Vermont Notice to Debt Collector - Posing Lengthy Series of Questions or Comments

Description

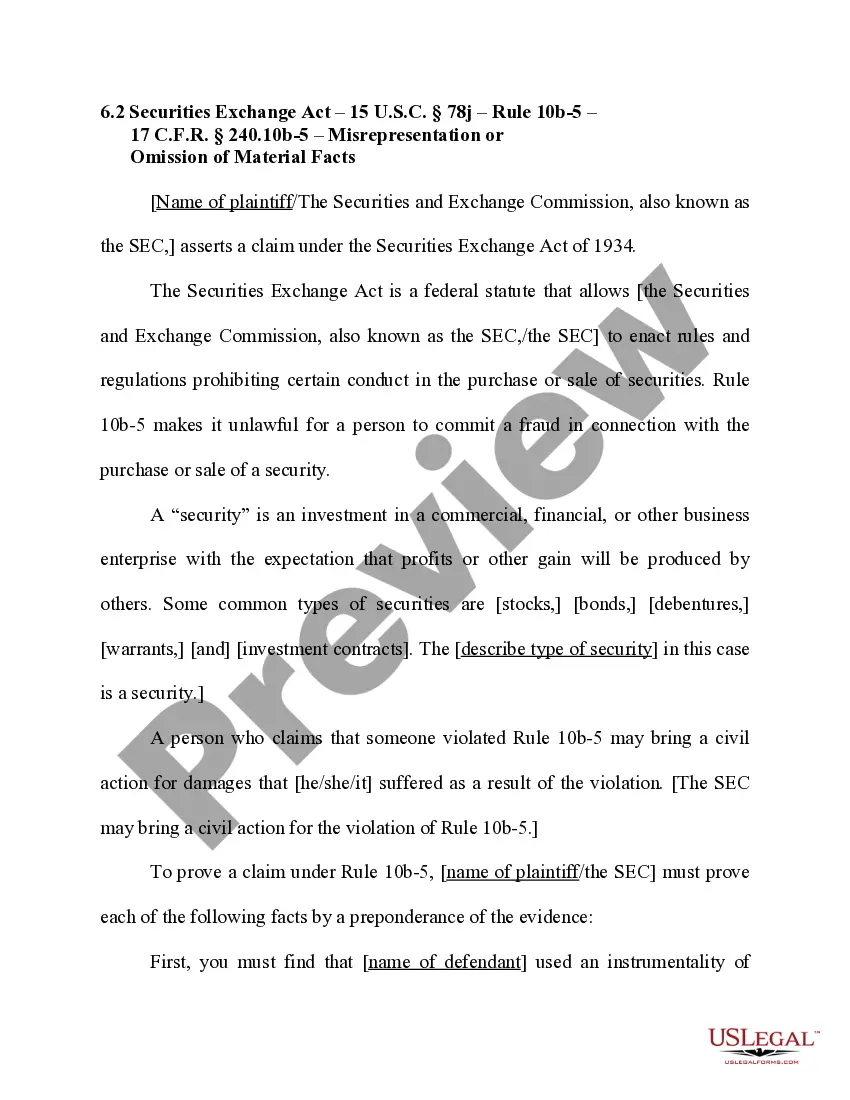

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes posing a lengthy series of questions or comments to the consumer without giving the consumer a chance to reply.

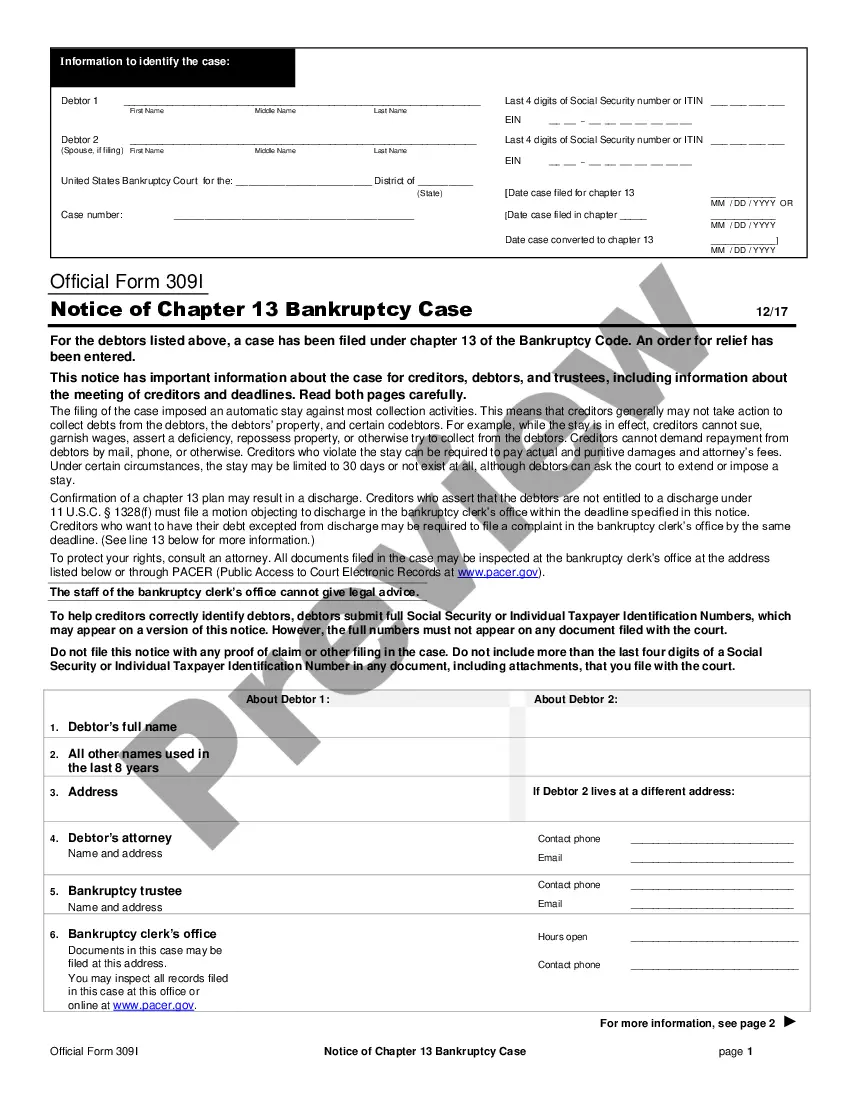

How to fill out Notice To Debt Collector - Posing Lengthy Series Of Questions Or Comments?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

On the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords.

You can access the updated versions of documents like the Vermont Notice to Debt Collector - Asking an Extensive Series of Questions or Comments in moments.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, select the payment plan you prefer and provide your credentials to register for an account.

- If you already possess an account, Log In and obtain the Vermont Notice to Debt Collector - Asking an Extensive Series of Questions or Comments from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can find all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your specific region/state.

- Click the Preview button to check the form's details.

Form popularity

FAQ

In the book Credit Secrets, the suggested 11-word phrase is often aimed at helping consumers manage their debt situations. This phrase empowers individuals to demand validation of the debt, providing a foundation for further negotiation. Utilizing this phrase aligns perfectly with the goals stated in the Vermont Notice to Debt Collector - Posing Lengthy Series of Questions or Comments, ensuring you know your rights.

The 11-word credit phrase loophole refers to a strategy that helps consumers contest debts. By using a specific phrase, you can compel the debt collector to prove the legitimacy of the debt before any further action occurs. This tactic reinforces your rights and puts you in control of the conversation. The Vermont Notice to Debt Collector - Posing Lengthy Series of Questions or Comments can further guide you in using such strategies effectively.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.

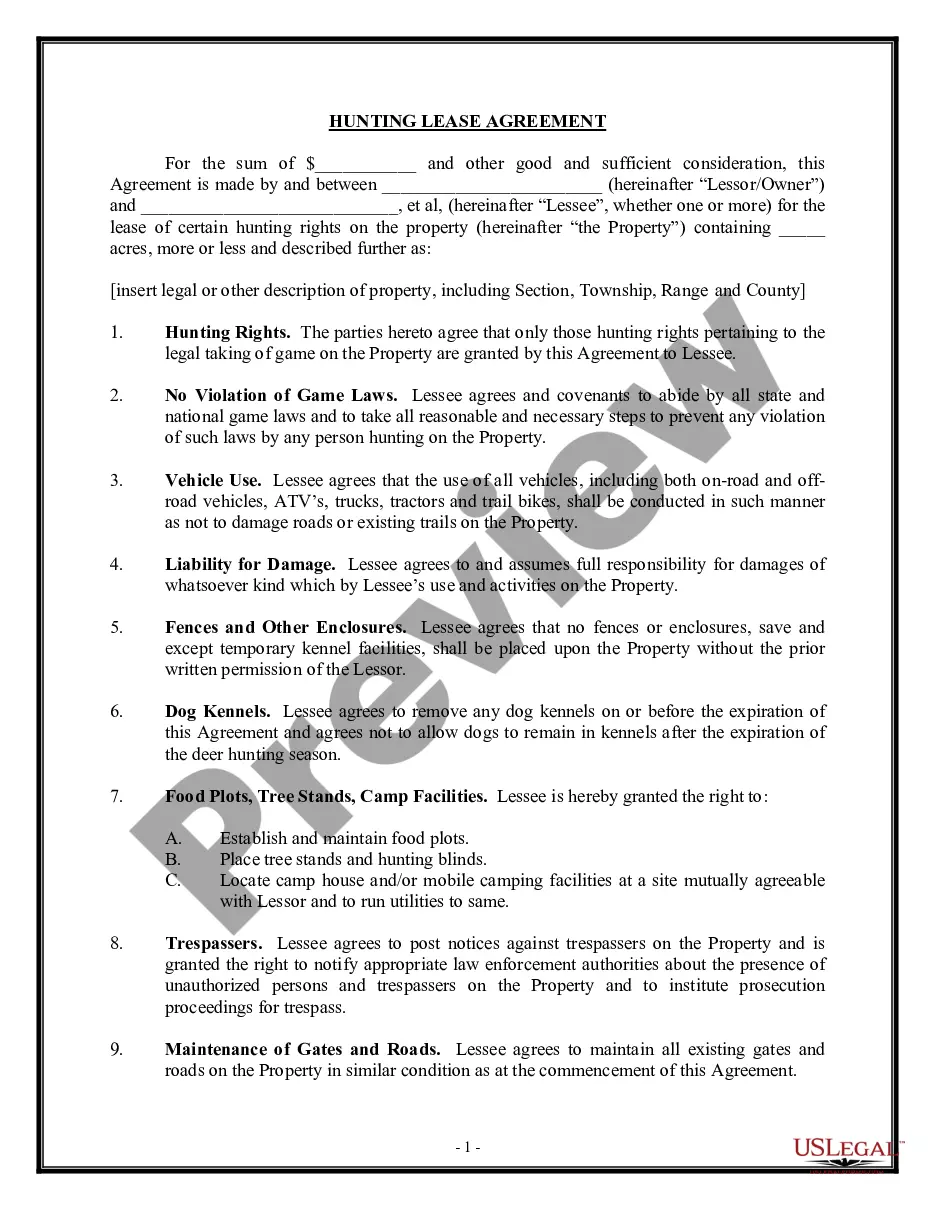

You only need to say a few things:This is not a good time. Please call back at 6.I don't believe I owe this debt. Can you send information on it?I prefer to pay the original creditor. Give me your address so I can send you a cease and desist letter.My employer does not allow me to take these calls at work.

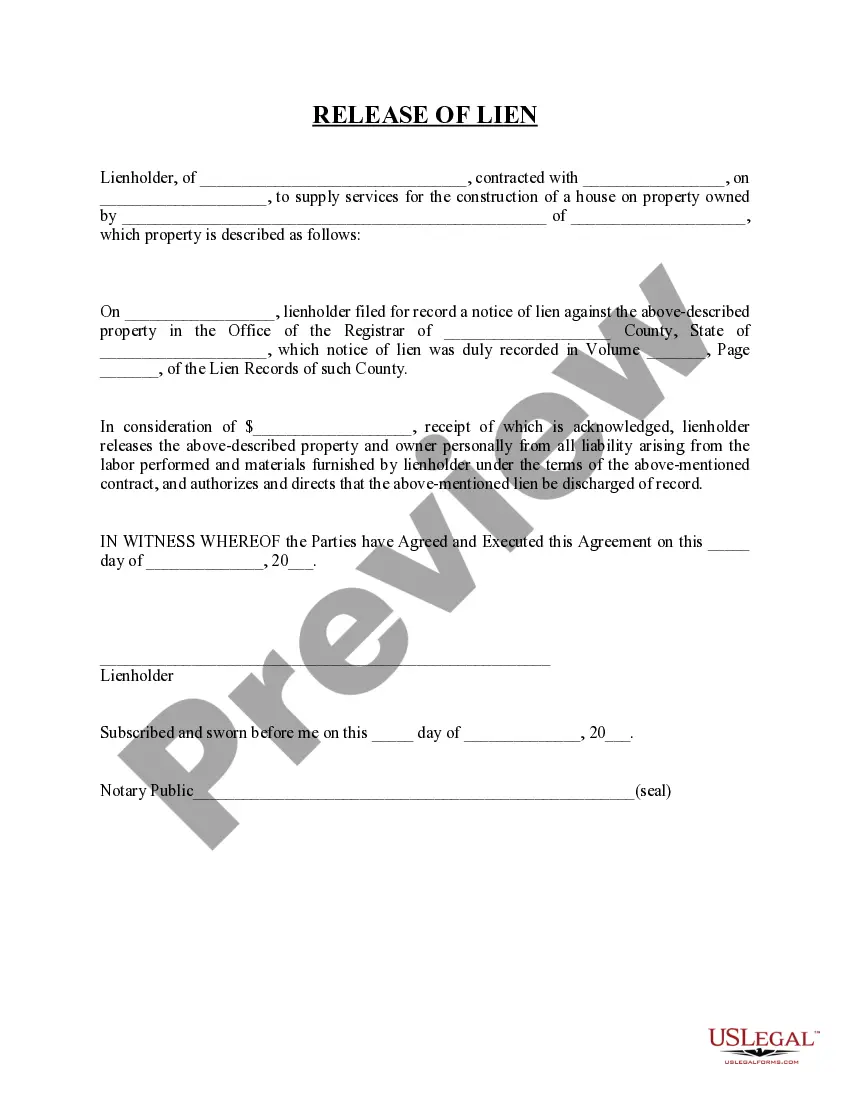

If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) of this section that the debt, or any portion thereof, is disputed, or that the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.

Debt collectors have a reputationin some cases a well-deserved onefor being obnoxious, rude, and even scary while trying to get borrowers to pay up. The federal Fair Debt Collection Practices Act (FDCPA) was enacted to curb these annoying and abusive behaviors, but some debt collectors flout the law.

If you choose not to speak with a debt collector over the phone or in writing about a debt, collection activity can still take place. You continue to run the risk of fees and finance charges, as well as being sued or the debt being reported as delinquent to the credit reporting companies.

If you believe a debt collector is harassing you, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372). You can also contact your state's attorney general .