District of Columbia Worksheet for Job Requirements

Description

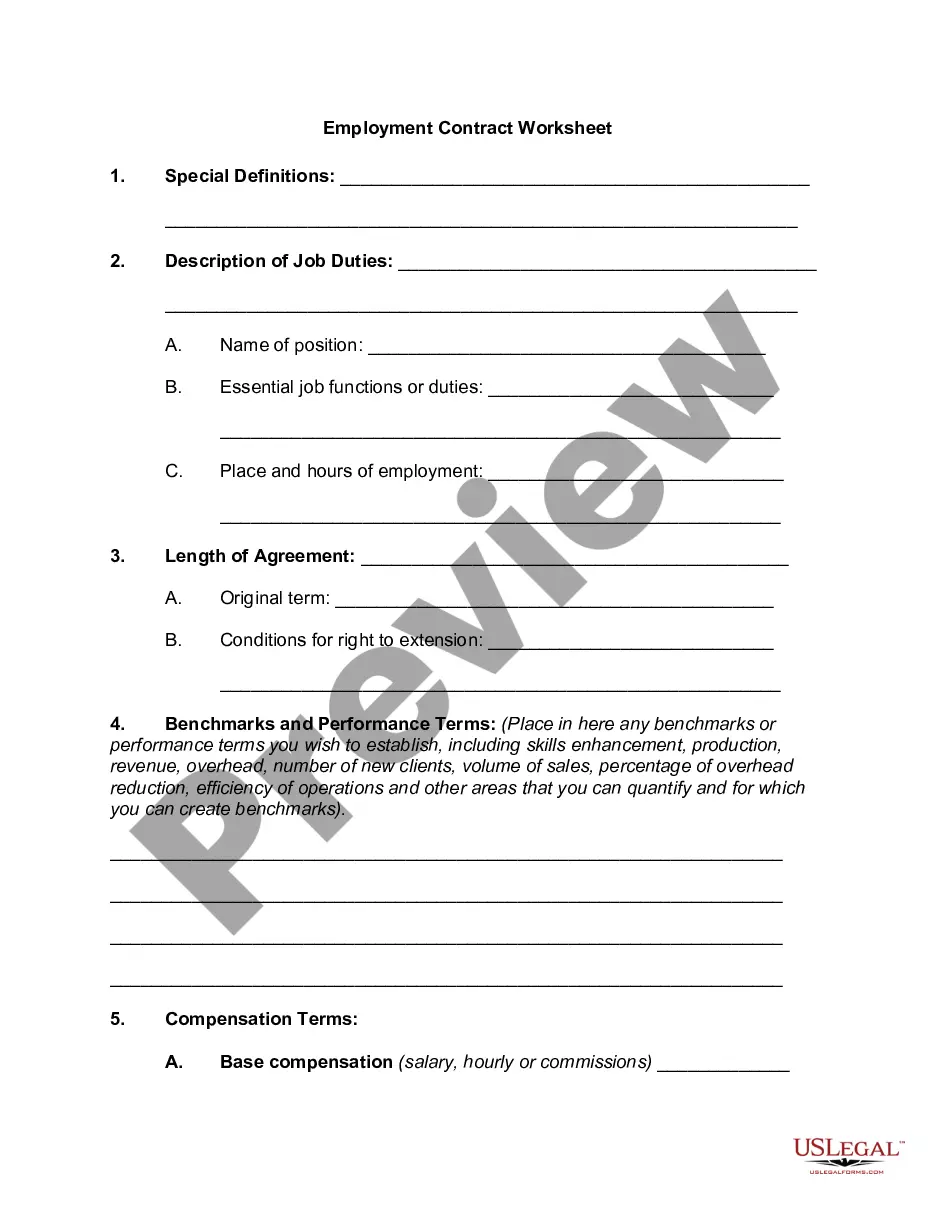

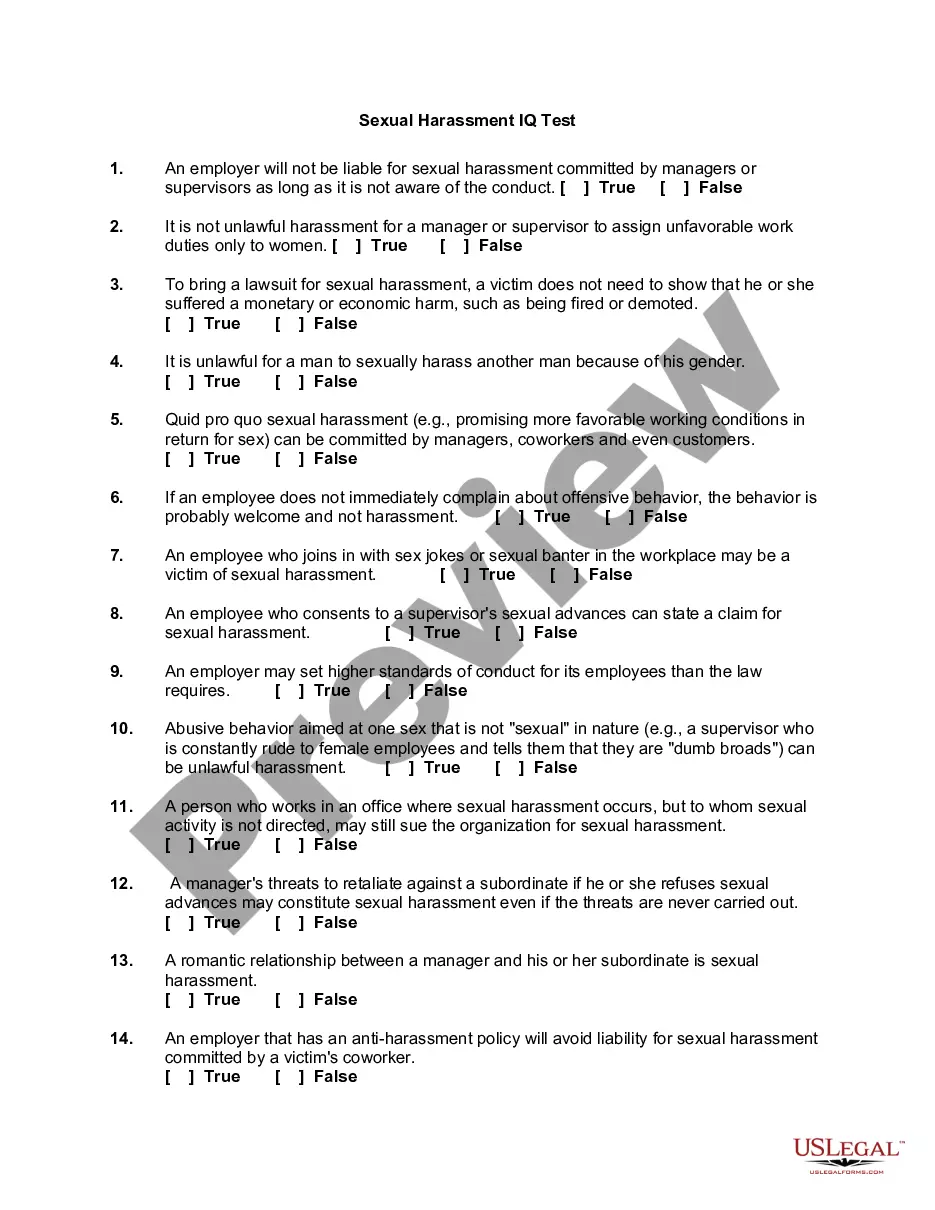

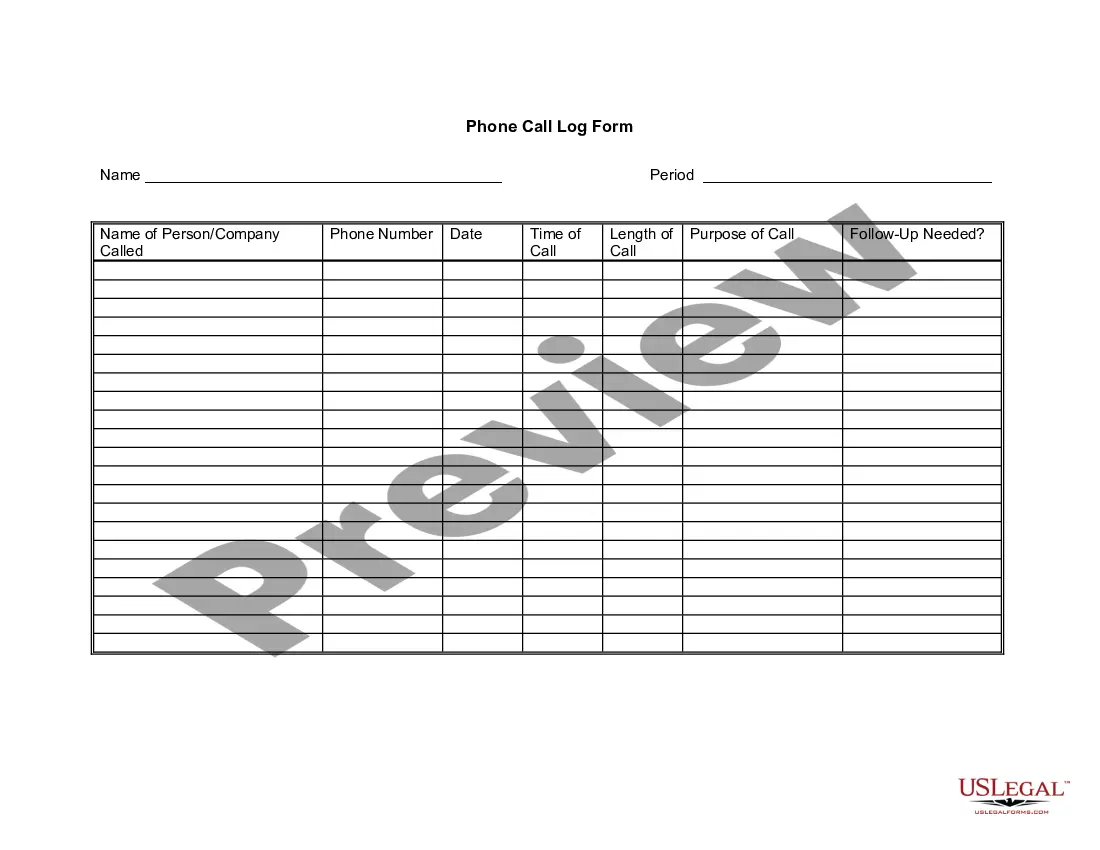

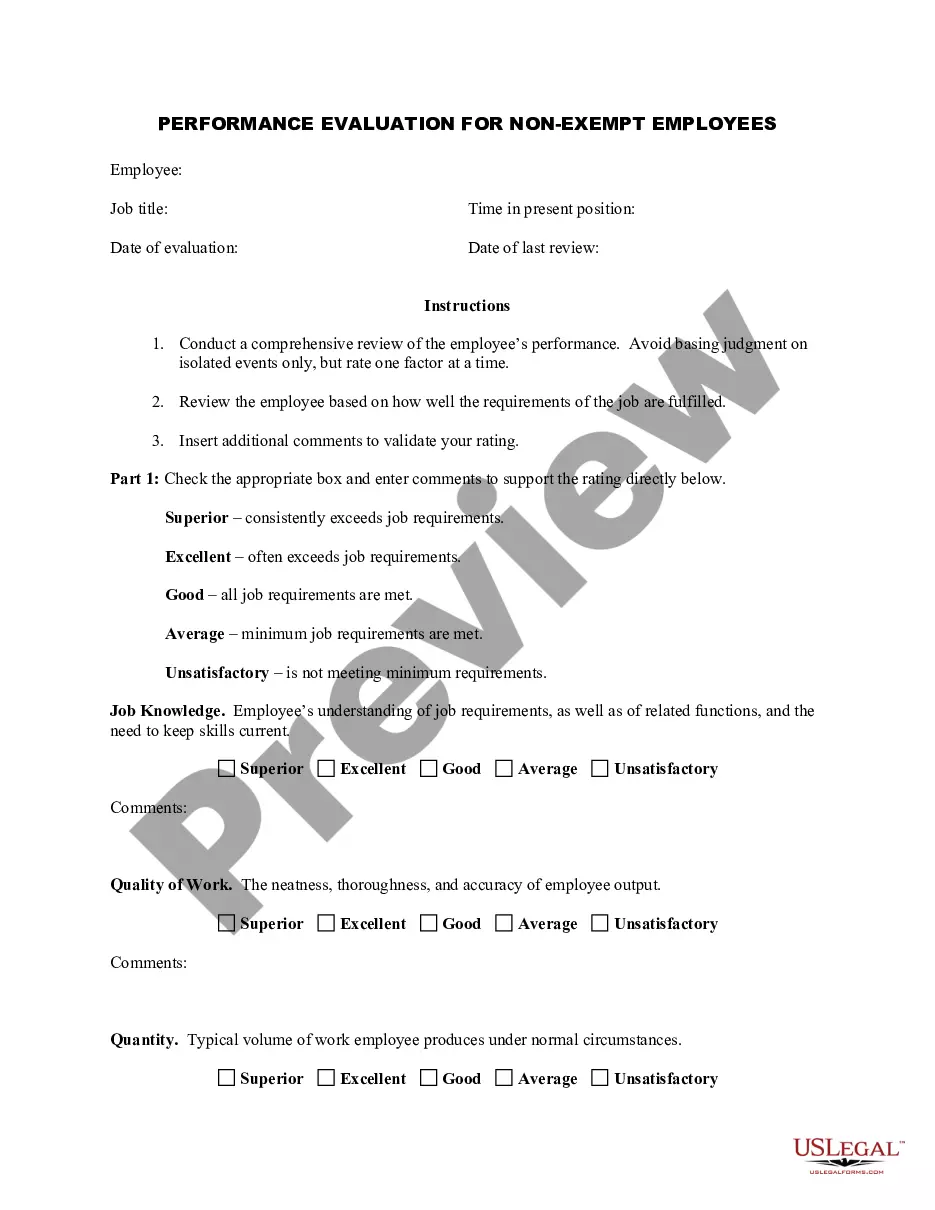

How to fill out Worksheet For Job Requirements?

Are you in the location where you often need documents for business or particular intentions every time.

There is a multitude of valid document templates available online, but finding ones you can trust is not simple.

US Legal Forms provides a wide array of form templates, such as the District of Columbia Worksheet for Job Requirements, which can be tailored to meet federal and state regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the District of Columbia Worksheet for Job Requirements template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

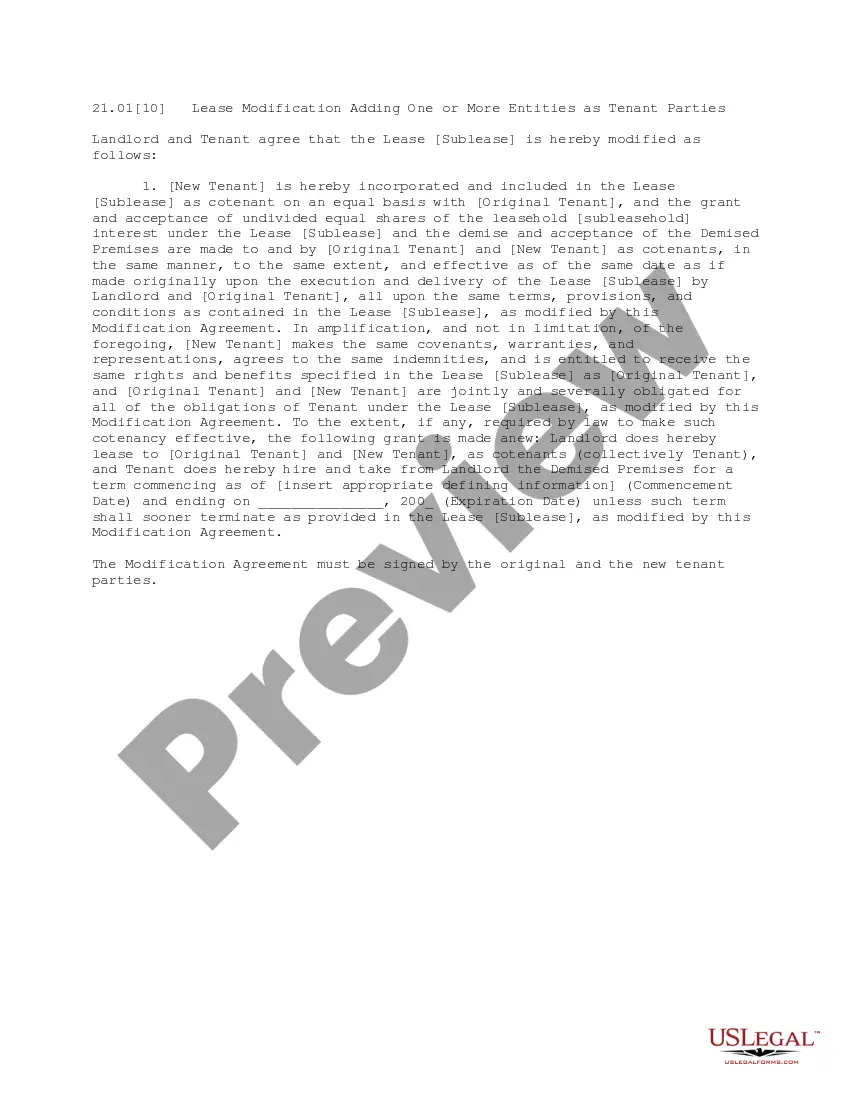

- Utilize the Review button to inspect the form.

- Examine the information to confirm that you have chosen the appropriate form.

- If the form does not meet your expectations, use the Search area to find the form that suits your requirements.

Form popularity

FAQ

Most taxpayers will put a number on line 5 (indicated here by the red arrow) that will help your employer calculate how much federal income tax is to be withheld from your paycheck. That number is the number of allowances you are claiming and it's the one that gives taxpayers fits trying to get right.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.

Your federal W 4 withholding allowance form lists a number of personal exemptions that affect what your employer sets aside for the IRS every time you're paid. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for.

The processing window for selected tax returns could take up to six weeks. Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return.

To be exempt from withholding, both of the following must be true:You owed no federal income tax in the prior tax year, and.You expect to owe no federal income tax in the current tax year.

A D.C. resident may claim exemption from withholding of D.C. tax if the employee did not owe any D.C. income tax for the immediately preceding calendar year, had a right to a full refund of all D.C. income tax withheld for that year, does not expect to owe any D.C. tax for the current year, does not expect to owe any

Every new employee who resides in DC and is required to have DC income taxes withheld, must fill out Form D-4 and file it with his/her employer.

Being a 501(c)(3) nonprofit means your organization is exempt from paying most taxes at the federal level. However, being recognized as tax-exempt by the IRS does not automatically mean your organization is exempt from local D.C. taxes including income, franchise, sales, use, and personal property taxes.

Worksheet A is used if a parent has less than 25% of the annual overnights with the child or children and Worksheet B is used if a parent has 25% or more of annual overnights with the child or children. Worksheet B modifies child support downward.

If you are not a resident of DC you must file a Form D-4A with your employer to establish that you are not subject to DC income tax withholding. You qualify as a nonresident if: Your permanent residence is outside DC during all of the tax year and you do not reside in DC for 183 days or more in the tax year.