District of Columbia Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Acknowledgment By Debtor Of Correctness Of Account Stated?

Are you presently within a placement the place you need files for both enterprise or specific reasons almost every day? There are tons of lawful document templates available online, but locating kinds you can rely on isn`t effortless. US Legal Forms gives a large number of type templates, just like the District of Columbia Acknowledgment by Debtor of Correctness of Account Stated, that are composed to meet federal and state needs.

When you are presently familiar with US Legal Forms web site and possess your account, just log in. Next, you are able to acquire the District of Columbia Acknowledgment by Debtor of Correctness of Account Stated web template.

If you do not come with an accounts and need to begin to use US Legal Forms, adopt these measures:

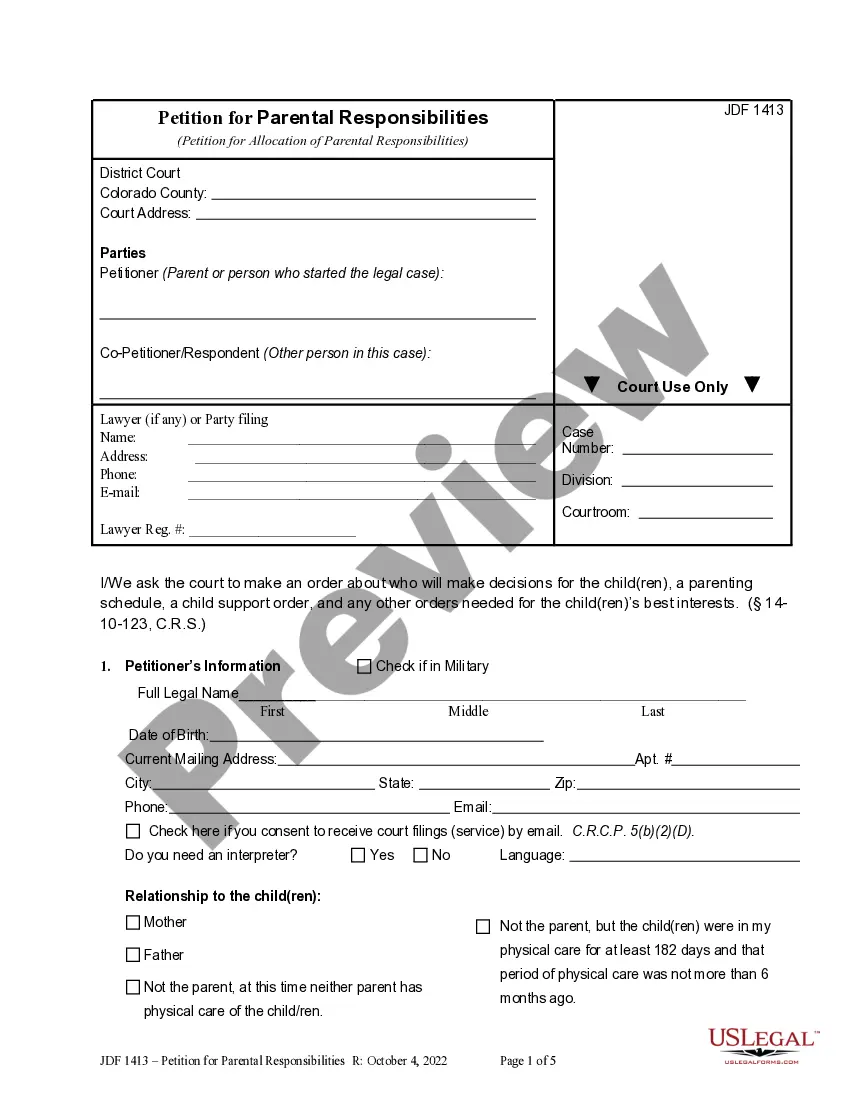

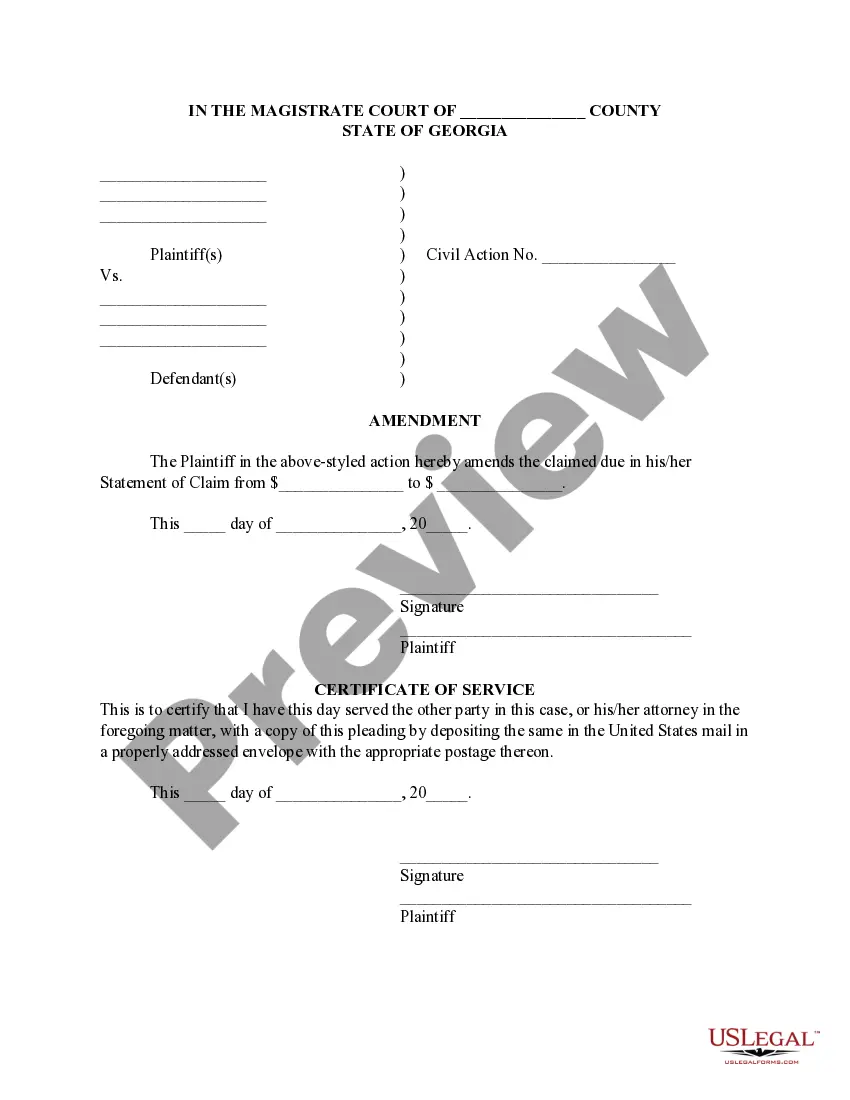

- Find the type you require and ensure it is for your right city/area.

- Take advantage of the Preview key to analyze the shape.

- Look at the description to ensure that you have selected the proper type.

- In case the type isn`t what you`re seeking, make use of the Search industry to find the type that meets your requirements and needs.

- Whenever you obtain the right type, simply click Purchase now.

- Opt for the costs plan you need, complete the specified details to produce your account, and buy the transaction with your PayPal or Visa or Mastercard.

- Pick a hassle-free document formatting and acquire your backup.

Get each of the document templates you possess purchased in the My Forms menu. You can obtain a extra backup of District of Columbia Acknowledgment by Debtor of Correctness of Account Stated anytime, if required. Just go through the necessary type to acquire or print the document web template.

Use US Legal Forms, by far the most considerable selection of lawful kinds, to save lots of some time and stay away from blunders. The support gives appropriately made lawful document templates that you can use for a selection of reasons. Generate your account on US Legal Forms and initiate generating your life easier.

Form popularity

FAQ

DC Code Section 48-904.01(a) states that it is illegal for an individual to knowingly make or sell controlled substances. Furthermore, it is just as illegal for an individual to possess controlled substances for the purpose of making or selling controlled substances.

The District of Columbia's general consumer protection law, which prohibits a wide variety of deceptive and unconscionable business practices, is called the Consumer Protection Procedures Act or ?CPPA.? It is codified at DC Official Code §§ 28-3901 to 28-3913.

In finance, consumer protection laws seek to prevent predatory lending, housing discrimination, securities fraud, privacy violations, and other unethical practices.

§ 28?3502. Special promise to answer for debt or default of another.

§ 28?3801. This subchapter applies to actions to enforce rights arising from a consumer credit sale or a direct installment loan.

Account stated refers to a document summarizing the amount a debtor owes a creditor. An account stated is also a cause of action in many states that allows a creditor to sue for payment.

Debt collection. (a)(1) This section applies to conduct and practices in connection with the collection of obligations arising from any consumer debt (other than a loan directly secured on real estate or a direct motor vehicle installment loan covered by Chapter 36 of this title).

With respect to a consumer credit sale or direct installment loan the agreement may provide for the payment by the consumer of reasonable attorney's fees not in excess of 15% of the unpaid balance of the obligation.