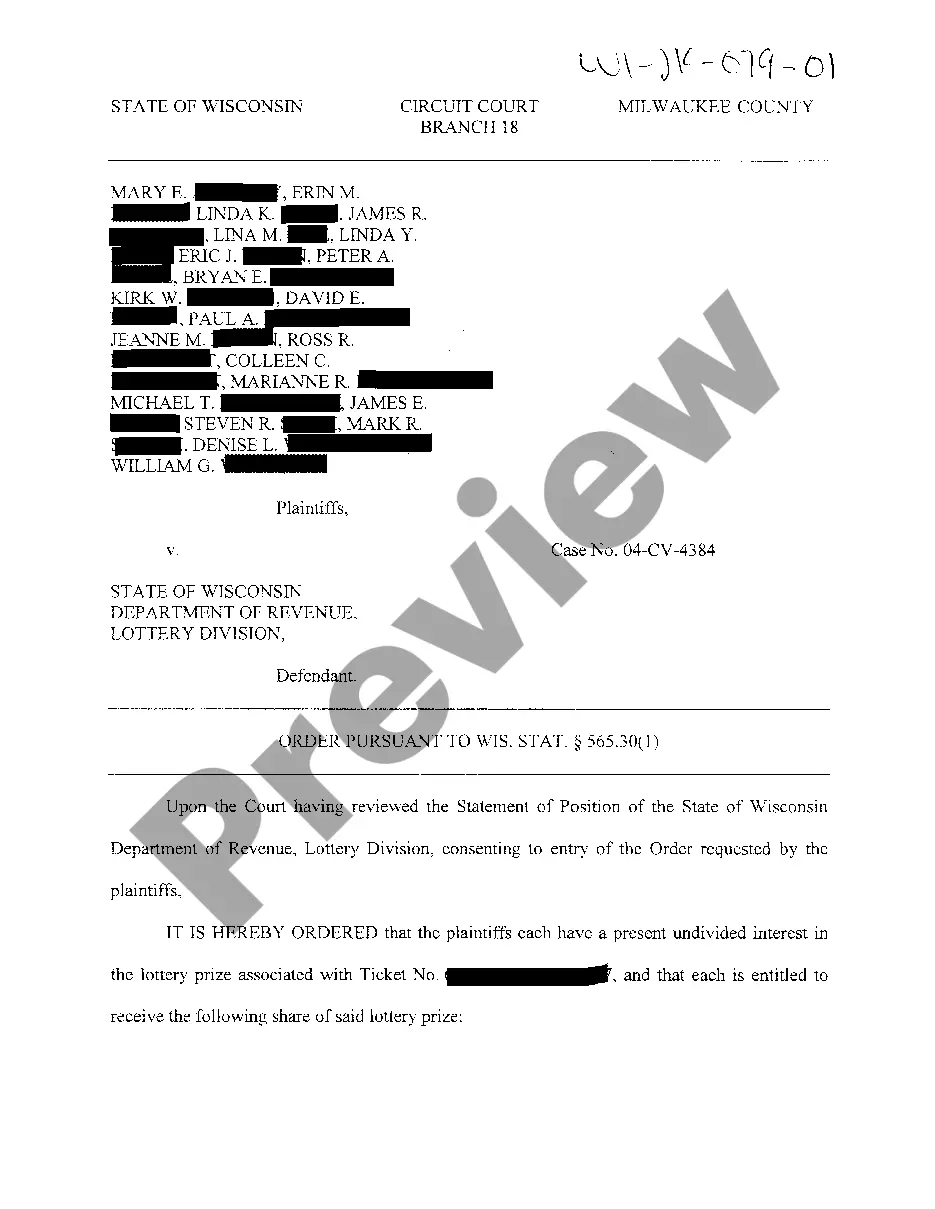

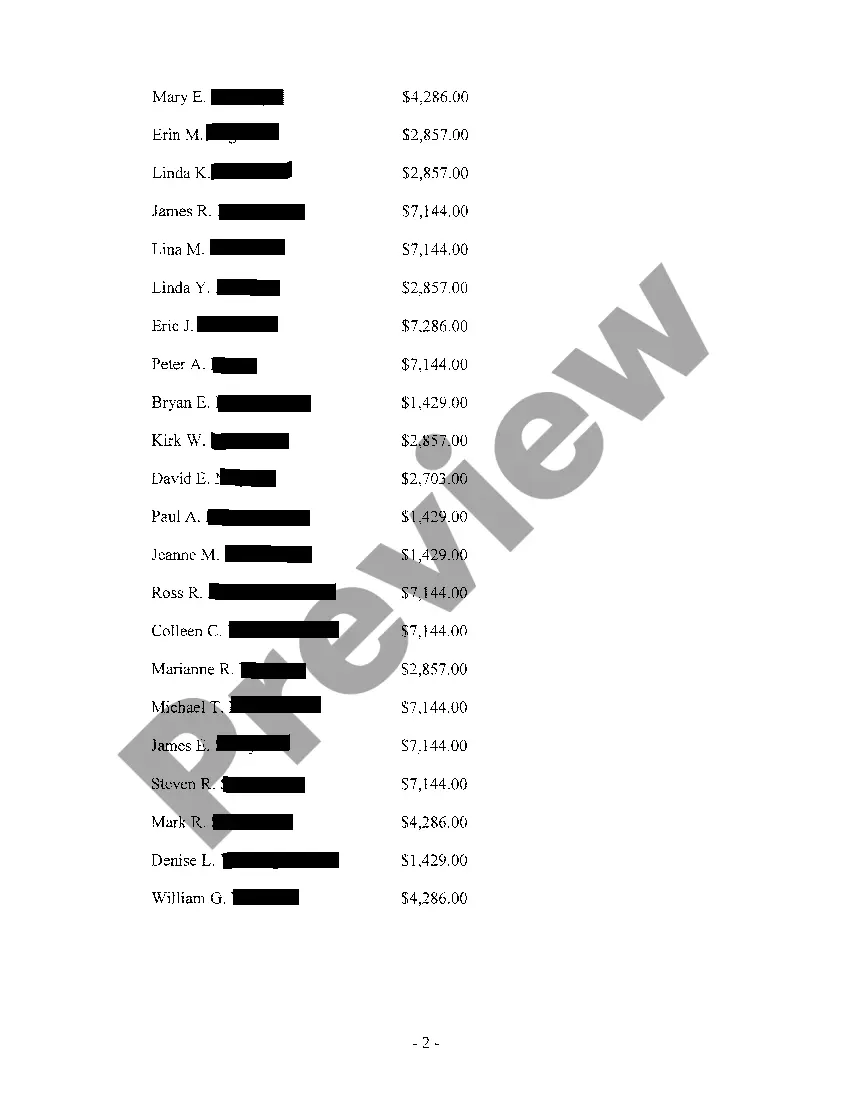

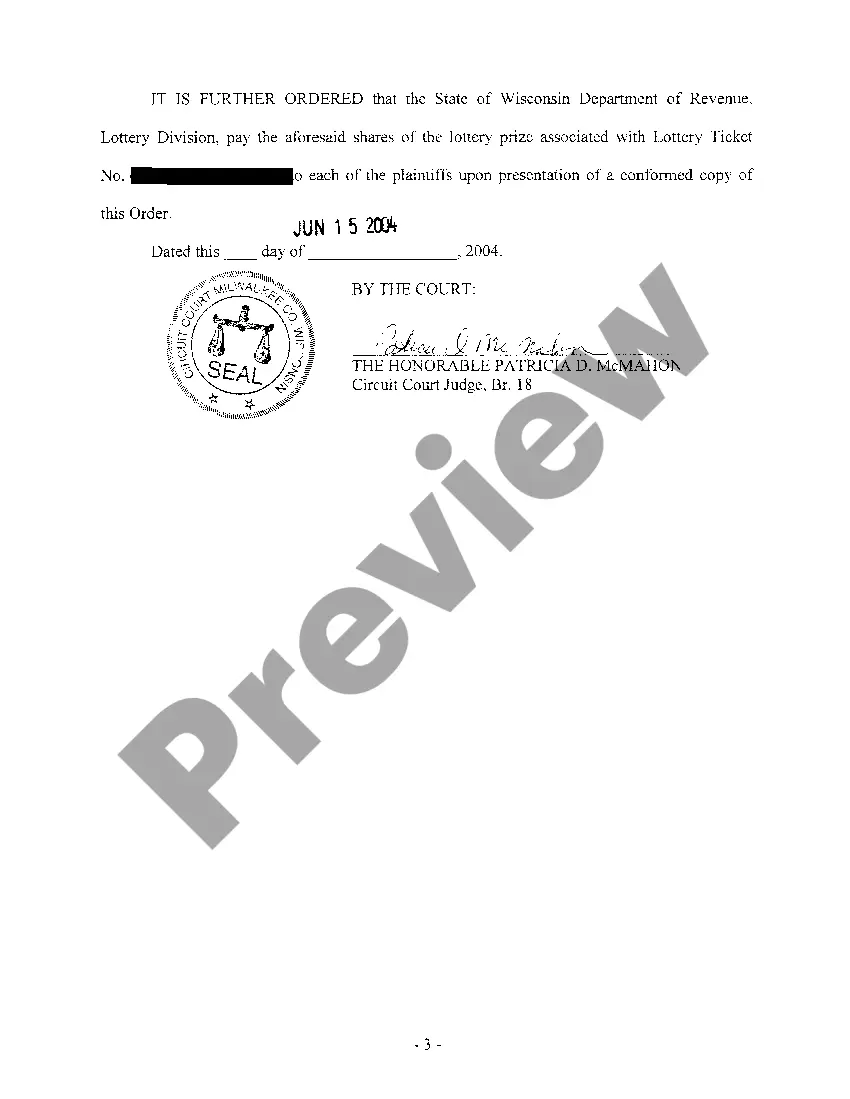

Wisconsin Order for Distribution of Lottery Prize

Description

How to fill out Wisconsin Order For Distribution Of Lottery Prize?

Out of the large number of services that offer legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates prior to buying them. Its comprehensive library of 85,000 templates is categorized by state and use for simplicity. All of the forms on the platform have been drafted to meet individual state requirements by licensed lawyers.

If you already have a US Legal Forms subscription, just log in, search for the template, press Download and get access to your Form name in the My Forms; the My Forms tab keeps your saved forms.

Keep to the guidelines below to obtain the form:

- Once you discover a Form name, make sure it’s the one for the state you really need it to file in.

- Preview the template and read the document description before downloading the template.

- Search for a new sample through the Search engine if the one you have already found is not correct.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the document.

Once you have downloaded your Form name, you are able to edit it, fill it out and sign it in an web-based editor that you pick. Any form you add to your My Forms tab might be reused multiple times, or for as long as it continues to be the most updated version in your state. Our service offers easy and fast access to templates that fit both legal professionals and their customers.

Form popularity

FAQ

The bill would prohibit retailers that sell lottery tickets, the administrator of the state lottery and the Department of Revenue from disclosing the name and personal details of the lottery prize winner if the person requests confidentiality.

Tickets with prize value $200,000 or more MUST be claimed in-person at the Madison Office, 2135 Rimrock Rd Madison, WI 53713. If a prize is being claimed by more than one person, see back for details.

That's because lottery winnings are generally taxed as ordinary income at both the federal and state (and, where applicable, local) level. In fact, in most states (and at the federal level), taxes on lottery winnings over $5,000 are withheld automatically.

Taxes are calculated based on your taxable income for the year, so if the extra income from lottery winnings moves you into a higher tax bracket, you'll typically end up paying more income tax.

To take home the jackpot, your ticket must have the same five white numbers order doesn't matter and the one red number.Multiply that by the 26 possible red balls, and you get 292,201,338 possible Powerball number combinations.

Please call (608) 261-4916 at least two hours before your arrival. Tickets with prize value $200,000 or more MUST be claimed in-person at the Madison Office, 2135 Rimrock Rd Madison, WI 53713. If a prize is being claimed by more than one person, see back for details.

Lottery winners can collect their prize as an annuity or as a lump-sum.A lump-sum payout distributes the full amount of after-tax winnings at once. Powerball and Mega Millions offer winners a single lump sum or 30 annuity payments over 29 years.

All prize winnings are subject to federal and state income tax withholding. State tax of 7.65% is automatically taken out for payouts $2,000 or more. Payouts $5,001 or more have state and federal tax of 24% automatically withheld.