District of Columbia Self-Employed Travel Agent Employment Contract

Description

How to fill out Self-Employed Travel Agent Employment Contract?

Are you in a situation where you need documents for either professional or personal purposes almost constantly.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of template options, such as the District of Columbia Self-Employed Travel Agent Employment Contract, designed to meet federal and state regulations.

Once you obtain the right form, click Purchase now.

Select the pricing plan you prefer, enter the necessary information to process your payment, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the District of Columbia Self-Employed Travel Agent Employment Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you require and ensure it is for the correct city/region.

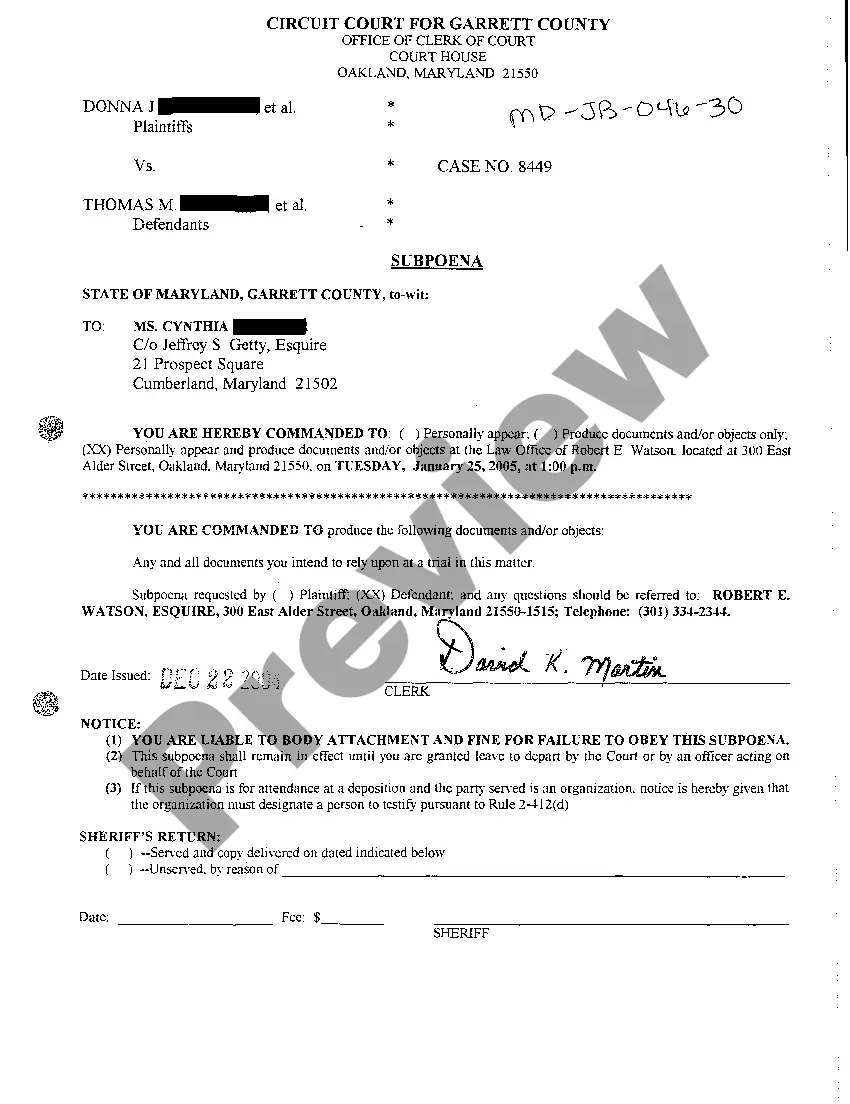

- Use the Review option to examine the form.

- Check the description to confirm you have chosen the correct form.

- If the form is not what you are looking for, utilize the Search box to find the form that fits your needs.

Form popularity

FAQ

A 1099 form indicates that a person is working as a contractor or freelancer, not as an employee. This classification is crucial for tax purposes and affects how income is reported. If you're a travel agent in the District of Columbia, understanding your 1099 status is vital when creating your District of Columbia Self-Employed Travel Agent Employment Contract, as it impacts your financial responsibilities and rights.

Yes, a travel agent typically operates as an independent contractor. This means they manage their own business, set their own hours, and have the flexibility to choose how they serve their clients. When drafting a District of Columbia Self-Employed Travel Agent Employment Contract, it's essential to clarify the nature of the independent relationship to avoid any confusion regarding responsibilities and expectations.

Finding a District of Columbia Self-Employed Travel Agent Employment Contract is simple with our extensive collection at US Legal Forms. You can browse our library of customizable templates that cater to various employment needs. Plus, our platform allows you to search by keywords, ensuring you find the perfect contract for your situation.

You can easily download a District of Columbia Self-Employed Travel Agent Employment Contract from the US Legal Forms website. We provide a variety of employment contract templates tailored to your needs. Simply navigate to our forms section, select the appropriate template, and download it instantly.

Writing a simple District of Columbia Self-Employed Travel Agent Employment Contract can be straightforward. Start by outlining the key terms, such as the scope of work, payment details, and duration of the contract. Our platform offers templates that guide you through each section, making it easier to craft a clear and effective contract.

You can download your District of Columbia Self-Employed Travel Agent Employment Contract directly from our user-friendly platform. Simply visit the US Legal Forms website, search for the specific contract, and follow the prompts to access your document. This streamlined process ensures you have your employment contract ready for use in no time.

Writing a self-employed contract involves outlining key elements such as the scope of work, payment terms, and deadlines. Start by clearly defining the services you will provide and the expectations of your client. Utilizing templates, such as those provided by USLegalForms, can simplify this process and ensure you include all necessary details in your District of Columbia Self-Employed Travel Agent Employment Contract.

The agreement between a tour operator and travel agency is typically a formal contract that outlines the terms of their partnership. This contract includes details like commission rates, responsibilities, and service expectations. For travel agents, having a District of Columbia Self-Employed Travel Agent Employment Contract can help clarify these terms and foster a successful working relationship.

Yes, having a contract is crucial if you are self-employed. A District of Columbia Self-Employed Travel Agent Employment Contract helps safeguard your interests and ensures that both you and your clients are on the same page. This formal agreement can prevent misunderstandings and provide a framework for resolving any conflicts that might arise.

Yes, it is legal to work without a signed contract, but it is risky. A District of Columbia Self-Employed Travel Agent Employment Contract offers protection and clarity, ensuring that all parties understand their roles and responsibilities. Without a signed agreement, you may face disputes that could have been avoided with proper documentation.