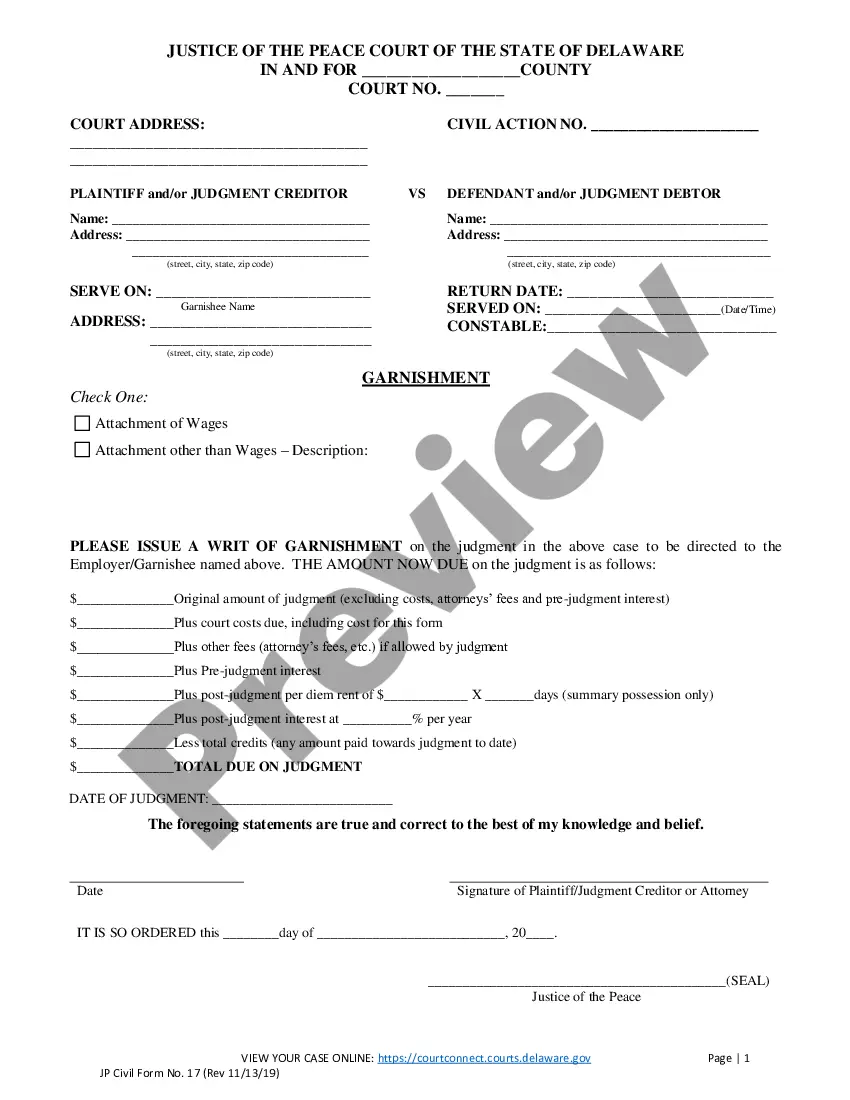

Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 10% ATTACHMENT

Description

How to fill out Delaware CHART FOR DETERMINING AMOUNT Of WAGES SUBJECT TO 10% ATTACHMENT?

The greater the quantity of documents you need to produce - the more anxious you become.

A vast array of Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 10% templates can be found online, but it's uncertain which ones are trustworthy.

Simplify the process of locating samples by utilizing US Legal Forms.

Access every template you acquire in the My documents section. Just visit there to fill out a new version of your Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 10%. Even with well-prepared documents, it remains wise to consult your local attorney to ensure your filled form is accurately completed. Achieve more for less with US Legal Forms!

- Ensure the Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 10% is valid in your state.

- Verify your choice by reviewing the description or using the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and pick a pricing plan that suits your needs.

- Provide the requested information to create your account and complete the payment for your order using PayPal or credit card.

- Choose a convenient document format and obtain your copy.

Form popularity

FAQ

As of 2023, the Delaware minimum wage is set at $11.75 per hour. This reflects Delaware's commitment to ensuring fair compensation for all workers, which is important when considering the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 10% ATTACHMENT. Understanding the minimum wage is crucial for calculating what portion of your earnings may be subject to wage attachment. For more detailed calculations, consider using tools or resources from US Legal Forms that align with your employment situation.

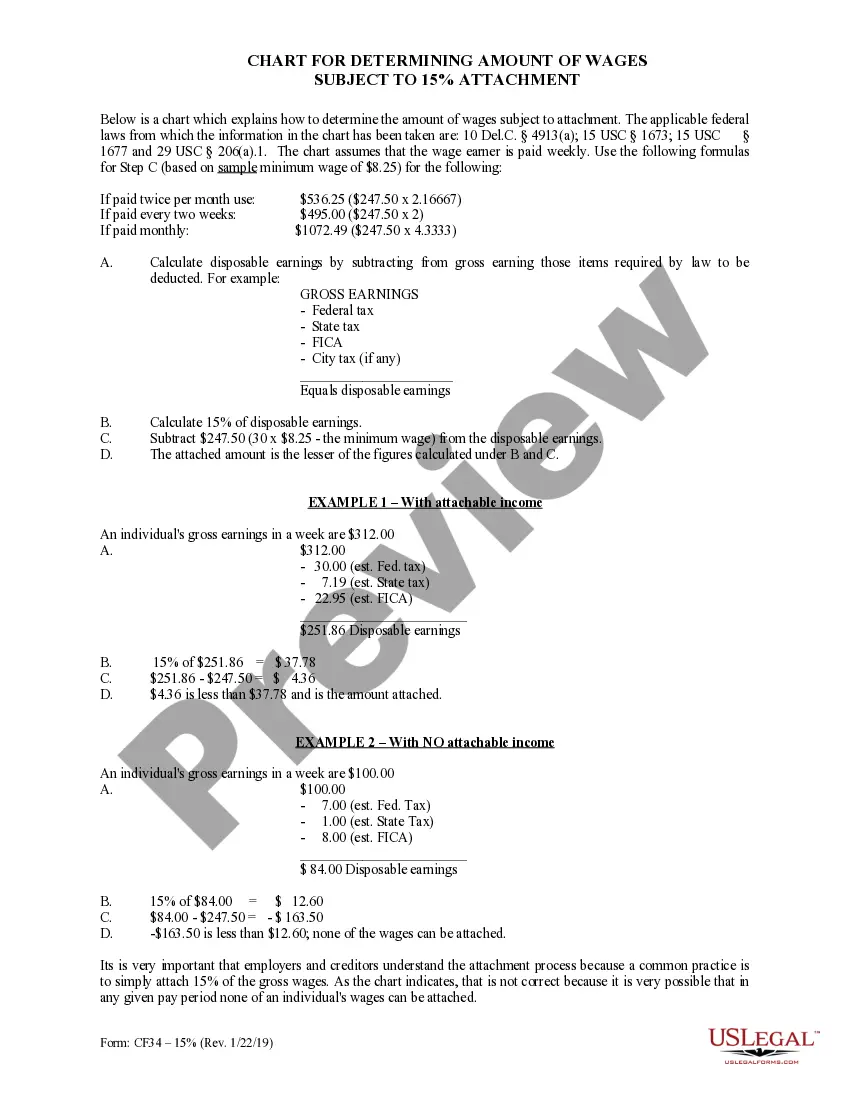

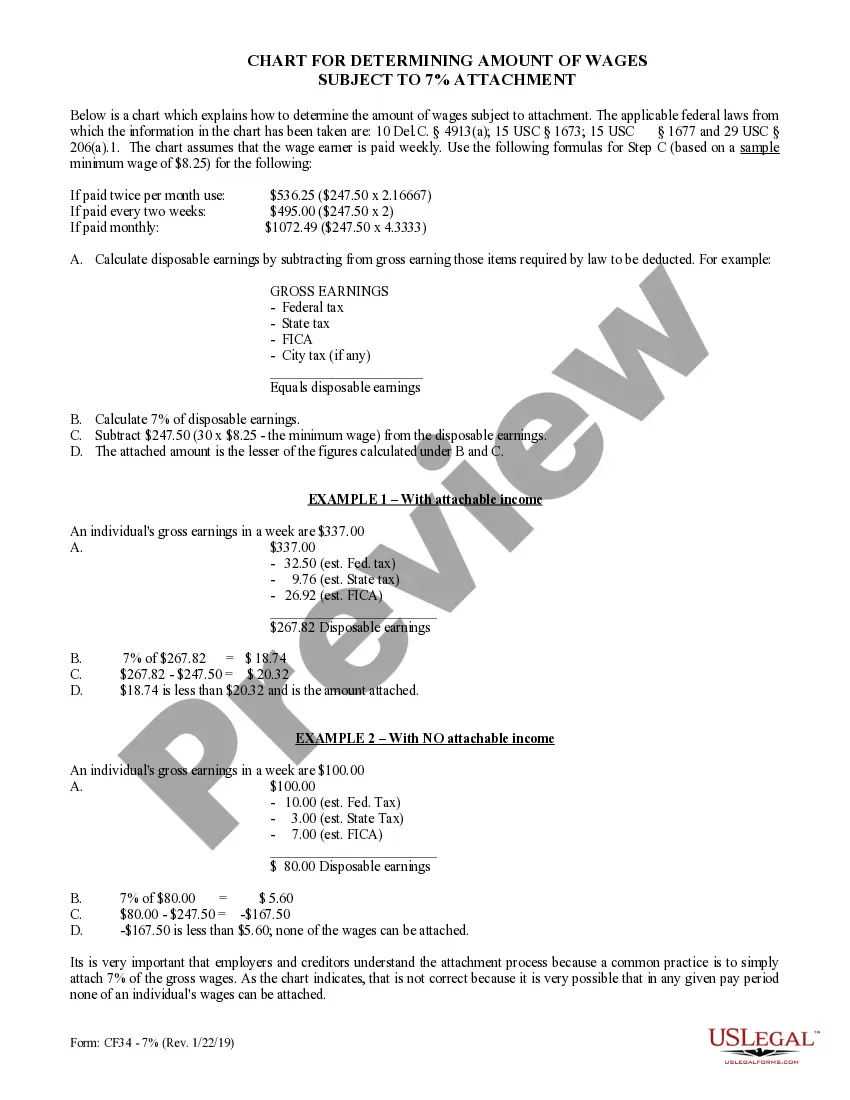

To calculate the subject wages in accordance with the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 10% ATTACHMENT, begin by identifying the employee's total earnings. This comprises regular wages and potentially some bonuses or overtime. Next, apply the chart to determine the portion of these wages that is subject to the 10% attachment rule, ensuring compliance with Delaware laws. For a streamlined and accurate approach, consider using USLegalForms, which provides tools and templates that simplify this calculation process.

In Delaware, the standard percentage of wages that can be garnished for most debts is 10%. This cap ensures that employees retain a portion of their earnings for essential living expenses. For a clear breakdown of how this applies to your specific situation, the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 10% ATTACHMENT is an invaluable tool.

As of the latest updates, Delaware's minimum wage is set to gradually increase annually, reaching $15.00 per hour by 2025. This increase will bring more financial stability to employees, which is crucial when calculating wage attachments. Understanding the implications of these changes is easier with the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 10% ATTACHMENT.

Employers are generally required by law to comply with wage garnishment orders unless they have a valid reason to refuse. If there are discrepancies or if the order is improperly issued, your employer may have grounds to contest the garnishment. Always refer to the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 10% ATTACHMENT for guidance and clarity on this matter.

Delaware's wage garnishment laws are designed to protect employees while allowing creditors to recover debts. Under these laws, the maximum garnishment for most debts is capped at 10% of an employee's gross wages. For detailed scenarios and calculations, consult the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 10% ATTACHMENT, which helps clarify the process.

In Delaware, the maximum percentage allowed for wage garnishment is 10%. This means that an employer can legally withhold up to 10% of your disposable earnings to satisfy a debt. The Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 10% ATTACHMENT provides a straightforward guideline for both employees and employers.