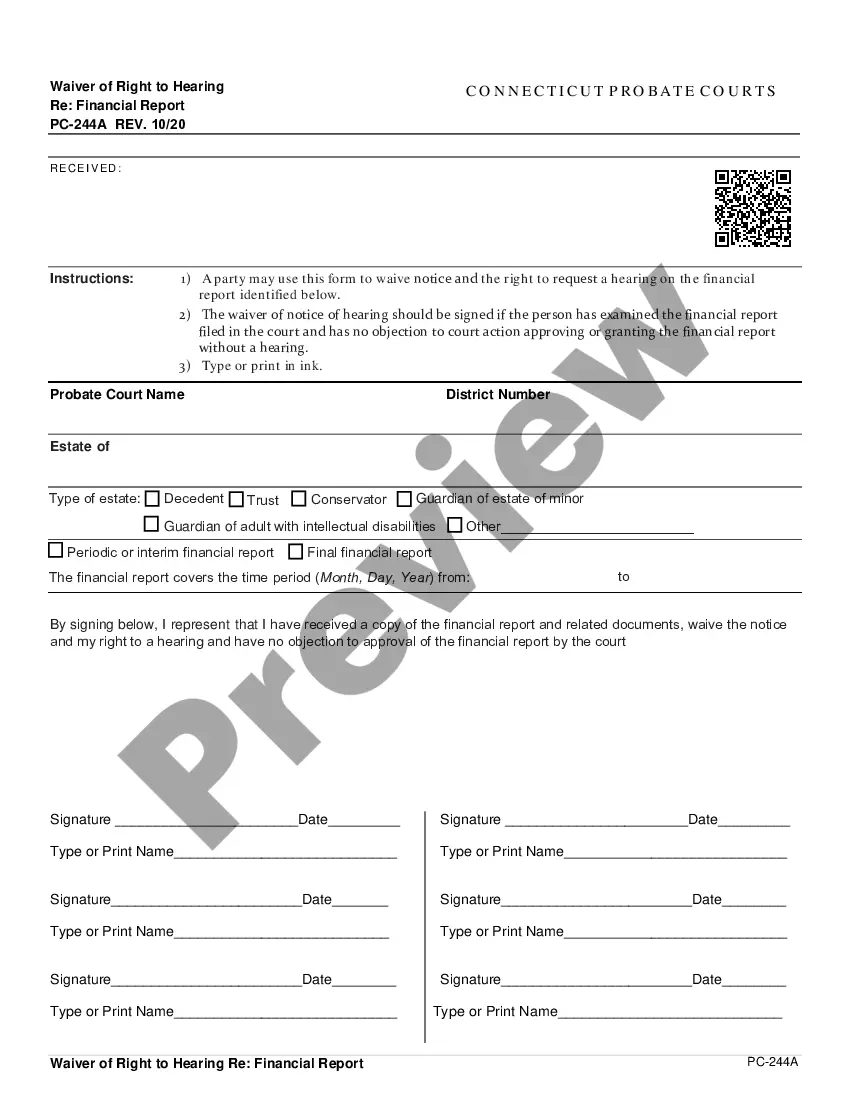

This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Waiver of Right to Hearing Re: Account

Description

How to fill out Connecticut Waiver Of Right To Hearing Re: Account?

The greater number of documents you have to produce - the more anxious you become.

You can find numerous Connecticut Acceptance and Waiver Regarding Final Account templates online, but you may be unsure which ones to trust.

Eliminate the confusion and simplify the process of locating samples using US Legal Forms.

Proceed by clicking Buy Now to initiate the registration process and select a pricing plan that matches your needs. Input the required information to create your account and pay for your purchase using PayPal or a credit card. Choose a suitable document type and download your sample. Access every document you download in the My documents section. Simply visit there to complete a new version of the Connecticut Acceptance and Waiver Regarding Final Account. Even with well-prepared forms, it is still critical to consider consulting your local attorney to verify that your document is filled out correctly. Achieve more for less with US Legal Forms!

- Obtain accurately prepared forms that comply with state requirements.

- If you possess a US Legal Forms subscription, sign in to your account, and you will see the Download button on the Connecticut Acceptance and Waiver Regarding Final Account’s webpage.

- If this is your first time using our platform, complete the registration process by following these steps.

- Confirm that the Connecticut Acceptance and Waiver Regarding Final Account is applicable in your state.

- Double-check your choice by reviewing the description or utilizing the Preview feature if available for the selected document.

Form popularity

FAQ

Yes, you can live in a house going through probate in Connecticut as long as you are an heir or the designated occupant of the property. However, the property's management typically falls under the executor's responsibilities, who must follow court guidelines. If you understand the nuances of the Connecticut Waiver of Right to Hearing Re: Account, you can navigate the property rights more easily. Staying informed ensures a peaceful coexistence during the probate process.

In Connecticut, joint bank accounts typically do not go through probate, as the surviving account holder automatically retains access to the funds. This joint ownership allows for a smooth transition of assets and can simplify estate management. When setting up accounts, it's wise to review the implications of a Connecticut Waiver of Right to Hearing Re: Account for future estate planning. This helps ensure that your wishes are followed without unnecessary legal hurdles.

The probate process in Connecticut can take anywhere from a few months to over a year, depending on various factors such as the estate's complexity and any disputes among heirs. Generally, straightforward estates may settle more quickly, while contested cases will take longer and require judicial intervention. To minimize complications, consider utilizing tools like the Connecticut Waiver of Right to Hearing Re: Account. Effective planning plays a crucial role in expediting this process.

When a house goes into probate in Connecticut, the court oversees the distribution of the property according to the deceased's will or state law if there is no will. The executor must inform potential heirs and creditors about the estate. Proper documentation and management, like implementing a Connecticut Waiver of Right to Hearing Re: Account, can make this process easier. You should also prepare for possible delays while the court assesses the estate.

In Connecticut, an executor generally has 12 months to settle an estate, although this timeframe can vary based on the complexity of the estate or disputes that may arise. It’s important to address all claims and distribute assets in a timely manner to avoid delays. Utilizing resources, such as the Connecticut Waiver of Right to Hearing Re: Account, can help facilitate smoother estate management. Staying organized accelerates the probate process.

To avoid probate in Connecticut, consider using trusts or joint ownership strategies. By establishing a revocable living trust, you can ensure your assets pass directly to your beneficiaries upon your death, bypassing the lengthy probate process. You can also set up joint ownership for properties, which allows the surviving owner to take full ownership without going through probate. This is where understanding a Connecticut Waiver of Right to Hearing Re: Account can be beneficial; it streamlines estate management.

If you do not file for probate in Connecticut, the estate cannot be legally settled, and the assets may remain in limbo. This can lead to complications for heirs, including potential financial liabilities or disputes. In such situations, a Connecticut Waiver of Right to Hearing Re: Account can provide clarity and expedite the resolution process. Utilizing this option can ultimately protect the interests of the estate and its beneficiaries.

Creditors can pursue claims against an estate for six months after the executor has been appointed, as mandated by Connecticut law. This timeline ensures that all debts are collected before the estate is closed. By understanding these timelines and utilizing tools like the Connecticut Waiver of Right to Hearing Re: Account, estate administrators can navigate creditor claims more effectively. Staying proactive can ease the process for the heirs left behind.

In Connecticut, creditors have a period of six months from the date of the appointment of the executor to file a claim against the estate. This timeframe is crucial for ensuring all debts are settled before distributing assets. To effectively manage this process, using a Connecticut Waiver of Right to Hearing Re: Account may help streamline communications with creditors. This allows for better clarity in resolving any outstanding claims.

Some individuals may choose not to probate a will to avoid the costs and delays associated with the process. By utilizing a Connecticut Waiver of Right to Hearing Re: Account, a person can simplify estate administration. This can be particularly useful in cases where the estate is straightforward or when heirs agree on the distribution. Avoiding probate may preserve family harmony and save time.