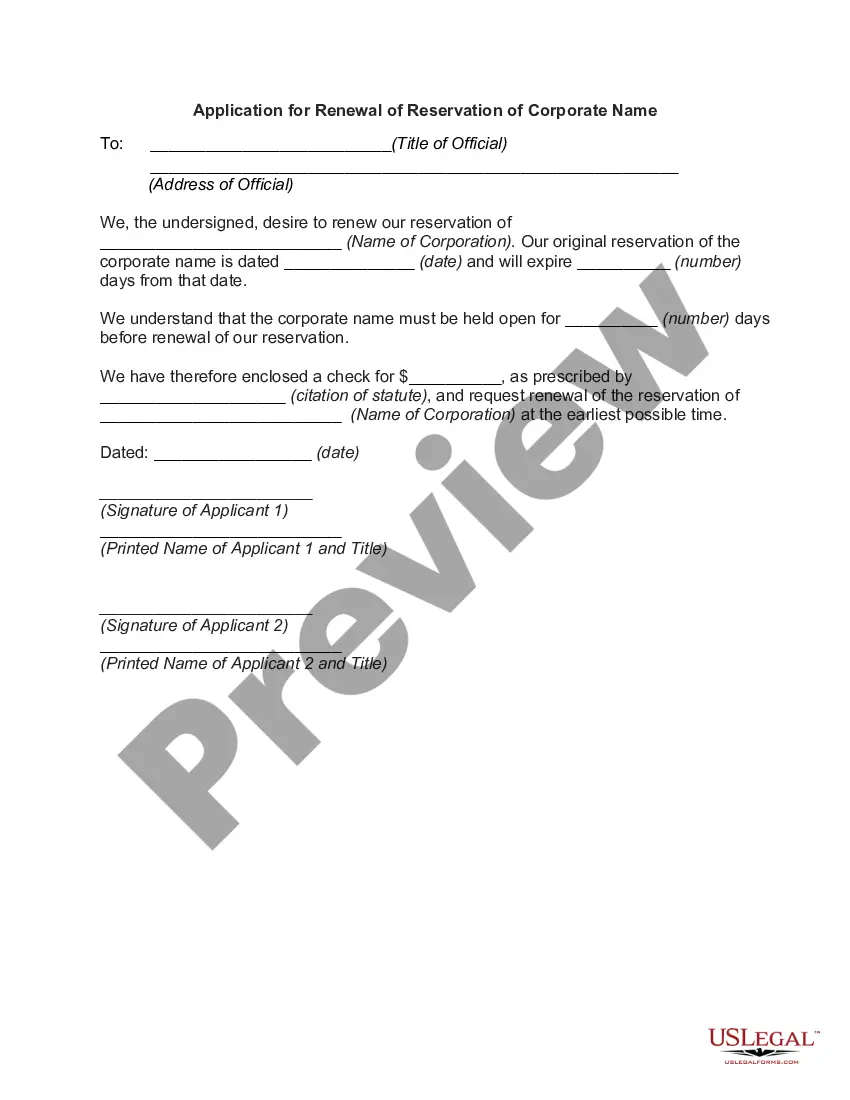

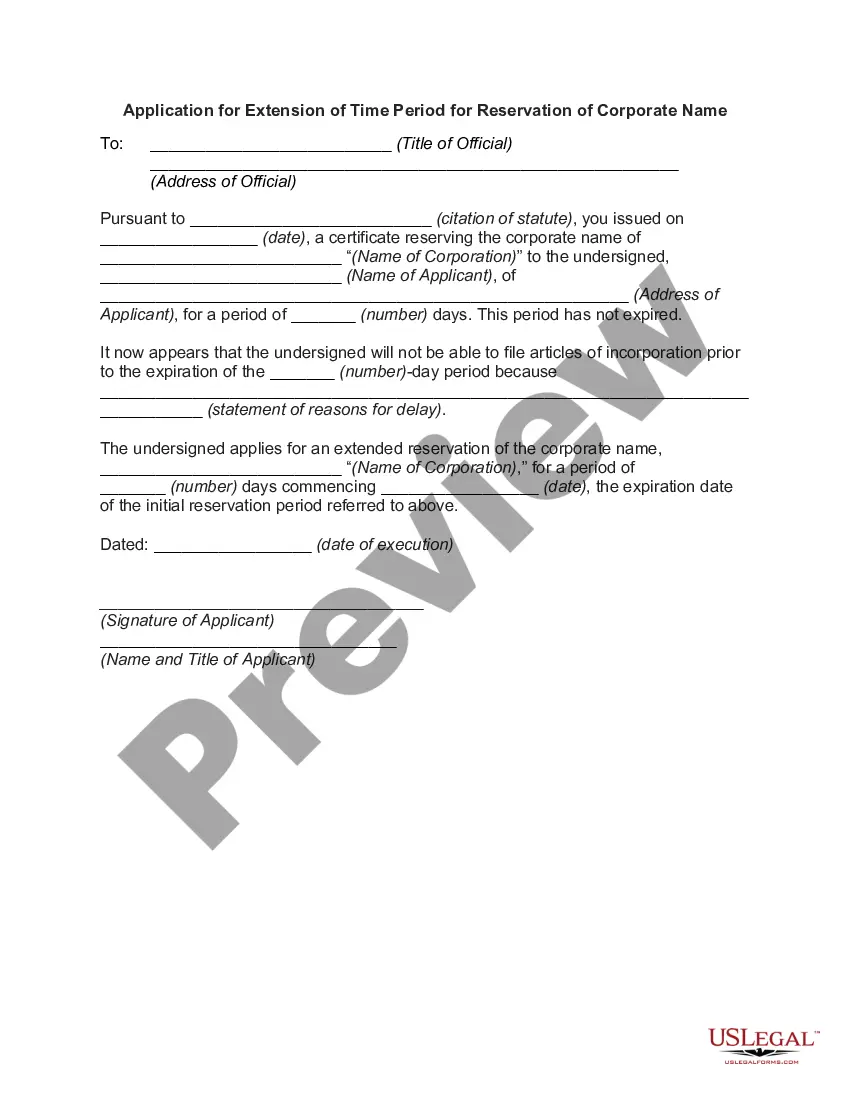

Connecticut Application for Extension of Time Period for Reservation of Corporate Name

Description

How to fill out Application For Extension Of Time Period For Reservation Of Corporate Name?

If you wish to full, acquire, or produce lawful document web templates, use US Legal Forms, the biggest variety of lawful forms, that can be found on the Internet. Use the site`s simple and handy research to get the files you need. A variety of web templates for enterprise and specific uses are categorized by classes and states, or keywords. Use US Legal Forms to get the Connecticut Application for Extension of Time Period for Reservation of Corporate Name with a number of mouse clicks.

Should you be previously a US Legal Forms customer, log in to the profile and click on the Down load key to obtain the Connecticut Application for Extension of Time Period for Reservation of Corporate Name. You may also access forms you previously acquired inside the My Forms tab of your profile.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have chosen the shape for that right town/land.

- Step 2. Utilize the Preview option to look through the form`s articles. Never forget about to read the outline.

- Step 3. Should you be unhappy with all the develop, use the Research area towards the top of the display to locate other versions from the lawful develop template.

- Step 4. Upon having located the shape you need, go through the Get now key. Select the rates strategy you prefer and put your references to register on an profile.

- Step 5. Method the transaction. You may use your credit card or PayPal profile to perform the transaction.

- Step 6. Pick the formatting from the lawful develop and acquire it on your system.

- Step 7. Complete, change and produce or signal the Connecticut Application for Extension of Time Period for Reservation of Corporate Name.

Every lawful document template you purchase is the one you have for a long time. You have acces to each and every develop you acquired in your acccount. Click the My Forms section and pick a develop to produce or acquire once again.

Remain competitive and acquire, and produce the Connecticut Application for Extension of Time Period for Reservation of Corporate Name with US Legal Forms. There are millions of professional and state-specific forms you may use to your enterprise or specific needs.

Form popularity

FAQ

Pay by Mail: Make your check payable to Commissioner of Revenue Services. To ensure proper posting of your payment, write ?2022 Form CT-1040 EXT? and your Social Security Number(s) (optional) on the front of your check. Be sure to sign your check and paper clip it to the front of your return.

To ensure payment is applied to your account, write ?2022 Form CT-1120 EXT? and the corporation's Connecticut Tax Registration Number on the front of the check. Be sure to sign your check and paper clip it to the front of your return. Do not send cash. DRS may submit your check to your bank electronically.

If the Corporation files a federal extension, the entity must still electronically file the CT-1120 EXT. If the Corporation does not file a federal extension it can still file Form CT-1120 EXT, but the Corporation must provide reasonable cause for requesting the extension.

To get a Connecticut filing extension, the PE must complete and file Form CT?1065/CT?1120SI EXT on or before the due date of the return and pay the amount shown on Line 3. If you are filing a calendar?year Form CT?1065/CT?1120SI, file Form CT-1065/CT-1120SI EXT on or before March 15, 2023.

To request this extension, you must file Form CT-1127, Application for Extension of Time for Payment of Income Tax, with your timely filed Connecticut income tax return or extension. Purpose: Use Form CT-1040 EXT to request a six-month extension to file your Connecticut income tax return for individuals.

If federal Form 7004 was not filed, the corporation may apply for an extension to file the Connecticut Corporation Business Tax return if there is reasonable cause for the request. Pay the amount shown on Line 15. Form CT-1120 EXT extends only the time to file the Connecticut Corporation Business Tax return.

MyconneCT is the new online hub for business tax needs. Now you can file tax returns, make payments, and view your filing history in one location. Visit myconneCT now to file, pay, and manage the following tax types: Sales and Use / Business Use.

Form CT-1120 must be filed electronically and payments must be made electronically using either myconneCT or the Connecticut Federal/State Electronic Filing Modernized e-File (MeF) Program, unless a taxpayer has received an electronic filing and payment waiver from DRS.