Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 15% ATTACHMENT

Description

How to fill out Delaware CHART FOR DETERMINING AMOUNT Of WAGES SUBJECT TO 15% ATTACHMENT?

The larger quantity of documents you are required to produce - the more anxious you become.

You can find countless Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 15% forms online, yet, you remain uncertain about which ones to rely on.

Eliminate the hassle to make identifying samples simpler with US Legal Forms. Obtain accurately prepared forms that are available to comply with state regulations.

Submit the necessary information to create your profile and complete your order using PayPal or credit card. Choose a convenient document format and receive your copy. You can find every document you acquire in the My documents section. Simply navigate there to generate a new version of the Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 15%. Even when utilizing professionally crafted templates, it remains crucial to consider consulting a local attorney to verify that your submitted document is accurately completed. Achieve more for less with US Legal Forms!

- If you possess a US Legal Forms subscription, Log In to your account, and you'll locate the Download button on the Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 15%’s page.

- If you haven't utilized our service before, complete the registration process using the following instructions.

- Verify if the Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 15% is applicable in your state.

- Re-confirm your selection by reviewing the description or by utilizing the Preview feature if available for the selected document.

- Click on Buy Now to initiate the registration process and select a payment plan that suits your needs.

Form popularity

FAQ

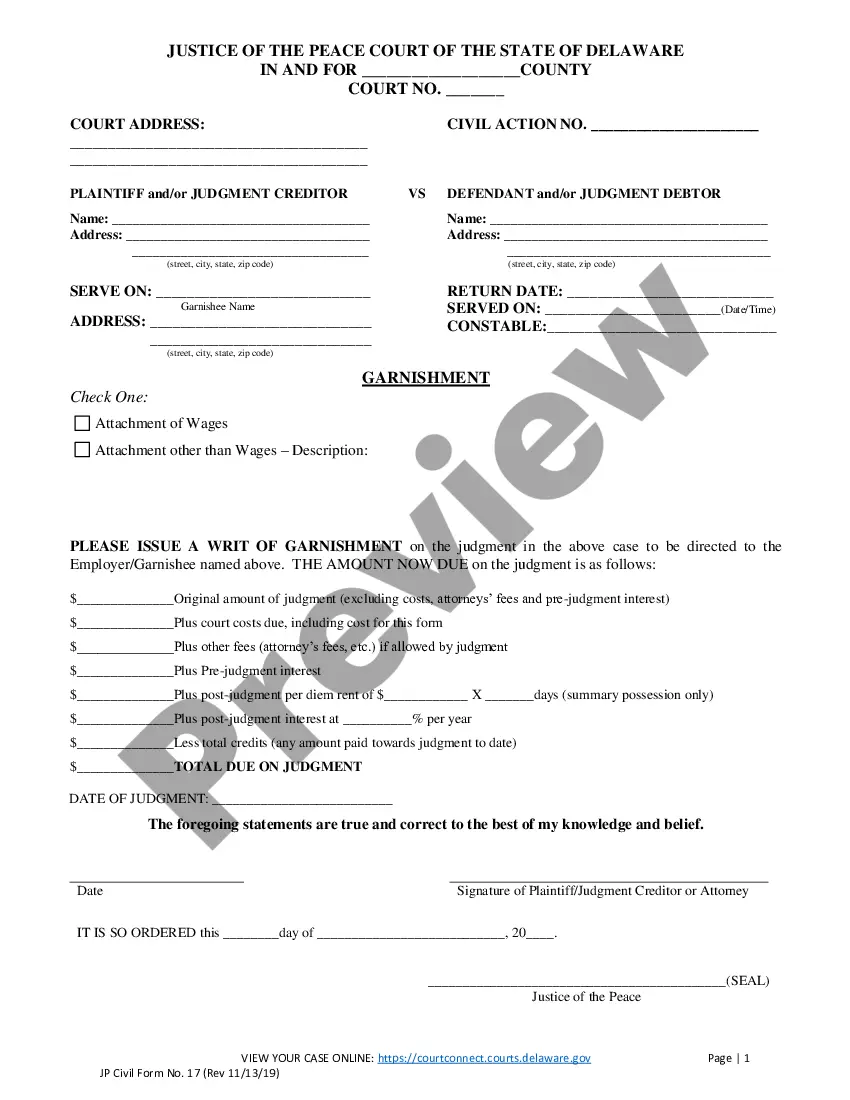

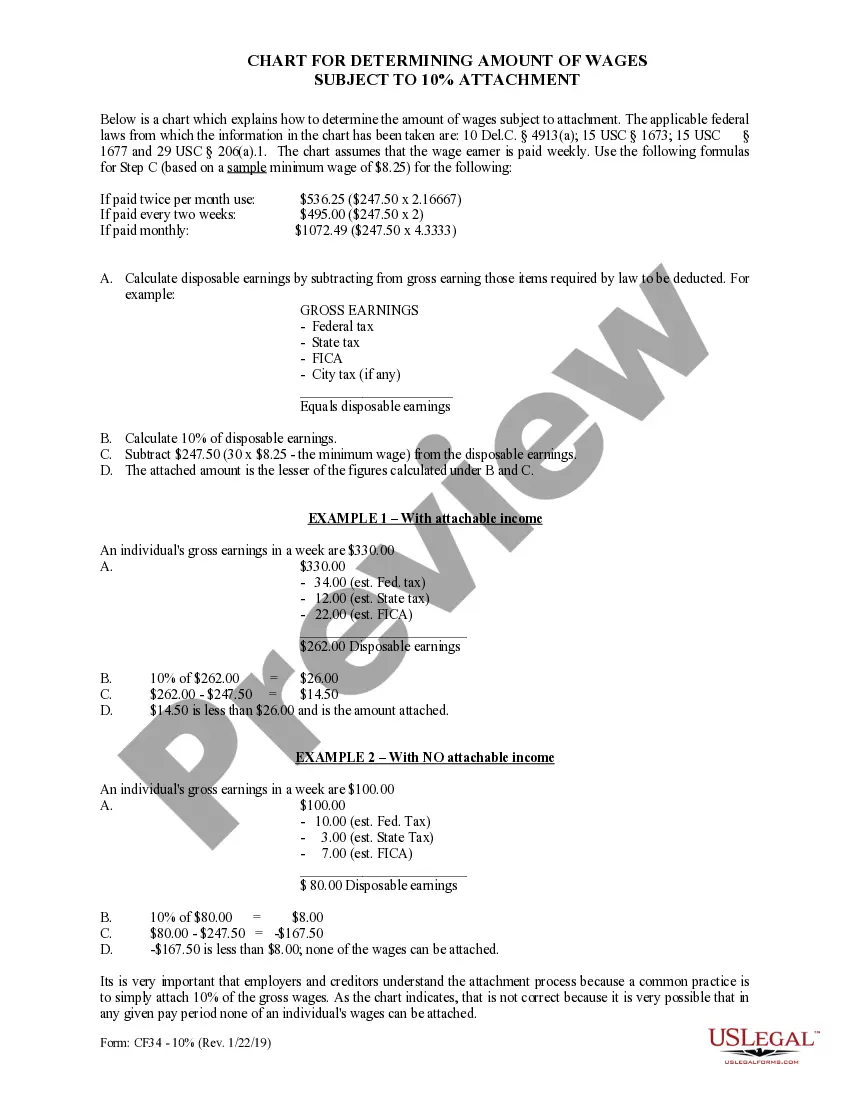

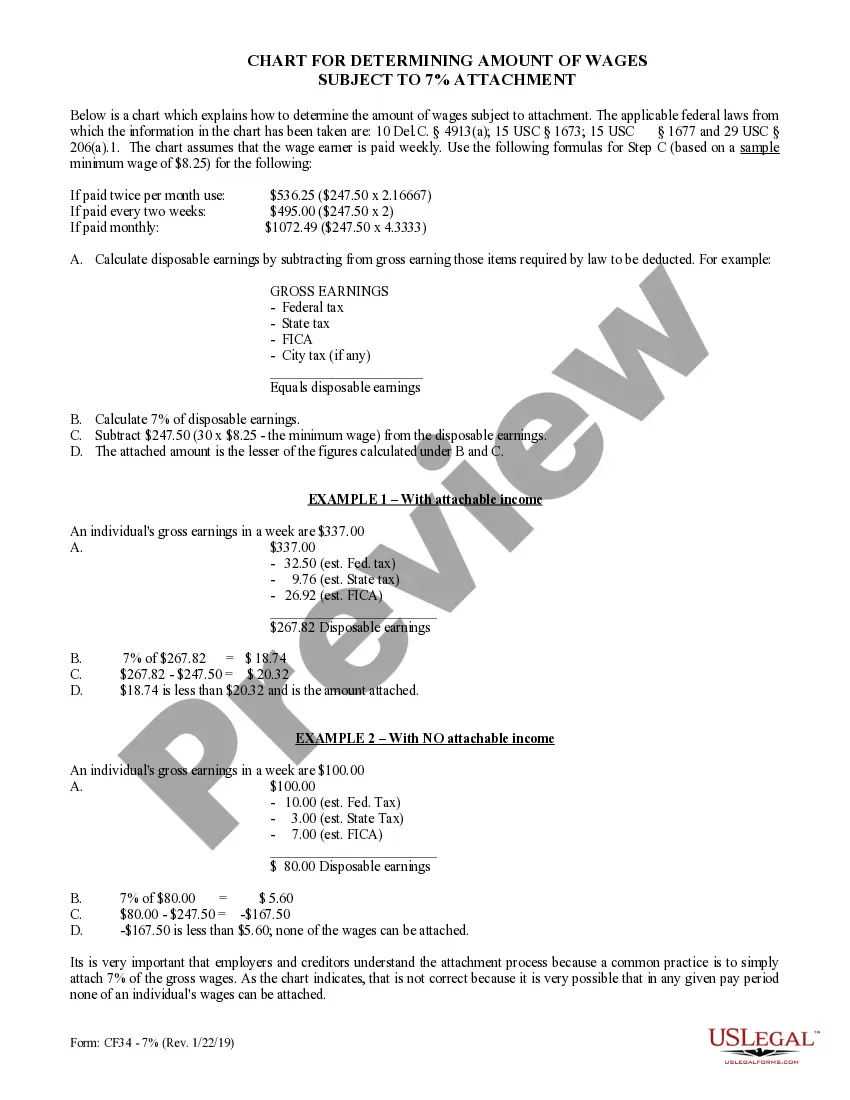

To determine disposable income for wage garnishment, subtract necessary expenses and taxes from your total income. This calculation gives an accurate picture of what can legally be garnished. It's vital to ensure you account for all necessary expenses to avoid undue financial hardship. Using the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 15% ATTACHMENT will help ensure that the garnishment amounts are correctly assessed.

Attachment is a legal action that allows a creditor to claim a person's wages to settle a debt, while garnishment specifically involves court orders directing the employer to withhold wages. Both are ways to enforce debt collection, but they arise from different legal procedures. Knowing these distinctions can help you navigate personal finance better. The Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 15% ATTACHMENT can clarify how these processes may impact your income.

Twenty-five percent of your disposable income is calculated by taking your disposable earnings and multiplying them by 0.25. This figure can be useful in situations where creditors request a higher rate or if you need to assess potential financial impact. When reviewing options, consider the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 15% ATTACHMENT to ensure compliance with state garnishment laws.

To determine the garnishment amount, identify your disposable income as defined by the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 15% ATTACHMENT. This involves calculating your total wages after mandatory deductions and applying the appropriate percentage for garnishment, which is typically up to 15% of your disposable earnings. Understanding this process can help you predict and manage potential deductions from your paycheck.

Negotiating wage garnishment involves communicating directly with your creditor or their representative. Present your financial situation, and reference the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 15% ATTACHMENT to propose a more manageable payment plan. Being proactive can often lead to favorable adjustments that help ease your financial burden.

To calculate your disposable income for wage garnishment, start with your total earnings and subtract mandatory deductions such as taxes, Social Security, and retirement contributions. The remaining amount is considered disposable income and will help you understand how the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 15% ATTACHMENT applies to your situation. Accurate calculations ensure that garnishments are appropriate and lawful.

Yes, it is possible for someone to garnish your wages without your prior knowledge. Creditors may obtain a court order to initiate wage garnishment, following the guidelines outlined in the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 15% ATTACHMENT. Usually, you will receive a notice prior to garnishment, but being unaware of the initial action is not uncommon.

The maximum amount that can be garnished from your paycheck typically depends on your disposable income. In Delaware, the law follows the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 15% ATTACHMENT, which limits garnishment to a percentage of your disposable earnings. Generally, a creditor can garnish up to 15% of your wages after necessary deductions have been made.

To fill out a challenge to garnishment form, start by gathering your personal information, including your name, address, and any relevant case numbers. Clearly state your reasons for challenging the garnishment, referencing the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 15% ATTACHMENT to support your claim. Make sure to sign and date the form before submitting it to the appropriate court.

According to Delaware law, the most that can be garnished from wages is typically 15% of your disposable income, which is calculated after deducting mandatory payments. This cap is designed to safeguard employees' ability to maintain a basic standard of living. To better understand your situation, refer to the Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 15% ATTACHMENT as a guide for your wage garnishment queries.