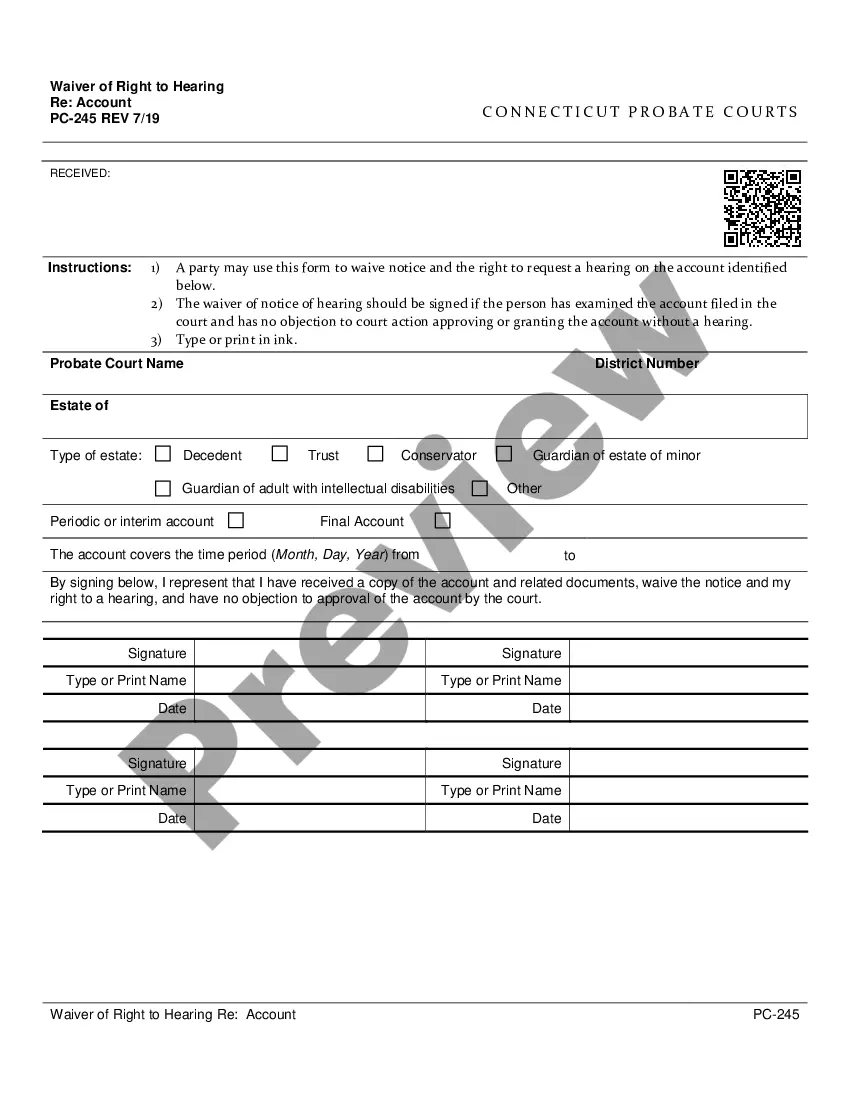

This form is used in probate matters to ask that the court approve a financial report without a hearing. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Waiver of Right to Hearing Re: Financial Report

Description

How to fill out Connecticut Waiver Of Right To Hearing Re: Financial Report?

The greater the number of documents you need to produce - the more nervous you feel.

You can find a vast assortment of Connecticut Waiver of Rights to Hearing regarding Financial Report templates online, but you're unsure which ones to trust.

Reduce the stress and simplify acquiring samples by using US Legal Forms. Obtain accurately created documents that are designed to comply with state regulations.

Input the necessary information to create your account and complete your order payment with PayPal or credit card. Select a convenient file format and obtain your sample. Access all documents you receive in the My documents section. Simply visit there to generate a new version of the Connecticut Waiver of Rights to Hearing regarding Financial Report. Even when using accurately prepared documents, it's still important to consider consulting a local attorney to verify that your form is properly completed. Do more for less with US Legal Forms!

- If you already have a US Legal Forms subscription, Log In to your account, and you will find the Download button on the Connecticut Waiver of Rights to Hearing regarding Financial Report’s webpage.

- If you haven't visited our site before, complete the registration process by following these instructions.

- Verify that the Connecticut Waiver of Rights to Hearing regarding Financial Report is valid in your state.

- Double-check your choice by reading the description or using the Preview function if available for the selected document.

- Click Buy Now to begin the subscription process and choose a pricing plan that suits your preferences.

Form popularity

FAQ

Assets subject to probate in Connecticut typically comprise those that are part of the deceased's estate at the time of death. This includes property without a named beneficiary or trust arrangements. Utilizing the Connecticut Waiver of Right to Hearing Re: Financial Report can provide clarity in these situations and help families manage their loved ones' estates efficiently.

In Connecticut, probate generally applies to assets solely owned by a deceased person. This includes real estate, bank accounts without designated beneficiaries, and personal property. Navigating this can be complex, and using resources like the Connecticut Waiver of Right to Hearing Re: Financial Report can help streamline the process for those dealing with estate matters.

In Connecticut, certain assets are exempt from probate. These include assets held in joint tenancy, life insurance policies with a named beneficiary, and retirement accounts that provide for payable-on-death designations. Understanding these exceptions can simplify asset management, especially in relation to the Connecticut Waiver of Right to Hearing Re: Financial Report, ensuring a smoother transition for beneficiaries.

In Connecticut, any estate valued at over $40,000 requires probate. This threshold includes the total value of assets owned at the time of death. If your estate falls below this amount, you may avoid formal probate, simplifying the settlement process. For those navigating probate complexities, a Connecticut Waiver of Right to Hearing Re: Financial Report may help streamline the management and oversight of estate financials.

An executor has a maximum of 18 months to complete the probate process and settle an estate in Connecticut. However, most estates are resolved much sooner, typically within a year. If complications arise, such as disputes or delays, an executor may seek a Connecticut Waiver of Right to Hearing Re: Financial Report to address these issues quickly. Understanding the timeline helps ensure smooth progress through the probate process.

While there is no specific time limit set for an executor to sell a house in Connecticut, they must act in the best interest of the estate and its beneficiaries. An executor often aims to sell the property in a reasonable time frame to prevent additional costs. If you're facing challenges with estate management, consider the Connecticut Waiver of Right to Hearing Re: Financial Report to streamline decisions. This can support timely actions and clear communication with involved parties.

In Connecticut, creditors generally have a period of six months from the date of the estate's probate to present their claims. If the estate's executor files a Connecticut Waiver of Right to Hearing Re: Financial Report, this may influence the timing and management of financial matters. It is crucial to ensure that all debts are settled within this timeframe to avoid complications. Keeping track of these deadlines can help simplify the estate settlement process.

An estate must generally exceed $40,000 in value to enter the probate process in Connecticut. It is crucial for estate planning to be aware of this threshold to avoid unnecessary complications. Understanding the implications of the Connecticut Waiver of Right to Hearing Re: Financial Report can help in determining proper financial reporting and management during the probate process.

In Connecticut, if an estate's value exceeds $40,000, it typically requires probate. Assets below this threshold may not need to go through the court process, allowing for a more straightforward transition. Knowing about the Connecticut Waiver of Right to Hearing Re: Financial Report can further clarify the requirements and help in preparing necessary financial reports for any probate proceedings.

Closing an estate in Connecticut involves a few key steps. You must settle debts, distribute assets, and file necessary documents with the court. Utilizing tools like the Connecticut Waiver of Right to Hearing Re: Financial Report can simplify this process, as it assists in handling financial disclosures effectively. Subsequently, you can finalize the estate closure with fewer complications.