Connecticut Gutter Services Contract - Self-Employed

Description

How to fill out Gutter Services Contract - Self-Employed?

If you wish to finalize, download, or print lawful document templates, utilize US Legal Forms, the primary collection of legal forms accessible online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Connecticut Gutter Services Contract - Self-Employed in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you acquired within your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, and print the Connecticut Gutter Services Contract - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Connecticut Gutter Services Contract - Self-Employed.

- You can also access forms you previously acquired from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

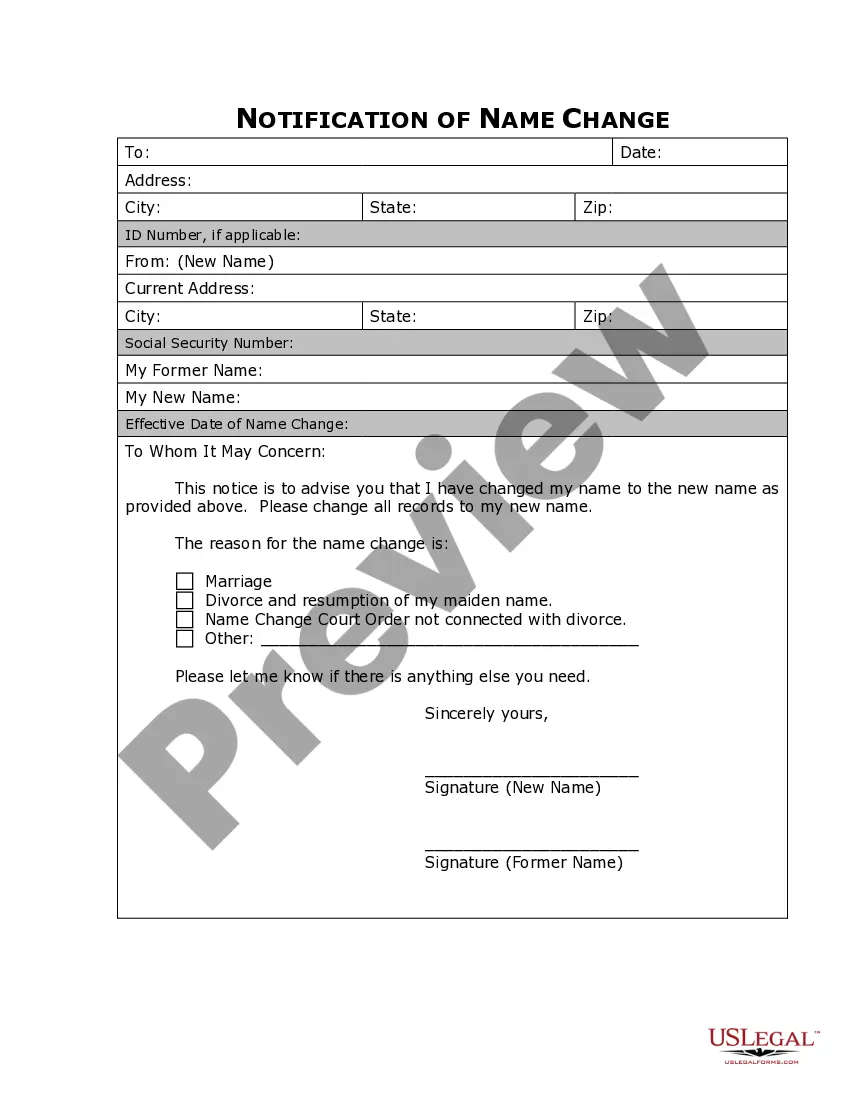

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of the legal form format.

- Step 4. After you have found the form you need, select the Buy now option. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Connecticut Gutter Services Contract - Self-Employed.

Form popularity

FAQ

To fill out an independent contractor agreement for your Connecticut Gutter Services Contract - Self-Employed, start by entering your information and the details of the client. Specify the services, timelines, and compensation terms. Make sure to review each section to avoid misunderstandings later. You can find helpful templates through USLegalForms to guide you step-by-step.

Filling out an independent contractor form for your Connecticut Gutter Services Contract - Self-Employed requires careful attention to details. Begin with your personal information, including your name and address, followed by your business details. Clearly indicate the services you will provide and the agreed payment structure. Utilizing USLegalForms can help ensure you complete it accurately.

Writing a contract agreement for your Connecticut Gutter Services Contract - Self-Employed involves outlining all essential terms of service. Specify the services provided, rates, and payment schedules. Including legal protections such as indemnification clauses can safeguard both parties. Consider using a template from USLegalForms to simplify the process.

To create an effective independent contractor agreement for your Connecticut Gutter Services Contract - Self-Employed, start by defining the scope of work clearly. Include payment terms, deadlines, and any specific duties required. It’s essential to outline confidentiality terms and dispute resolution procedures. You can use platforms like USLegalForms to access templates and guidelines.

To qualify as an independent contractor, you need to demonstrate that you work independently and set your own hours and methods. In Connecticut, this often means maintaining control over your business practices and having more than one client. Furthermore, engaging in a Connecticut Gutter Services Contract - Self-Employed can clarify your status and ensure you meet the necessary criteria for operating independently. It is crucial to understand and document the nature of your work arrangements.

Yes, in Connecticut, most contractors require a license to operate legally, especially in specific fields, including gutter services. If your work falls under home improvement, you must obtain a license from the Department of Consumer Protection. However, if you're working as a self-employed contractor and your activities qualify for exemptions, you might not need a formal license. Always verify the specific requirements for a Connecticut Gutter Services Contract - Self-Employed to ensure compliance.

The 7 minute rule in Connecticut is a guideline that helps you determine whether you are genuinely an independent contractor or an employee based on the amount of control your employer has over your work. If you perform services for less than seven minutes in the presence of the hiring party, it may support your status as self-employed. Understanding this rule is particularly beneficial when operating under a Connecticut Gutter Services Contract - Self-Employed. It's essential to evaluate your work relationship consistently to avoid misclassification.

Owning a gutter cleaning business can yield substantial profits, with some self-employed owners making over $50,000 annually. Your income depends on the number of customers you serve and the prices you set within your Connecticut Gutter Services Contract - Self-Employed. By creating a strong marketing strategy and maintaining customer satisfaction, you can effectively grow your business and increase your earnings. Additionally, investing in high-quality tools can improve efficiency and service quality, further enhancing your profits.

Yes, a gutter cleaning business can be an excellent venture, especially in areas with frequent rainfall like Connecticut. With a Connecticut Gutter Services Contract - Self-Employed, you can offer reliable services that many homeowners need. This business caters to a consistent demand, allowing you to build a steady client base. Additionally, by providing quality service, you can enhance your reputation and attract more customers.

Homeowners hold the primary responsibility for cleaning their gutters. However, many choose to hire professionals through a Connecticut Gutter Services Contract - Self-Employed. This choice not only ensures the job gets done correctly but also saves time and effort. By utilizing a contract, you can establish a clear understanding of services and expectations with your contractor.