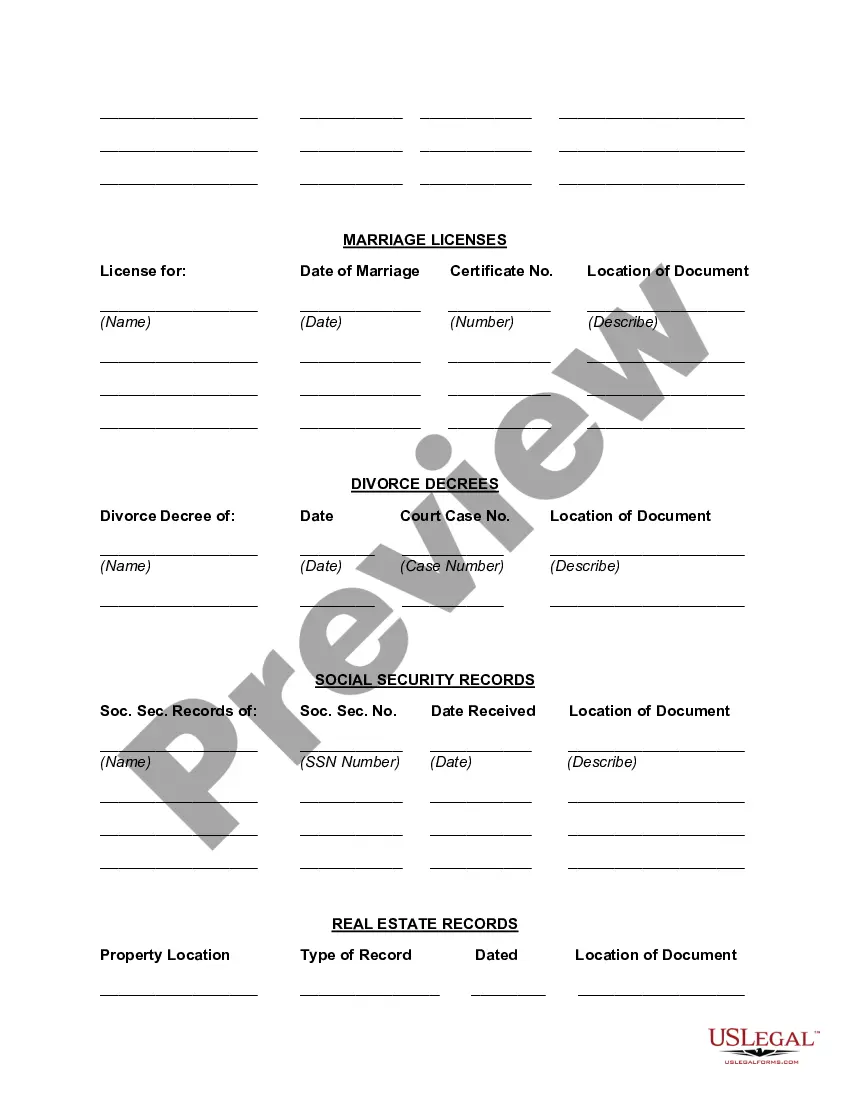

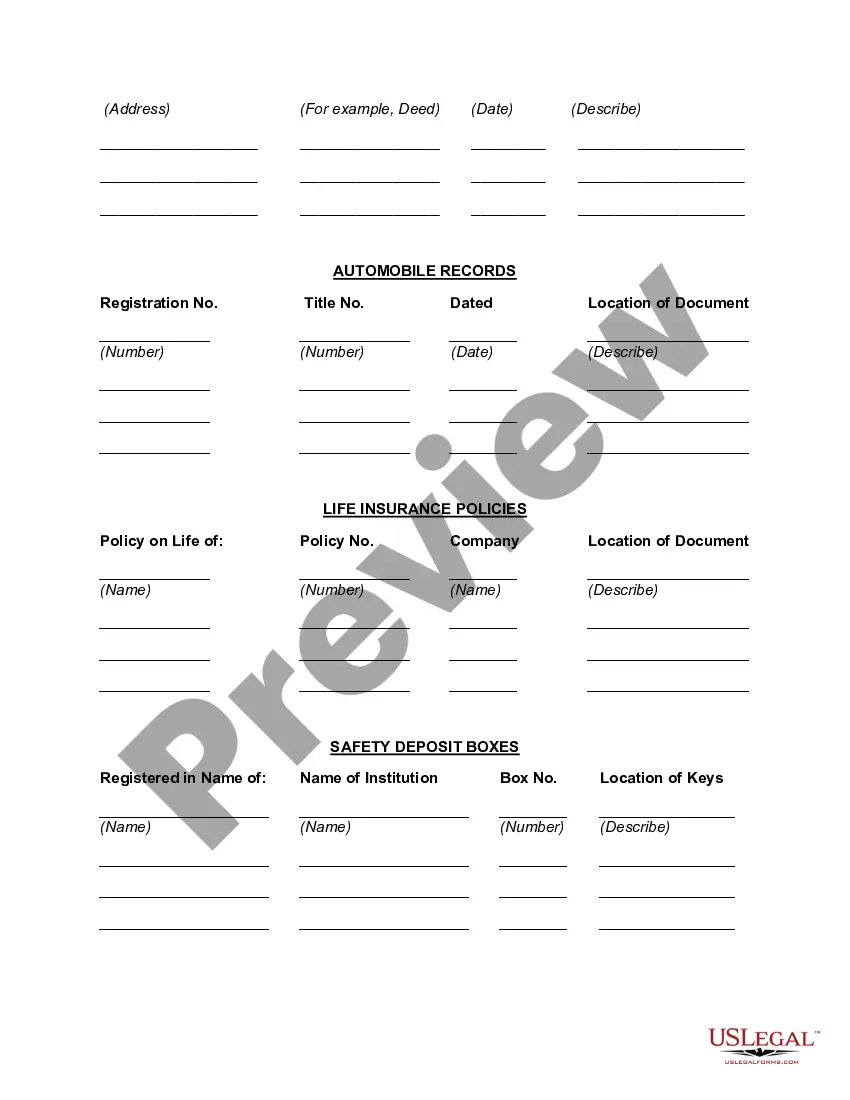

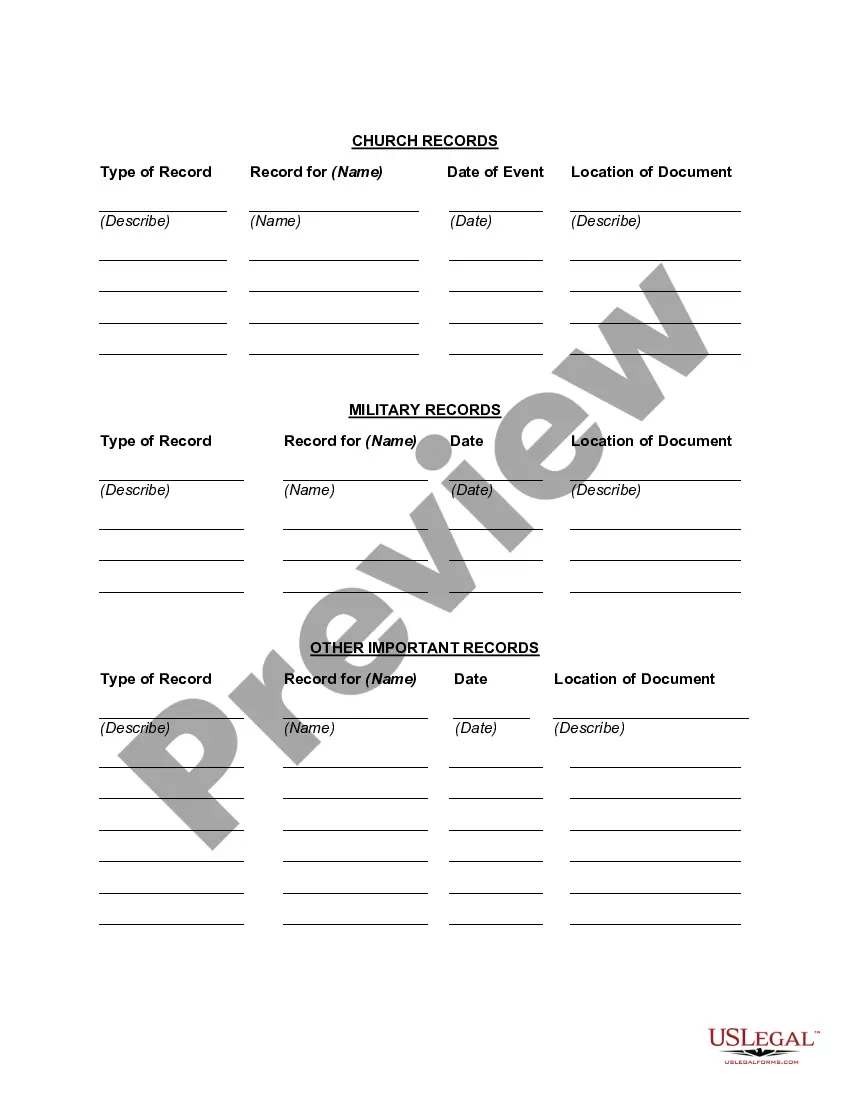

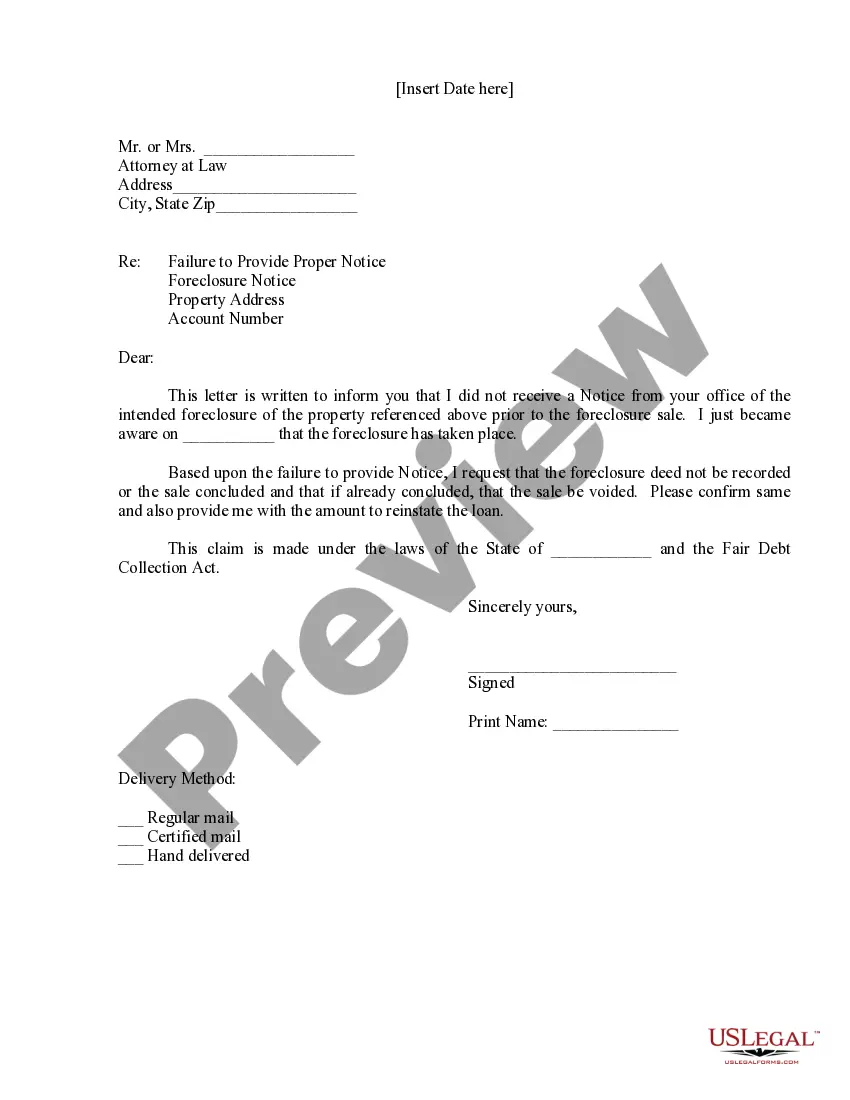

Connecticut Worksheet for Location of Important Documents

Description

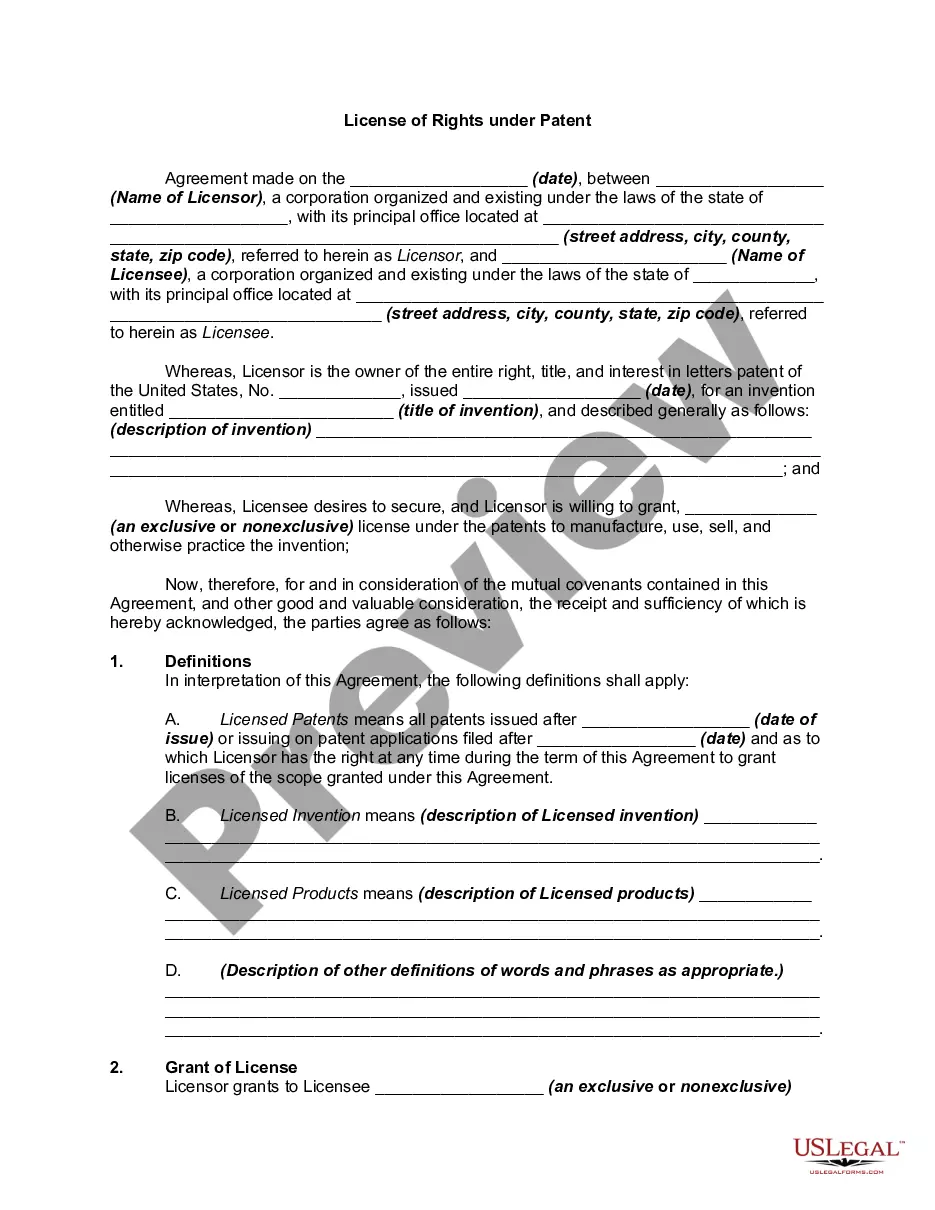

How to fill out Worksheet For Location Of Important Documents?

You have the capability to dedicate hours online trying to locate the legal document format that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal documents that are reviewed by professionals.

You can conveniently download or print the Connecticut Worksheet for Location of Important Documents from my assistance.

If needed, utilize the Review button to examine the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- Next, you can complete, modify, print, or sign the Connecticut Worksheet for Location of Important Documents.

- Each legal document format you obtain is yours indefinitely.

- To retrieve another copy of an acquired document, go to the My documents tab and click on the respective button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you select the correct document format for your county/city that you choose.

- Refer to the document description to validate you have chosen the correct form.

Form popularity

FAQ

Withholding is the money an employer withholds from each employee's wages to help prepay the state income tax of the employee. An employer must withhold Connecticut tax if the employee is a resident of Connecticut, performing services in the state.

You are required to pay Connecticut income tax as income is earned or received during the year. You should complete a new Form CT-W4 at least once a year or if your tax situation changes.

If you are underwithheld, you should consider adjusting your withholding or making estimated payments using Form CT-1040ES, Estimated Connecticut Income Tax Payment Coupon for Individuals. You may also select Withholding Code D to elect the highest level of withholding.

Written by a TurboTax Expert 2022 Reviewed by a TurboTax CPA. The W-4 Form is an IRS form that you complete to let your employer know how much money to withhold from your paycheck for federal taxes. Accurately completing your W-4 can help you prevent having a big balance due at tax time.

C Married, filing jointly, and spouse is not employed; this the default when the federal marital status is M. D Married, filing jointly, both work, and combined income. is more than $100,500; or there is significant non-wage income; this code also applies to nonresident employees.

If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if: 2022 You are NOT a surviving spouse filing an original or amended joint return with the decedent; and 2022 You are NOT a personal representative (defined later) filing, for the decedent, an original Form 1040, 1040-SR, 1040A, 1040EZ,

Form CT-W4NA, in addition to Form CT-W4, Employee's Withholding Certificate, will assist your employer in withholding the correct amount of Connecticut income tax from your wages for services performed in Connecticut.

Married - Filing Jointly, Spouse Not Working. D. Married - Filing Jointly, Both Spouses Working (combined income greater than $100,500) F. Single.

F Married, withhold at the higher Single rate. M Married. S Single.

HOW TO OBTAIN CONNECTICUT TAX FORMSConnecticut state tax forms can be downloaded at the Department of Revenue Services (DRS) website: tax forms and publications are available at any DRS office and at some libraries and post offices, during tax filing season.