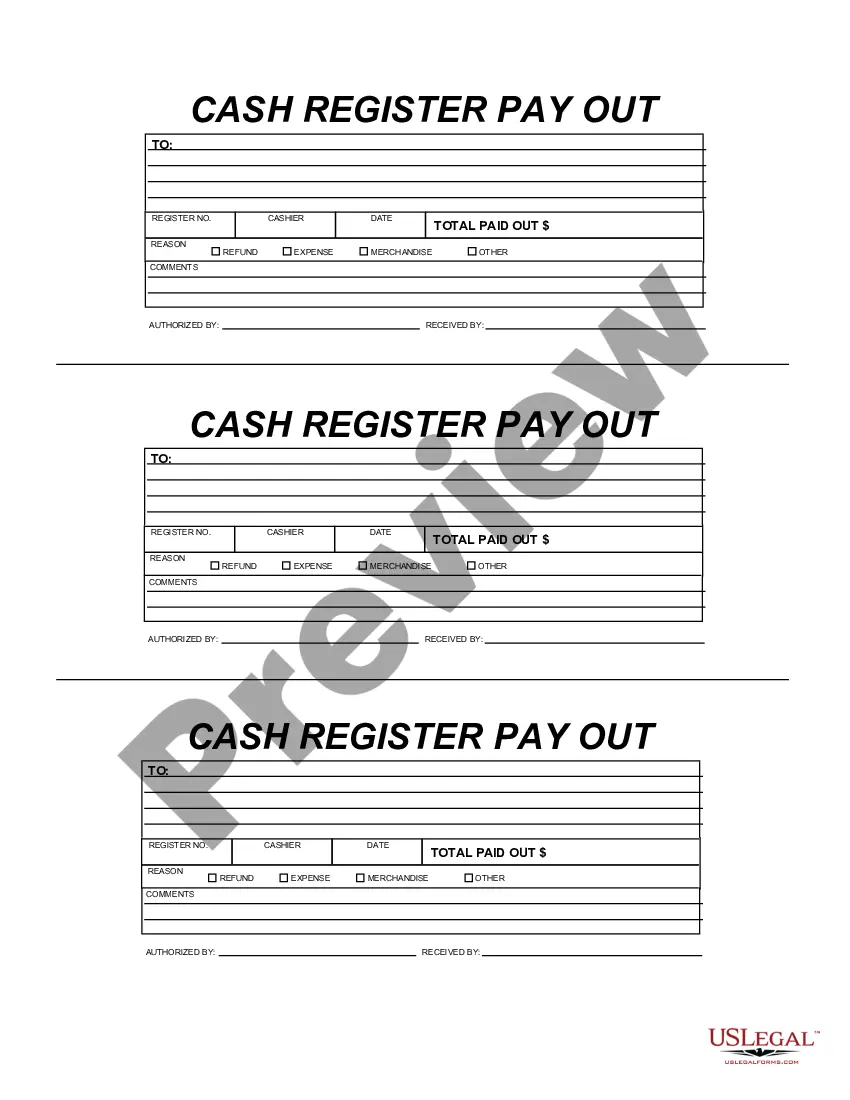

Delaware Cash Register Payout

Description

How to fill out Cash Register Payout?

Searching for the ideal legal document template can be quite challenging.

It goes without saying that there is a multitude of designs available online, but how do you pinpoint the legal version you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Delaware Cash Register Payout, which can serve business and personal purposes. All forms are vetted by experts and comply with federal and state regulations.

If the form does not suit your needs, use the Search field to locate the appropriate form. Once you are confident that the form is suitable, click the Get now button to obtain the form. Select the payment plan you desire and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Delaware Cash Register Payout. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Take advantage of the service to download professionally crafted documents that adhere to state regulations.

- If you are already a registered user, Log In to your account and click the Acquire button to obtain the Delaware Cash Register Payout.

- Use your account to search through the legal forms you have purchased previously.

- Navigate to the My documents section in your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are some straightforward steps for you to follow.

- First, ensure you have selected the correct type for your locality/state.

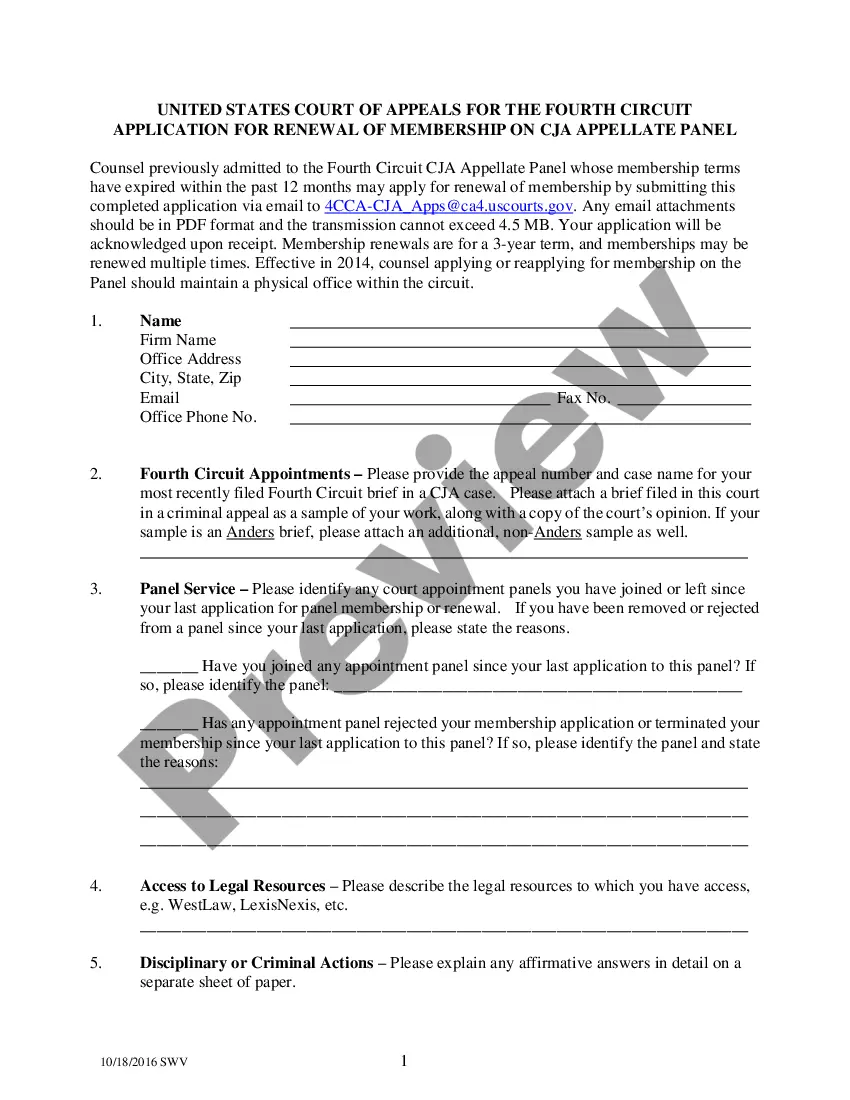

- You can browse the form using the Preview button and review the form description to ensure it is suitable for you.

Form popularity

FAQ

When referring to shares of stock in a Delaware company, Delaware par value is the bottom or lowest limit set to the value of a share of stock in a corporation. A share may not be bought, sold or traded for less than the par value.

The short answer is maybe. Surrendering accrued and unused vacation time to an employee who separates from your company, whether by choice or not, isn't a federal requirement, so there's no federal law that your company has to comply with.

Under Section 154 of the DGCL, statutory capital is determined as follows: (1) for par value stock, the par value of the consideration received for the issuance of such stock constitutes capital unless the Board determines that a greater amount of the consideration received for such stock shall constitute capital;

How to Make Stock AmendmentsHold an internal company meeting and have any changes approved by the company's appropriate authorities.Prepare a Certificate of Amendment for the Delaware Secretary of State's office.Have the document signed by an Authorized Officer of the company.File the certificate with the state.

No federal or state law in Delaware requires employers to pay out an employee's accrued vacation, sick leave, or other paid time off (PTO) at the termination of employment.

WebBenefits and TeleBenefits claims requested by a.m. Monday through Friday will normally be processed the same day. Benefits requested after a.m. Monday through Friday will normally be processed the next business day.

As a result, Delaware at some point allowed for corporations to be created without par value; and, in cases where a corporation does have a par value on its stock, that value is typically nominal (e.g. $0.00001).

Pursuant to the DGCL, the Reverse Stock Split Charter Amendment must be approved by a majority of the outstanding shares of our common stock, and therefore the Company elected to obtain stockholder approval of the Reverse Stock Split Charter Amendment by written consent of the stockholders.

Payout of vacation at termination. In such circumstances, earned vacation will generally be treated as wages pursuant to state wage payment and collection laws. In Delaware, vacation pay is considered a benefit or wage supplement.