Connecticut Affidavit of Heirship - Descent

Description

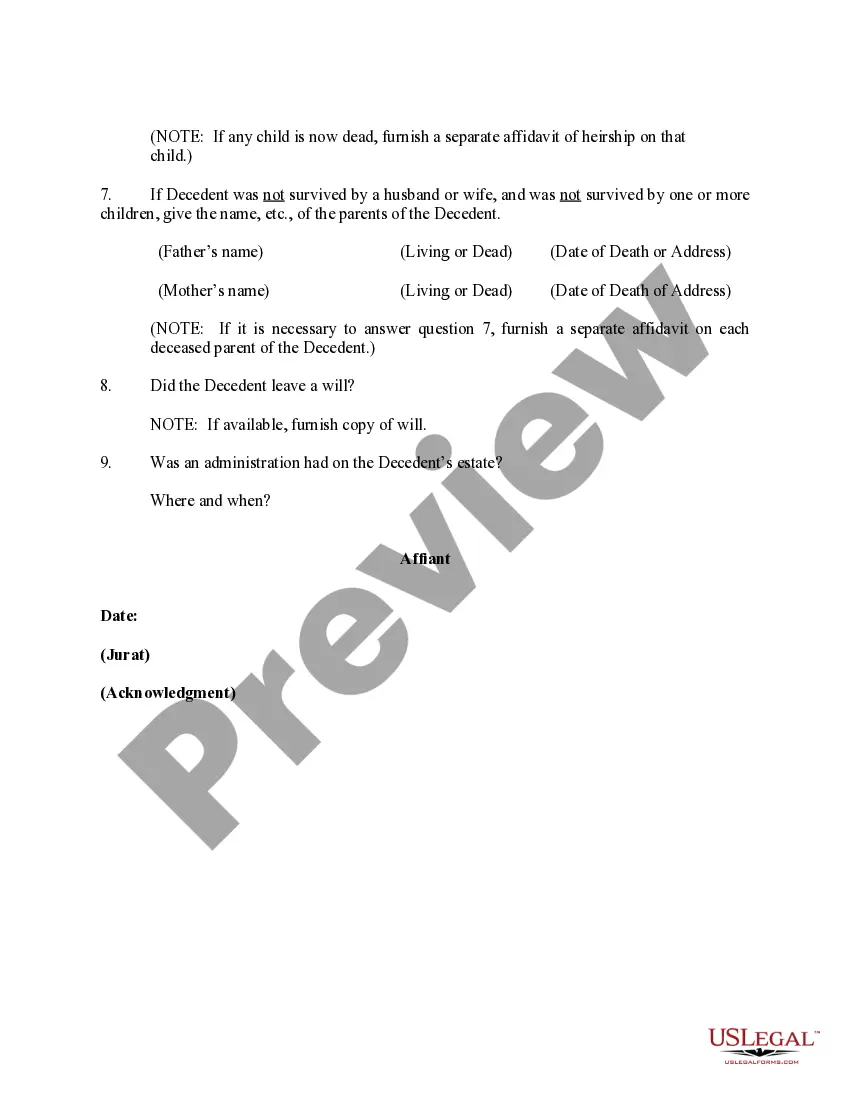

How to fill out Affidavit Of Heirship - Descent?

US Legal Forms - among the largest libraries of lawful kinds in America - gives a wide range of lawful file themes it is possible to download or produce. Making use of the web site, you can find a large number of kinds for enterprise and individual functions, categorized by groups, claims, or keywords and phrases.You will find the most up-to-date versions of kinds like the Connecticut Affidavit of Heirship - Descent within minutes.

If you already possess a registration, log in and download Connecticut Affidavit of Heirship - Descent from the US Legal Forms catalogue. The Obtain key will show up on each develop you view. You have access to all formerly delivered electronically kinds within the My Forms tab of the bank account.

In order to use US Legal Forms initially, listed here are simple instructions to help you get started:

- Ensure you have selected the right develop to your town/region. Select the Preview key to review the form`s articles. See the develop outline to actually have chosen the appropriate develop.

- If the develop does not satisfy your requirements, take advantage of the Research discipline near the top of the screen to obtain the the one that does.

- When you are content with the shape, confirm your choice by visiting the Acquire now key. Then, choose the pricing prepare you prefer and offer your qualifications to register on an bank account.

- Process the transaction. Use your charge card or PayPal bank account to complete the transaction.

- Choose the format and download the shape in your device.

- Make alterations. Complete, edit and produce and signal the delivered electronically Connecticut Affidavit of Heirship - Descent.

Each and every format you included with your account does not have an expiry date and it is your own property permanently. So, if you want to download or produce another version, just check out the My Forms segment and click on around the develop you want.

Get access to the Connecticut Affidavit of Heirship - Descent with US Legal Forms, by far the most considerable catalogue of lawful file themes. Use a large number of specialist and state-certain themes that meet your company or individual demands and requirements.

Form popularity

FAQ

The Declaration of Heirs aims to legally establish the quality of heirs who succeed in an inheritance, establishing their legitimacy to proceed to the division of that inheritance. As a rule, the declaration is made to designate the heirs; and not some legatees who also succeed in that inheritance.

If you die intestate in Connecticut, what your spouse inherits depends on whether or not you have living parents or descendants. If you don't, your spouse inherits everything. If you have living parents, and a surviving spouse, your spouse will inherit the first $100,000 of intestate property.

Spouse and children -- spouse takes 1/2 the estate. If the children are also the spouse's, the spouse also takes $100,000. If they are not, spouse only takes 1/2. Whatever remains is divided equally among the children in the same generation.

There is no inheritance tax in Connecticut. However, another state's inheritance tax may apply to you if your grantor lived in a state that has an inheritance tax. In Kentucky, for instance, the inheritance tax applies to all in-state property, even if the inheritor lives in another state.

If the decedent is survived by: Estate is divided as follows: Spouse, and the children* of both decedent and spouse -Spouse takes first $100,000 plus ½ of the remainder. Children* take the other ½ of the remainder. Spouse, and children* of decedent, one or more of whom is not the child of the spouse ? Spouse takes ½.

Spouse and children -- spouse takes 1/2 the estate. If the children are also the spouse's, the spouse also takes $100,000. If they are not, spouse only takes 1/2. Whatever remains is divided equally among the children in the same generation.

Full "probate" is ONLY required by law if the person who dies, with or without a will, (1) owned real estate (not just a life use) that does not pass by the deed to the "surviving" joint owner, OR (2) owned $40,000 or more of other assets that also don't pass by beneficiary or joint ownership to another person.