Connecticut Acoustical Contractor Agreement - Self-Employed

Description

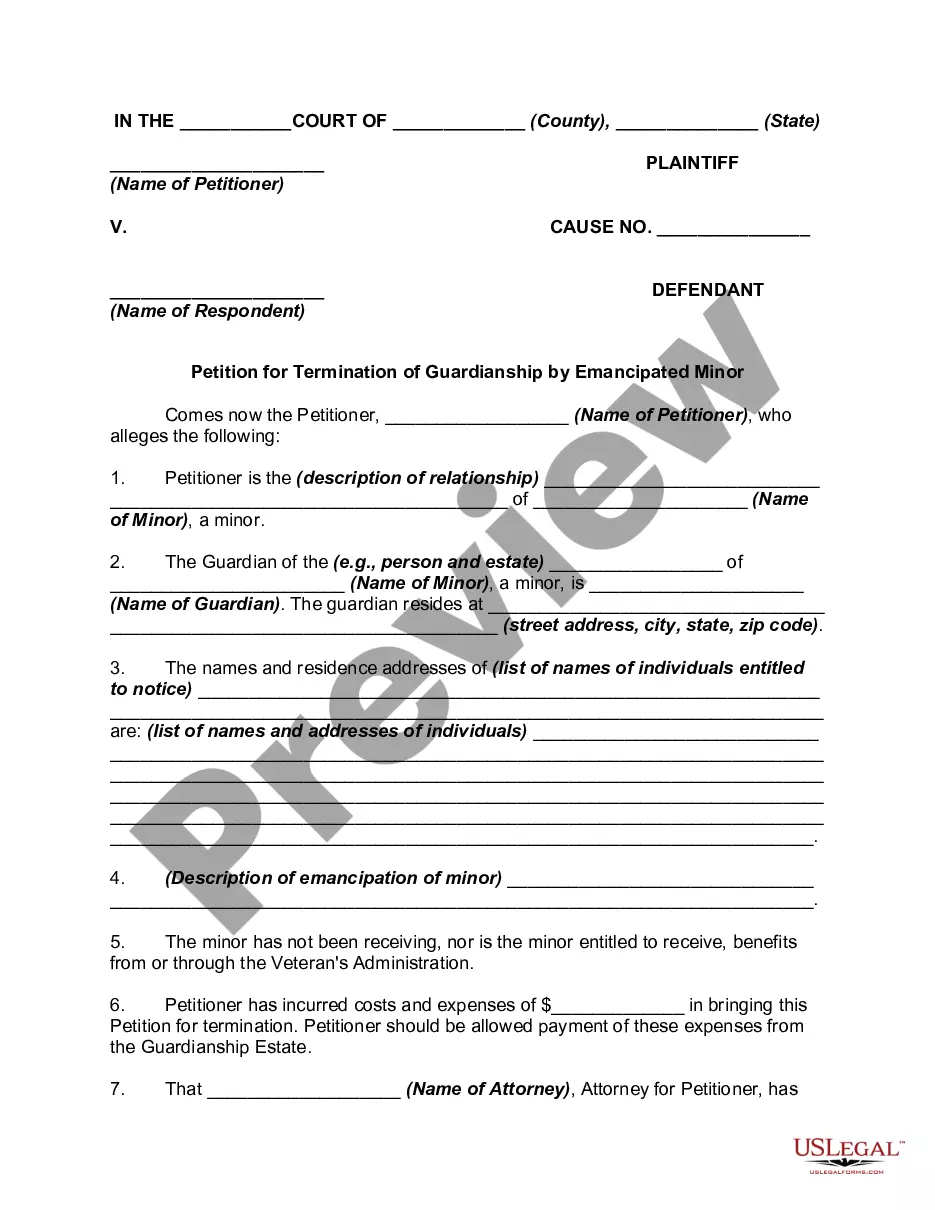

How to fill out Acoustical Contractor Agreement - Self-Employed?

Locating the appropriate authorized document template can be a challenge. Certainly, there are numerous templates accessible online, but how do you locate the authorized form you require? Utilize the US Legal Forms website. The service provides a plethora of templates, including the Connecticut Acoustical Contractor Agreement - Self-Employed, which can be utilized for business and personal purposes. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are currently registered, Log In to your account and click the Obtain button to download the Connecticut Acoustical Contractor Agreement - Self-Employed. Use your account to check the authorized forms you have purchased previously. Visit the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct form for your city/county. You can browse the form using the Preview button and review the form description to ensure it is suitable for you. If the form does not meet your needs, use the Search area to find the right form. Once you are certain that the form is appropriate, click on the Get now button to obtain the form. Select the pricing plan you desire and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the authorized document template to your device. Complete, modify, print, and sign the received Connecticut Acoustical Contractor Agreement - Self-Employed.

Use US Legal Forms to simplify your document needs and ensure compliance with legal standards.

- US Legal Forms is the largest collection of authorized forms.

- You will find a variety of document templates.

- Utilize the service to download professionally-crafted paperwork.

- All documents comply with state requirements.

- Access a wide range of legal templates.

- Conveniently manage your purchased forms.

Form popularity

FAQ

Becoming an independent contractor in Connecticut involves several steps. First, you need to register your business and acquire any necessary licenses. Next, consider drafting a Connecticut Acoustical Contractor Agreement - Self-Employed to clarify your services and terms. Finally, stay informed about the state’s tax requirements to ensure compliance while maximizing your potential earnings.

Absolutely, a self-employed person can and should have a contract. A Connecticut Acoustical Contractor Agreement - Self-Employed outlines the terms of your work, payment, and responsibilities. This written agreement protects both you and your client, ensuring everyone understands the expectations. Using a well-structured contract can help establish trust and professionalism in your working relationship.

Yes, independent contractors file as self-employed. This means they report their earnings on their tax returns using Schedule C. When you work under a Connecticut Acoustical Contractor Agreement - Self-Employed, you maintain control over your work, which benefits both you and your clients. Understanding your tax obligations is crucial to managing your finances effectively.

Yes, Connecticut does require a contractor's license for individuals working in construction, including acoustical contractors. To operate legally as a self-employed contractor, it is important to obtain the appropriate licenses and permits. The Connecticut Acoustical Contractor Agreement - Self-Employed can guide you through the necessary steps to ensure compliance with state regulations. Using resources like uslegalforms can simplify the process and help you navigate your legal obligations.

employed contract should include the names of both parties, the services to be provided, payment terms, and deadlines. Additionally, it should outline the responsibilities of each party and any termination clauses. To enhance clarity, include confidentiality and noncompete agreements if necessary. Utilizing a Connecticut Acoustical Contractor Agreement SelfEmployed from uslegalforms can simplify this process and ensure you cover all important aspects.

An independent contractor should fill out several forms, including a contractor agreement, tax forms, and possibly liability waivers. Depending on the project, state-specific forms related to labor laws may also be necessary. It is essential to keep accurate records for tax purposes. The Connecticut Acoustical Contractor Agreement - Self-Employed offered on uslegalforms covers all the essential elements for a solid foundation.

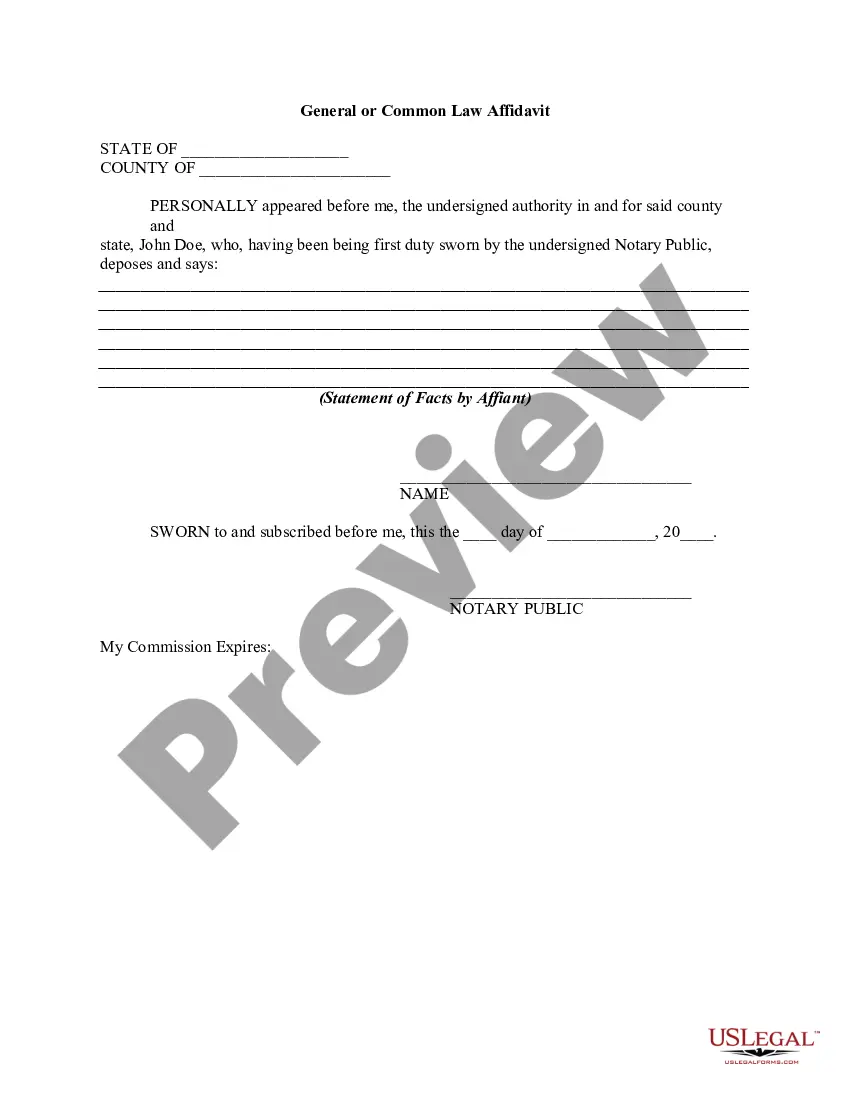

To fill out an independent contractor form, gather the information required, such as personal identification details and tax information. Ensure you accurately describe the services being provided and set the payment structure. After completing the form, both parties must sign and date it to make it legally binding. You can find user-friendly forms tailored for the Connecticut Acoustical Contractor Agreement - Self-Employed on uslegalforms.

Filling out an independent contractor agreement involves reviewing the necessary sections and entering relevant information. Make sure to provide detailed descriptions of the project, including milestones and payment amounts. Additionally, both parties should review the terms carefully before signing. Platforms like uslegalforms offer templates designed for creating a Connecticut Acoustical Contractor Agreement - Self-Employed.

To write an independent contractor agreement, begin by clearly stating the names and addresses of both parties. Next, outline the scope of work, payment terms, and deadlines. Additionally, include clauses regarding confidentiality, liability, and dispute resolution. A well-structured Connecticut Acoustical Contractor Agreement - Self-Employed can protect both the contractor and the client.

Yes, receiving a 1099 form typically indicates you are self-employed. This form is issued to independent contractors who earn income outside of traditional employment. If you are entering a Connecticut Acoustical Contractor Agreement - Self-Employed, it reinforces your status as a self-employed individual and helps clarify your tax obligations.