Delaware Sample Letter for Authorization for Late Return

Description

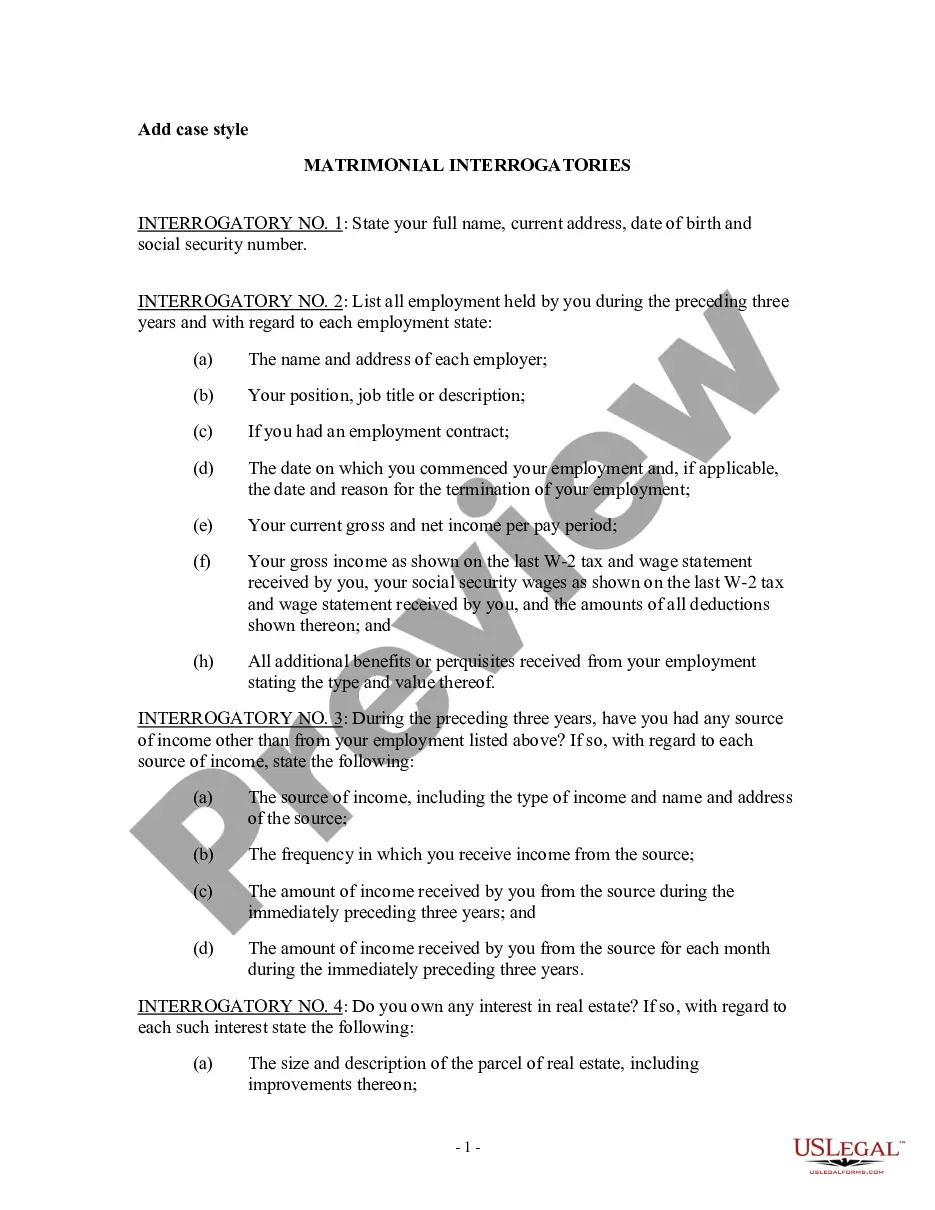

How to fill out Sample Letter For Authorization For Late Return?

Are you currently in a situation where you need documents for perhaps business or personal activities on a daily basis.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Delaware Sample Letter for Authorization for Late Return, which can be tailored to fulfill state and federal requirements.

Select the pricing plan you would like, complete the required information to create your account, and make your purchase using PayPal or Visa or Mastercard.

Choose a convenient file format and download your copy. You can find all the document templates you have acquired in the My documents section. You can retrieve another copy of the Delaware Sample Letter for Authorization for Late Return whenever necessary. Just select the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides properly designed legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Delaware Sample Letter for Authorization for Late Return template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Identify the form you need and ensure it corresponds to the correct city/county.

- Use the Preview button to review the form.

- Check the description to make sure you have picked the right form.

- If the form is not what you are seeking, use the Search field to find the form that fits your needs and criteria.

- When you find the appropriate form, click Get now.

Form popularity

FAQ

If your business operates as a corporation in Delaware, you are indeed required to file a corporate tax return. This ensures you meet state tax obligations and avoid penalties. Should you need to file late, a Delaware Sample Letter for Authorization for Late Return can guide you through the necessary explanations. This tool can be a valuable asset for maintaining clarity in your tax affairs.

A corporation typically must file a tax return each year, regardless of profit or loss. This is crucial for maintaining good standing with state and federal authorities. If you encounter situations where filing is delayed, a Delaware Sample Letter for Authorization for Late Return can effectively explain your delay. This approach can help demonstrate your commitment to compliance.

Yes, if you earn income in Delaware, you are typically required to file a tax return. This applies to individuals as well as businesses operating in the state. In cases where a late filing is necessary, a Delaware Sample Letter for Authorization for Late Return can provide a formal explanation for your delay. This letter can help facilitate your communication with tax officials.

To be considered a resident of Delaware, you generally need to live in the state for at least six months. Residency can affect your tax obligations and legal rights. If you need to establish residency quickly, a Delaware Sample Letter for Authorization for Late Return can assist in clarifying your intent or addressing specific needs. This can be useful for those moving for work or personal reasons.

Yes, a Delaware corporation is required to file a tax return, regardless of where it conducts business. Filing ensures compliance with Delaware tax laws and can be essential for maintaining your corporate status. If you need to file late, consider using a Delaware Sample Letter for Authorization for Late Return to explain your situation. This letter can help you communicate effectively with tax authorities.

Delaware does not provide an automatic extension for individual tax returns. Therefore, if you believe you will need more time, it is wise to submit a Delaware Sample Letter for Authorization for Late Return. By doing this, you formally signal your request for an extension, helping you stay compliant while you prepare your paperwork.

Yes, Delaware imposes a state income tax on residents and businesses. If you encounter challenges meeting the deadline, a Delaware Sample Letter for Authorization for Late Return can be useful. This letter not only aids in requesting extra time, but it also clarifies your intentions to fulfill your tax responsibilities.

Yes, businesses operating in Delaware must file a corporate tax return annually. If your business requires a filing extension, using a Delaware Sample Letter for Authorization for Late Return can streamline this process. This letter can help in formally requesting additional time to ensure thorough and accurate submissions.

In Delaware, the penalty for late tax filing can involve fines and interest on the amount due. If you anticipate a delay, it's advisable to consider submitting a Delaware Sample Letter for Authorization for Late Return. Taking this step can demonstrate your intent to comply and may reduce potential penalties.

Several states offer extended tax deadlines under specific conditions. However, if you find yourself needing more time to file in Delaware, consider using a Delaware Sample Letter for Authorization for Late Return. This letter may assist you in securing additional time and can ease concerns about missing deadlines.