Connecticut Contract with Independent Contractor - Contractor has Employees

Description

How to fill out Contract With Independent Contractor - Contractor Has Employees?

Selecting the appropriate legal document template can be challenging.

Certainly, there are numerous templates accessible online, but how will you obtain the legal form you need? Utilize the US Legal Forms website.

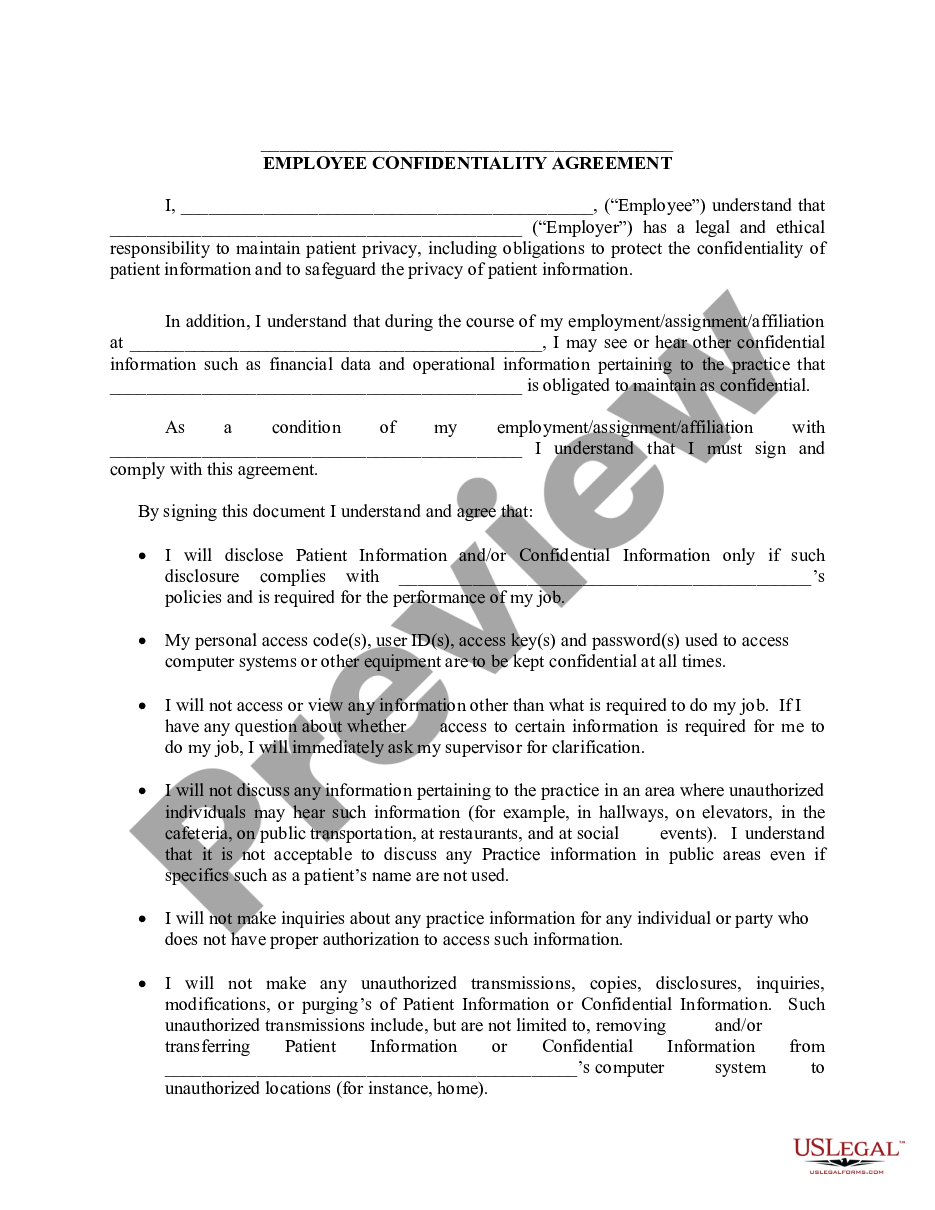

The service offers a vast array of templates, including the Connecticut Contract with Independent Contractor - Contractor has Employees, which can be utilized for business and personal purposes.

You can review the form using the Review button and read the form description to ensure it is suitable for you.

- Each of the forms is reviewed by experts and meets state and federal regulations.

- When you are already registered, Log In to your account and click on the Download button to locate the Connecticut Contract with Independent Contractor - Contractor has Employees.

- Use your account to look through the legal forms you have purchased previously.

- Visit the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you should follow.

- First, ensure you have selected the correct form for your specific town/area.

Form popularity

FAQ

It is also important to note that a self-employed worker can be both employed and self-employed at the same time. For example, a worker can be an employee at a company during the day and run a business by night. Employment status may also change from contract to contract.

Wage & Hour LawIndependent contractors are not considered employees under the Fair Labor Standards Act and therefore are not covered by its wage and hour provisions. Generally, an independent contractor's wages are set pursuant to his or her contract with the employer.

Yes, an employee can receive a W2 and a 1099, but it should be avoided whenever possible. That's because this type of situation is a red flag and frequently results in a response from the IRS seeking further information. It also takes unusual circumstances for this type of dual filing to be legitimate.

Independent contractors usually offer their services to the general public, not just to one person or company. Government auditors will be impressed if you market your services to the public. Here are some ways to do this: Obtain a business card and letterhead.

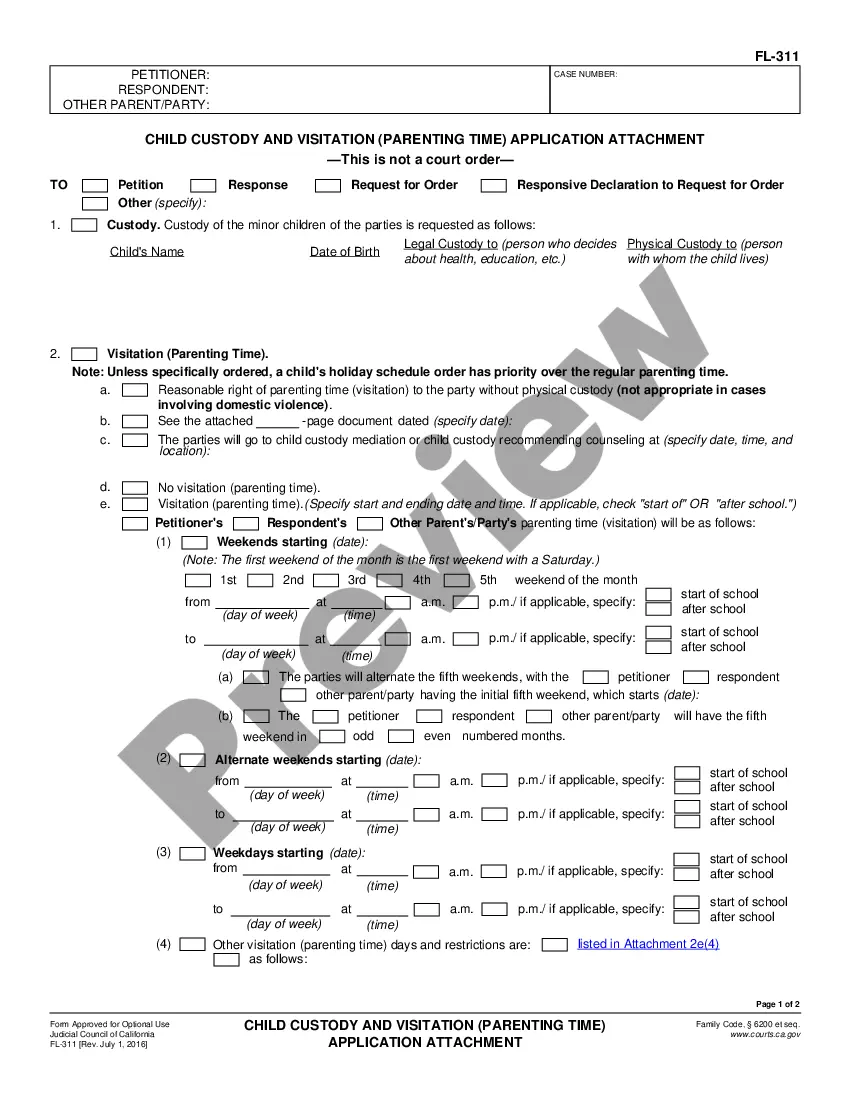

A: Typically a worker cannot be both an employee and an independent contractor for the same company. An employer can certainly have some employees and some independent contractors for different roles, and an employee for one company can perform contract work for another company.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.