District of Columbia Contractor's Performance Bond with Limitation of Right of Action

Description

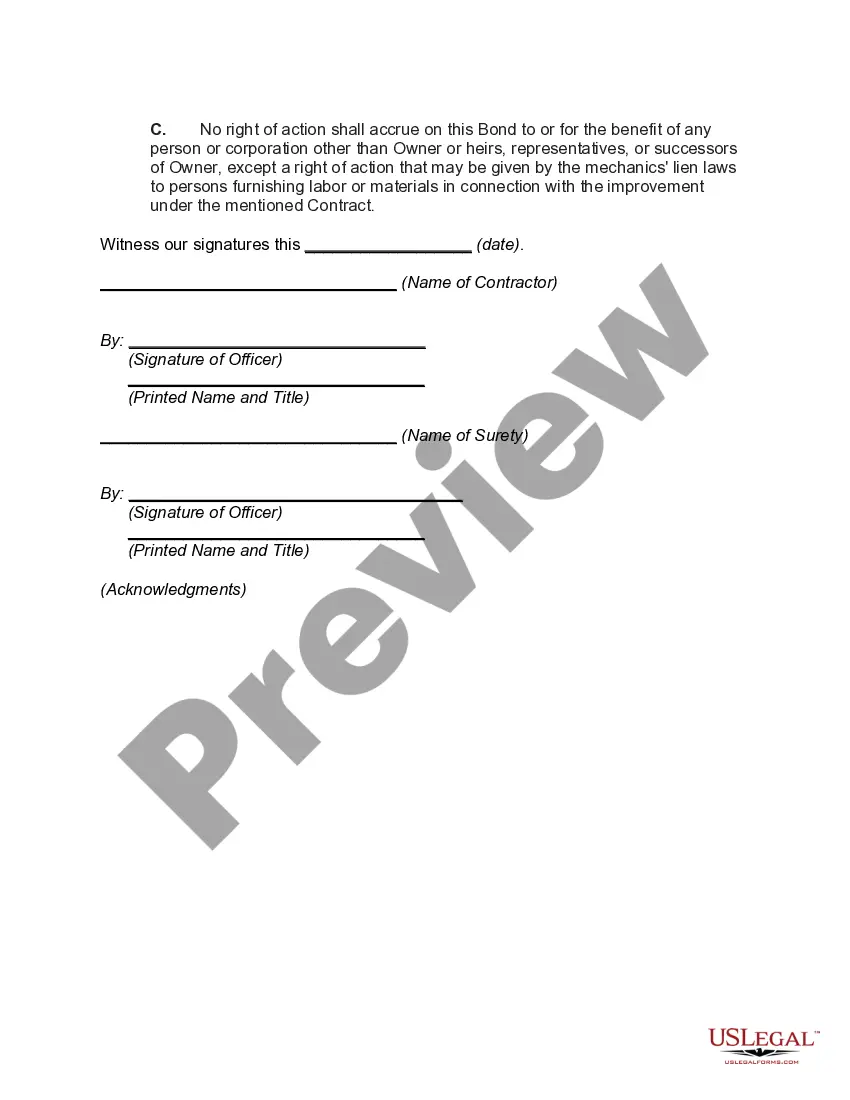

How to fill out Contractor's Performance Bond With Limitation Of Right Of Action?

US Legal Forms - one of several biggest libraries of lawful types in America - delivers a variety of lawful document themes it is possible to obtain or print. While using site, you may get 1000s of types for enterprise and personal uses, categorized by categories, claims, or keywords and phrases.You will find the most recent versions of types such as the District of Columbia Contractor's Performance Bond with Limitation of Right of Action in seconds.

If you already possess a subscription, log in and obtain District of Columbia Contractor's Performance Bond with Limitation of Right of Action from your US Legal Forms collection. The Acquire switch can look on every kind you see. You gain access to all previously acquired types in the My Forms tab of your own profile.

If you would like use US Legal Forms initially, listed below are basic directions to help you started:

- Be sure you have picked out the right kind for your area/area. Go through the Preview switch to check the form`s articles. Look at the kind information to ensure that you have chosen the correct kind.

- If the kind doesn`t satisfy your specifications, make use of the Search area near the top of the display screen to obtain the the one that does.

- When you are satisfied with the shape, confirm your decision by visiting the Purchase now switch. Then, pick the pricing strategy you favor and offer your accreditations to sign up on an profile.

- Approach the financial transaction. Make use of your bank card or PayPal profile to complete the financial transaction.

- Find the format and obtain the shape on your own gadget.

- Make alterations. Load, change and print and sign the acquired District of Columbia Contractor's Performance Bond with Limitation of Right of Action.

Every single web template you included in your money does not have an expiry particular date which is the one you have forever. So, if you wish to obtain or print yet another backup, just proceed to the My Forms portion and then click about the kind you will need.

Get access to the District of Columbia Contractor's Performance Bond with Limitation of Right of Action with US Legal Forms, by far the most substantial collection of lawful document themes. Use 1000s of skilled and state-certain themes that satisfy your business or personal requires and specifications.

Form popularity

FAQ

If the surety does not voluntarily pay the claim, a lawsuit must be filed against the payment bond surety as follows: (a) if the public entity files a notice of completion or cessation notice, thirty (30) days six plus (6) months after the notice is filed or (b) if neither a notice of completion or cessation is filed, ...

A bid bond is a legal agreement that ensures contractors fulfill their stated obligations on a project. This form of assurance provides both financial and legal recourse to the owner of the project. Bid bonds are usually submitted in conjunction with the project's contract.

Statute of limitations in contracts for sale. (1) An action for breach of any contract for sale must be commenced within four years after the cause of action has accrued. By the original agreement the parties may reduce the period of limitation to not less than one year but may not extend it.

One key difference between performance bonds and surety bonds is the scope of their coverage. Performance bonds only cover a specific project, while surety bonds can cover multiple projects or ongoing business activities. Another difference is the party responsible for paying the bond premium.

The protection a bond will offer the employer and what hurdles must be jumped must be considered before a call can be made on it. Bonds in the UK construction market are either 'on demand' or conditional bonds (or sometimes are a hybrid between these two forms).

A performance bond is a financial guarantee that the terms of a contract will be honored. If one party to a contract cannot complete their obligations, the bond is paid out to the other party to compensate for their damages or costs.

A performance bond issued by a financial institution guarantees the fulfillment of a contract. If the U.S. exporter fails to "perform" as agreed, the buyer is compensated. A bid bond - often required in a bid selection process - guarantees the foreign buyer that the U.S. exporter will execute the contract if selected.