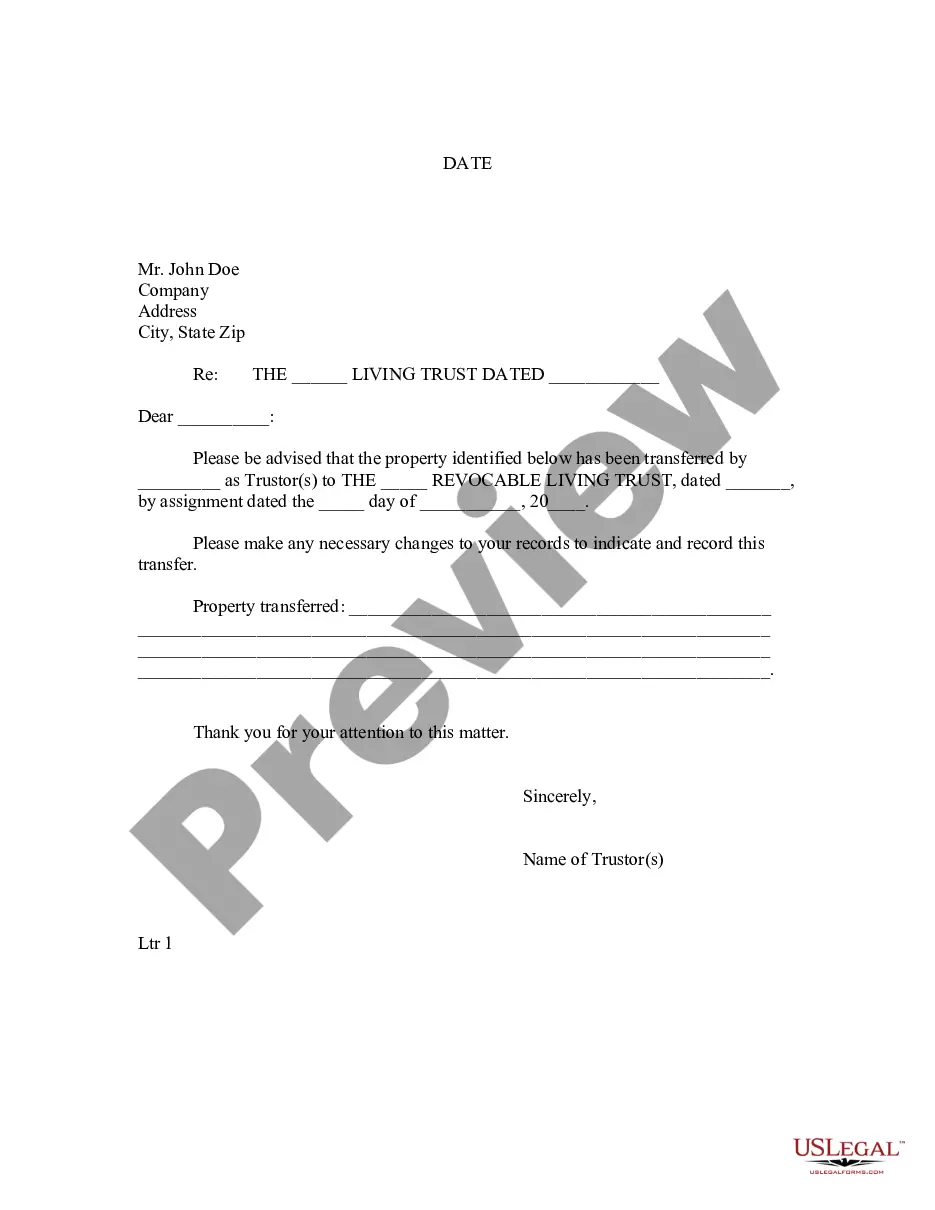

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

District of Columbia Letter to Lienholder to Notify of Trust

Description

How to fill out District Of Columbia Letter To Lienholder To Notify Of Trust?

The greater the number of documents you need to prepare - the more anxious you become.

You can find numerous District of Columbia Letter to Lienholder to Notify of Trust templates online, but it may be unclear which ones to trust.

Relieve the stress and simplify obtaining samples with US Legal Forms. Obtain professionally prepared documents that are crafted to meet state requirements.

Access all the files you receive in the My documents section. Simply navigate there to create a new version of your District of Columbia Letter to Lienholder to Notify of Trust. Even when using professionally drafted documents, it remains crucial to consider consulting your local attorney to confirm that your form is accurately completed. Achieve more for less with US Legal Forms!

- Verify that the District of Columbia Letter to Lienholder to Notify of Trust is valid in your state.

- Confirm your selection by reviewing the description or using the Preview feature if it’s available for the selected document.

- Click Buy Now to initiate the registration process and choose a pricing option that suits your needs.

- Provide the necessary information to set up your account and process your payment via PayPal or credit card.

- Choose a convenient file format and obtain your copy.

Form popularity

FAQ

A recorded lien release document is an official record that indicates a lien has been removed from a property title. This document is filed with the appropriate government office, serving as public proof that the borrower has fulfilled their obligations. If you require help with preparing and filing this important document, consider using the US Legal Forms platform, which simplifies the process for homeowners and lenders.

A letter of trust is a formal document that outlines the terms and conditions under which a trust operates. This letter designates the trustee’s responsibilities and provides details about the beneficiaries. The District of Columbia Letter to Lienholder to Notify of Trust specifically serves to inform lienholders of a trust’s existence, ensuring that all parties are aware of their rights and obligations.

The District of Columbia is primarily a tax lien state. This means that unpaid property taxes can lead to the creation of a tax lien, which can then be sold to investors. Understanding this classification is beneficial when drafting a District of Columbia Letter to Lienholder to Notify of Trust, as these factors can impact property rights.

The process involves several parties, including the borrower, lender, and trustee. Each has specific responsibilities to ensure the transaction is completed correctly and legally. When preparing a District of Columbia Letter to Lienholder to Notify of Trust, understanding these roles can facilitate smoother communication.

Several states, including California, Texas, and Washington, require a deed of trust for property transactions. In these locations, the deed serves as a security mechanism for loans. Knowing which states use this approach can help when formulating a District of Columbia Letter to Lienholder to Notify of Trust.

The trustee is responsible for filing the deed of trust with the appropriate county recorder or land registry office. This ensures that the deed is recorded in public records, establishing the lien on the property. When creating a District of Columbia Letter to Lienholder to Notify of Trust, coordinating with the trustee for accurate filing is essential.

In the District of Columbia, a deed of trust must be in writing and signed by the parties involved. Additionally, it should include a legal description of the property and be notarized to ensure authenticity. When drafting a District of Columbia Letter to Lienholder to Notify of Trust, meeting these requirements is vital for legality.

Deed tax and transfer tax are not exactly the same, though they are often confused. Transfer tax applies to the sale or transfer of property, while deed tax specifically relates to the recording of the property's deed. Both taxes can affect your overall costs in real estate transactions. For more information or support in creating a District of Columbia Letter to Lienholder to Notify of Trust, check out our US Legal Forms platform.

In Washington County, the responsibility for transfer tax often falls on the seller. However, it can also be negotiated as part of the sales agreement between the buyer and seller. Understanding these details is essential to avoid any surprises during the closing process. For guidance on preparing a District of Columbia Letter to Lienholder to Notify of Trust, consider using our US Legal Forms platform.