Connecticut Self-Employed Irrigation Specialist Services Contract

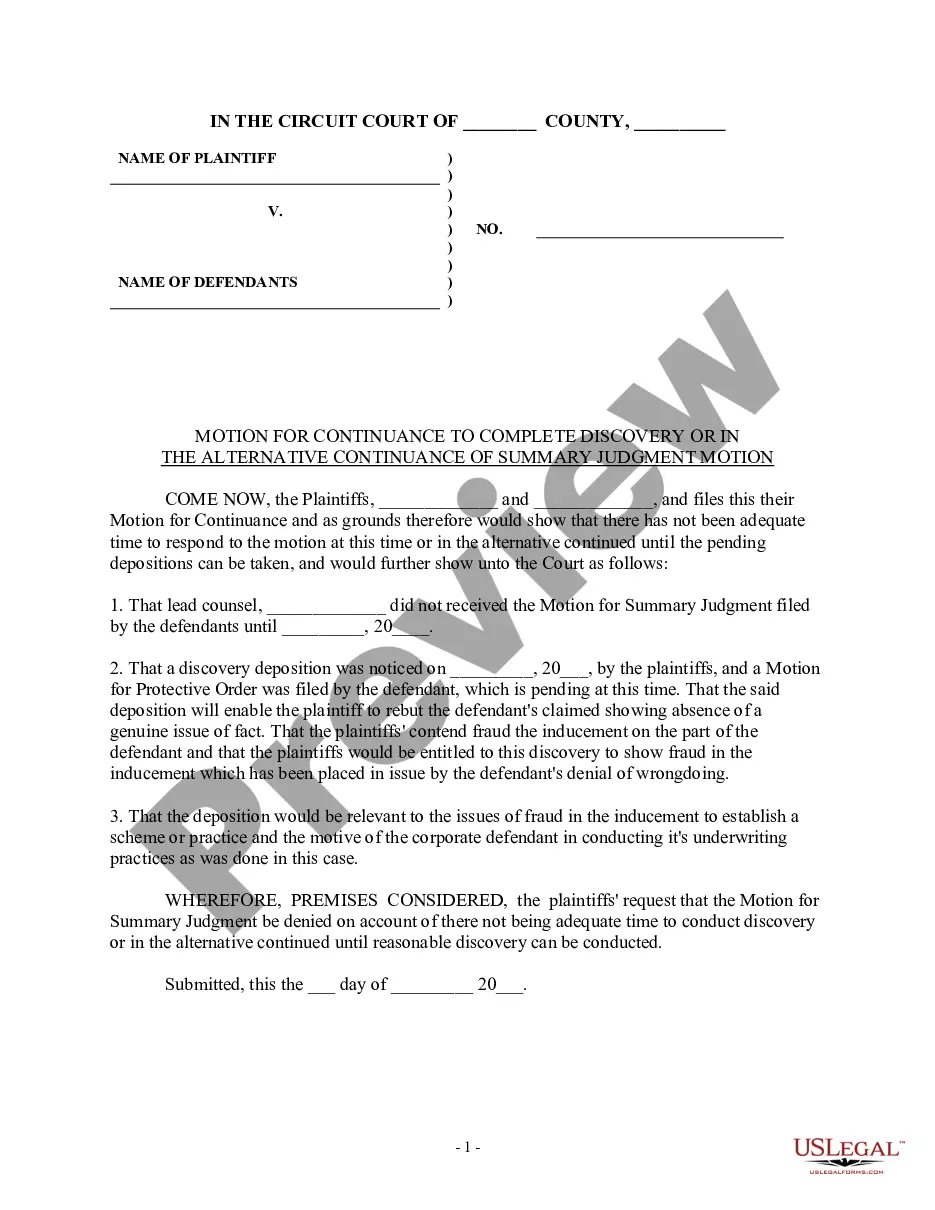

Description

How to fill out Self-Employed Irrigation Specialist Services Contract?

Are you currently in the location where you require papers for both business or personal purposes almost every day.

There are numerous legal document samples accessible online, but finding ones you can rely on isn't simple.

US Legal Forms offers thousands of template forms, including the Connecticut Self-Employed Irrigation Specialist Services Agreement, that are designed to meet state and federal requirements.

Once you acquire the appropriate form, click on Get now.

Choose the pricing plan you prefer, enter the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Connecticut Self-Employed Irrigation Specialist Services Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

- Utilize the Preview button to review the form.

- Examine the information to confirm that you have chosen the right form.

- If the form isn't what you require, use the Lookup field to find the form that fits your needs and specifications.

Form popularity

FAQ

To become an independent contractor in Connecticut, start by registering your business and obtaining any needed licenses. It’s also critical to decide on your business structure, especially if you intend to provide services under a Connecticut Self-Employed Irrigation Specialist Services Contract. Utilizing platforms like uslegalforms can assist you in understanding contract requirements, ensuring you are prepared for your new venture.

To perform services as an independent contractor in the U.S., ensure you understand the requirements for your specific industry and market. Typically, this includes obtaining necessary licenses, permits, and insurance. When pursuing a Connecticut Self-Employed Irrigation Specialist Services Contract, you should familiarize yourself with state-specific regulations and have appropriate documentation for compliance.

Yes, landscaping services are subject to Connecticut sales tax. However, there are exceptions, so it is essential to classify your services correctly. When working under a Connecticut Self-Employed Irrigation Specialist Services Contract, confirming whether your specific services are taxable can help you avoid any tax-related issues.

Choosing between forming an LLC or working as an independent contractor depends on your business goals and needs. An LLC offers liability protection and may have tax advantages, while an independent contractor operates with fewer regulations. Understanding the distinctions is crucial, especially when considering a Connecticut Self-Employed Irrigation Specialist Services Contract, as it may impact your liability and tax situation.

In Connecticut, landscaping services are generally taxable unless they are specifically exempt. You should understand that applying the right taxation rules can be complex; however, engaging in Connecticut Self-Employed Irrigation Specialist Services Contract can offer you clarity. It is essential to stay informed about any updates to tax regulations to ensure compliance.

Starting a home health care business in Connecticut requires several licenses and certifications. You may need to obtain a home health care agency license, as well as certifications for your caregivers. It's important to familiarize yourself with state regulations to ensure compliance. Additionally, having a Connecticut Self-Employed Irrigation Specialist Services Contract can provide the necessary framework for safeguarding your business.

The process of obtaining an irrigation license can take several weeks to months, depending on your state and specific requirements. Factors such as application reviews, testing, and approval times can affect the overall duration. Preparing your documents in advance and ensuring everything is complete can expedite the process. A Connecticut Self-Employed Irrigation Specialist Services Contract can also simplify your journey.

Irrigation licensing requirements vary by state. Some states, like California and Texas, require specific licensing, while others do not. Always check local regulations to ensure compliance. Holding a Connecticut Self-Employed Irrigation Specialist Services Contract can help you navigate these requirements in Connecticut effectively.

To become an independent contractor in Connecticut, you need to establish your business legally. First, choose a business structure that suits you, such as a sole proprietorship or LLC. Next, register your business with the state. Lastly, consider obtaining liability insurance and a Connecticut Self-Employed Irrigation Specialist Services Contract to ensure you meet all legal requirements.

Writing a simple service level agreement requires you to define the services offered, performance metrics, and quality standards. It’s important to set expectations for delivery and responsiveness. Utilizing a template for a Connecticut Self-Employed Irrigation Specialist Services Contract can provide a strong foundation, making sure all necessary details are addressed for both parties.