District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment

Description

How to fill out Agreement For Assignment And Sale Of Partnership Interest And Reorganization With Purchaser As New Partner Including Assignment?

You can dedicate time online searching for the legal document template that complies with the state and federal regulations you will require.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

You can conveniently obtain or print the District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment from the service.

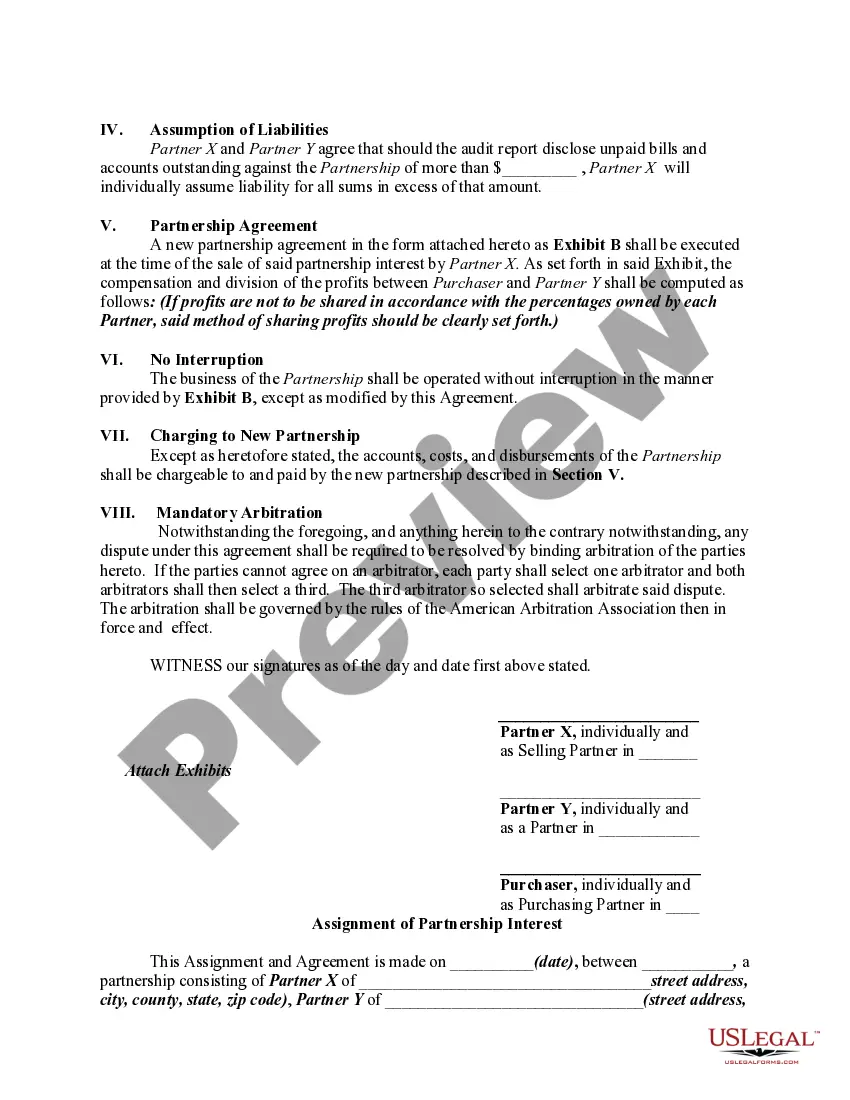

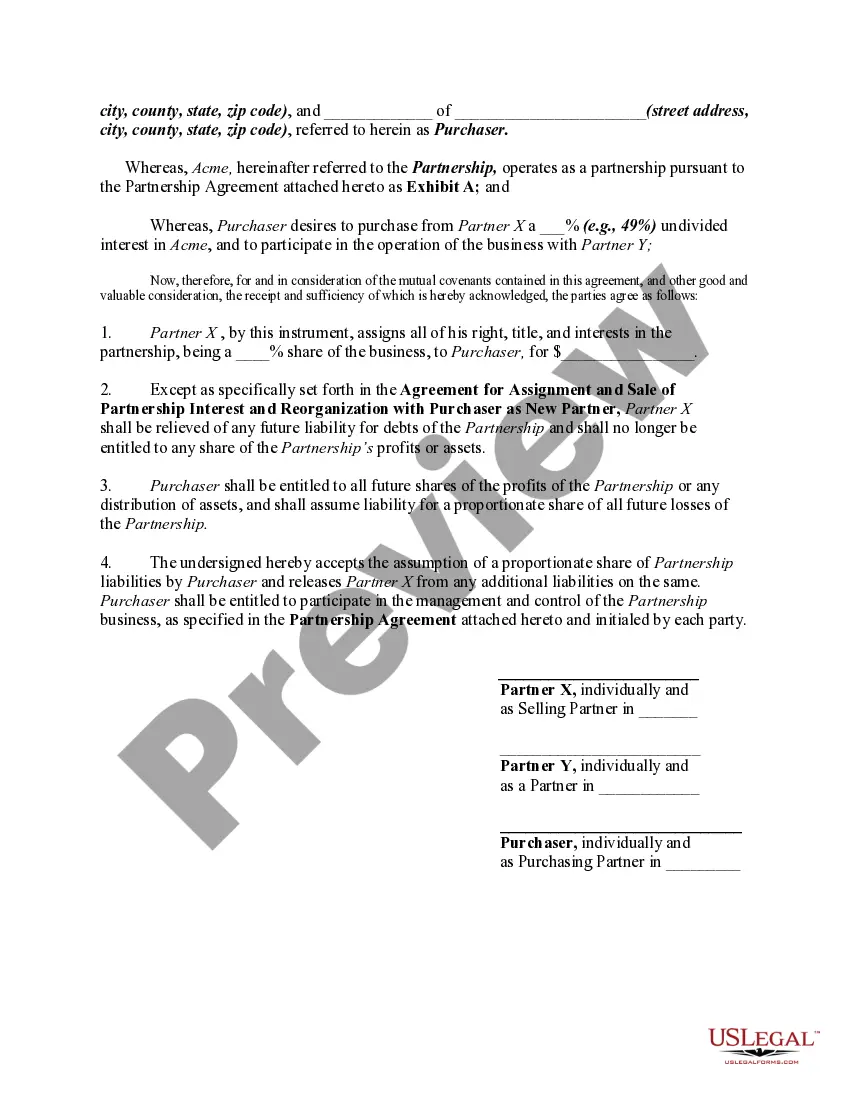

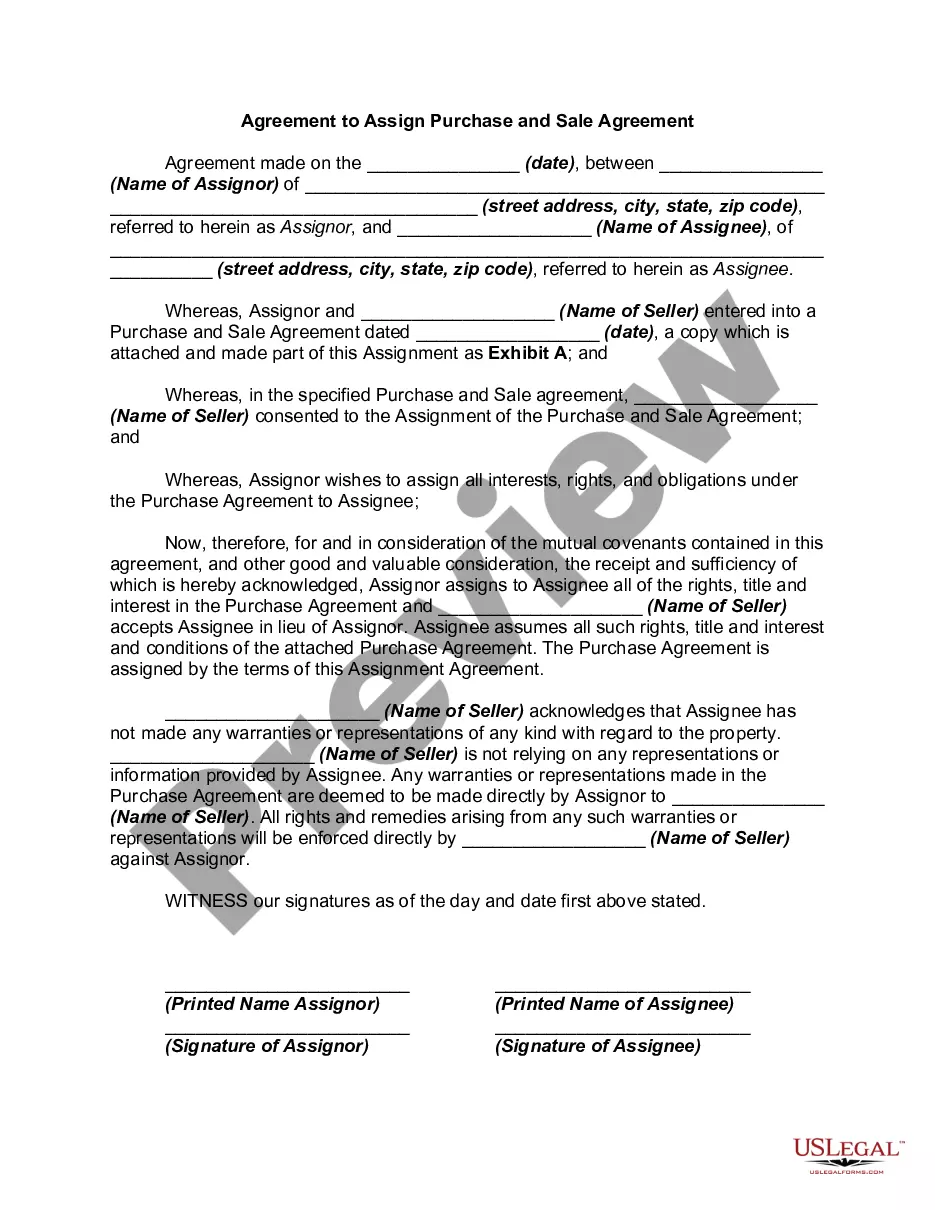

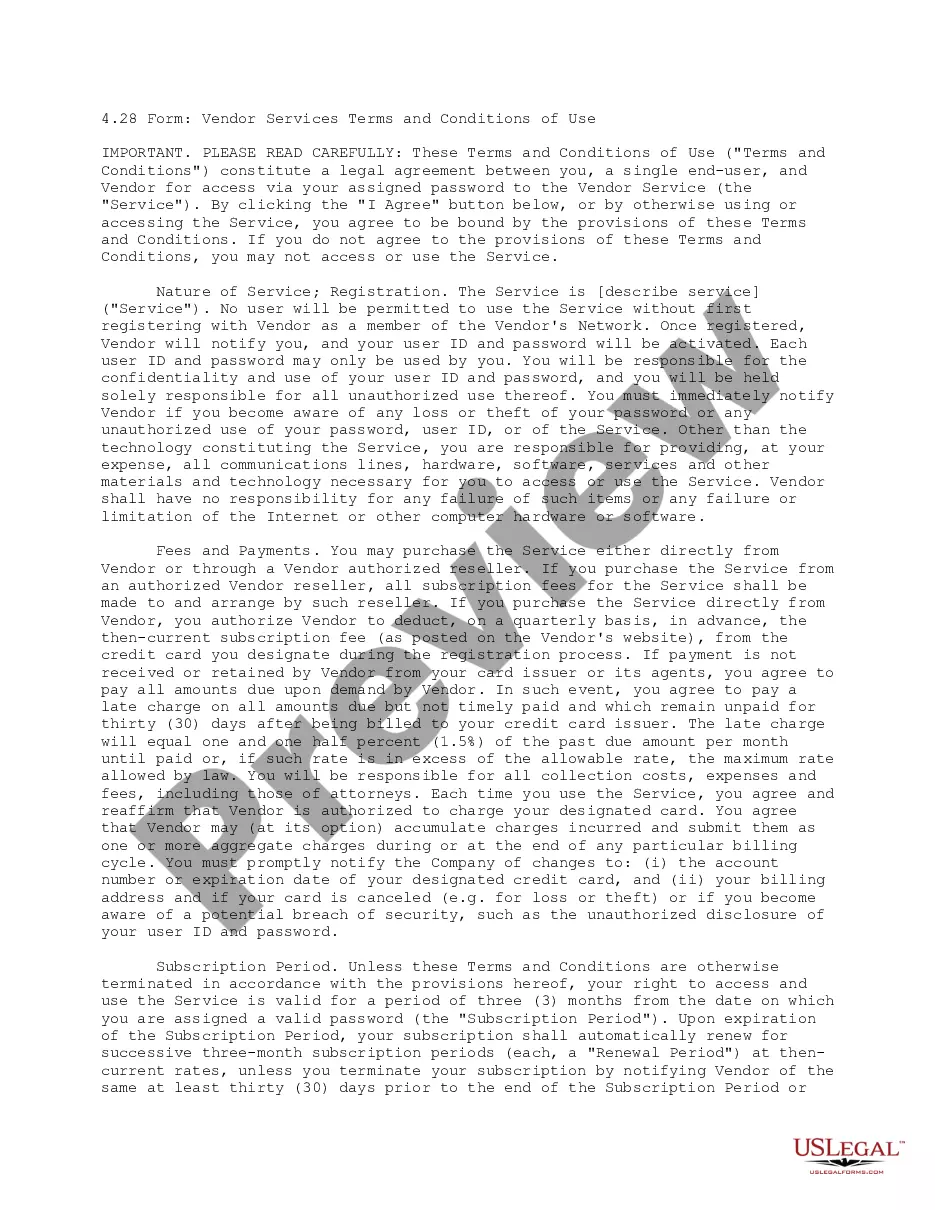

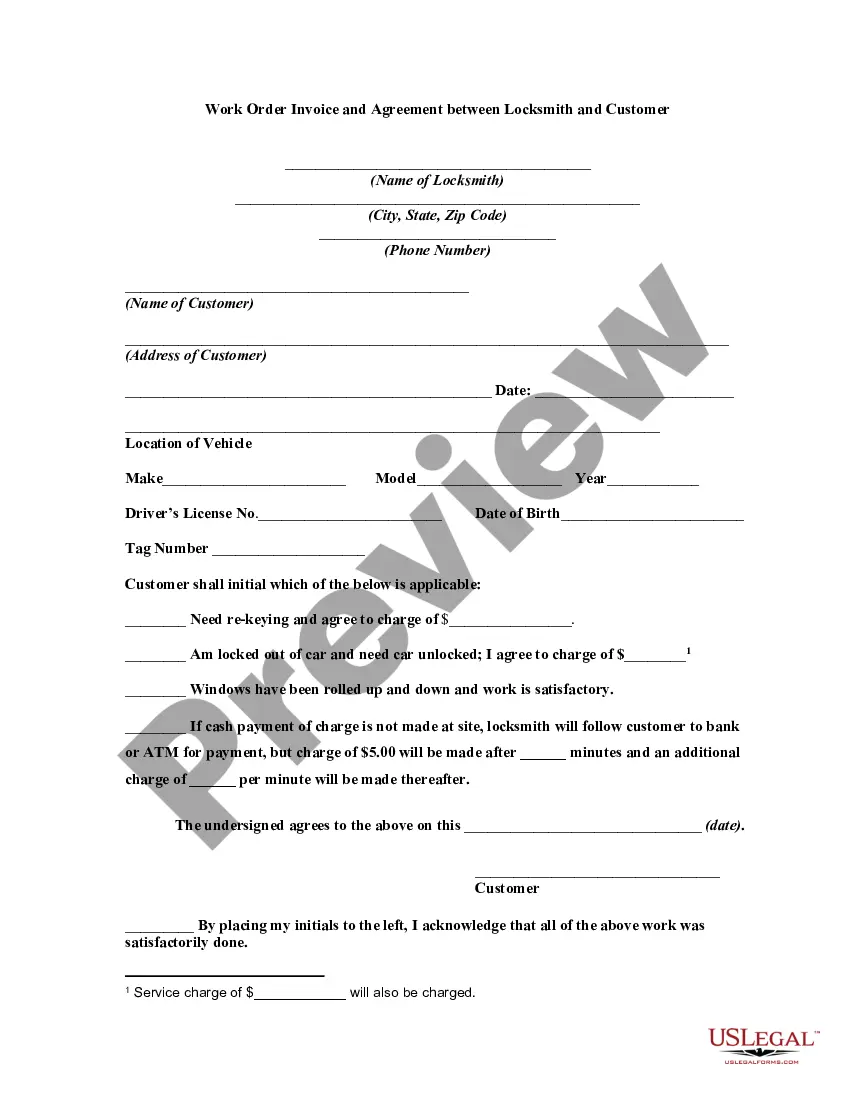

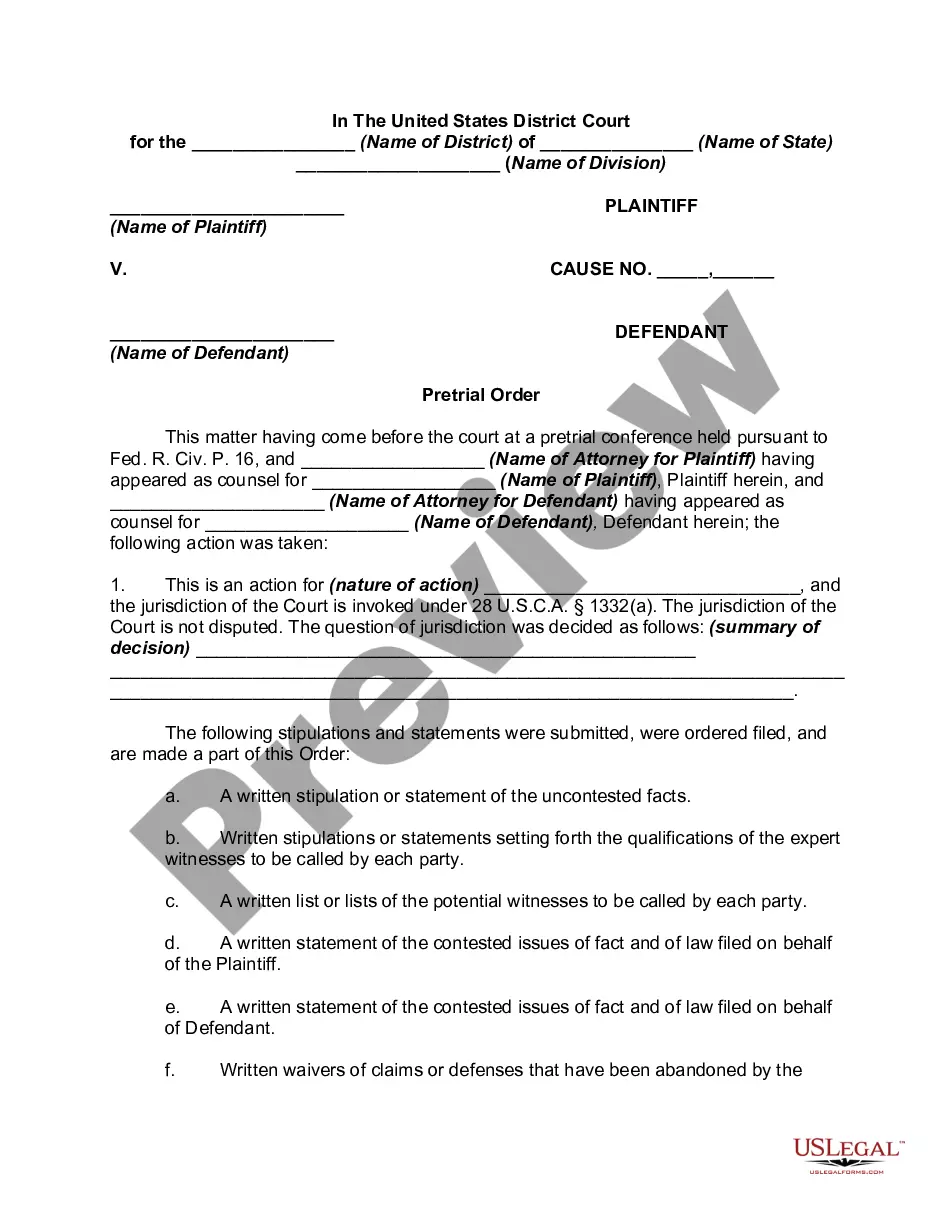

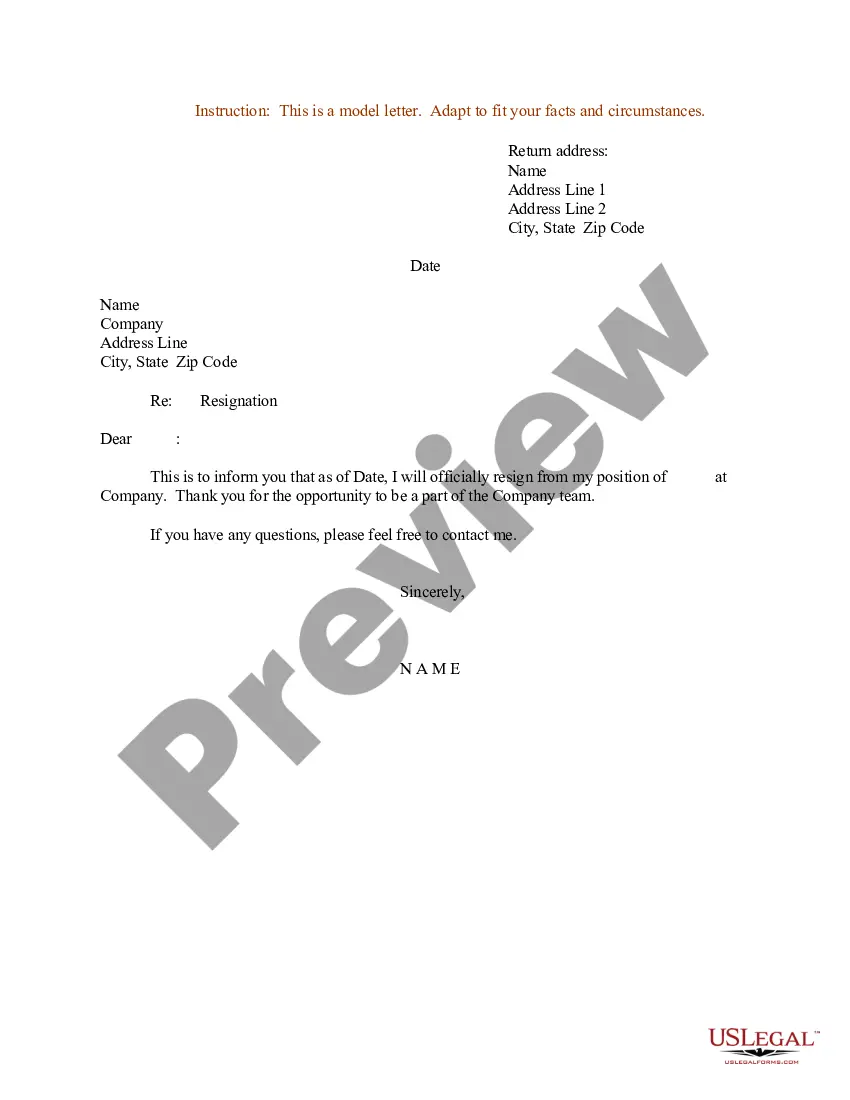

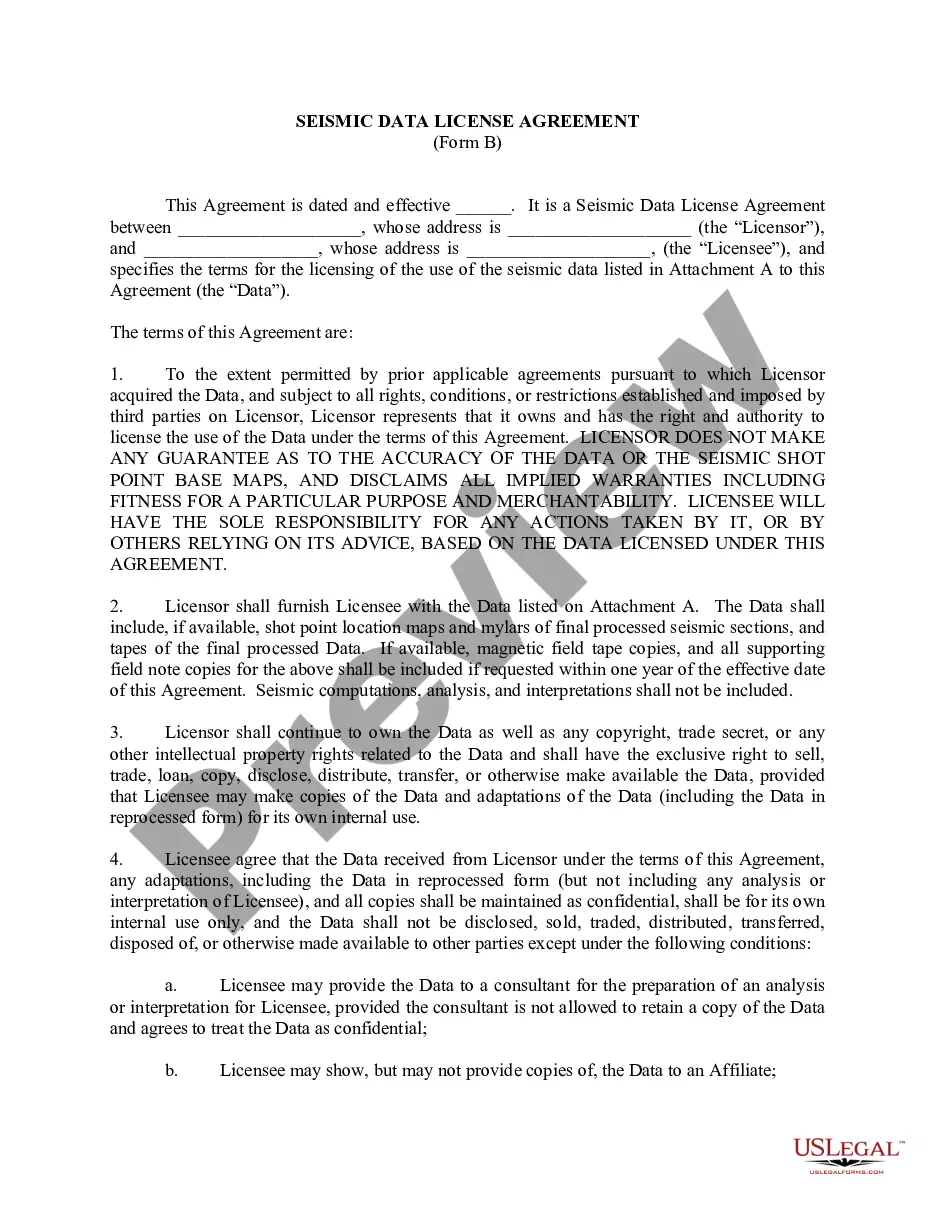

If available, use the Review button to preview the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- Afterward, you may complete, edit, print, or sign the District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of an acquired form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have chosen the correct document template for the area/city of your choice.

- Read the form description to confirm that you have selected the appropriate one.

Form popularity

FAQ

To account for the sale of partnership interest, you will need to recognize any gain or loss from the sale on your financial statements. This involves aligning your accounting practices with the details outlined in the District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. Additionally, it's important to keep thorough records to support your accounting treatment.

Reporting the sale of partnership interest involves documenting the transaction correctly, typically using IRS Form 4797. Integrating the details from the District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can streamline this process. Consulting a tax advisor is advisable to ensure you're meeting all necessary filing and reporting requirements.

A partnership agreement should be formatted clearly, typically starting with a title, followed by an introduction, and then detailed sections outlining the roles of partners, profit-sharing, and procedures for transfer of interest. Including provisions for a District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can set the framework for any future changes in partnership. Remember to review it with legal counsel to ensure compliance.

An assignment of an interest in a general partnership allows a partner to transfer their ownership stake to another individual or entity. This process generally requires a District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment to define the terms and ensure all parties understand the reassignment. It’s important to review the partnership agreement for any restrictions on transferring interests.

A Section 751 sale of partnership interest involves the sale of a partnership interest that includes unrealized receivables or inventory items, which are subject to special rules. Such sales are considered ordinary income and may lead to different tax treatments. Understanding these implications can be simpler with the District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment, which addresses relevant details in the transaction.

To report the sale of partnership interest, you must complete IRS Form 4797 to detail the sale's specifics. Additionally, ensure you reference the District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment for accurate reporting. It's crucial to consult with a tax professional to determine your individual reporting obligations based on your partnership agreement.

When a partnership is sold, the partnership interest is transferred from the selling partner to the buyer. This transition often requires a District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment to formalize the sale. Following the sale, the buyer typically assumes the selling partner's rights and responsibilities in the partnership.

To assign a partnership interest, first, review the partnership agreement for any specific requirements related to assignments. You will prepare a District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment, which outlines the terms of the assignment. Ensure all partners consent to the assignment, as this step is often necessary to comply with the partnership agreement.

Structuring a partnership agreement involves several steps, starting with the identification of all partners and their intended contributions. You should clarify how profits and losses will be divided, outline decision-making processes, and include terms regarding the addition or exit of partners. Utilizing a District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can streamline this process, ensuring all legal aspects are carefully addressed.

Four essential contents of a partnership agreement typically include the definition of each partner's contributions, the profit distribution method, roles and responsibilities of the partners, and the procedures for adding or removing partners. These components create a solid foundation for how the partnership will operate. In the context of a District of Columbia Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment, these details ensure that all parties are aligned and aware of their obligations.