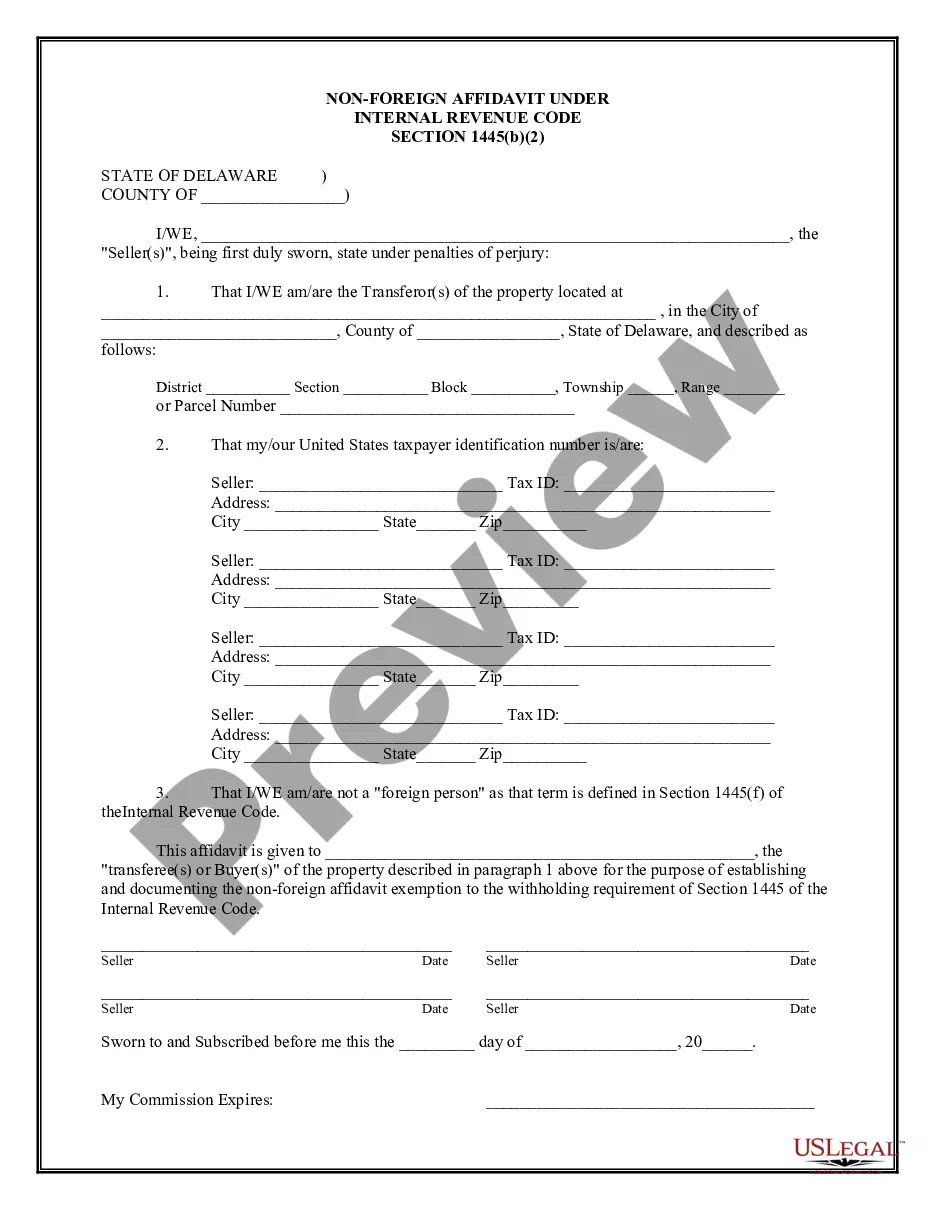

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Delaware Non-Foreign Affidavit Under IRC 1445

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Non-Foreign Affidavit Under IRC 1445?

The greater amount of documentation you need to produce - the more anxious you become.

You may find a vast selection of Delaware Non-Foreign Affidavit Under IRC 1445 forms online, yet you are unsure which ones to trust.

Eliminate the trouble and simplify locating samples with the help of US Legal Forms.

Click Buy Now to initiate the registration process and select a pricing plan that aligns with your needs. Provide the required information to create your account and settle your order using your PayPal or credit card. Choose a convenient file format and obtain your sample. Locate each sample you receive in the My documents section. Simply visit there to complete a new version of your Delaware Non-Foreign Affidavit Under IRC 1445. Even when working with professionally prepared templates, it remains essential to consider consulting your local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- Obtain expertly drafted documents that are written to comply with state regulations.

- If you already possess a US Legal Forms account, sign in to your profile, and you'll discover the Download option on the page for Delaware Non-Foreign Affidavit Under IRC 1445.

- If you haven't utilized our service before, follow these steps to register.

- Ensure the Delaware Non-Foreign Affidavit Under IRC 1445 is applicable in your jurisdiction.

- Confirm your choice by reviewing the overview or by using the Preview feature if available for the selected file.

Form popularity

FAQ

FIRPTA section 1445, also known as the Foreign Investment in Real Property Tax Act, governs the tax implications for foreign sellers of U.S. real estate. When a foreign person sells property in the United States, they may be subject to withholding taxes to ensure that tax obligations are met. The Delaware Non-Foreign Affidavit Under IRC 1445 allows certain sellers to avoid withholding if they meet specific criteria. By filing this affidavit, qualifying sellers can confirm their non-foreign status, facilitating a smoother transaction and minimizing tax complications.

Form 8288 is prepared by the withholding agent, usually the purchaser or their representative. This form is necessary to report and remit the FIRPTA withholding to the IRS. Providing the Delaware Non-Foreign Affidavit Under IRC 1445 along with Form 8288 can streamline the process. It’s advisable to seek assistance from a professional, such as those available on uslegalforms, to ensure accurate completion.

The FIRPTA certificate is usually signed by the seller, affirming their status as either a foreign or a non-foreign person. This document may also require a witness or notary, especially in the case of the Delaware Non-Foreign Affidavit Under IRC 1445. The signature attests to the validity of the information presented, protecting both parties in the transaction. Make sure to keep a copy for your records.

foreign person affidavit is a declaration that confirms a seller's U.S. person status, thus exempting them from FIRPTA provisions. This document typically includes the Delaware NonForeign Affidavit Under IRC 1445 and serves to protect the purchaser from unnecessary tax withholding. Providing this affidavit is essential for a smoother real estate transaction. Always ensure its accuracy to avoid future complications.

The seller or their legal representative typically provides the FIRPTA affidavit. This document should outline the seller's foreign status and include the Delaware Non-Foreign Affidavit Under IRC 1445 if applicable. It serves as a declaration that helps to determine the withholding requirements for the purchaser. Make sure to obtain this document early in the transaction process to avoid delays.

To file FIRPTA withholding, the withholding agent must submit Form 8288 to the IRS along with the payment for the amount withheld. This process may also require you to include the Delaware Non-Foreign Affidavit Under IRC 1445 to confirm the non-foreign status of the seller. Completing this step accurately ensures compliance with federal tax obligations. Using resources from platforms like uslegalforms can help simplify the submission of these forms.

Yes, a FIRPTA affidavit generally needs to be notarized for it to be considered valid. The notary's role is to verify the identity of the signer, ensuring the accuracy of the Delaware Non-Foreign Affidavit Under IRC 1445. Notarization adds a layer of protection against fraud, making it essential for a smooth transaction. Always check local requirements as some states may have specific nuances.

The foreign person affidavit is crucial because it protects the purchaser from potential tax liabilities related to the property sale. By obtaining the Delaware Non-Foreign Affidavit Under IRC 1445, purchasers can confirm that the seller is not subject to FIRPTA withholding obligations. This clarity can save the purchaser significant financial responsibility in the future. Without it, the purchaser may face unexpected tax consequences.

The FIRPTA affidavit is typically prepared by the seller or the seller's attorney. If the seller is a foreign person, they must provide the Delaware Non-Foreign Affidavit Under IRC 1445 to prove their status. This document ensures that the purchaser complies with tax withholding regulations. Utilizing a platform like uslegalforms can streamline this process for you.

A nonresident certificate indicates an individual's status as a nonresident alien with respect to U.S. taxes. It is vital for determining taxation policies for foreign individuals involved in property transactions. Understanding how this relates to the Delaware Non-Foreign Affidavit Under IRC 1445 can prevent potential complications. For assistance in generating this certificate, consider visiting uslegalforms.