Delaware Sample Letter for Return Authorization

Description

How to fill out Sample Letter For Return Authorization?

You can devote hours online searching for the legal document template that fulfills the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that are vetted by professionals.

You can download or print the Delaware Sample Letter for Return Authorization from my service.

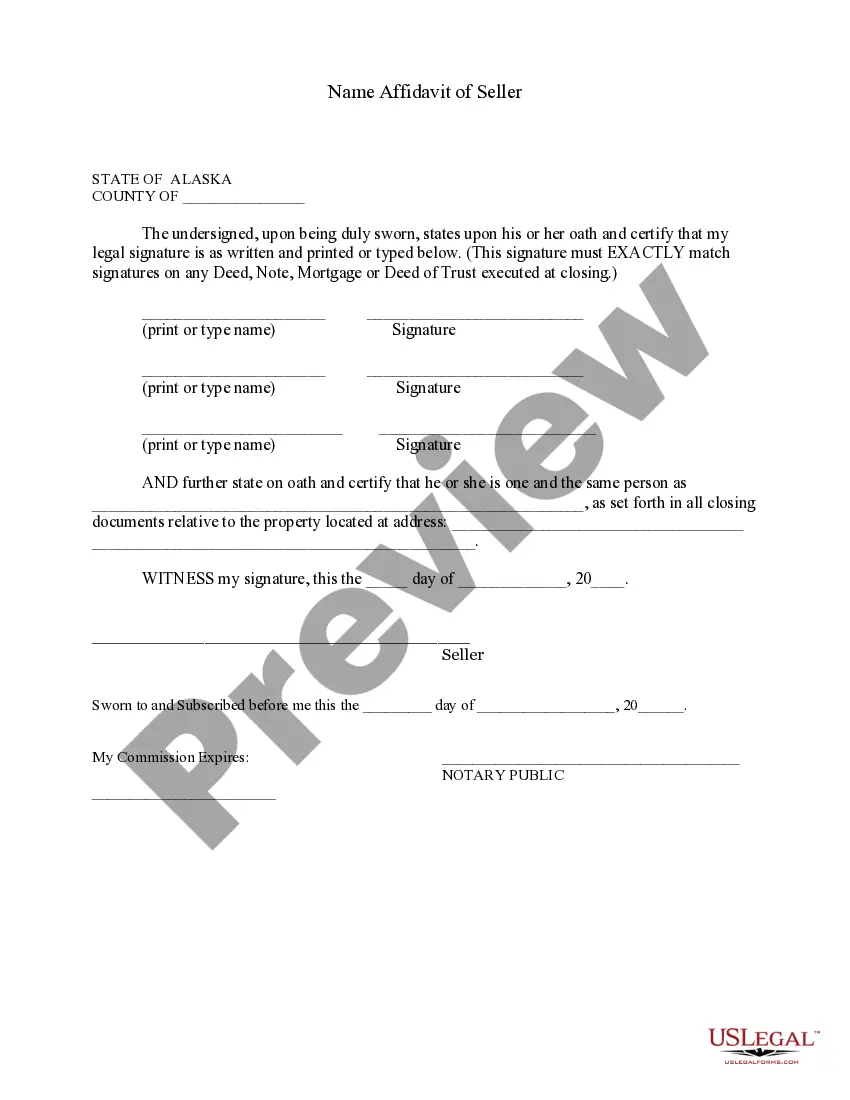

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you may Log In and then click the Obtain button.

- After that, you can fill out, modify, print, or sign the Delaware Sample Letter for Return Authorization.

- Every legal document template you purchase belongs to you indefinitely.

- To get an additional copy of any purchased form, visit the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the easy instructions provided below.

- First, ensure you have selected the appropriate document template for your region/city that you choose.

- Check the form description to confirm you have selected the correct one.

Form popularity

FAQ

Modified Delaware source income refers to the income generated from sources within Delaware that has been adjusted to comply with specific tax regulations. For those dealing with return authorization matters, understanding this concept is crucial. Utilizing a Delaware Sample Letter for Return Authorization can help clarify your obligations to the state. You can find templates and guidance on managing such income effectively through the US Legal Forms platform.

To establish residency in Delaware, you generally need to live in the state for at least 183 days during the year. This duration allows you to qualify for in-state benefits, including specific tax exemptions. If you recently moved, a Delaware Sample Letter for Return Authorization can serve to address your residency status. It’s a helpful tool to confirm your intention to remain in the state for tax purposes.

Filing a tax return is often required, depending on your income level and filing status. If you earn income in Delaware, you may need to submit a tax return, even if it's a simple one. Using a Delaware Sample Letter for Return Authorization can help streamline this process. By clearly outlining your intent, you can ensure compliance with Delaware tax laws and avoid penalties.

If you have income sourced from Delaware or operate a business in the state, you are generally required to file a Delaware tax return. This obligation applies to both residents and non-residents depending on the income earned. Failing to file can result in penalties, so it’s best to stay informed about your responsibilities. For assistance with your filings, consider using a Delaware Sample Letter for Return Authorization to streamline your communication with tax authorities.

Form 5403 is the Delaware state tax form used for the application of a tax credit for various types of businesses. This form is essential for companies seeking to apply specific credits that can reduce their tax liabilities. It is crucial to fill out this form accurately to maximize potential benefits. To help you in this process, you might find that a Delaware Sample Letter for Return Authorization can clarify your request for credits.

Delaware tax forms can be accessed conveniently on the Delaware Division of Revenue's website. Here, you will find forms for various tax purposes, including personal income tax, business taxes, and more. You can download the forms directly or submit some of them electronically. If you are unsure about which form to use, a Delaware Sample Letter for Return Authorization can provide a basis for your request for assistance.

To obtain a letter of good standing from the state of Delaware, you must request it through the Division of Corporations. This letter confirms that your business is compliant with state regulations and is current on its filings and fees. You can make a request online or via mail, providing necessary details about your business. Using a Delaware Sample Letter for Return Authorization could streamline your request process where applicable.

A certificate of conversion is a legal document that allows a business entity to change its legal structure under Delaware law. For example, a corporation can convert to a limited liability company or vice versa. This process ensures that all legal rights and obligations are preserved during the transition. If you need guidance on this, consider using a Delaware Sample Letter for Return Authorization to authorize any necessary changes.

All corporations formed in Delaware must file franchise tax, regardless of where they conduct business. This requirement applies not just to active entities but also to those that are inactive. To simplify the process and ensure compliance, you can reference a Delaware Sample Letter for Return Authorization.

Delaware offers an efile option for individuals and businesses to submit their tax returns electronically. This method is convenient and helps expedite processing. Utilizing a Delaware Sample Letter for Return Authorization can enhance your efiling experience and ensure compliance with state requirements.