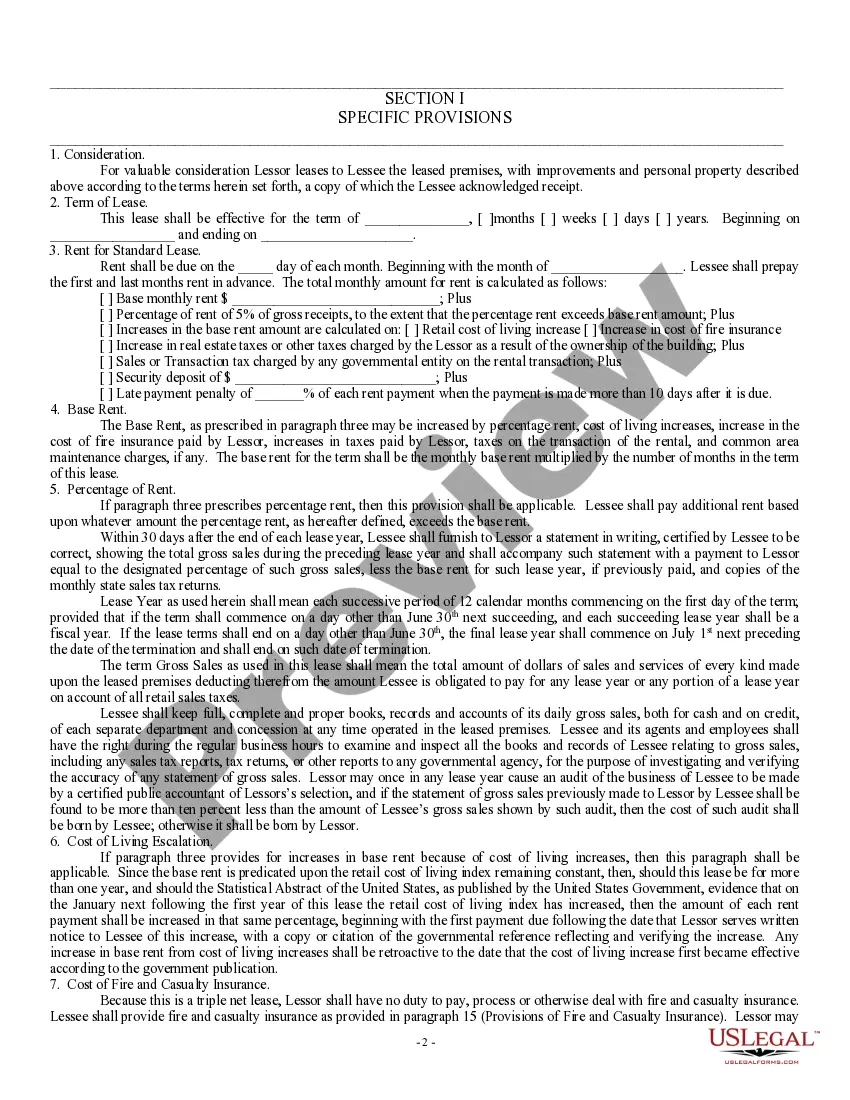

Hawaii Triple Net Lease for Commercial Real Estate

Description

How to fill out Triple Net Lease For Commercial Real Estate?

You may spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal forms that can be reviewed by professionals.

You can download or print the Hawaii Triple Net Lease for Commercial Real Estate from the service.

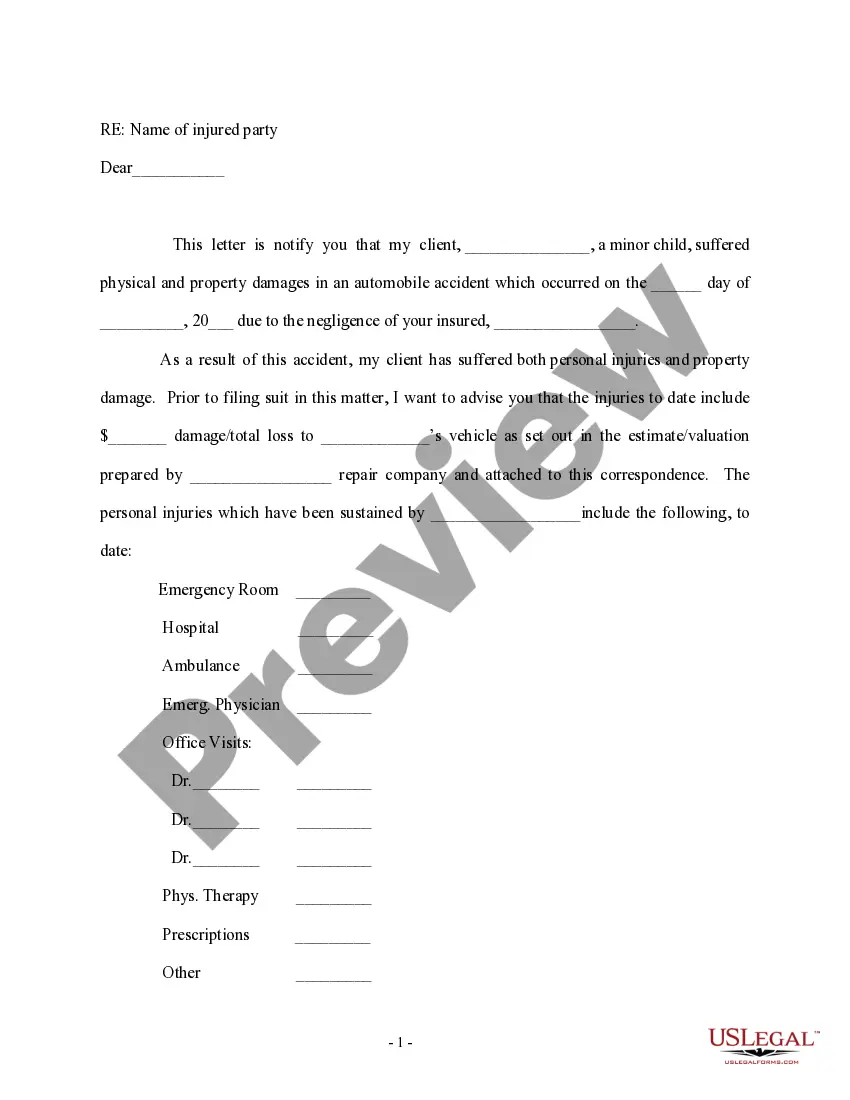

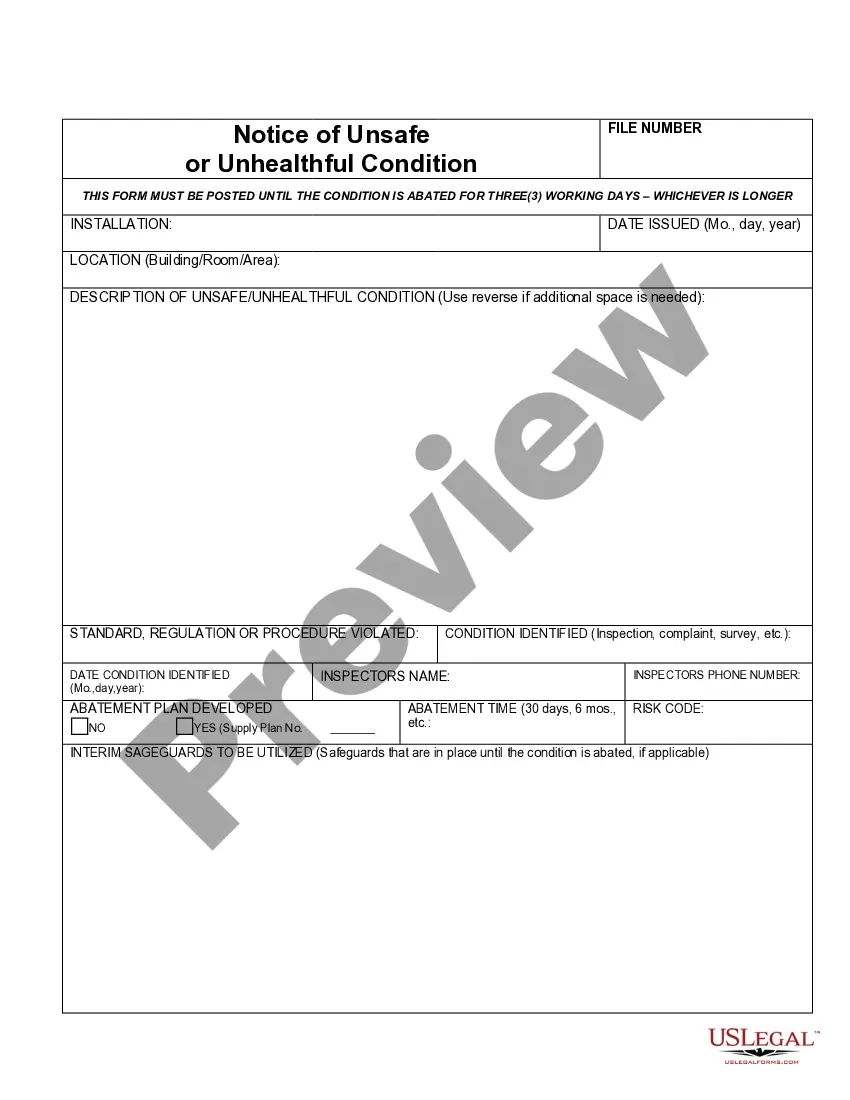

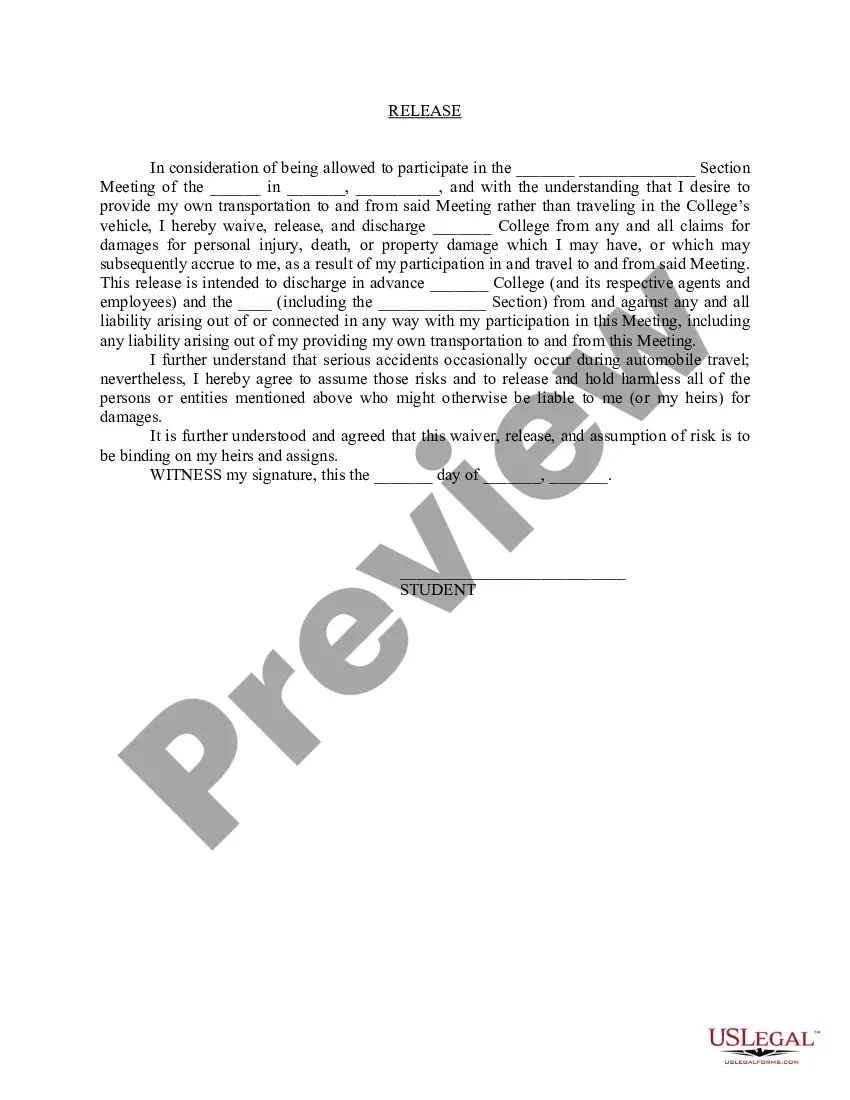

If available, utilize the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you may complete, edit, print, or sign the Hawaii Triple Net Lease for Commercial Real Estate.

- Each legal document template you receive is yours indefinitely.

- To obtain another copy of any purchased template, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document template for the county/area that you choose.

- Review the template details to confirm you have chosen the right form.

Form popularity

FAQ

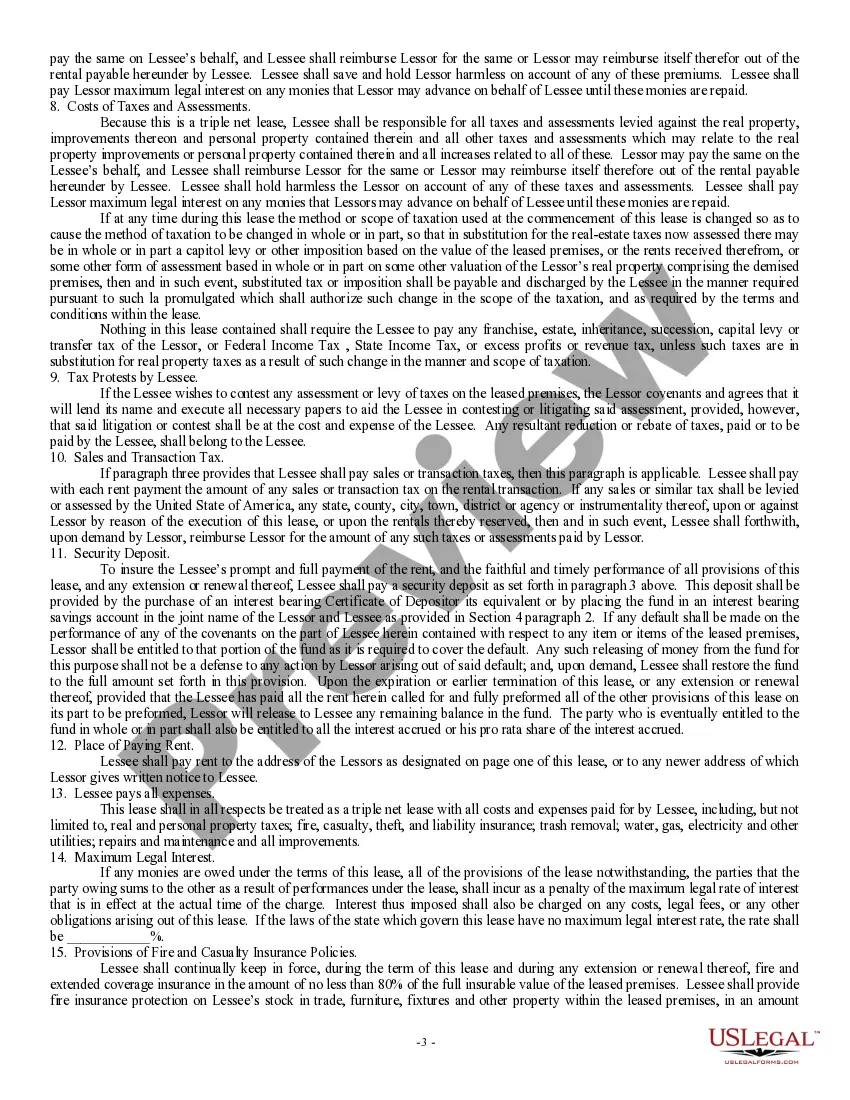

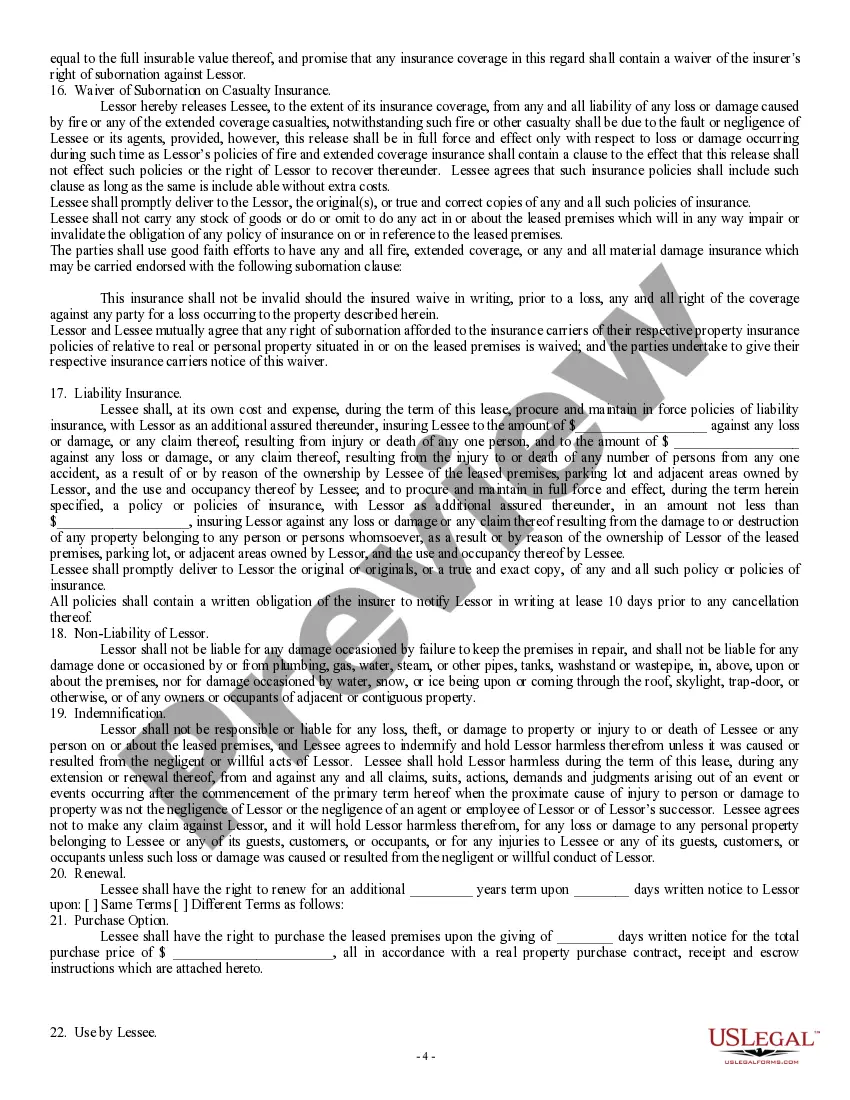

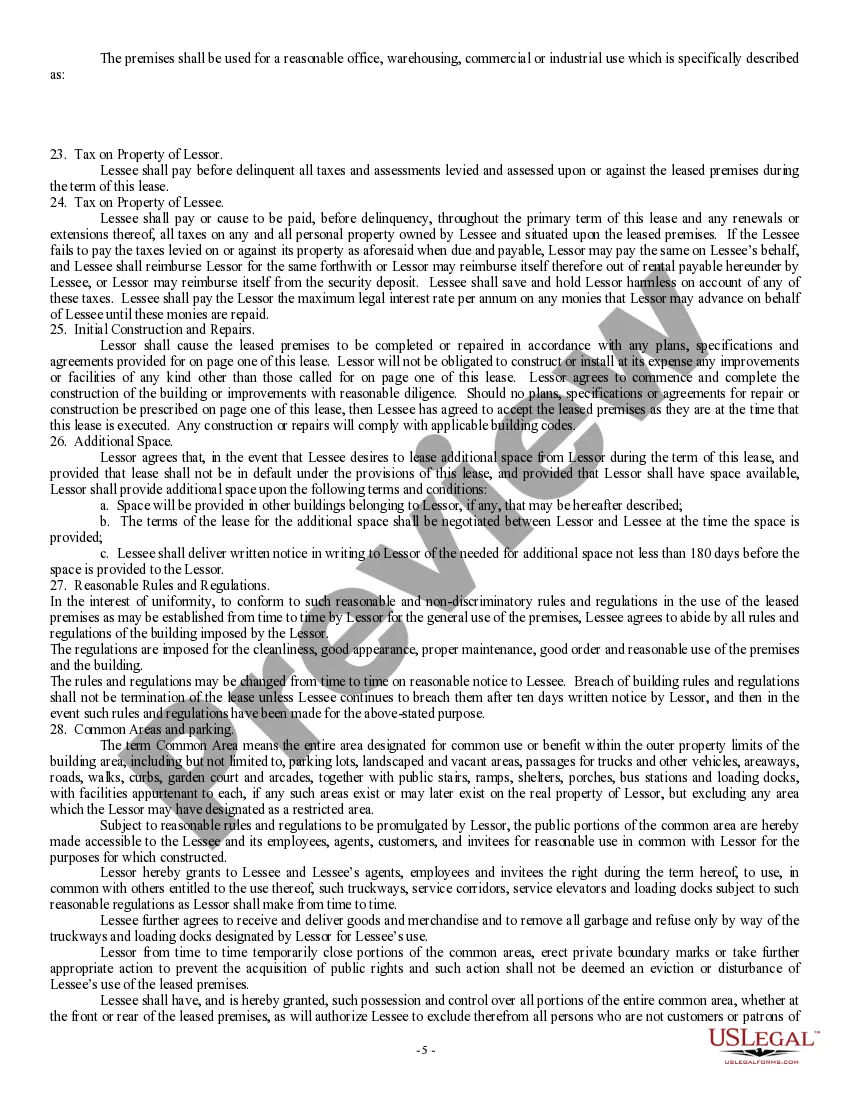

The most common type of commercial lease is the triple net lease, especially in the Hawaii Triple Net Lease for Commercial Real Estate market. This lease structure allows landlords to pass on specific expenses to tenants, creating a predictable income stream. Understanding different lease types helps you choose the best option for your financial goals. If you need guidance, uslegalforms offers resources to help clarify your choices.

Yes, many commercial leases are structured as triple net leases. The Hawaii Triple Net Lease for Commercial Real Estate is popular among landlords because it minimizes their expenses and shifts responsibility to the tenant. This structure can lead to lower vacancy rates and more stable income streams for property owners. Always review the lease terms to ensure you understand your commitments.

A Hawaii Triple Net Lease for Commercial Real Estate can have significant tax implications for both landlords and tenants. Tenants typically pass property taxes, insurance costs, and maintenance responsibilities directly to them. This can lead to lower taxable income for landlords, while tenants may need to adjust their budgeting to account for these additional expenses. Consulting a tax professional can guide you through the nuances.

NNN stands for 'net, net, net' in a commercial lease context. In a Hawaii Triple Net Lease for Commercial Real Estate, this means that the tenant is responsible for paying three different types of expenses: property taxes, insurance, and maintenance costs, in addition to the base rent. By understanding these terms, landlords and tenants can negotiate better lease agreements. Knowing what NNN entails helps you make informed decisions.

To calculate commercial rent in a Hawaii Triple Net Lease for Commercial Real Estate, start with the base rent and add the estimated nnn fees. Divide the total by the rentable square footage to find a per-square-foot rate. Make sure to regularly review actual expenses against estimates to adjust your budget effectively. Use our USLegalForms tools to simplify this process and generate accurate financial documents.

Operating expenses in a Hawaii Triple Net Lease for Commercial Real Estate typically include property taxes, property insurance, and maintenance costs. These expenses can vary significantly, depending on the property type and location. Being aware of these operating costs will assist you in budgeting effectively. For comprehensive insights, check out our templates on the USLegalForms platform, designed to clarify these details.

While a Hawaii Triple Net Lease for Commercial Real Estate can offer lower base rent, it does come with certain disadvantages. Tenants may face rising operating expenses, which can fluctuate unpredictably. Additionally, as a tenant, the burden of maintenance and repairs falls on you, which may add stress and financial uncertainty. Educating yourself about these factors is essential, and resources are available on USLegalForms to help navigate lease terms.

The three main types of commercial leases are gross leases, modified gross leases, and triple net leases. In a Hawaii Triple Net Lease for Commercial Real Estate, tenants assume more responsibility for expenses, unlike in gross leases, where landlords cover most costs. Each lease type has its benefits, so it's crucial to choose one that aligns with your financial strategy. Our platform offers leasing templates to assist you in making an informed decision.

A tenant might choose a Hawaii Triple Net Lease for Commercial Real Estate because it often results in lower base rent compared to gross leases. This arrangement provides more control over property management and operational costs, allowing businesses to tailor their expenses. Additionally, tenants can directly manage maintenance and repair, ensuring that the property aligns with their standards. Overall, a triple net lease can lead to a more predictable and manageable financial commitment.

To get approved for a Hawaii Triple Net Lease for Commercial Real Estate, demonstrate your financial stability and business plan to potential landlords. Prepare documents such as credit reports, tax returns, and bank statements that showcase your ability to meet lease obligations. It's also beneficial to establish a solid rental history, as this can enhance your credibility as a tenant. Consider working with uslegalforms to streamline the application process and ensure compliance with all legal requirements.