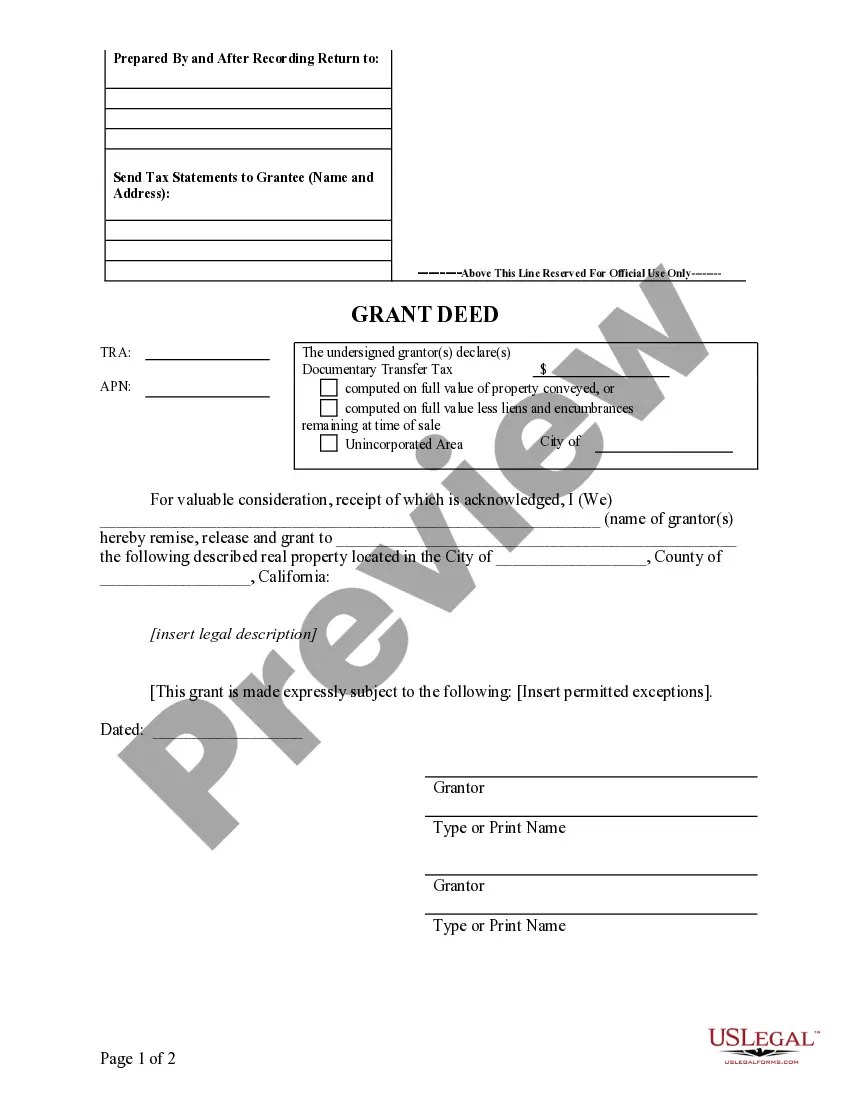

California Grant Deed

What is this form?

A Grant Deed is a legal document used in property transactions to transfer ownership of real estate from one party to another. Unlike other types of deeds, it provides a warranty that the property has not been sold to anyone else and that there are no undisclosed liens or encumbrances on the property. This deed can be essential for ensuring a clear title in a real estate transaction.

What’s included in this form

- Grantor's name and address: The individual or entity transferring the property.

- Grantee's name and address: The individual or entity receiving the property.

- Legal property description: A detailed description of the property being transferred.

- Declaration of transfer: A statement acknowledging the transfer of property.

- Signature and date: Necessary for validating the deed.

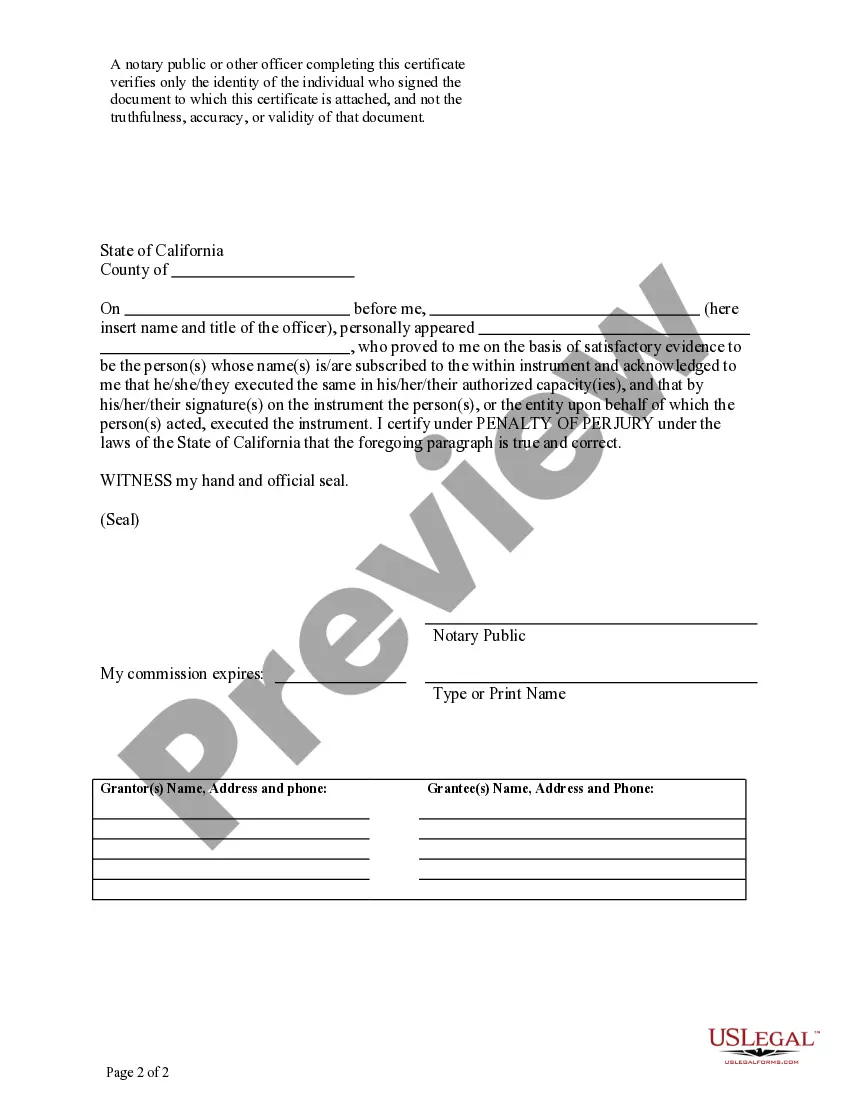

- Notary section: Required for notarization to confirm authenticity.

Common use cases

This form should be used when you are transferring ownership of real property in California. You may need this Grant Deed if you are selling, gifting, or otherwise conveying property to another party. It is essential for situations where a clear title is needed to ensure the legality of property ownership and to avoid disputes in the future.

Who can use this document

This form is intended for:

- Property owners (grantors) wishing to transfer ownership of their real estate.

- Individuals or entities (grantees) receiving property in a purchase, gift, or inheritance.

- Real estate professionals managing property transactions.

- Anyone needing to clarify ownership of real estate to prevent future legal issues.

How to complete this form

- Identify the parties involved: Fill in the names and addresses of both the grantor and the grantee.

- Specify the property: Provide a complete legal description of the property being transferred.

- Enter the transfer date: Include the date the transfer is taking place.

- Sign the document: Both parties must sign and date the Grant Deed.

- Complete the notarization section: Arrange for a notary public to verify the signatures.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include the full legal description of the property.

- Not properly signing the document before a notary.

- Leaving out the names and addresses of the grantor and grantee.

- Not understanding the implications of property encumbrances.

Why complete this form online

- Convenience: Download the form immediately to complete at your own pace.

- Editability: Customize the form fields easily before printing or signing.

- Cost-effective: Save time and money compared to hiring an attorney for simple transfers.

Looking for another form?

Form popularity

FAQ

The primary purpose of a grant deed is to provide a clear and legally binding transfer of property ownership with specific guarantees about the title. In contrast, a quitclaim deed simplifies the transfer process, focusing on the relinquishment of any claim the grantor has without offering assurances. Knowing when to use each type of deed can facilitate smoother property transactions and ensure better legal protections in California.

A quitclaim deed transfers ownership of a property, but it does not guarantee that the grantor holds valid title. Therefore, while it can give the recipient a share of ownership, it may come without clear title or the right to the property. For those seeking more security, a California Grant Deed is a better option, as it offers assurances about the property's ownership.

The primary difference between a grant deed and a quitclaim deed lies in the level of protection they offer. A grant deed provides assurances regarding the ownership and condition of the property, ensuring that the grantor has the right to transfer it. Conversely, a quitclaim deed merely transfers whatever interest the grantor has, with no warranties attached. Understanding these distinctions can help you choose the right option for your needs in California.

To obtain a copy of your grant deed in California, you can visit your local county assessor's office or their website. You may also request a copy online or by mail, depending on the services offered by your county. Additionally, using platforms like USLegalForms can simplify the process by providing guidance on obtaining and organizing your grant deed effectively.

Individuals who want to transfer property ownership quickly and simply often benefit the most from a quitclaim deed. This type of deed is useful in situations like transferring property between family members or settling a divorce. However, it's crucial to understand that a quitclaim deed does not guarantee that the person transferring the property has legal title. In many cases, those who need to clarify ownership may also consider obtaining a California Grant Deed for added security.

In California, anyone can prepare a Grant Deed, but it's often best to have a real estate attorney or a qualified professional handle it for accuracy. Utilizing services like US Legal Forms can help you create a compliant deed without legal confusion. Their templates guide you through the process, ensuring you meet California's legal standards.

Filling out a California Grant Deed involves entering the names of the property owners, providing a detailed property description, and including the grantor's signature. You can access templates through online services, such as US Legal Forms, which simplifies the process and ensures compliance with state requirements.

A valid California Grant Deed must contain specific elements, including the names of the grantor and grantee, a clear description of the property, and the grantor's signature. Additionally, the deed should state the intent to transfer ownership. Meeting these requirements ensures the deed is legally effective.

To file a California Grant Deed, you must complete the required form and submit it to the county recorder's office. Include any applicable fees and additional documentation, if necessary. It's a straightforward process that ensures your deed is properly recognized and recorded.

Yes, a California Grant Deed must be recorded with the county recorder's office where the property is located. Recording the deed protects your ownership rights, making it public record. By recording, you ensure future buyers and lenders can verify your ownership, which is essential in real estate transactions.