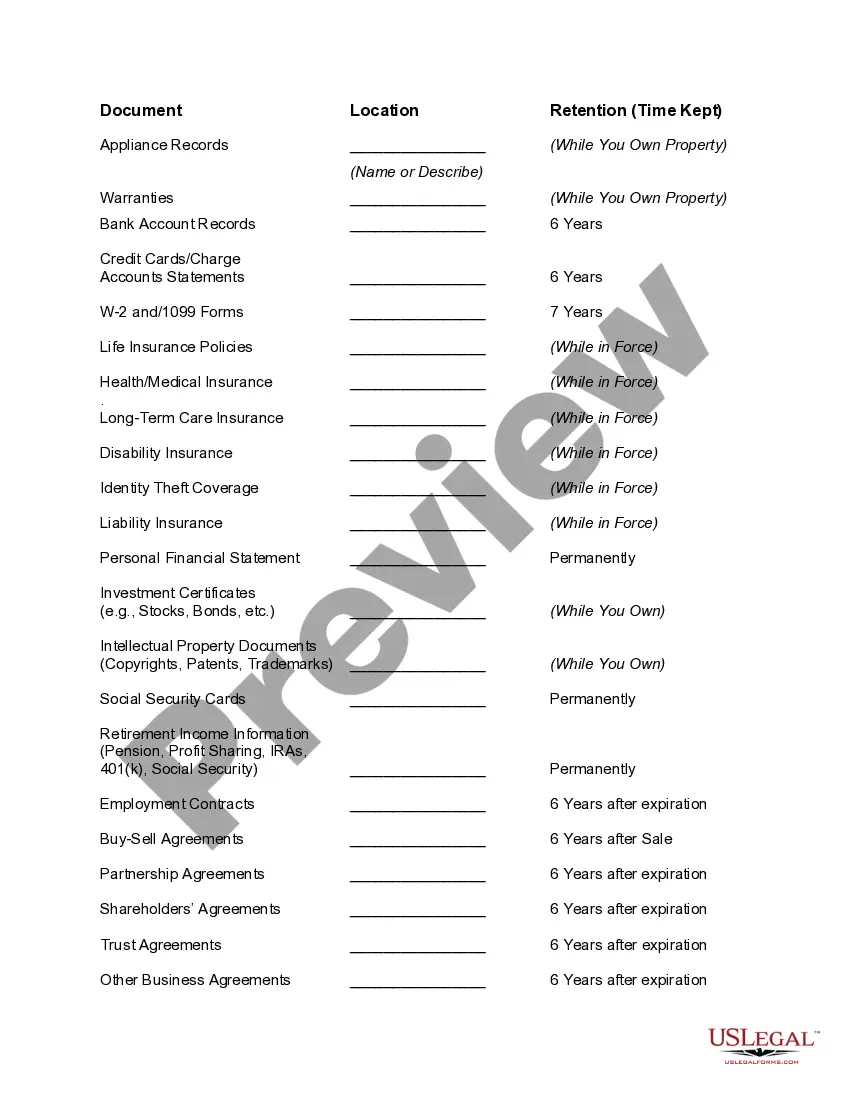

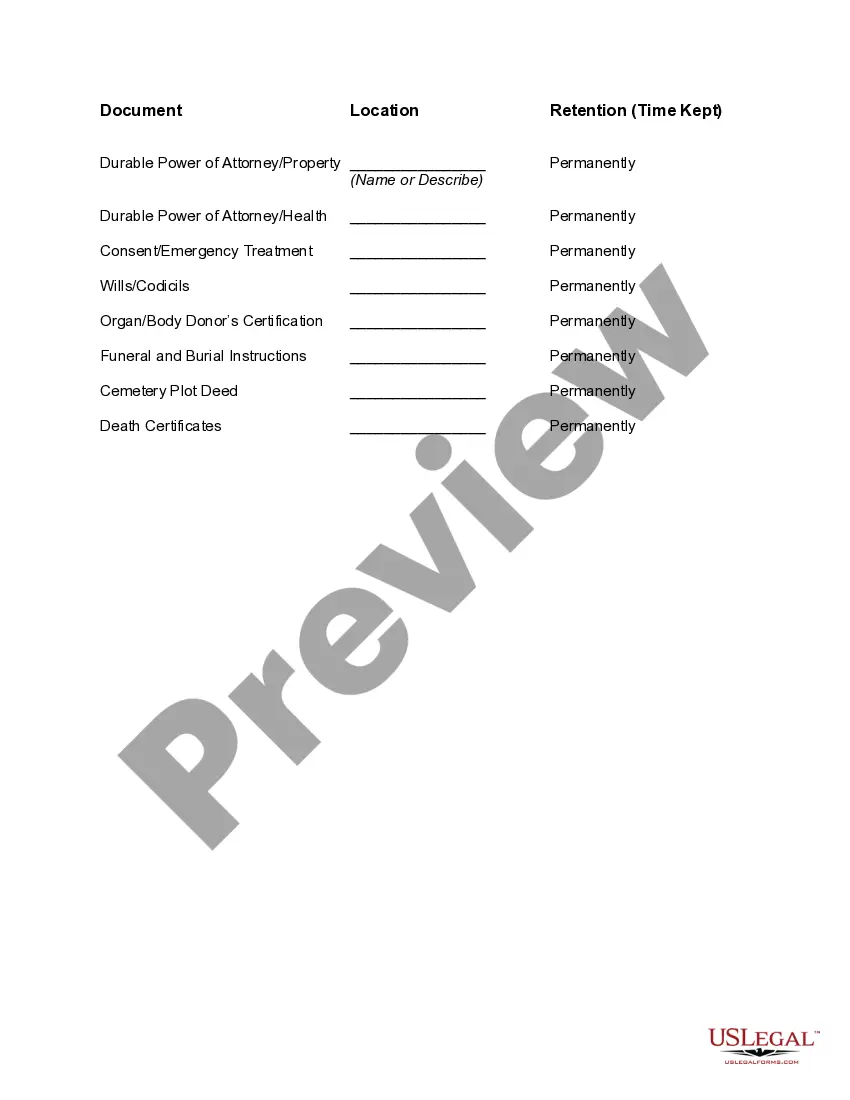

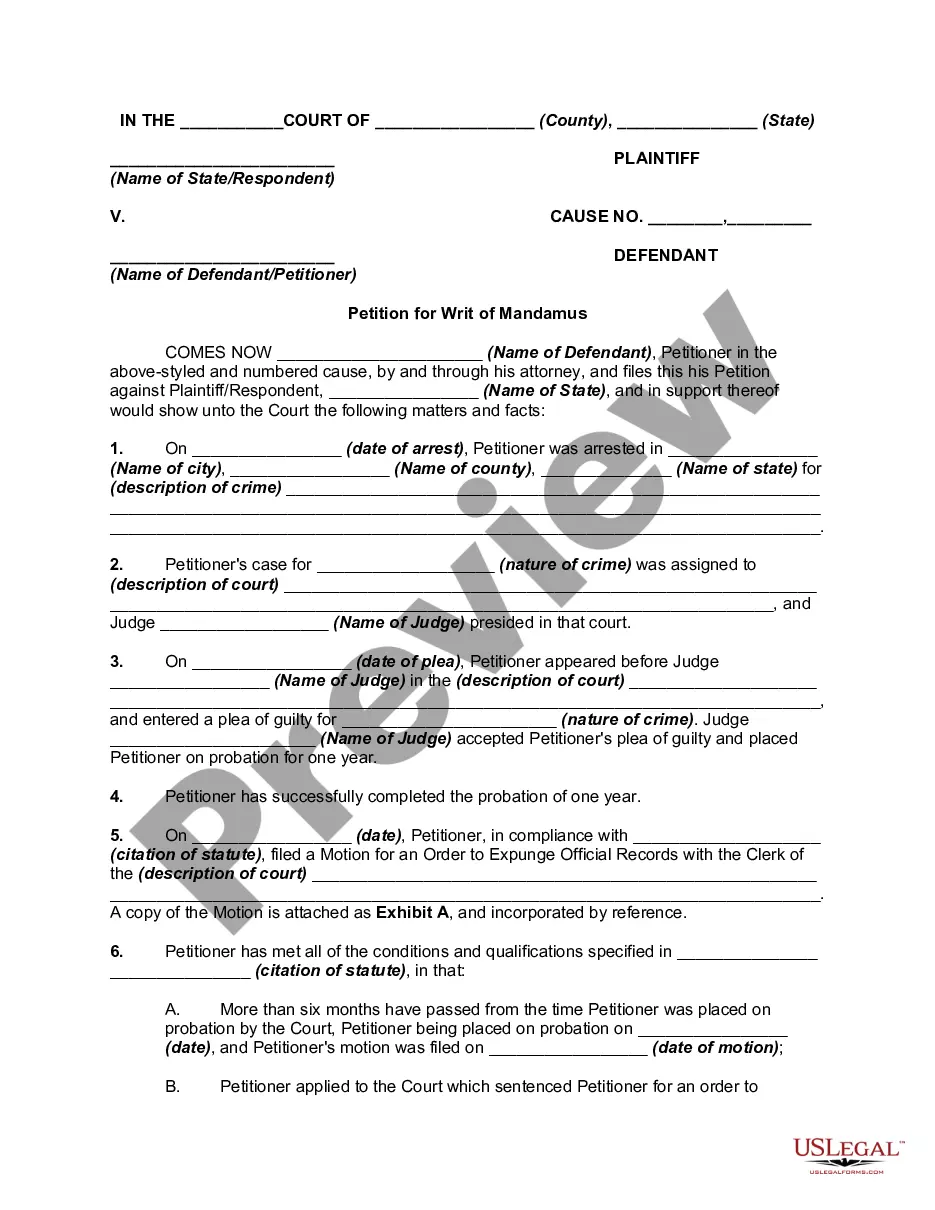

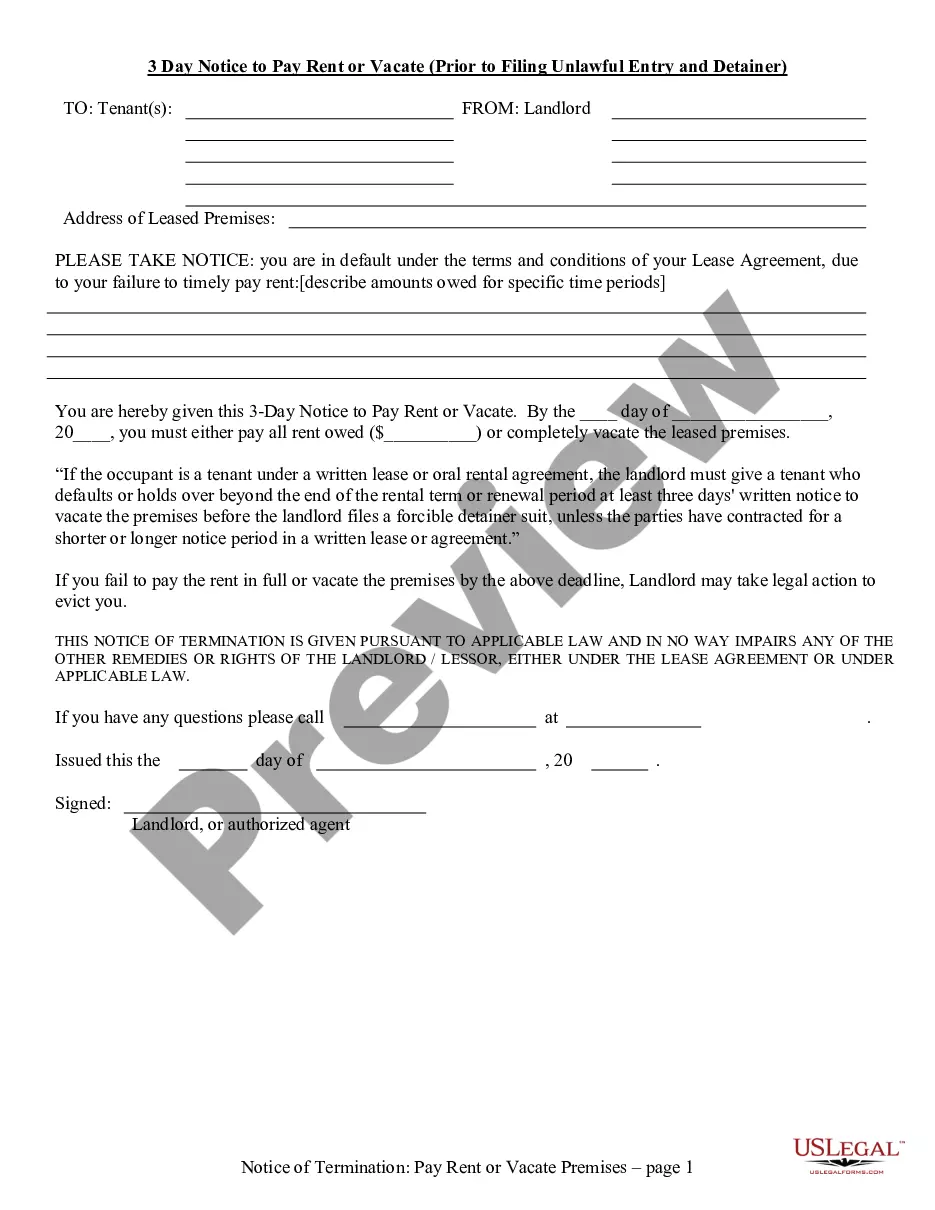

Connecticut Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal document templates that you can access or create.

By using the website, you can find thousands of documents for business and personal needs, categorized by types, states, or keywords.

You can access the latest versions of documents such as the Connecticut Document Organizer and Retention in just a few minutes.

Review the document description to ensure you have chosen the correct template.

If the document does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you already have an account, Log In and download Connecticut Document Organizer and Retention from the US Legal Forms library.

- The Download button will appear on each document you view.

- You can access all previously saved documents from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple guidelines to help you get started.

- Ensure you have selected the appropriate document for your city/state.

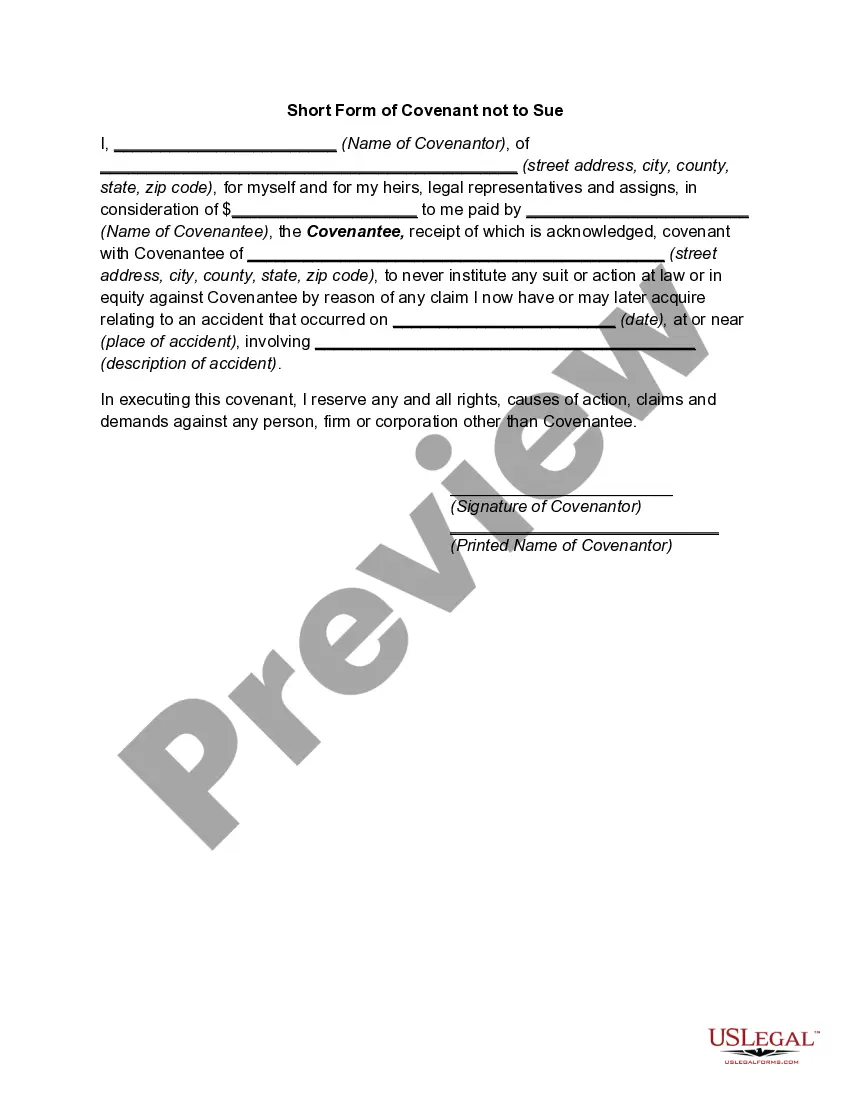

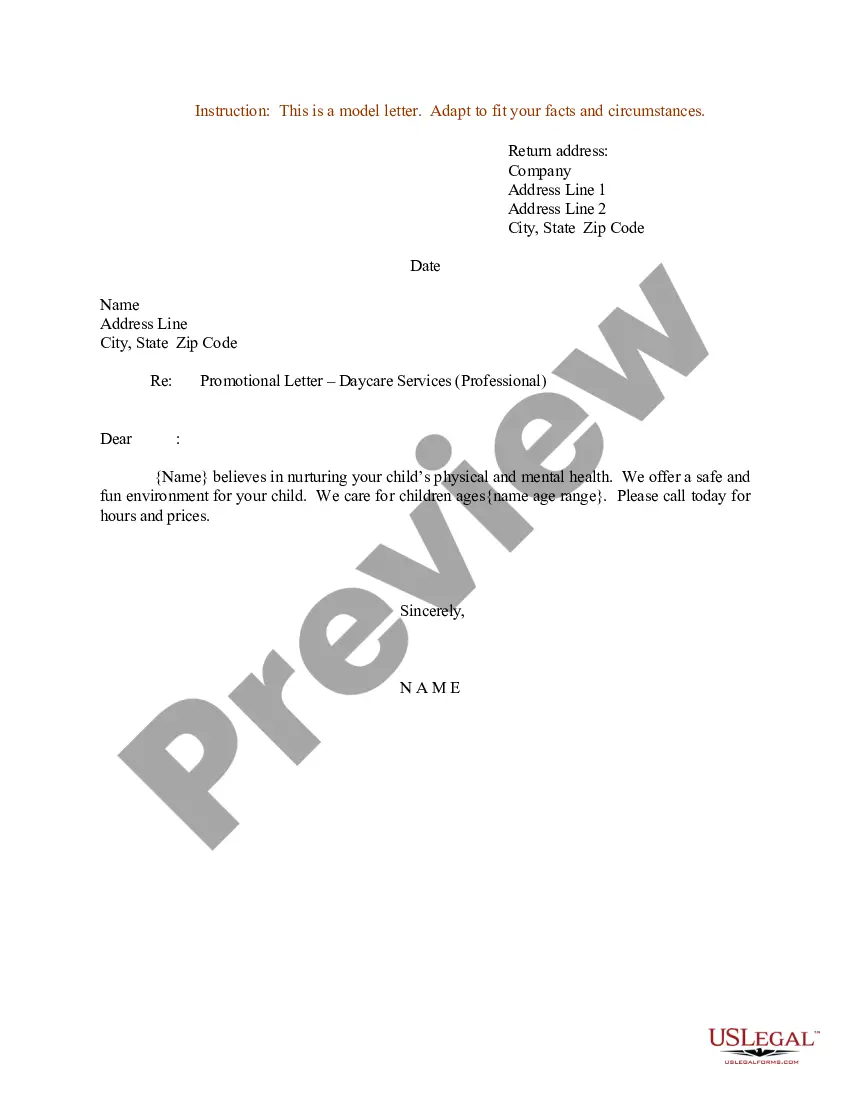

- Click the Preview button to review the document’s contents.

Form popularity

FAQ

Records retention is important because it helps organizations save storage and operating expenses when dealing with paper records, reduce litigation risks by adhering to various rules and regulations, and increase record security by preventing unauthorized access.

Bank statements, credit card statements, canceled checks, paid invoices and other financial information quickly pile up. Accountants typically will advise businesses to keep their bank account and credit statements for 7 years.

Records retention refers to methods and practices organizations use to maintain important information for a required period of time for administrative, financial, legal, and historical purposes. It applies to paper documents as well as the retention of electronic records such as word documents and spreadsheets.

Records retention is a practice by which organizations maintain confidential records for set lengths of time, and then employ a system of actions to either redirect, store or dispose of them.

Knowing that, a good rule of thumb is to save any document that verifies information on your tax returnincluding Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receiptsfor three to seven years.

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

Archiving A process of moving data that is no longer actively used to a separate storage device for long-term retention. Data subject Any living person who is the subject of personal data (see below for the definition of personal data) held by an organisation.

A document retention schedule is a policy that clearly defines what documents need to be maintained and for how long. A retention policy will include all types of documents and records that are created on behalf of the company as part of its business.

For example, if financial records have a retention period of five years, and the records were created during the 1995-1996 fiscal year (July 1, 1995 - June 30, 1996), the five-year retention period begins on July 1, 1996 and ends five years later on July 1, 2001.