Virginia Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

It is feasible to spend numerous hours online searching for the authentic document template that satisfies the state and federal criteria you require.

US Legal Forms offers thousands of legitimate forms that are reviewed by experts.

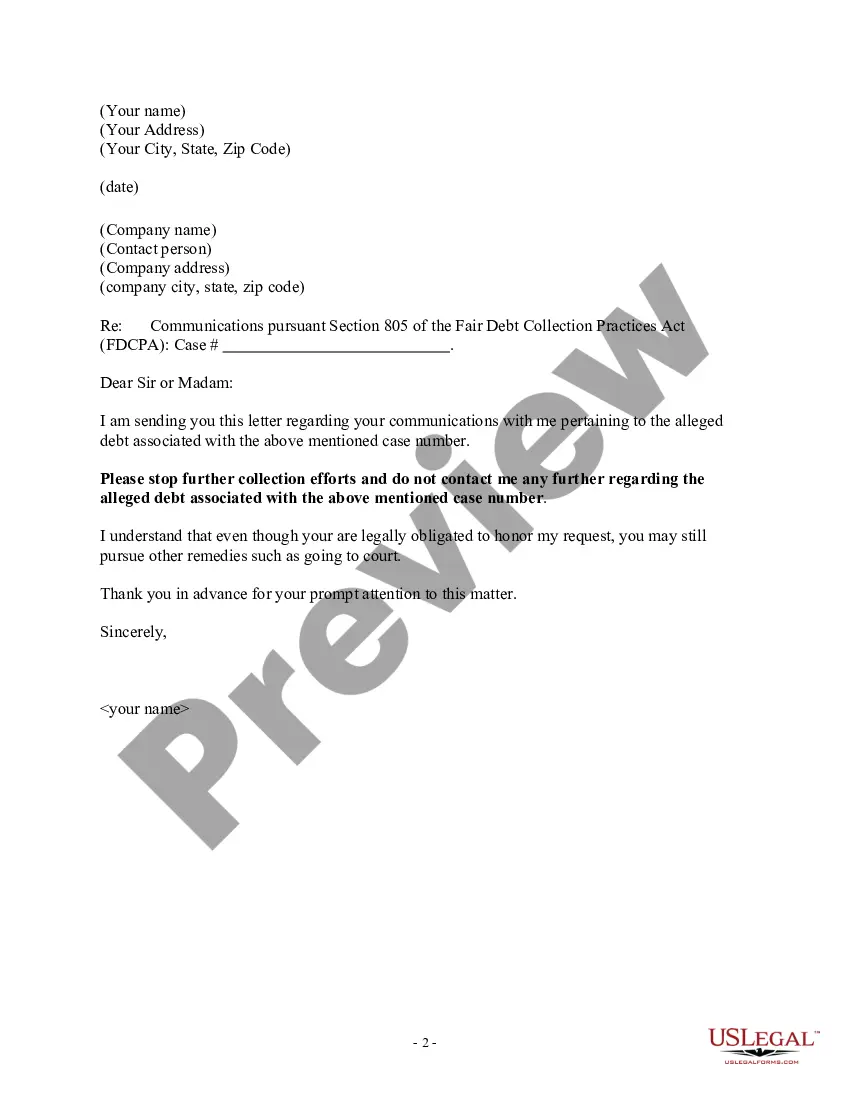

You can easily obtain or print the Virginia Notice of Violation of Fair Debt Act - Notice to Stop Contact from our service.

Read the form details to confirm you have selected the correct form. If available, utilize the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Virginia Notice of Violation of Fair Debt Act - Notice to Stop Contact.

- Each legal document template you purchase is yours for eternity.

- To obtain another copy of any purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/town of choice.

Form popularity

FAQ

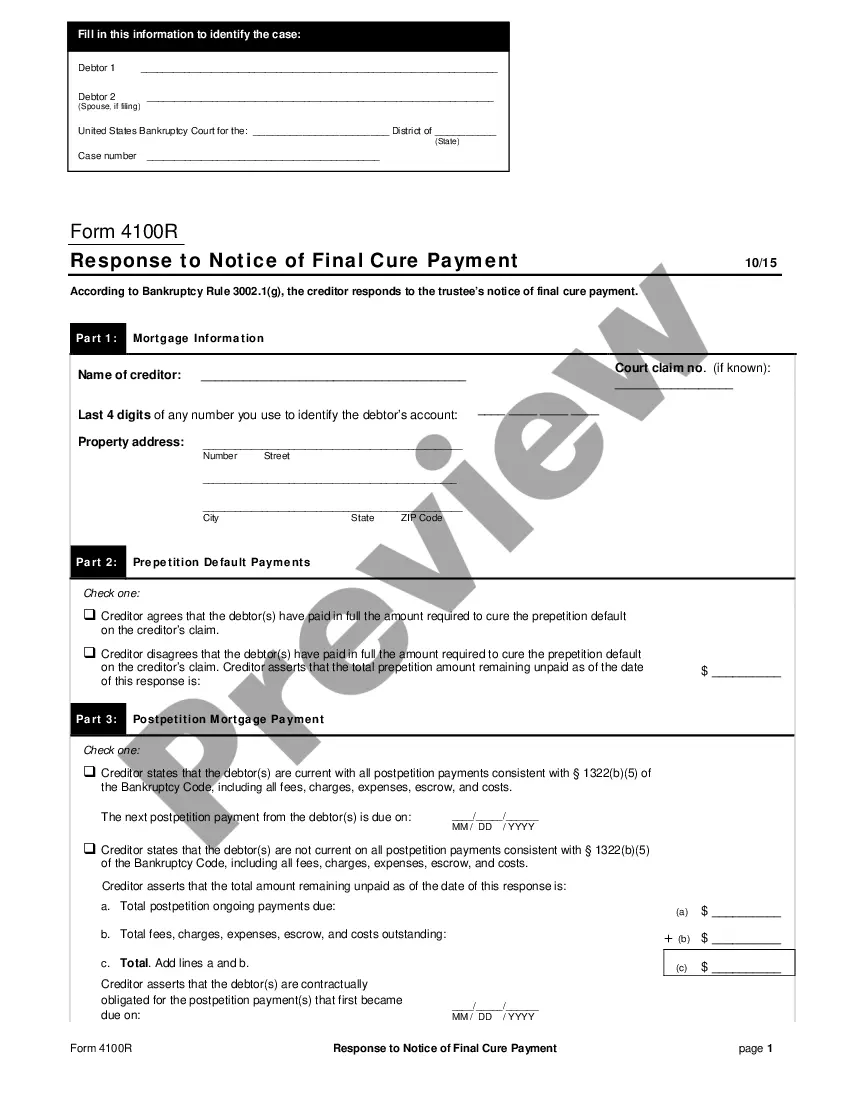

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Cease and desist letters are legally binding notices to debt collectors telling them to stop contacting you. You don't need a lawyer for this -- just get your debt collector's name, address, and your account information and write a letter telling them to stop all contact, and by law, they have to do so.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

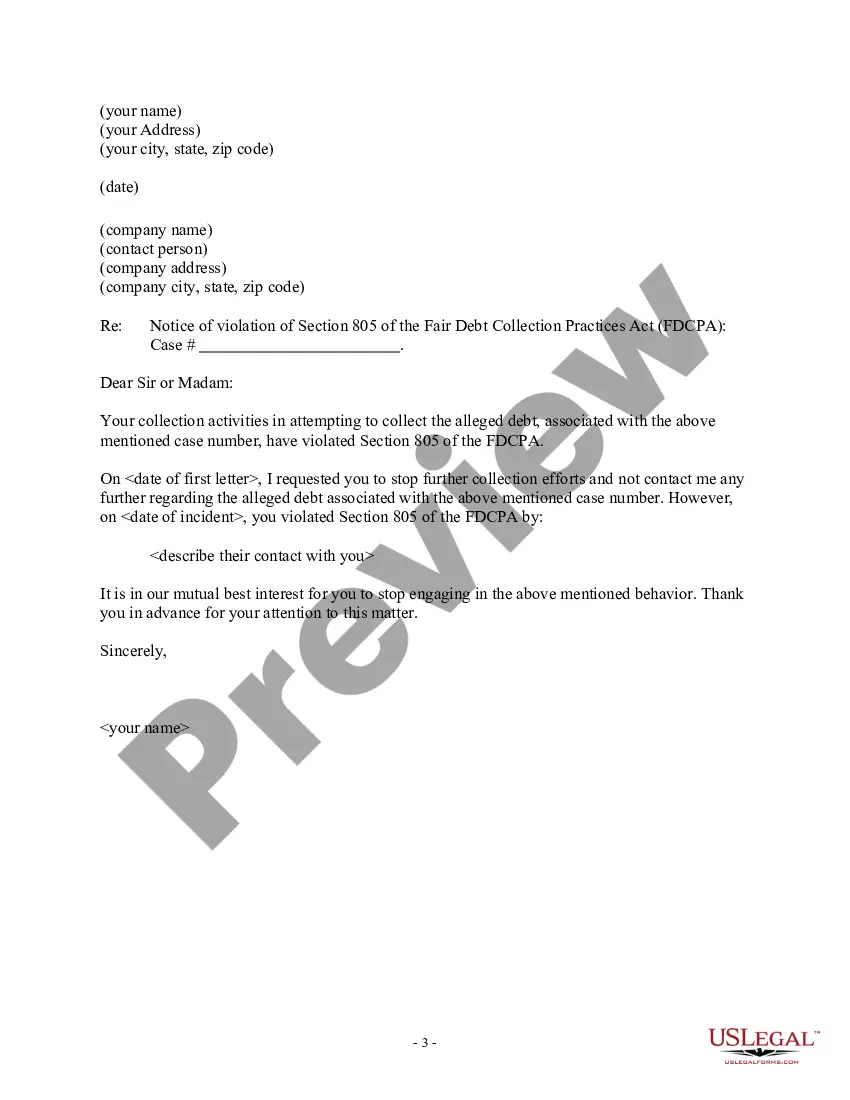

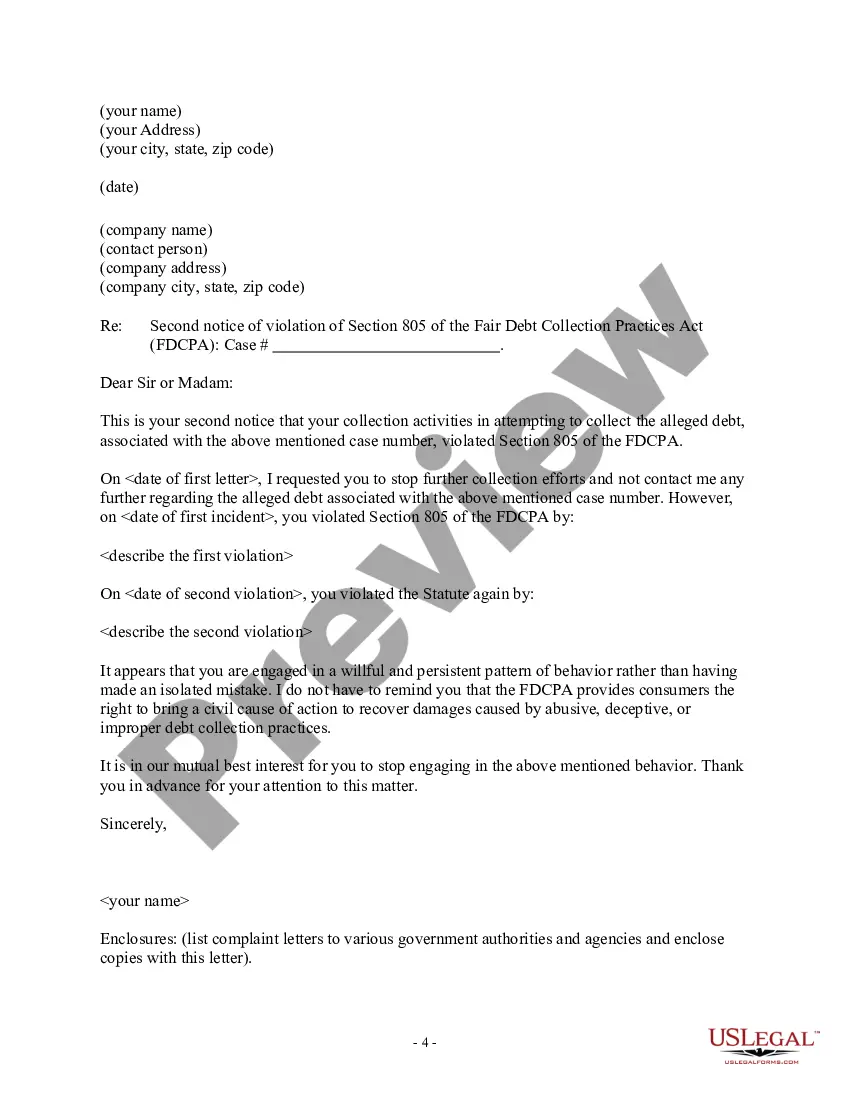

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The FDCPA prohibits debt collectors from calling you repeatedly, using profane language, making threats, or otherwise harassing you. If a debt collector is constantly calling you and causing you stress, sending a cease and desist letter can stop the collector from harassing you.

Revocation of Consent The safest and most effective way to stop harassing calls to your cell phone is to send a written cease and desist notice to the collector.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.