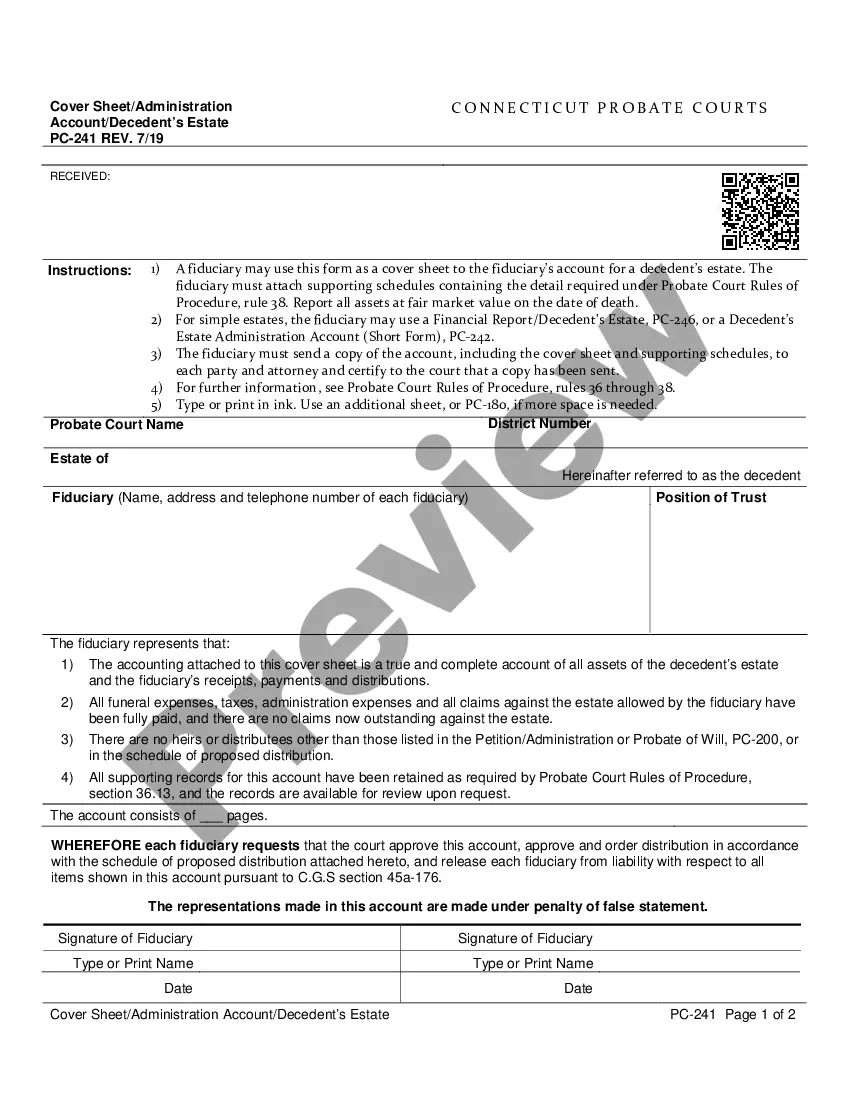

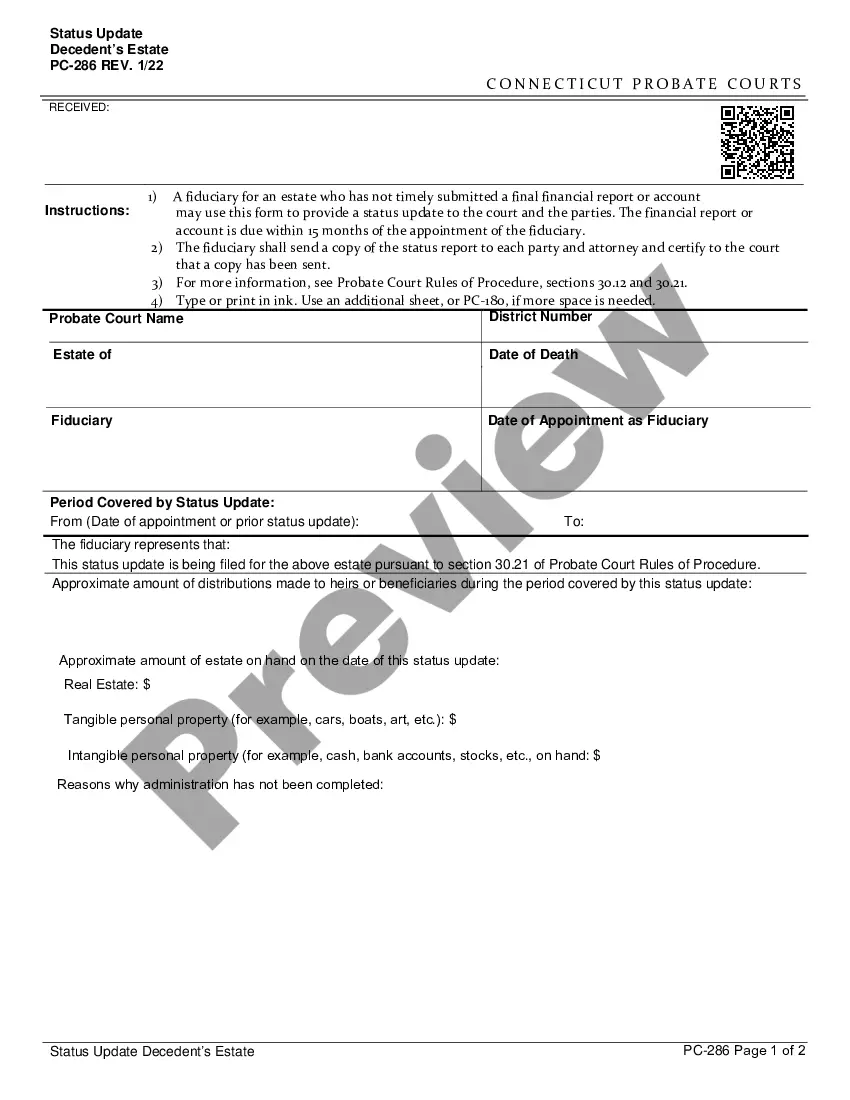

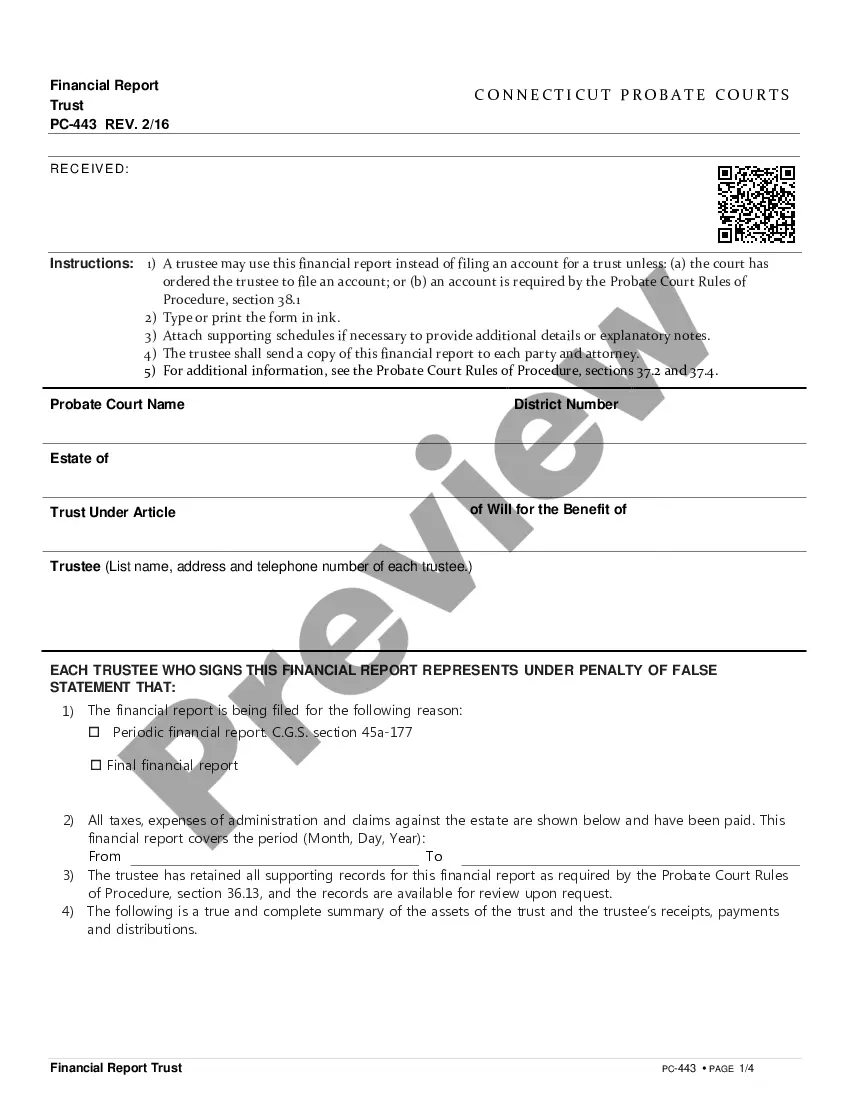

This form is a financial report for an estate in probate. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Financial Report Decedent's Estate

Description

How to fill out Connecticut Financial Report Decedent's Estate?

The larger quantity of documents you are required to produce - the more anxious you become.

You can discover countless Connecticut Financial Report for a Decedent's Estate formats online, yet you remain uncertain about which ones to trust.

Remove the hassle and simplify obtaining samples by utilizing US Legal Forms. Acquire precisely composed forms that comply with state standards.

Choose a preferred file format and receive your copy. Locate all templates you obtain in the My documents section. Simply navigate there to create a new copy of your Connecticut Financial Report for a Decedent's Estate. Even when using professionally drafted templates, it is still advisable to consider asking your local legal counsel to review the filled-out sample to confirm that your document is accurately completed. Achieve more for less with US Legal Forms!

- If you already have a US Legal Forms subscription, sign in to your account, and you will see the Download button on the Connecticut Financial Report for a Decedent's Estate’s page.

- If you are new to our website, follow these steps to register.

- Ensure the Connecticut Financial Report for a Decedent's Estate is permissible in your residing state.

- Verify your selection by reviewing the description or utilizing the Preview option if available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing plan that suits your requirements.

- Enter the necessary information to create your account and pay for the order using PayPal or a credit card.

Form popularity

FAQ

If no will exists, the property is divided according to Connecticut law. The Probate Courts ensure that any debt owed by the deceased person, funeral expenses and taxes are paid before the remaining assets are distributed. Often a family member or friend is responsible for settling the affairs of the estate.

The state of Connecticut, however, doesn't have any hard and fast rules about executor compensation. A rule of thumb used by many Connecticut probate judges is that a fiduciary's fee of less than 4% of the gross estate is presumed reasonable, and many people believe that anything on the order of 3-5% is okay.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

Connecticut has a simplified and expedited probate process for settling small decedent's estates. The entire process can be completed within 30 days, instead of six months or longer as is normally required for the regular probate process.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

The first step in probating an estate is to locate all of the decedent's estate planning documents and other important papers, even before being appointed to serve as the personal representative or executor.

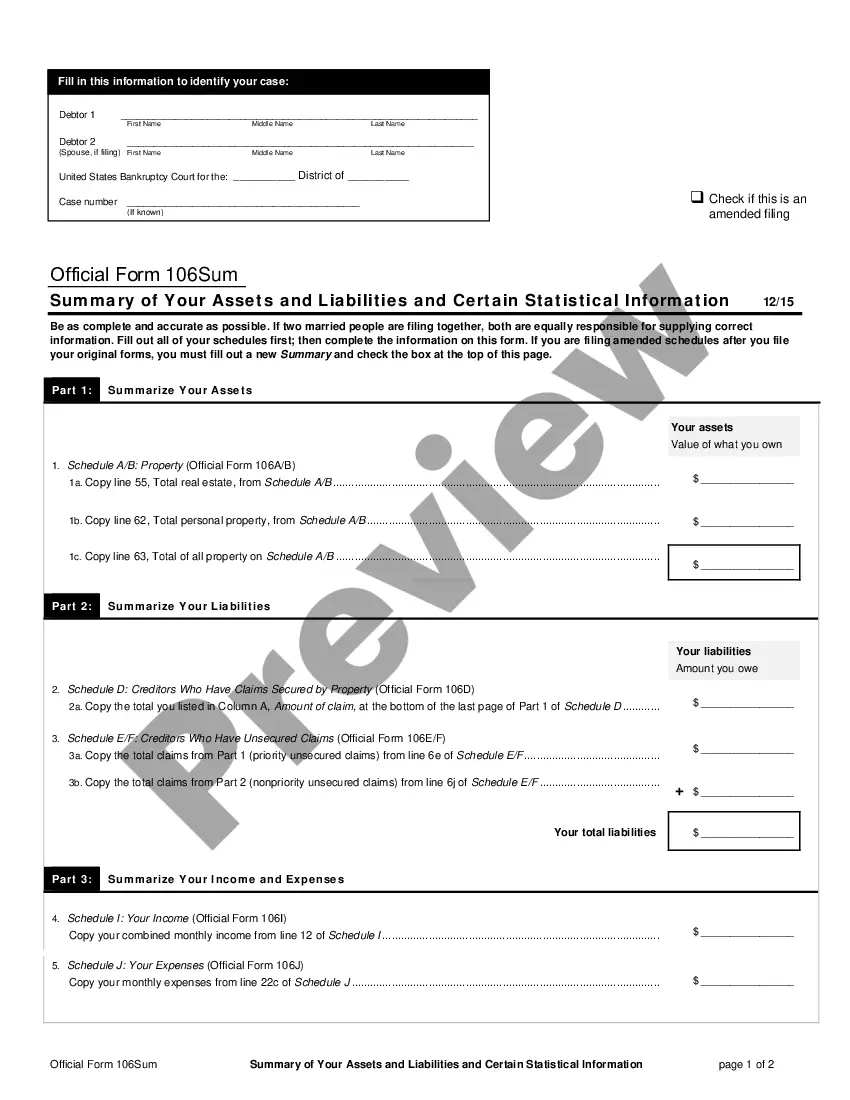

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

File an application with the appropriate probate court, together with a certified death certificate and the original Will and codicils. The application will list basic information about the decedent, including the beneficiaries under any Will or codicil and all heirs at law.