The form is used when the Assignor transfers, assigns, and conveys to Assignee an overriding royalty interest in the Leases and all of the oil, gas and other minerals produced, saved and marketed from the Lease equal to a pecentage of 8/8 (the Override ).

West Virginia Assignment of Overriding Royalty Interest by Overriding Royalty Interest Owner, No Proportionate Reduction,

Description

How to fill out Assignment Of Overriding Royalty Interest By Overriding Royalty Interest Owner, No Proportionate Reduction,?

Finding the right authorized record design can be quite a have difficulties. Needless to say, there are plenty of templates available online, but how would you obtain the authorized develop you require? Use the US Legal Forms website. The services provides a huge number of templates, such as the West Virginia Assignment of Overriding Royalty Interest by Overriding Royalty Interest Owner, No Proportionate Reduction,, which you can use for company and personal requires. All the forms are checked out by pros and fulfill state and federal specifications.

Should you be previously signed up, log in for your account and then click the Acquire key to find the West Virginia Assignment of Overriding Royalty Interest by Overriding Royalty Interest Owner, No Proportionate Reduction,. Use your account to look from the authorized forms you might have ordered in the past. Check out the My Forms tab of your own account and acquire another backup of your record you require.

Should you be a new user of US Legal Forms, here are easy recommendations for you to comply with:

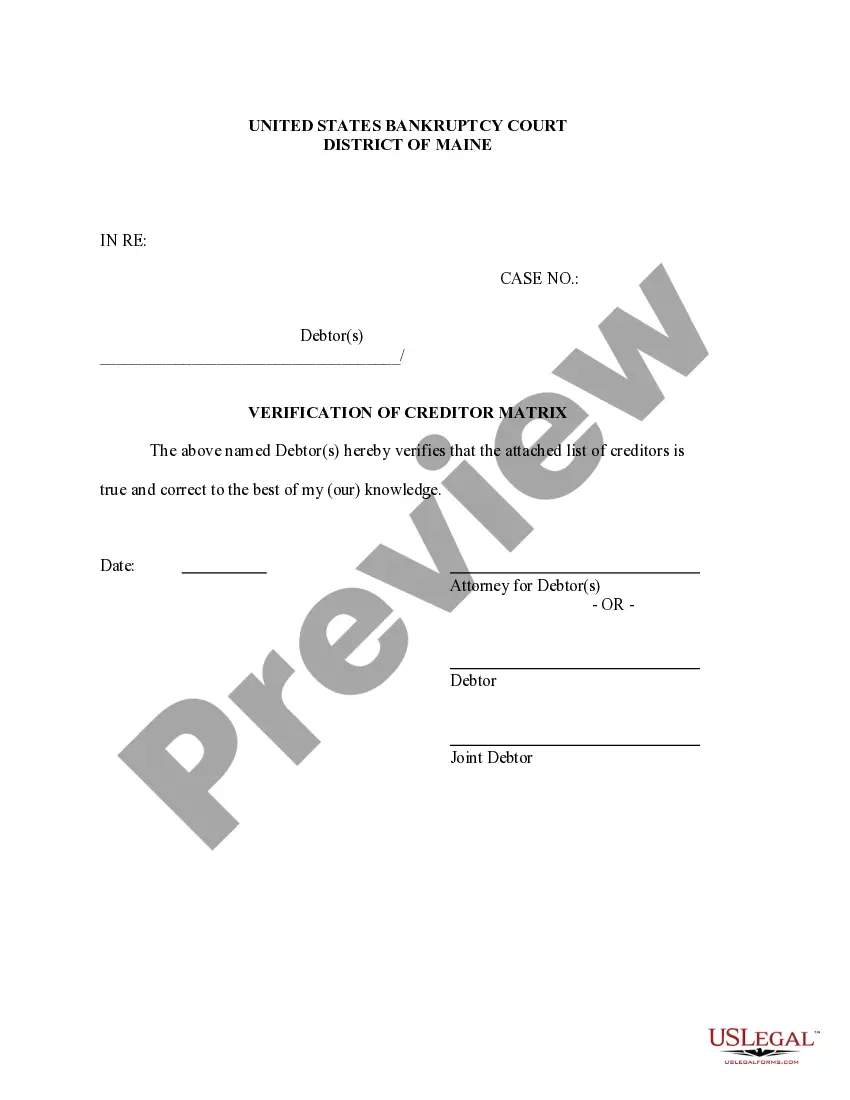

- Initially, ensure you have selected the right develop for the metropolis/area. You can look through the shape making use of the Preview key and browse the shape information to guarantee this is basically the right one for you.

- In the event the develop does not fulfill your needs, use the Seach area to discover the proper develop.

- When you are sure that the shape is proper, go through the Acquire now key to find the develop.

- Select the costs strategy you want and type in the necessary information and facts. Build your account and purchase an order using your PayPal account or charge card.

- Pick the file formatting and obtain the authorized record design for your gadget.

- Complete, revise and printing and indication the attained West Virginia Assignment of Overriding Royalty Interest by Overriding Royalty Interest Owner, No Proportionate Reduction,.

US Legal Forms is the largest library of authorized forms for which you can see different record templates. Use the service to obtain professionally-made documents that comply with express specifications.