California Interspousal Grant Deed from Individual

What is this form?

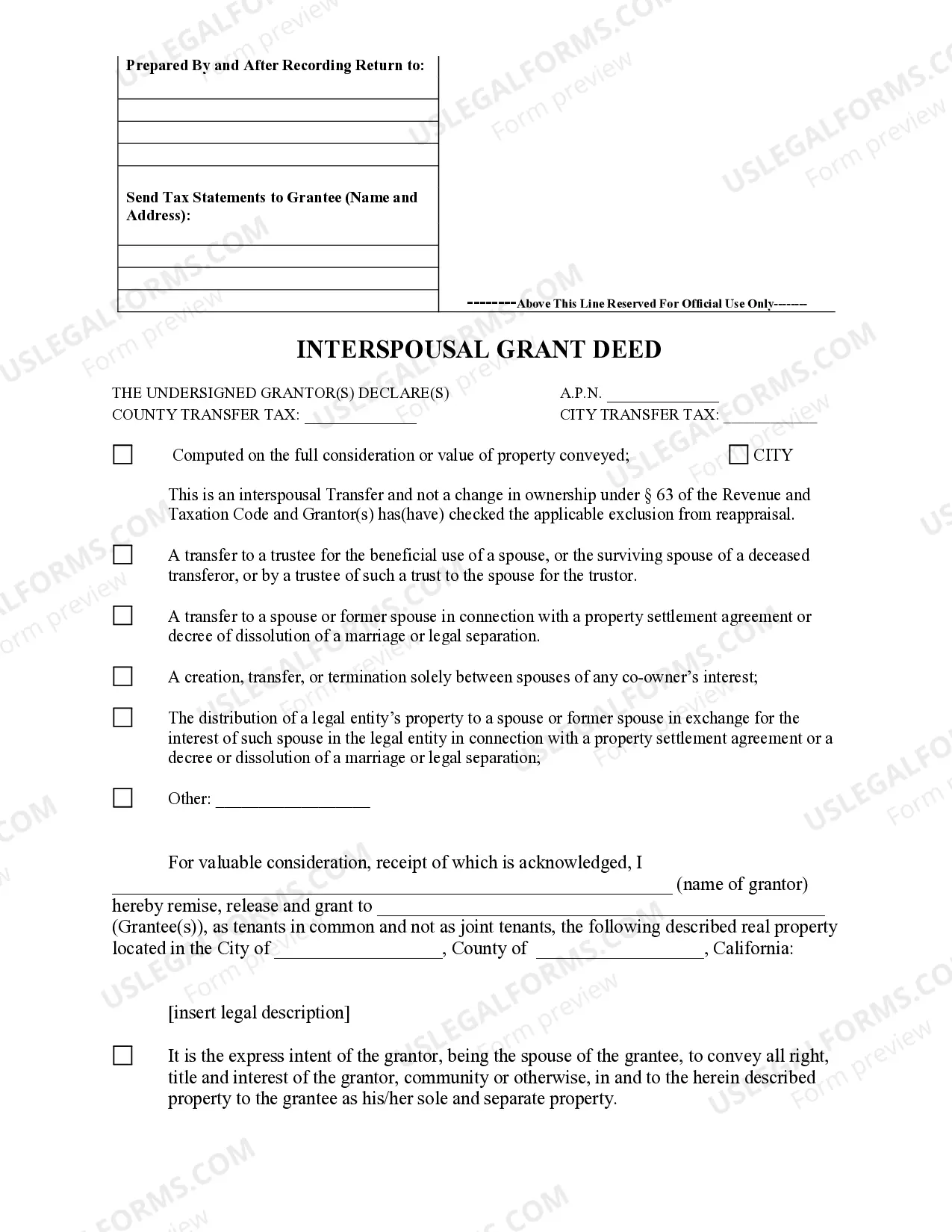

The Interspousal Grant Deed from Individual is a legal document used to transfer property ownership between spouses. This form is specifically designed for situations where one spouse grants property to the other without consideration, such as a gift. It differs from other deeds, such as a general grant deed, by focusing on spouse-to-spouse transactions, which often have unique tax implications and legal protections under California law.

Key components of this form

- Grantor and Grantee information: Names and addresses of the parties involved in the deed.

- Property description: Detailed legal description of the property being transferred.

- Transfer tax exemptions: Options for exemptions under California Revenue and Taxation Code.

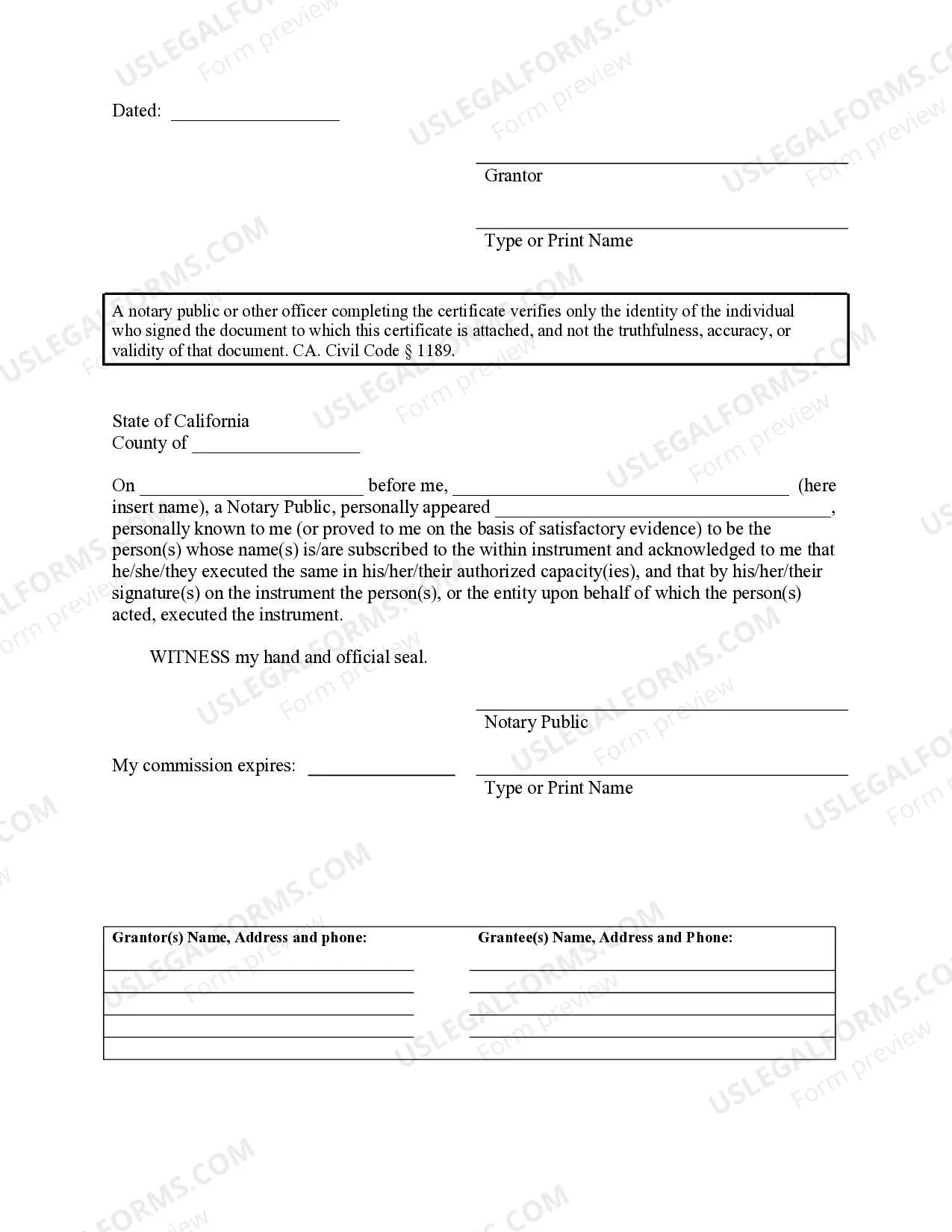

- Signature fields: Spaces for the grantor's and grantee's signatures to validate the transfer.

- Notarization section: Confirmation of whether notarization is required for the deed.

Situations where this form applies

This form should be used when one spouse wishes to transfer real property to the other spouse in any of the following scenarios: as part of a property settlement agreement during a divorce, as a transfer related to legal separation, or when no monetary exchange is involved. It is applicable in situations where transferring ownership needs to be documented clearly to avoid confusion in future property disputes.

Who needs this form

- Married individuals wishing to transfer property to their spouse.

- Couples undergoing a divorce or legal separation requiring an agreement on property division.

- Individuals looking to clarify ownership of property held jointly with their spouse.

Instructions for completing this form

- Identify the parties: Enter the full names of the grantor (the spouse transferring the property) and the grantee (the spouse receiving the property).

- Specify the property: Provide a detailed legal description of the property being transferred.

- Check transfer tax exemptions: Indicate any applicable exemptions from tax reappraisal under California law.

- Complete signature fields: Ensure both spouses sign the deed to validate the transfer properly.

- Review and notarize: If required, have the deed notarized to ensure its legality in the state of California.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to complete all required fields, which may invalidate the deed.

- Not providing a complete legal property description.

- Omitting the necessary signatures from both spouses.

- Ignoring potential tax implications by not checking exemption fields.

Advantages of online completion

- Immediate access: Download the form instantly to fill out at your convenience.

- Easy to edit: The document can be completed using digital tools for ease and accuracy.

- Cost-effective: Save on legal fees by using a professionally drafted form tailored to your needs.

Looking for another form?

Form popularity

FAQ

To fill out a California grant deed, start by entering the complete names of both spouses, along with the property address and legal description. Ensure that you specify the nature of the transfer clearly and include the necessary signatures. For ease of use, templates offered by platforms such as US Legal Forms specifically for California Interspousal Grant Deed from Individual can offer step-by-step guidance to help you fill out the deed correctly.

In California, a grant deed can be prepared by the property owners themselves, or they can seek assistance from qualified professionals like attorneys or title companies. Choosing to use a service like US Legal Forms allows you to easily access professionally designed templates suitable for a California Interspousal Grant Deed from Individual. This ensures that your deed is prepared correctly and complies with state regulations.

Filling out a grant deed in California requires clear and accurate information. Start with the names of both spouses, followed by details about the property being transferred, such as its legal description. For clarity and ease, consider using templates offered by US Legal Forms specifically for California Interspousal Grant Deed from Individual to guide you in completing the document.

The interspousal transfer grant deed in California allows one spouse to transfer their interest in a property directly to the other spouse. This type of grant deed is beneficial during marriage or in the event of a divorce, as it helps avoid reassessment of property taxes. Utilizing a California Interspousal Grant Deed from Individual streamlines the process and ensures legal compliance.

To prepare a grant deed in California, you can either draft the document yourself using templates or seek help from professionals, such as attorneys or title companies. Using platforms like US Legal Forms can simplify this process by providing you with structured templates designed for California Interspousal Grant Deed from Individual. Ensure that all required information is included for smooth processing.

In California, both spouses must sign the grant deed when transferring property through a California Interspousal Grant Deed from Individual. This includes the spouse who is transferring their interest in the property and the spouse receiving it. By signing, both parties confirm their agreement to the transfer, making the deed legally effective.

Yes, a grant deed serves as proof of ownership in California. Once recorded, it establishes a public record of ownership, showing the transfer of property rights to the new owner. This is particularly important when using a California Interspousal Grant Deed from Individual, as it solidifies the ownership claim between spouses while providing a reliable trail of the property's history.

To change a grant deed in California, you will need to complete a new deed form that reflects the desired changes. This new deed must be executed, acknowledged before a notary public, and then recorded with the county recorder's office. Utilizing tools like USLegalForms can simplify this process; their platform provides guidance on how to properly create and file a California Interspousal Grant Deed from Individual to effectuate your changes effectively.

In California, when a court examines an interspousal transfer deed, it typically recognizes the deed as a means to change the nature of property from separate to community property, or vice versa. This legal recognition underscores the significance of using a California Interspousal Grant Deed from Individual in managing marital assets. Such a deed ensures clarity and protectiveness in property ownership between spouses.

To transfer property in California, you will need to execute a deed, such as a California Interspousal Grant Deed from Individual. This deed legally transfers ownership from one person to another, and it must be signed, notarized, and recorded with the county recorder's office. Using a California Interspousal Grant Deed can simplify this process between spouses, ensuring a clear transfer of property rights.