Vermont Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

US Legal Forms - one of the most extensive collections of authentic documents in the United States - provides a broad selection of authentic template files that you can obtain or print.

On the website, you can discover thousands of documents for commercial and personal purposes, categorized by groups, states, or keywords. You can find the latest editions of forms like the Vermont Notice of Violation of Fair Debt Act - Notice to Stop Contact within seconds.

If you already have a membership, Log In and obtain the Vermont Notice of Violation of Fair Debt Act - Notice to Stop Contact from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Make changes. Fill out, edit, print, and sign the saved Vermont Notice of Violation of Fair Debt Act - Notice to Stop Contact.

Every template you save in your account does not expire and is yours permanently. Therefore, if you wish to acquire or print another copy, simply navigate to the My documents section and click on the form you need. Access the Vermont Notice of Violation of Fair Debt Act - Notice to Stop Contact with US Legal Forms, the most comprehensive library of authentic document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

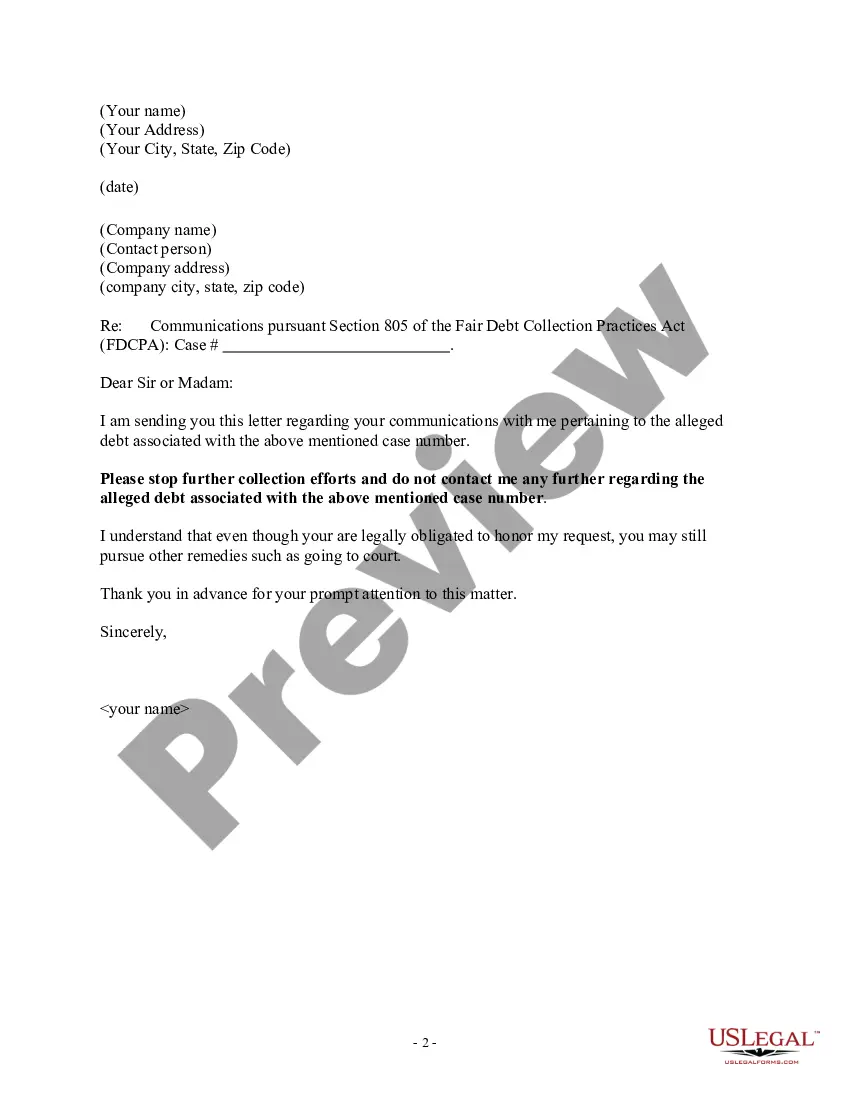

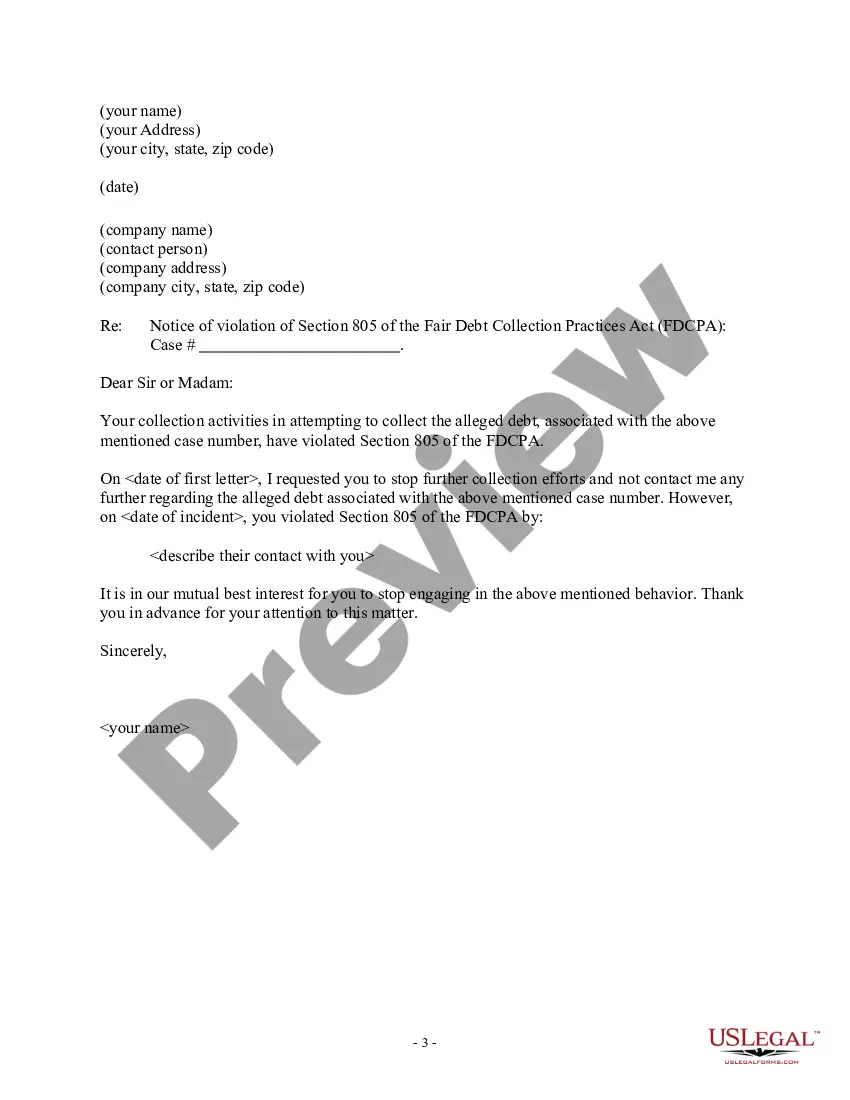

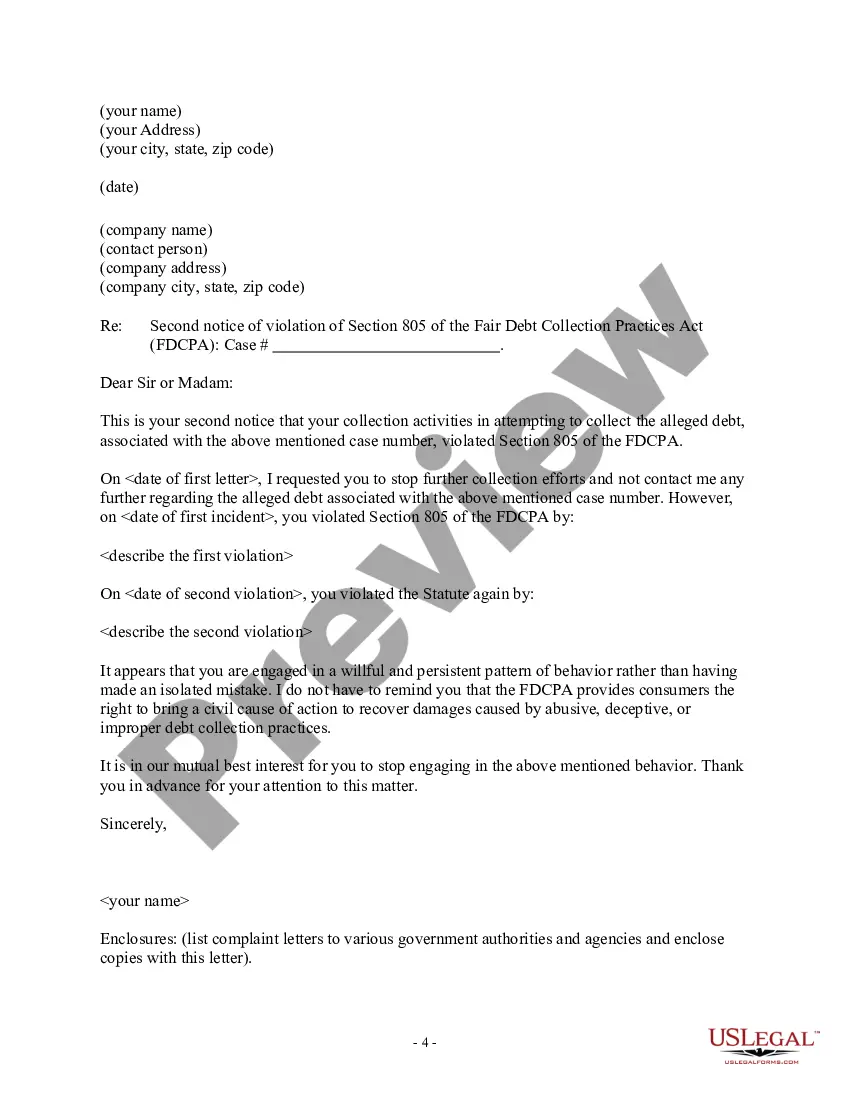

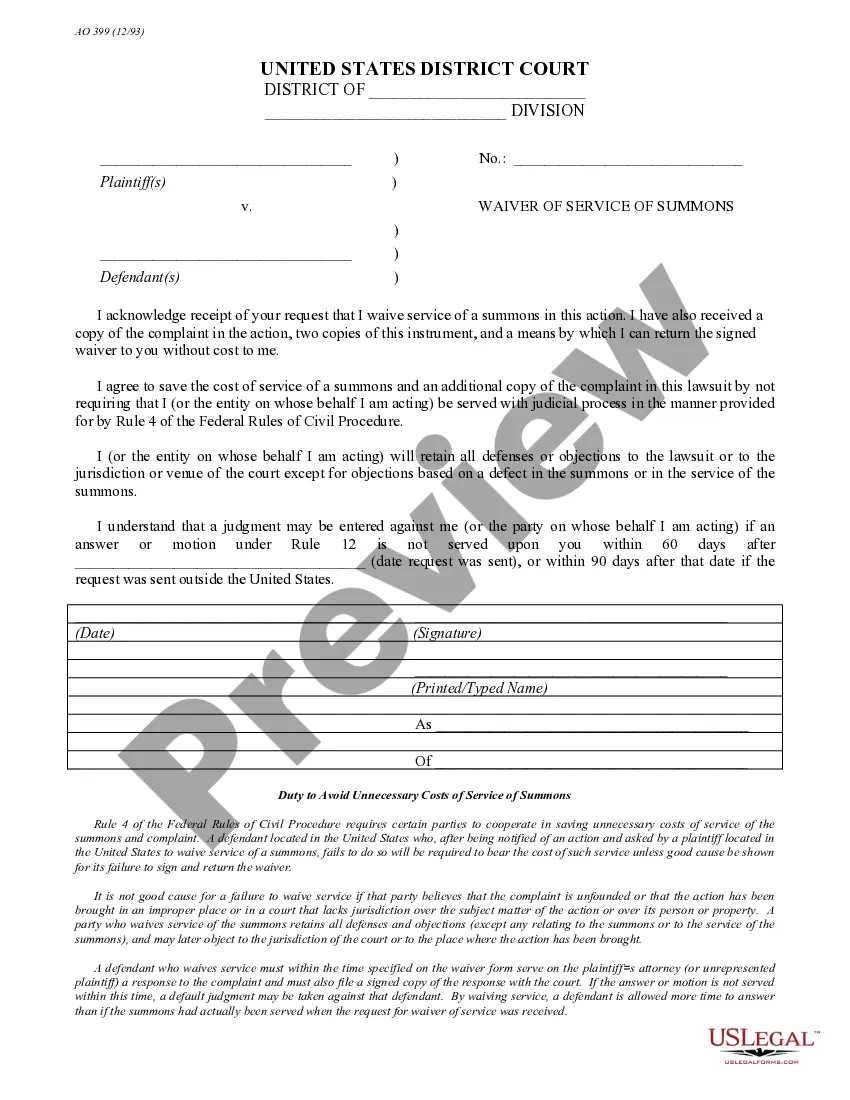

- Ensure you have selected the correct form for your city/state. Click the Preview button to check the form’s content. Review the form summary to ensure you have selected the right form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Download now button. Then, choose the pricing plan you prefer and provide your credentials to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form onto your device.

Form popularity

FAQ

The 7-7-7 rule in collections suggests you should expect a response within seven days, contacts every seven days, and resolution in seven weeks. Understanding this guideline can help manage your expectations when dealing with debt collectors. It’s essential to know your rights under the Vermont Notice of Violation of Fair Debt Act - Notice to Stop Contact during these interactions. Remember, timely communication can aid in resolving the issue efficiently.

The 11-word phrase to stop debt collectors is critical under the Vermont Notice of Violation of Fair Debt Act - Notice to Stop Contact. You can say, 'I do not owe this debt and request you cease all contact.' This phrase communicates your rights clearly and can deter unwanted communications. Use this statement when speaking with debt collectors.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Cease and desist letters increase your chances of being sued The reaction is quite simple: when you send a cease and desist letter to a collection agency, collection attorney, or to your original creditor, you leave them only one way to effectively collect from you: filing a lawsuit.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

If more than one creditor is harassing you for more than one debt, you will need to send each one a cease and desist letter. Even if the same creditor is trying to collect two different debts from you, you must write a letter for each of the two debts.

Many experts recommend waiting 90 days after your invoice's due date to send someone to collections. You can ask the nonpaying client to pay their debt once the due date arrives you just can't refer them to collections at that point.

If you believe a debt collector is harassing you, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372). You can also contact your state's attorney general .

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.