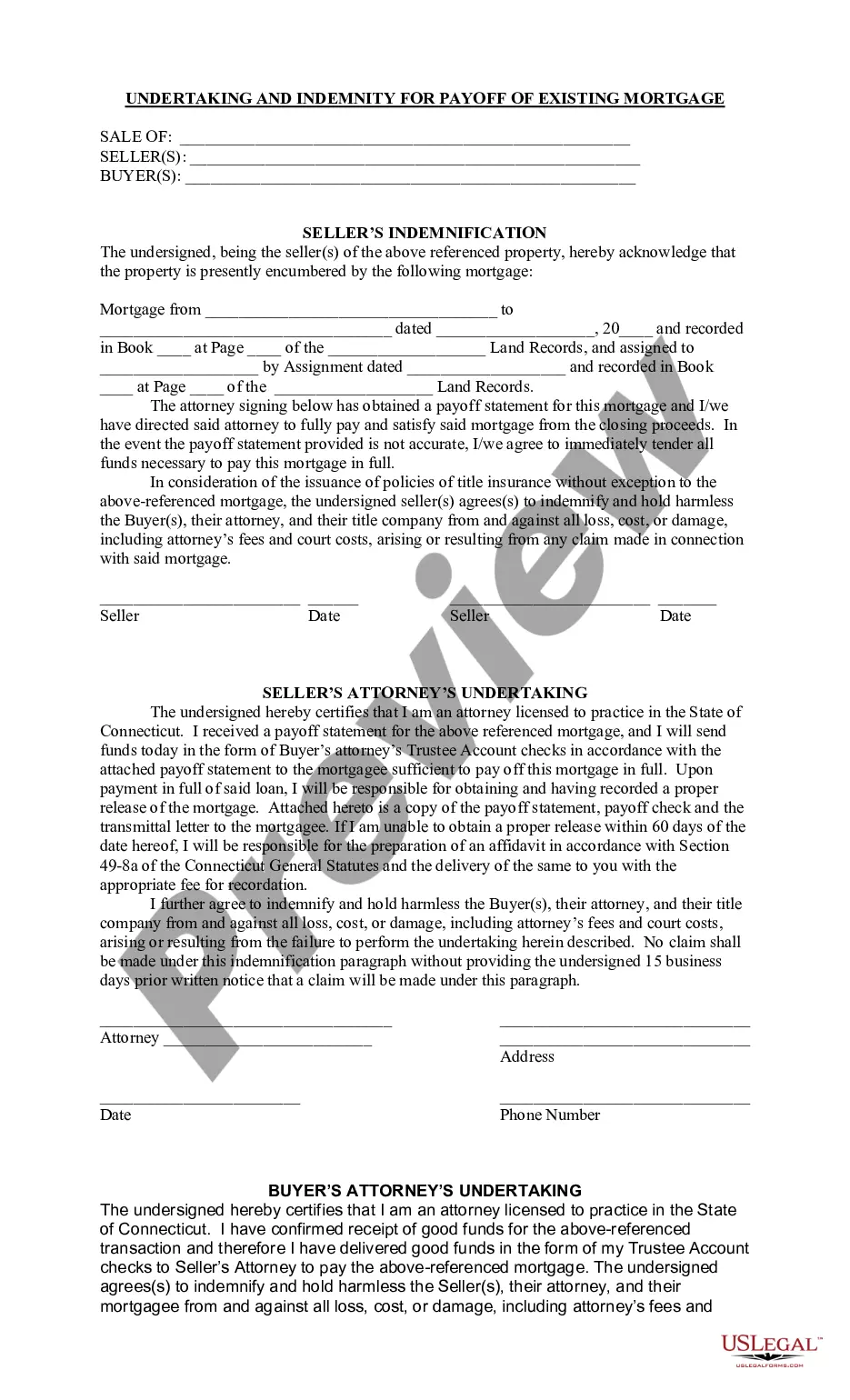

Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage is a legal document that is used when the borrower of a mortgage loan is refinancing and pays off the existing mortgage. This document provides a guarantee that the borrower will pay the mortgage they are refinancing in full, and also provides protection for the lender in the event of default. It also requires the borrower to indemnify the lender for any losses or damages that may occur in the event of a default. There are two main types of Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage: limited and unlimited. The limited version provides protection to the lender only in the event of a default, whereas the unlimited version offers a broader range of protection for the lender.

Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage

Description

How to fill out Connecticut Undertaking And Indemnity For Payoff Of Existing Mortgage?

Managing legal documentation necessitates focus, precision, and the utilization of well-structured templates. US Legal Forms has been assisting individuals nationwide for 25 years, ensuring that when you select your Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage template from our platform, it adheres to federal and state regulations.

Using our service is straightforward and rapid. To acquire the required documents, all you need is an account with an active subscription. Here’s a concise guide for you to obtain your Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage in just a few minutes.

All documents are crafted for multiple uses, like the Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage displayed on this page. If you require them again, you can fill them out without additional payment - simply access the My documents tab in your profile and complete your document whenever you need it. Experience US Legal Forms and prepare your business and personal documents swiftly and in complete legal conformity!

- Ensure to meticulously review the document content and its alignment with general and legal standards by previewing it or reading its description.

- Seek an alternative official template if the one you opened does not fit your circumstances or state regulations (the option for that is located at the top corner of the page).

- Log in to your account and save the Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage in your preferred format. If it’s your initial experience with our service, click Buy now to proceed.

- Establish an account, choose your subscription plan, and make a payment using your credit card or PayPal account.

- Select the format in which you wish to receive your document and click Download. Print the document or utilize a professional PDF editor to submit it electronically.

Form popularity

FAQ

To obtain a release of liability on your mortgage, you must complete the payoff process and request a release from your lender. This release signifies that you are no longer responsible for the mortgage after the payoff. This is essential for your Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage, ensuring you have no ongoing obligations.

A mortgage payoff request form is a document you fill out to formally request a payoff statement from your lender. This form typically requires your mortgage account information and may ask for your contact details. Using this form ensures that your request for a Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage is processed efficiently.

To obtain a payoff letter from your lender, you can Contact them directly through their customer service line or portal. Provide your account details and specify that you need a mortgage payoff letter for your records. This letter plays a crucial role in your Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage.

The time it takes to receive a mortgage payoff letter varies by lender but typically ranges from a few days to a couple of weeks. It's advisable to request this letter well in advance of your intended payoff date to avoid delays. This mortgage payoff letter is essential for your Connecticut Undertaking and Indemnity for Payoff of Existing Mortgage.

To indemnify means that the seller will reimburse the buyer for a loss or liability. To defend means that the seller will pay the buyer's legal fees for suits that arise from specific risks articulated in the contract.

The letter of indemnity will indemnify the buyer's title insurer from any losses incurred due to the title defect and will typically also contain an ?undertaking clause? which means that your title insurance company will resolve the title defect after your closing.

A more thorough explanation: Definition: An indemnity mortgage is a type of mortgage where the borrower is responsible for repaying the loan, but the lender has the right to take possession of the property if the borrower fails to repay the loan.

You should sign an indemnity agreement when there is a high degree of likelihood that you could incur third-party risk in a transaction. For example , when you run a construction company, you likely hire contractors that represent they complete work to specific standards ? standards that you are happy with.

Indemnification, also referred to as indemnity, is an undertaking by one party (the indemnifying party) to compensate the other party (the indemnified party) for certain costs and expenses, typically stemming from third-party claims.

An indemnification agreement, also called an indemnity agreement, hold harmless agreement, waiver of liability, or release of liability, is a contract that provides a business or a company with protection against damages, loss, or other burdens.