District of Columbia Receipt for Payment of Account

Description

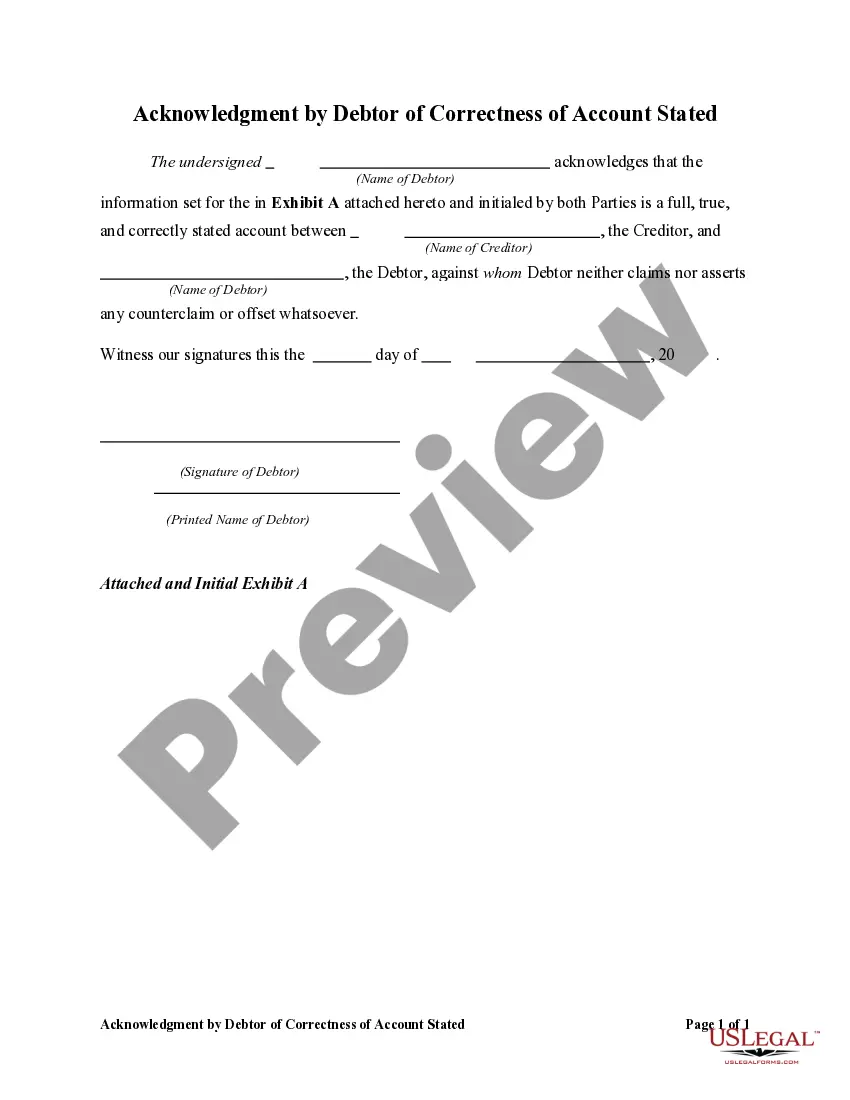

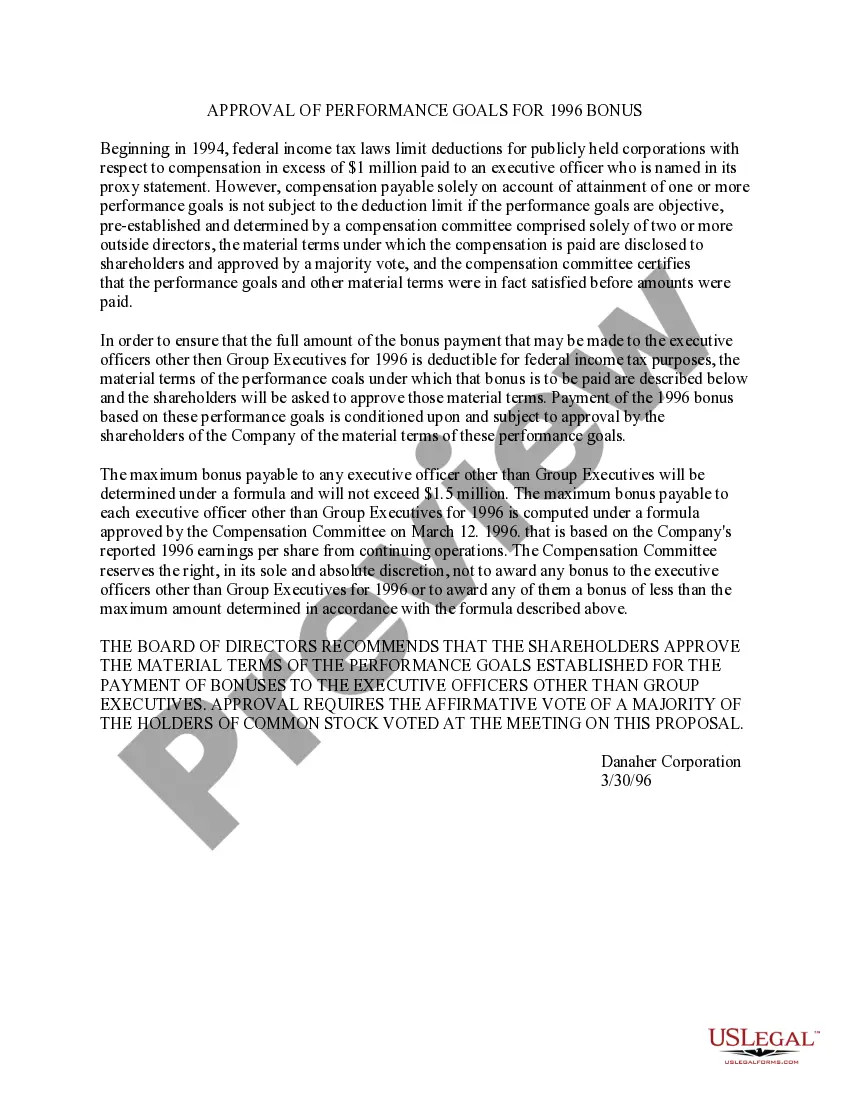

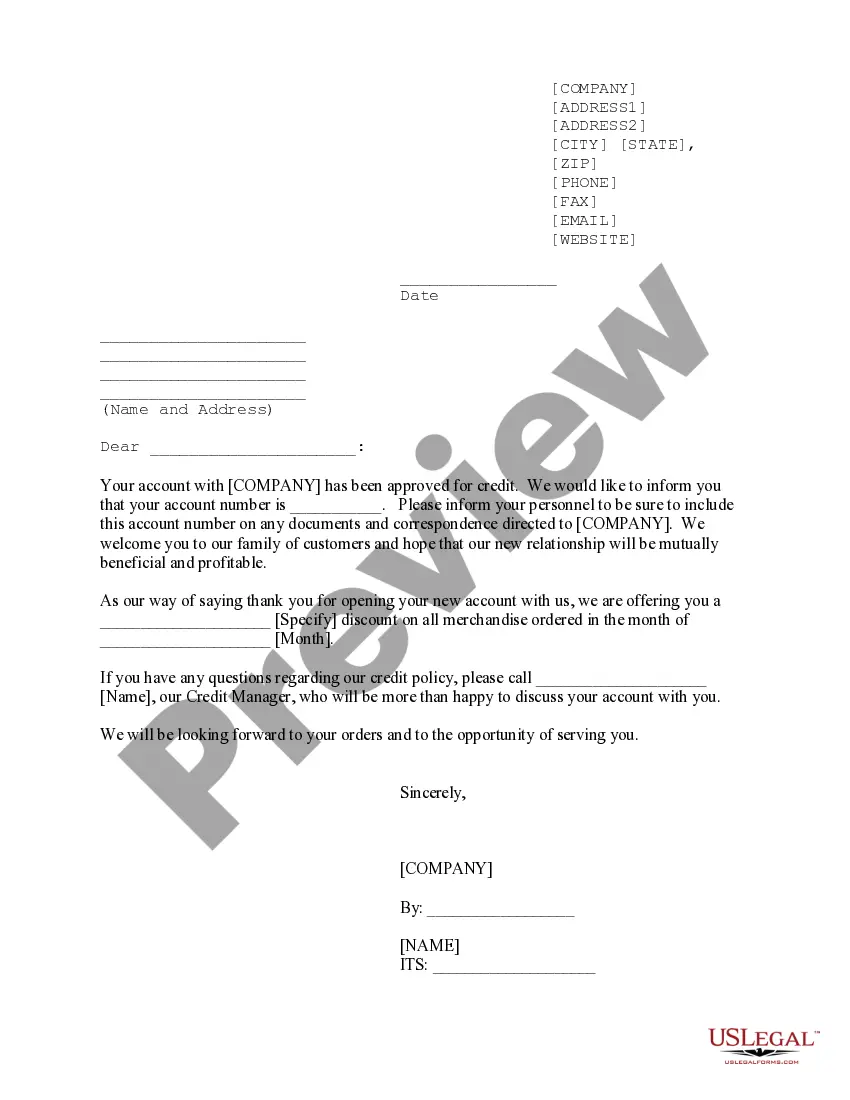

How to fill out Receipt For Payment Of Account?

If you need to complete, down load, or print authorized file web templates, use US Legal Forms, the largest selection of authorized types, that can be found on the web. Use the site`s simple and easy handy lookup to discover the files you require. A variety of web templates for business and individual reasons are categorized by classes and says, or key phrases. Use US Legal Forms to discover the District of Columbia Receipt for Payment of Account within a couple of clicks.

In case you are presently a US Legal Forms customer, log in in your accounts and click on the Obtain option to find the District of Columbia Receipt for Payment of Account. You may also entry types you formerly delivered electronically from the My Forms tab of your accounts.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for your proper metropolis/land.

- Step 2. Utilize the Review choice to look over the form`s articles. Don`t forget to learn the description.

- Step 3. In case you are not satisfied using the develop, utilize the Lookup field towards the top of the display screen to find other models of the authorized develop format.

- Step 4. After you have identified the shape you require, go through the Purchase now option. Opt for the pricing strategy you prefer and add your accreditations to register for the accounts.

- Step 5. Process the deal. You may use your charge card or PayPal accounts to finish the deal.

- Step 6. Find the formatting of the authorized develop and down load it on your product.

- Step 7. Full, edit and print or indicator the District of Columbia Receipt for Payment of Account.

Each authorized file format you get is yours for a long time. You might have acces to every single develop you delivered electronically inside your acccount. Select the My Forms portion and choose a develop to print or down load again.

Compete and down load, and print the District of Columbia Receipt for Payment of Account with US Legal Forms. There are thousands of professional and condition-specific types you can use to your business or individual needs.

Form popularity

FAQ

Contact Us For assistance with MyTax.DC.gov or account-related questions, please contact our e-Services Unit at (202) 759-1946 or email e-services.otr@dc.gov, am to pm, Monday through Friday.

Every new employee who resides in DC and is required to have DC income taxes withheld, must fill out Form D-4 and file it with his/her employer.

Tax Payments To remit payment, please log in to your MyTax.DC.gov account, which allows you to pay directly from your bank account without any fees. To remit payment, please log in to your MyTax.DC.gov account. You will be charged a fee that is paid directly to the District's credit card service provider.

Withholding Tax Account Number If you cannot locate this document or account number, please call the District of Columbia Office of Tax and Revenue at (202) 727-4829 to request it. Register with the DC Office of Tax and Revenue by completing Form FR-500 online. The online registration process can take 1-2 days.

FP-31 Tax Return The FP-31 tax return is essential for individuals who use property for business purposes in D.C. This includes rental property owners, freelancers, contractors, and 1099-NEC employees.

If you are a new business, register online with the DC Office of Tax and Revenue. If you already have a DC Withholding Account Number, you can look this up online or on on correspondence from the DC Office of Tax and Revenue. If you're unsure, contact the agency at 202-727-4829.

MyTax.DC.gov Visit the District's new online tax portal to view and pay your taxes.

If you are a resident of DC, MD or VA, you must file a state withholding form to notify Payroll Services of the correct amount of state tax to withhold from your compensation.