Connecticut Sample Letter for Collection of Payment for Mobile Home

Description

How to fill out Sample Letter For Collection Of Payment For Mobile Home?

Choosing the best lawful record web template can be a have a problem. Of course, there are plenty of templates available on the net, but how will you obtain the lawful kind you require? Use the US Legal Forms internet site. The services provides thousands of templates, such as the Connecticut Sample Letter for Collection of Payment for Mobile Home, that you can use for enterprise and personal requires. All of the forms are examined by pros and meet up with state and federal needs.

When you are presently listed, log in to the profile and then click the Obtain switch to get the Connecticut Sample Letter for Collection of Payment for Mobile Home. Make use of profile to check with the lawful forms you might have ordered earlier. Check out the My Forms tab of your own profile and acquire one more duplicate in the record you require.

When you are a whole new consumer of US Legal Forms, allow me to share basic recommendations for you to follow:

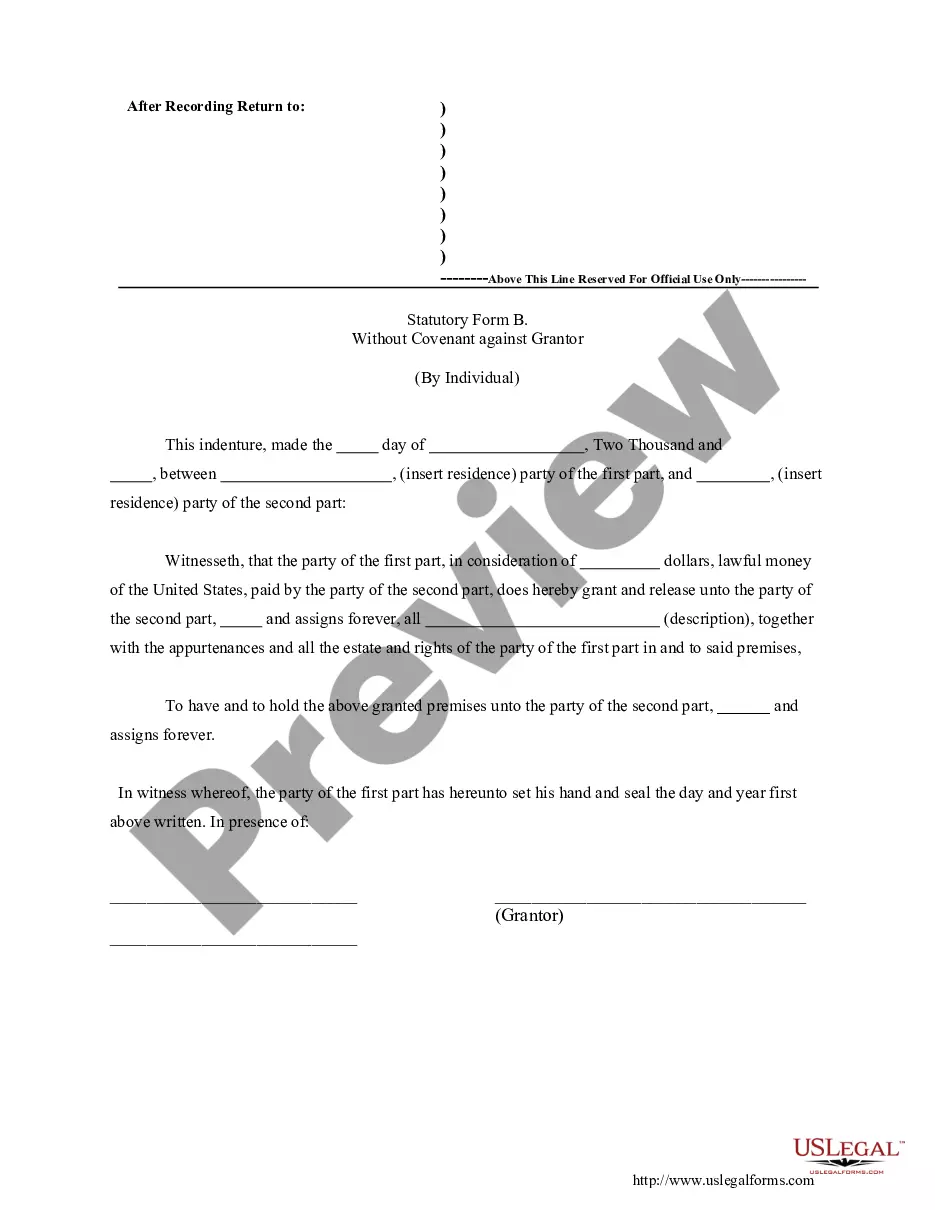

- Initially, ensure you have selected the correct kind for your area/area. You are able to examine the shape utilizing the Review switch and look at the shape outline to guarantee it will be the best for you.

- In the event the kind will not meet up with your preferences, use the Seach area to discover the right kind.

- When you are positive that the shape would work, click on the Get now switch to get the kind.

- Choose the pricing strategy you desire and type in the necessary info. Build your profile and buy your order making use of your PayPal profile or credit card.

- Choose the file format and acquire the lawful record web template to the system.

- Total, modify and print and sign the obtained Connecticut Sample Letter for Collection of Payment for Mobile Home.

US Legal Forms will be the biggest local library of lawful forms that you will find numerous record templates. Use the company to acquire appropriately-produced files that follow condition needs.

Form popularity

FAQ

A demand letter is the first formal step in collecting a debt. It clearly lays out the amount owed and the circumstances that led to it. Sending a debt collection letter makes it clear that you are serious about collecting on the debt.

You must draft the demand letter with as little emotion as possible. And-- stick to the facts. Keep a detailed record and copies of all your communications with the other person or company. Write down the date, time, name of the person you spoke to, and the nature of all your conversations about the problem.

You have to sound firm as well as professional. Add information like the account number, the number of days past due, the amount due, the account summary, the due date of payment, any invoice number, an invoice date, an invoice copy or more, etc. Do not forget to mention that you have previously contacted them.

How to Write An Effective Collection Letter Reference the products or services that were purchased. ... Maintain a friendly but firm tone. ... Remind the payee of their contract or agreement with you. ... Offer multiple ways the payee can take action. ... Add a personal touch. ... Give them a new deadline.

How To Write A Loan Request Letter Add basic information about the business. The first step to drafting a communicative, informative and persuasive business loan request letter is to begin with a header and a greeting. ... Mention the purpose of the loan. ... Assure the lender of repayment. ... Closing the business loan request letter.

The above/attached invoice for [outstanding amount] has recently become overdue for payment. As such, we would appreciate you making this payment as soon as possible. If there is an error on our part and full payment has been made, please get in touch so that the matter can be rectified as a matter of urgency.

I have taken a careful look at my financial situation. I have set up a realistic minimum budget for my living expenses and have developed a debt repayment program. I am hoping you will accept a reduced payment of per month. Amounts will be increased as soon as possible until the debt is totally paid.

Here are the general elements that should be incorporated into your letter: Today's date. Client's contact information. Your contact information. Greeting with client's name. Brief description of services rendered and price. Your payment details. Payment due date. Terms and conditions including late fees.