Utah Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

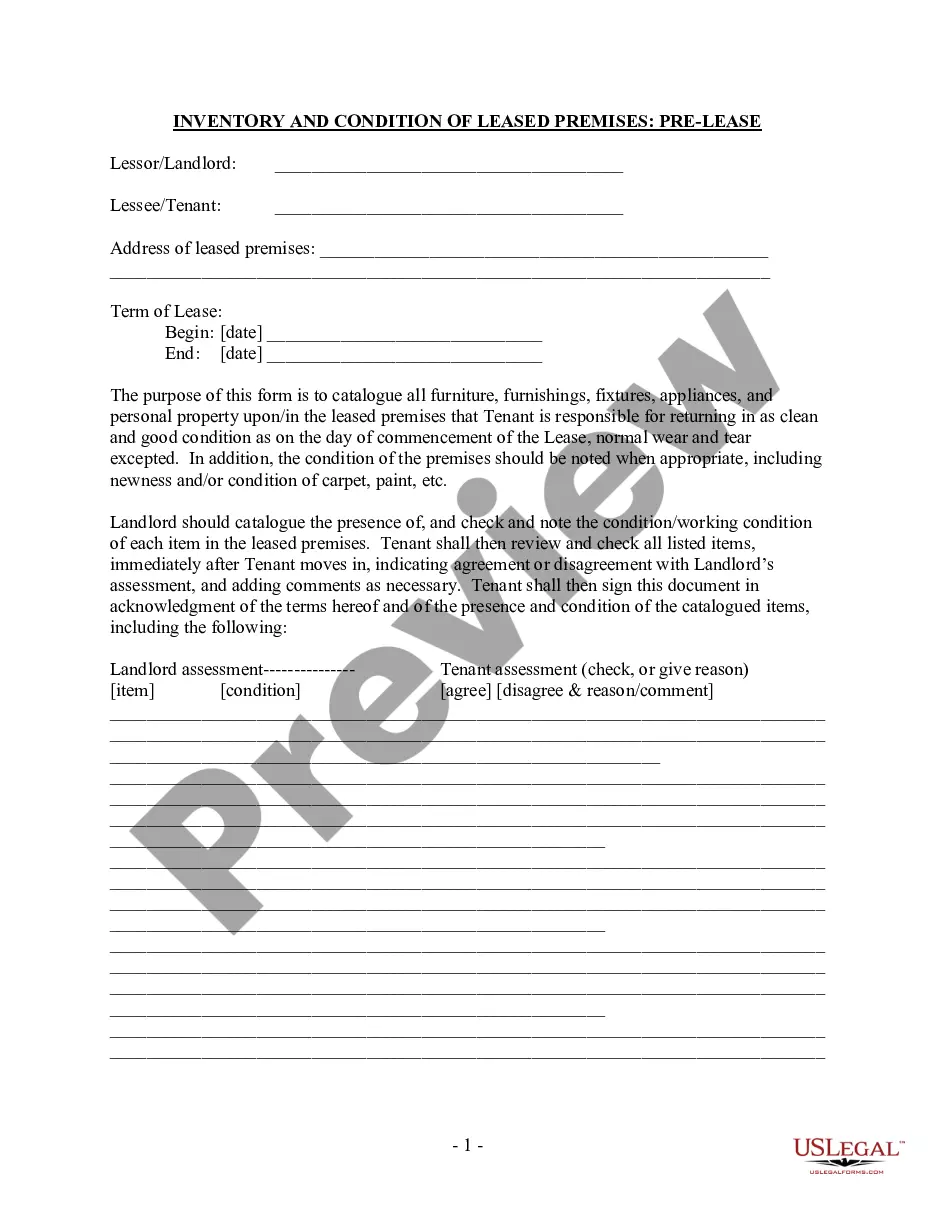

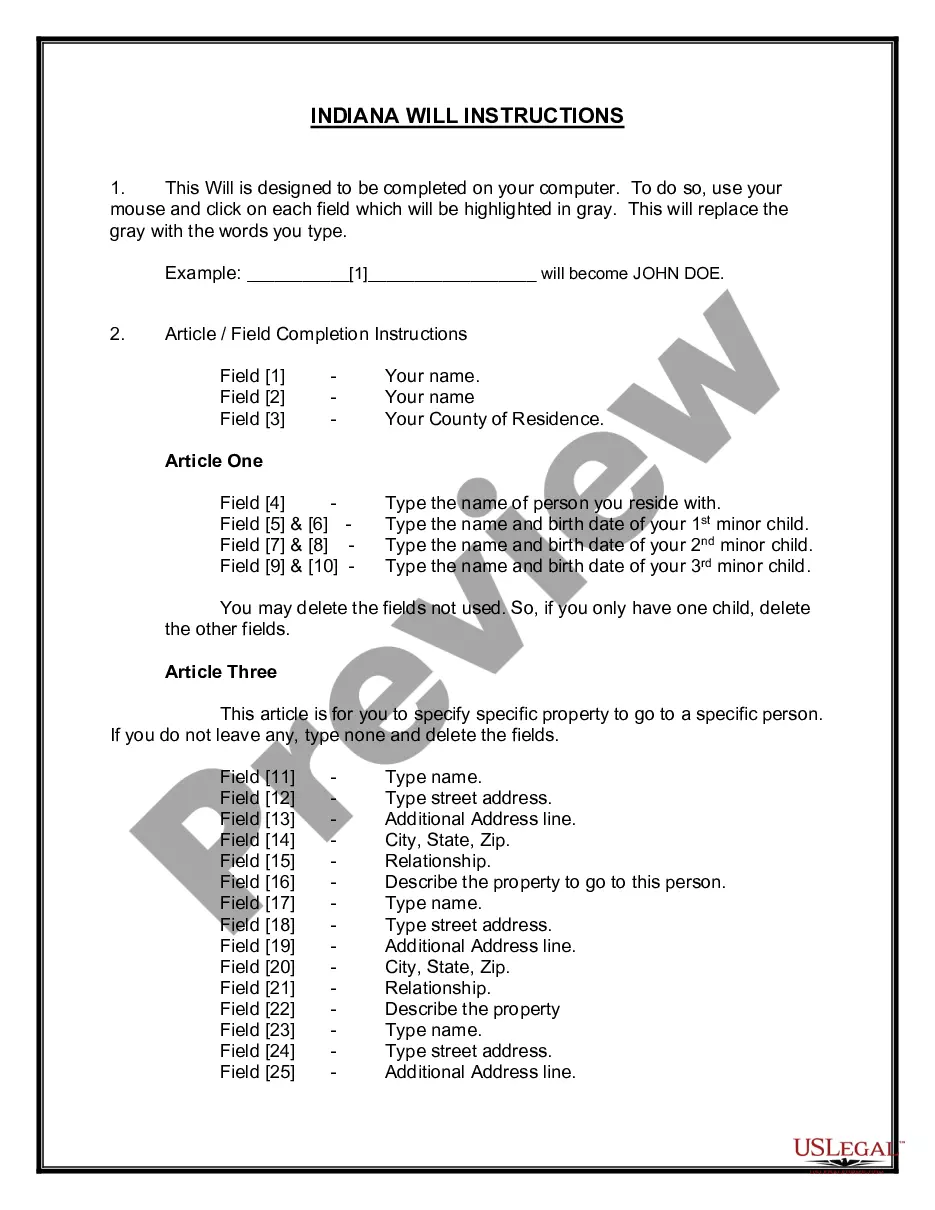

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

With the website, you can access thousands of forms for business and personal needs, organized by type, state, or keywords. You can find the latest versions of forms like the Utah Notice of Violation of Fair Debt Act - Notice to Stop Contact in moments.

If you already have a subscription, Log In and obtain the Utah Notice of Violation of Fair Debt Act - Notice to Stop Contact from the US Legal Forms collection. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make edits. Complete, modify, and print out and sign the downloaded Utah Notice of Violation of Fair Debt Act - Notice to Stop Contact. Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Utah Notice of Violation of Fair Debt Act - Notice to Stop Contact with US Legal Forms, one of the most extensive compilations of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have selected the correct form for your city/state.

- Click the Preview button to review the form's details.

- Check the form summary to confirm you have selected the right form.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

If more than one creditor is harassing you for more than one debt, you will need to send each one a cease and desist letter. Even if the same creditor is trying to collect two different debts from you, you must write a letter for each of the two debts.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

Cease and desist letters increase your chances of being sued The reaction is quite simple: when you send a cease and desist letter to a collection agency, collection attorney, or to your original creditor, you leave them only one way to effectively collect from you: filing a lawsuit.