Delaware Satisfaction of Judgment

Understanding this form

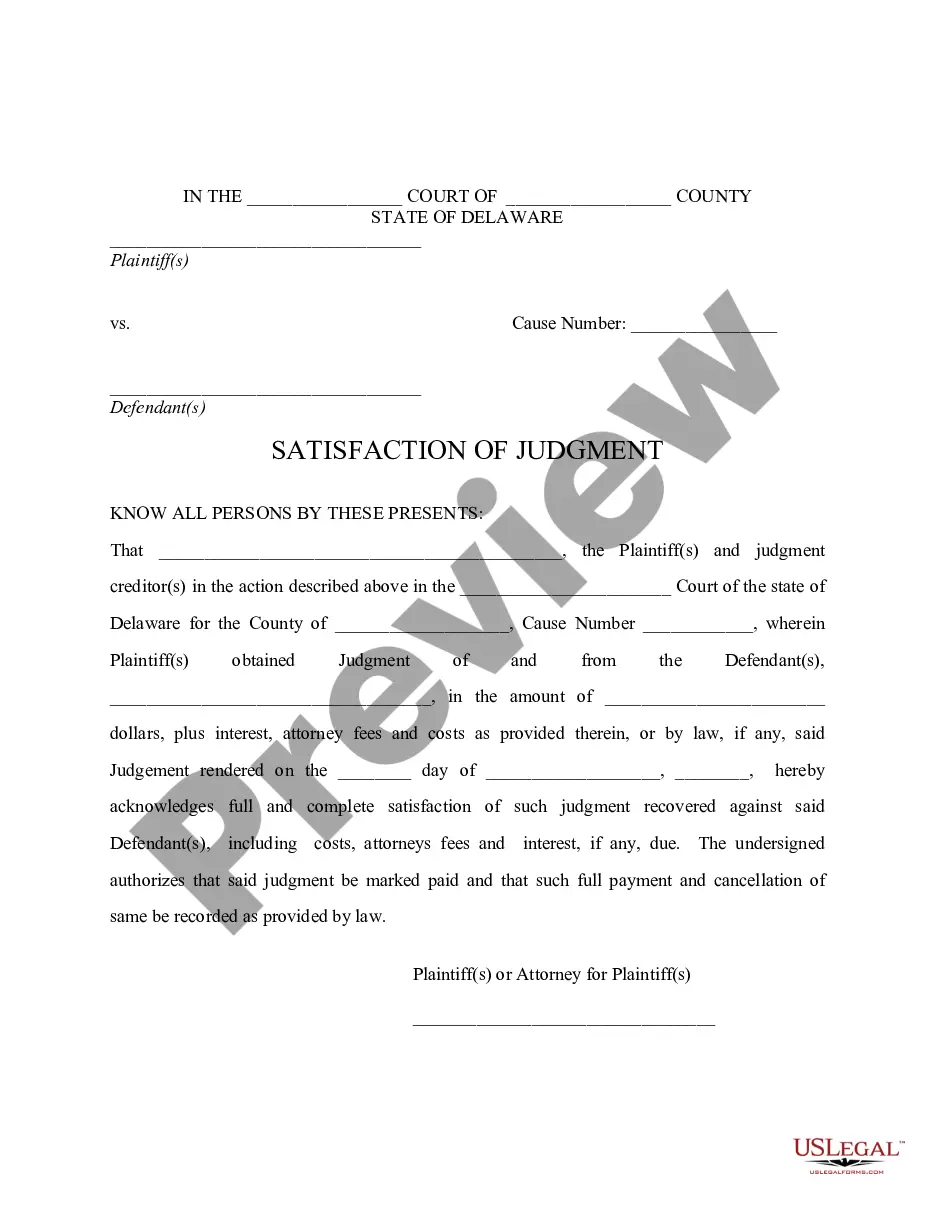

The Delaware Satisfaction of Judgment is a legal document that confirms a judgment has been fully paid, including any associated fees, costs, or interest. This form serves to officially acknowledge that the debtor has fulfilled their financial obligations, allowing them to have the judgment marked as paid in full. Unlike other forms related to judgments, this specific form is intended solely to document the satisfaction of a court's ruling in Delaware.

Main sections of this form

- Identification of the court where the judgment was issued.

- Details of the plaintiff(s) and defendant(s) involved in the case.

- Statement of the judgment amount, including any interest or fees.

- Acknowledgment of the full satisfaction of the judgment by the plaintiff.

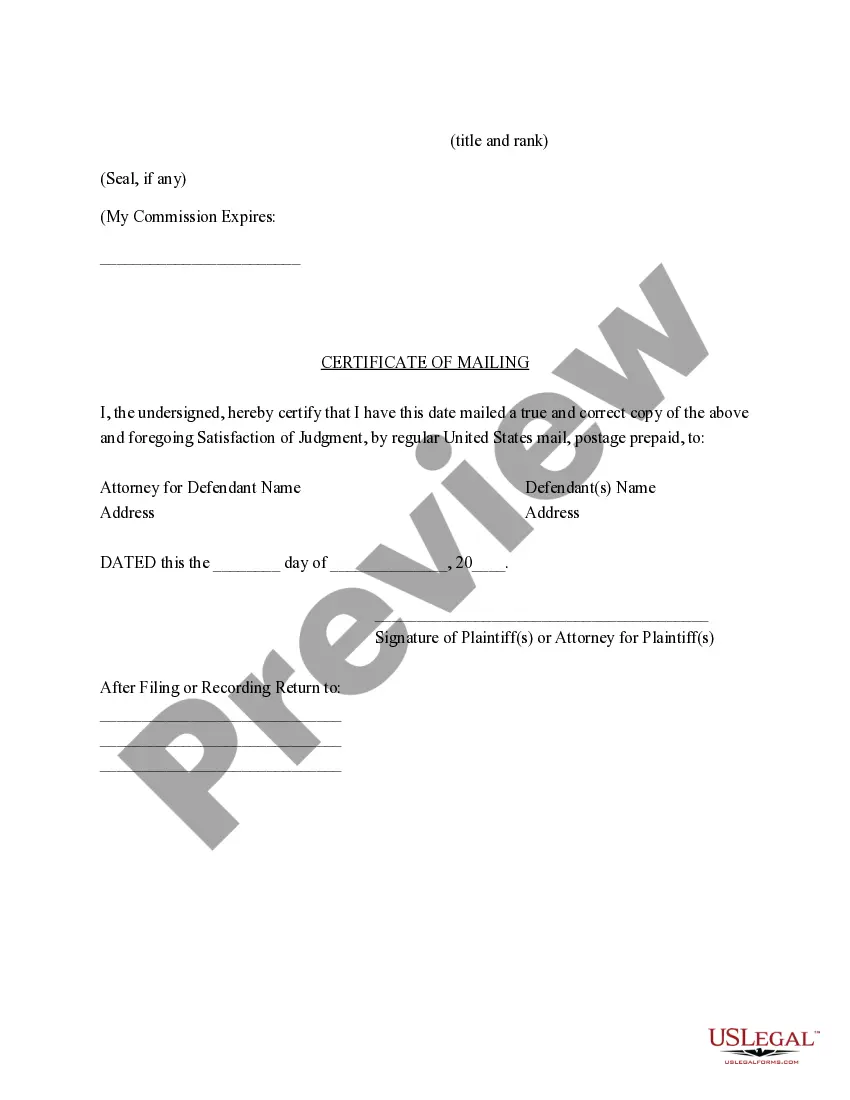

- Notarization section for individual, corporate, and attorney acknowledgment.

- Certification of mailing to the defendant's attorney.

Common use cases

This form should be used when a judgment awarded by the court has been fully paid by the defendant. It is especially important to file this document to ensure that the judgment is officially recorded as satisfied, which can help prevent future claims based on the same judgment. Scenarios may include after a business dispute, loan default, or any other legal matter that resulted in a judgment against the defendant.

Who this form is for

This form is intended for:

- Plaintiffs who have received a judgment in their favor and have been paid in full.

- Attorneys representing plaintiffs in judgment recovery cases.

- Entities (corporations or partnerships) that have obtained a court judgment and have settled the outstanding amount.

Steps to complete this form

- Identify the court and write down the details of the judgment.

- Fill in the names and addresses of the plaintiff(s) and defendant(s).

- Enter the judgment amount along with any accrued interest and fees.

- Have the form signed by the plaintiff(s) or the attorney as a confirmation of satisfaction.

- Obtain the necessary notarization for the signatures, if required.

- Mail a copy of the completed form to the defendant's attorney to inform them that the judgment has been satisfied.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Not including all required details regarding the judgment amount and parties involved.

- Failing to notarize the form if necessary.

- Forgetting to mail a copy of the satisfaction document to the defendant or their attorney.

- Using incorrect court information or cause number.

Advantages of online completion

- Convenient access to legal forms that can be filled out and downloaded instantly.

- Editable templates allow for easy customization to fit specific legal needs.

- Reliable and accurate information drafted by licensed attorneys ensures compliance with legal requirements.

Quick recap

- The Delaware Satisfaction of Judgment is essential for documenting that a judgment has been settled.

- It protects the debtor's credit record by officially marking the judgment as paid.

- Ensure you fill out the form completely, obtain notarization, and notify all involved parties to avoid potential issues.

Looking for another form?

Form popularity

FAQ

To satisfy a judgment, you need to fulfill the requirements set by the court. This often involves paying the amount ordered by the judge or reaching a settlement with the creditor. Once you complete the payment, you should obtain a Satisfaction of Judgment document, which officially confirms that the judgment has been satisfied. Utilizing platforms like US Legal Forms can streamline this process, providing you with the necessary forms and guidance for Delaware Satisfaction of Judgment.

You can confirm if a judgment has been satisfied by checking with the court where the judgment was issued. You can also request a copy of the satisfaction of judgment document from the creditor. Additionally, monitoring your credit report may reveal updates on the status of the judgment.

To file an acknowledgment of satisfaction of judgment, you need to prepare the satisfaction document signed by the creditor. Afterward, file it with the court where the original judgment was issued. Using a service like US Legal Forms can simplify this process by providing templates and guidance tailored to Delaware's requirements.

Rule 37 in the Delaware Chancery court pertains to the duty to make discovery. It outlines the procedures for how parties must share evidence and information before a trial. Understanding this rule is crucial for parties engaged in litigation, as it helps ensure fairness and transparency during the legal process.

Enforcing a judgment in Delaware involves several steps. You may need to file a writ of execution with the court, which allows you to seize the debtor's assets or wages. It is advisable to consult a legal expert, such as those found on the US Legal Forms platform, to navigate this process effectively and ensure that all legal requirements are met.

To remove a satisfied judgment from your credit report, you need to obtain a copy of the satisfaction of judgment document. Once you have this, contact each credit bureau that reports the judgment. You can dispute the entry and provide them with the evidence showing that the judgment has been satisfied, which can help clear your report of this negative mark.

A judgment is satisfied when the debtor pays the amount owed or fulfills the terms set by the court. This process is essential in obtaining a Delaware Satisfaction of Judgment, which serves as proof that the debt has been resolved. Typically, once satisfied, the creditor must file a release or satisfaction of judgment document to officially remove the judgment from the public record. This step is crucial to restore your financial reputation and ensure that your credit report reflects your new standing.

To verify a judgment in Delaware, you can access the Delaware Court's online database, where public records are maintained. This resource allows you to check the status of a judgment to see if it has been satisfied or remains unpaid. For individuals or businesses dealing with judgments, confirming this information is a vital step in understanding your legal standing. By utilizing platforms like USLegalForms, you can also find forms and guidance to assist with your verification process.

In Delaware, a judgment typically remains valid for 5 years from the date it is entered unless it is renewed. This means that the creditor can enforce their claim for that period, but after 5 years, the judgment may become unenforceable unless action is taken to renew it. For those facing a judgment, it is essential to know the timeline for Delaware Satisfaction of Judgment to avoid any long-term impacts on your financial health. Keeping track of these timelines can save you from unwanted complications.