Connecticut Self-Employed Roofing Services Agreement

Description

How to fill out Self-Employed Roofing Services Agreement?

US Legal Forms - one of the largest collections of legal documents in the USA - offers an extensive variety of legal form templates that you can obtain or print. By using the site, you can find thousands of forms for commercial and personal purposes, sorted by categories, states, or keywords. You can discover the most recent forms like the Connecticut Self-Employed Roofing Services Agreement in just moments.

If you hold a subscription, Log In and obtain the Connecticut Self-Employed Roofing Services Agreement from your US Legal Forms library. The Acquire button will appear on every form you view. You have access to all previously saved forms from the My documents section of your account.

If you want to utilize US Legal Forms for the first time, here are straightforward instructions to help you get started: Ensure you have selected the appropriate form for your location/region. Click the Preview button to review the form's details. Check the form summary to confirm that you have chosen the correct form. If the form does not meet your needs, use the Search area at the top of the screen to find one that does. Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the payment plan you prefer and provide your information to register for an account. Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction. Obtain the format and download the form to your device. Make modifications. Fill out, edit, and print, then sign the downloaded Connecticut Self-Employed Roofing Services Agreement. Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to obtain or print another copy, simply navigate to the My documents section and click on the form you need.

With US Legal Forms, you can easily find the necessary legal documents tailored to your needs.

Make sure to leverage the vast library of resources available for seamless legal documentation.

- Access the Connecticut Self-Employed Roofing Services Agreement with US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure to check the form details before confirming.

- Use the search feature if the selected form does not match your requirements.

- Complete the purchase securely using your preferred payment method.

- Save your forms for future access without expiration.

Form popularity

FAQ

Yes, you can be a self-employed roofer in Connecticut, provided you comply with local regulations and obtain the necessary licenses. This path allows for greater flexibility and control over your projects. To protect yourself and your clients, consider drafting a Connecticut Self-Employed Roofing Services Agreement that outlines the terms of your services. Using a reliable platform like US Legal Forms can make this process easier.

In Connecticut, roofers are generally required to have a license to operate legally. This requirement helps ensure that they meet safety and quality standards. When drafting a Connecticut Self-Employed Roofing Services Agreement, it's essential to include the license details to enhance credibility and trust with your clients. Always check the latest local regulations to stay compliant.

Yes, you can write your own legally binding contract as long as it meets the legal requirements in Connecticut. Ensure that your contract includes clear terms, signatures from both parties, and a date. A Connecticut Self-Employed Roofing Services Agreement can serve as a solid foundation, helping you incorporate all necessary elements without missing essential details. Consider using a template for guidance.

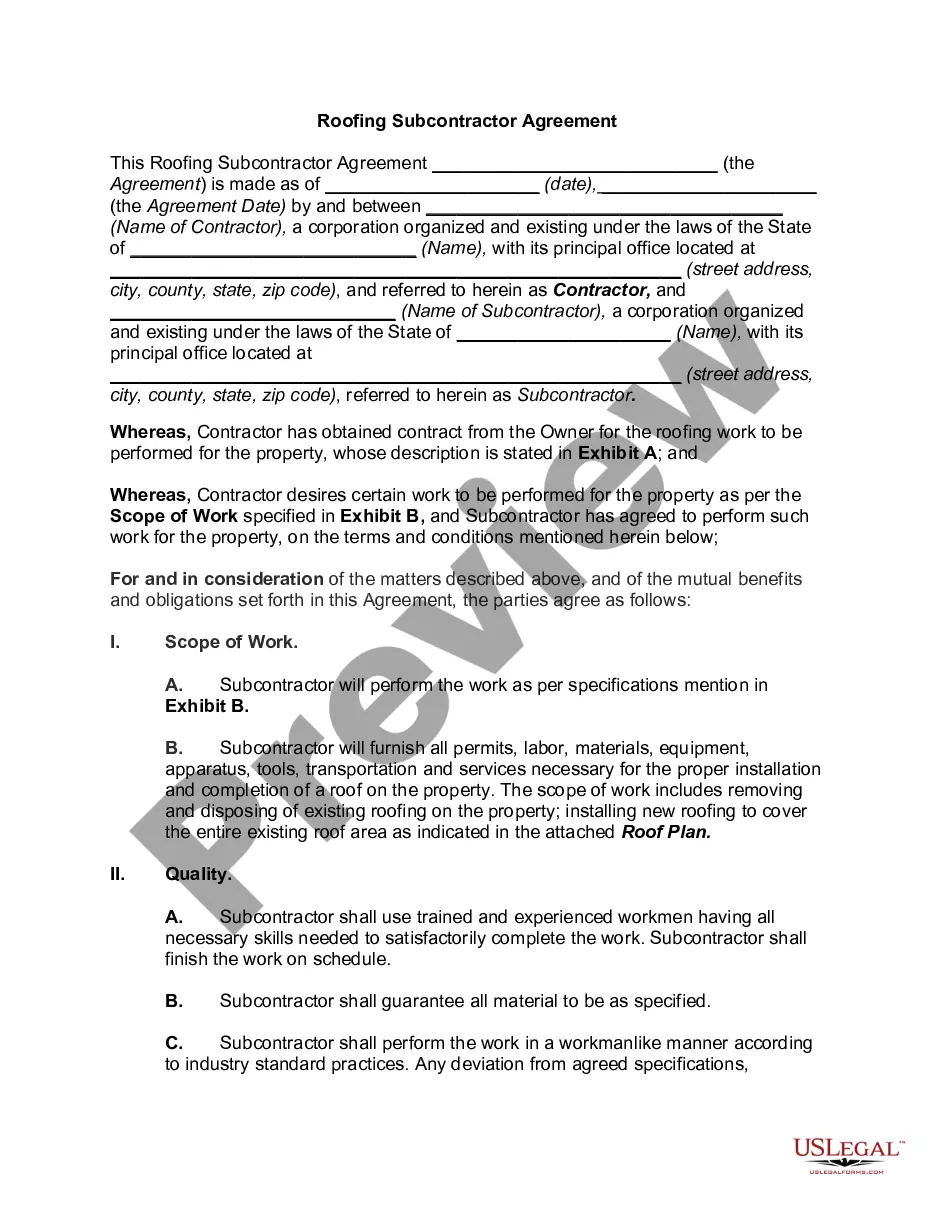

To create a roofing contract, start by outlining the essential elements, such as the scope of work, payment terms, and project timeline. Make sure to include specific details about materials and labor costs. Using a Connecticut Self-Employed Roofing Services Agreement template can simplify this process, ensuring you cover all necessary legal aspects. You can find user-friendly templates on platforms like US Legal Forms.

A standard roofing contract typically includes project details, timelines, payment schedules, and warranty information. It outlines the responsibilities of both the contractor and the client. Utilizing a Connecticut Self-Employed Roofing Services Agreement template can help ensure your contract covers all essential elements and protects your rights throughout the project.

To become an independent contractor in Connecticut, you must register your business and obtain the necessary licenses. Additionally, you should familiarize yourself with tax obligations and insurance requirements. A well-drafted Connecticut Self-Employed Roofing Services Agreement can help you define your business relationship and establish clear terms with clients.

In Connecticut, a roofing contractor must have a valid home improvement contractor license. This license ensures that the contractor meets state standards for quality and safety. When drafting a Connecticut Self-Employed Roofing Services Agreement, confirm that your contractor holds the necessary licenses to protect your interests.

The 25% rule refers to a guideline in the roofing industry about the percentage of roof replacement allowed without needing a full permit. This rule helps homeowners understand when they need to notify local authorities about significant repairs. For more clarity, refer to a Connecticut Self-Employed Roofing Services Agreement that outlines permit requirements specific to your situation.

Yes, you can create your own contract. However, it is crucial to ensure it meets state requirements and covers all essential elements. Using a Connecticut Self-Employed Roofing Services Agreement template can provide a solid foundation, ensuring that your contract is both comprehensive and compliant with local laws.

To create a roofing contract, start by outlining the scope of work. Include details such as materials, timelines, and payment terms. You can also reference a Connecticut Self-Employed Roofing Services Agreement template to ensure you cover all necessary legal aspects. This can save you time and help you avoid potential issues down the line.