Hawaii Triple Net Lease for Sale

Description

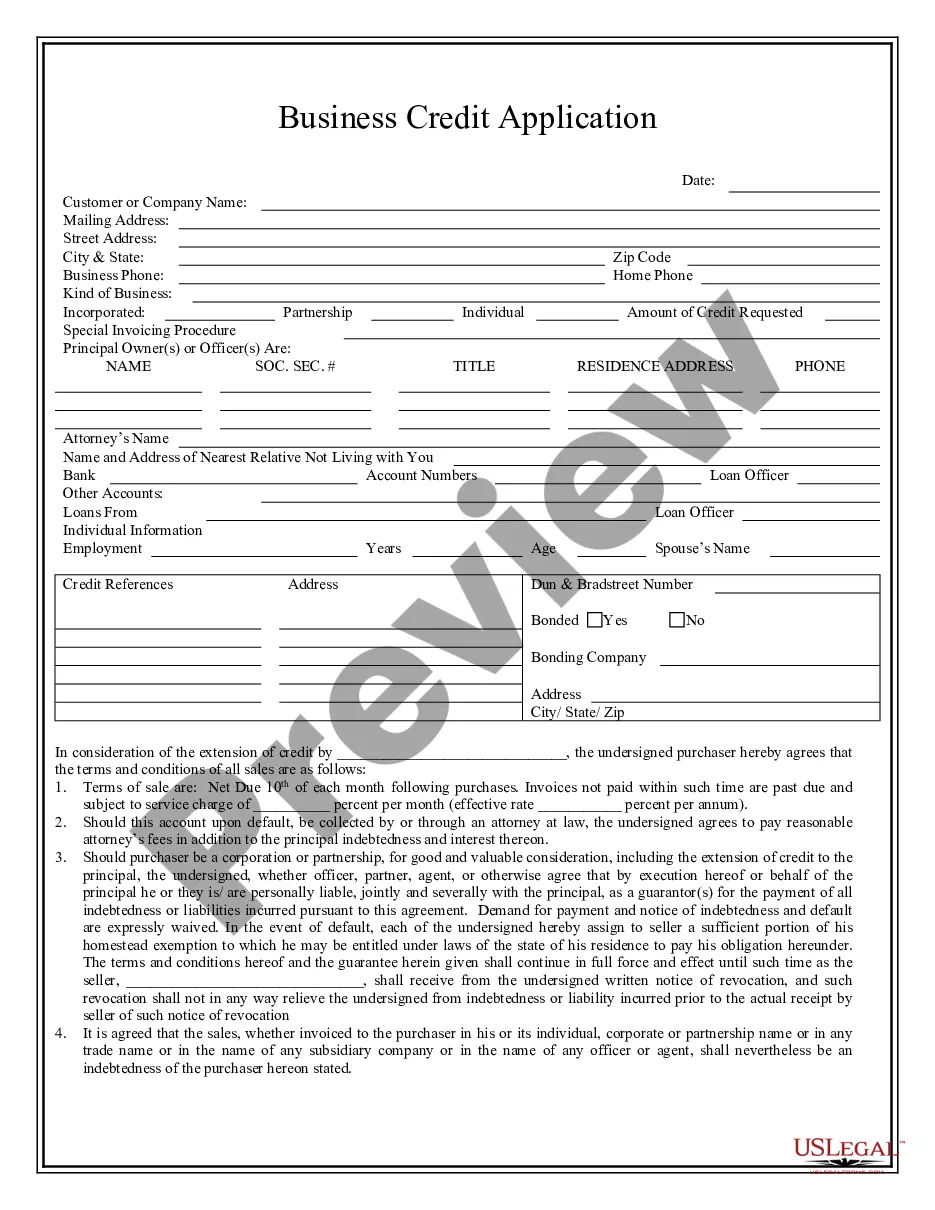

How to fill out Triple Net Lease For Sale?

You can spend hours online searching for the legal document format that meets the federal and state requirements you need.

US Legal Forms offers a wide array of legal documents that are evaluated by experts.

You can download or print the Hawaii Triple Net Lease for Sale from the service.

If available, utilize the Review button to browse through the document format as well. If you wish to obtain another version of the form, use the Search area to find the format that meets your needs and requirements. Once you have located the format you desire, click Buy now to proceed. Choose the pricing plan you wish, enter your details, and create your account on US Legal Forms. Complete the payment. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, and sign and print the Hawaii Triple Net Lease for Sale. Acquire and print numerous document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can sign in and click the Acquire button.

- Then, you can complete, modify, print, or sign the Hawaii Triple Net Lease for Sale.

- Every legal document format you purchase is yours indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document format for the state/city of your choice.

- Review the document description to confirm that you have selected the appropriate format.

Form popularity

FAQ

Valuing a triple net lease requires a comprehensive approach that considers factors like location, tenant creditworthiness, and lease terms. It's essential to analyze comparable properties to assess market rental rates. If you are exploring a Hawaii Triple Net Lease for Sale, leveraging resources from platforms like uslegalforms can provide valuable insights and tools to guide your valuation process.

To structure a triple net lease effectively, you need to outline the obligations of the tenant regarding property taxes, insurance, and maintenance. Clearly defining these responsibilities helps create a smooth landlord-tenant relationship. In the case of a Hawaii Triple Net Lease for Sale, it’s wise to include clauses that protect both interests and clarify ongoing costs to ensure mutual understanding.

Structuring an NNN lease involves clearly defining the responsibilities of both the landlord and tenant. Be sure to outline the base rent, additional expenses, and the length of the lease. When considering a Hawaii Triple Net Lease for Sale, including terms for property upkeep and any potential rent adjustments can make the lease more favorable for both parties.

A typical triple net lease includes costs such as property taxes, insurance, and maintenance. This means that the tenant takes on these responsibilities in addition to the base rent. If you are interested in a Hawaii Triple Net Lease for Sale, it’s essential to review the lease details to see what specific expenses are included to avoid any surprises.

Calculating a triple net lease involves adding the base rent to the estimated expenses such as taxes, insurance, and maintenance. It's crucial to review the lease terms to identify what expenses the tenant is responsible for. For those considering a Hawaii Triple Net Lease for Sale, be sure to consider market rates and potential income from the property to determine a fair lease amount.

To calculate the NNN, or triple net lease, you need to assess the total property expenses that the tenant will cover. Typically, this includes property taxes, insurance, and maintenance costs. For a Hawaii Triple Net Lease for Sale, you can calculate these expenses annually and divide by the lease term to determine the monthly payment. Make sure to factor in any fluctuations in costs during the lease period to ensure accuracy.

To get a triple net lease, start by identifying properties that suit your business needs and fit within your budget. Once you've located potential properties, reach out to landlords or real estate agents who specialize in commercial properties. Be prepared to negotiate terms and thoroughly review the lease details to ensure they align with your expectations. Utilizing platforms like uslegalforms can simplify the process of securing a Hawaii Triple Net Lease for Sale that meets your criteria.

To get approved for a triple net lease, you typically need to demonstrate financial stability and reliability to landlords. Prepare your financial documents, such as tax returns and bank statements, to showcase your ability to cover rent and associated expenses. Additionally, presenting a solid business plan can help reassure landlords of your commitment. Resources like uslegalforms can assist in finding a Hawaii Triple Net Lease for Sale that meets your requirements and improves your chances of approval.

Negotiating a triple net lease involves understanding both parties' needs and goals. It's essential to review the lease terms carefully, ensuring they align with your business plan and budget. Consider discussing property expenses you find excessive, seeking adjustments or caps on certain costs. Remember, a clear communication line with the landlord can lead to a mutually beneficial agreement, especially when exploring Hawaii Triple Net Lease for Sale options.

A tenant may choose a triple net lease for several reasons. First, it often allows for lower base rent since tenants assume responsibility for property expenses such as taxes, insurance, and maintenance. This can create a more predictable monthly budget for businesses. Additionally, tenants may appreciate the control they have over property management and maintenance, making it easier to tailor the space to their specific needs.