This form is used to request that a person be removed from his/her property in the execution of a mortgage foreclosure. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Execution for Ejectment, Mortgage Foreclosure

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

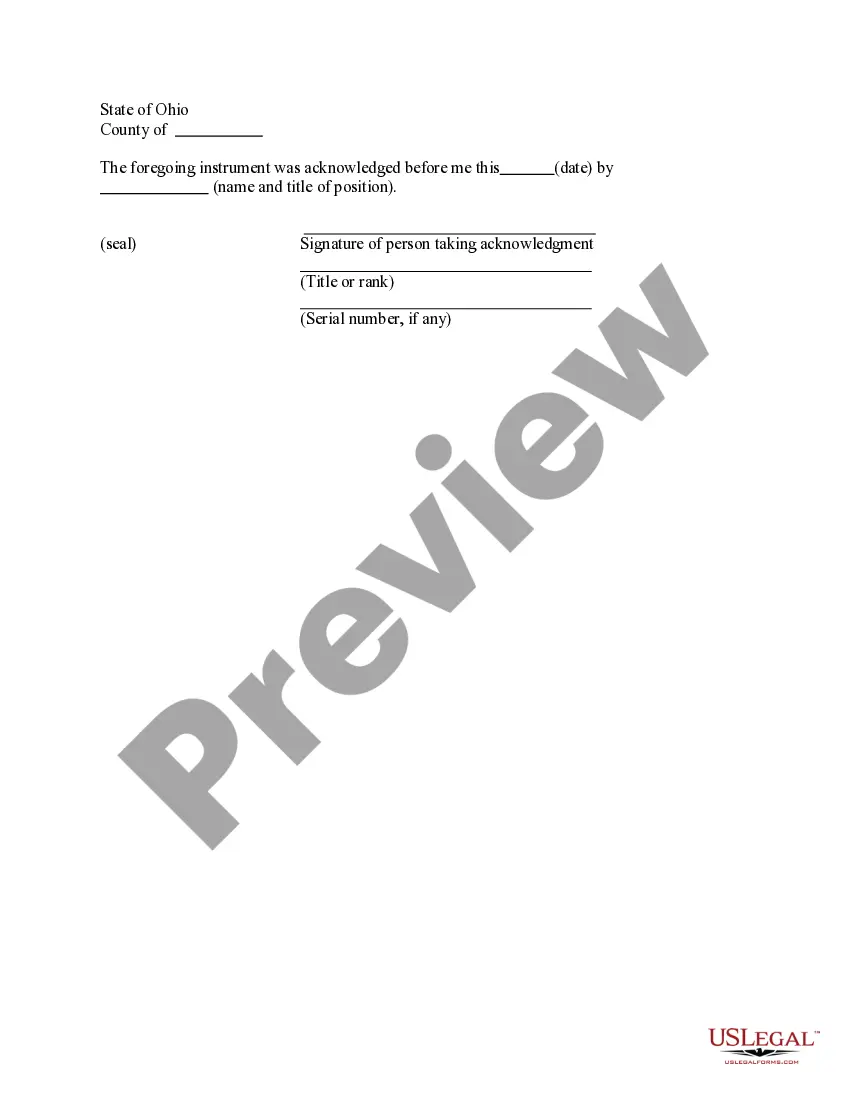

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Execution For Ejectment, Mortgage Foreclosure?

The greater the documentation you need to produce - the more distressed you become.

You can discover countless Connecticut Execution for Ejectment Mortgage Foreclosure samples online, but you are uncertain which ones to trust.

Eliminate the difficulty to make finding examples simpler with US Legal Forms.

Click Buy Now to initiate the registration process and select a payment plan that suits your requirements. Provide the requested information to create your account and finalize your purchase using your PayPal or credit card. Choose a convenient document type and obtain your sample. Access all templates you download in the My documents section. Simply visit there to create a new copy of the Connecticut Execution for Ejectment Mortgage Foreclosure. Even when utilizing well-prepared forms, it is still important to consider consulting your local attorney to verify that your document is properly completed. Do more for less with US Legal Forms!

- Obtain expertly crafted documents that comply with state regulations.

- If you possess a subscription to US Legal Forms, Log In to your account, and you will see the Download option on the Connecticut Execution for Ejectment Mortgage Foreclosure page.

- If you have yet to use our service previously, complete the registration process with these instructions.

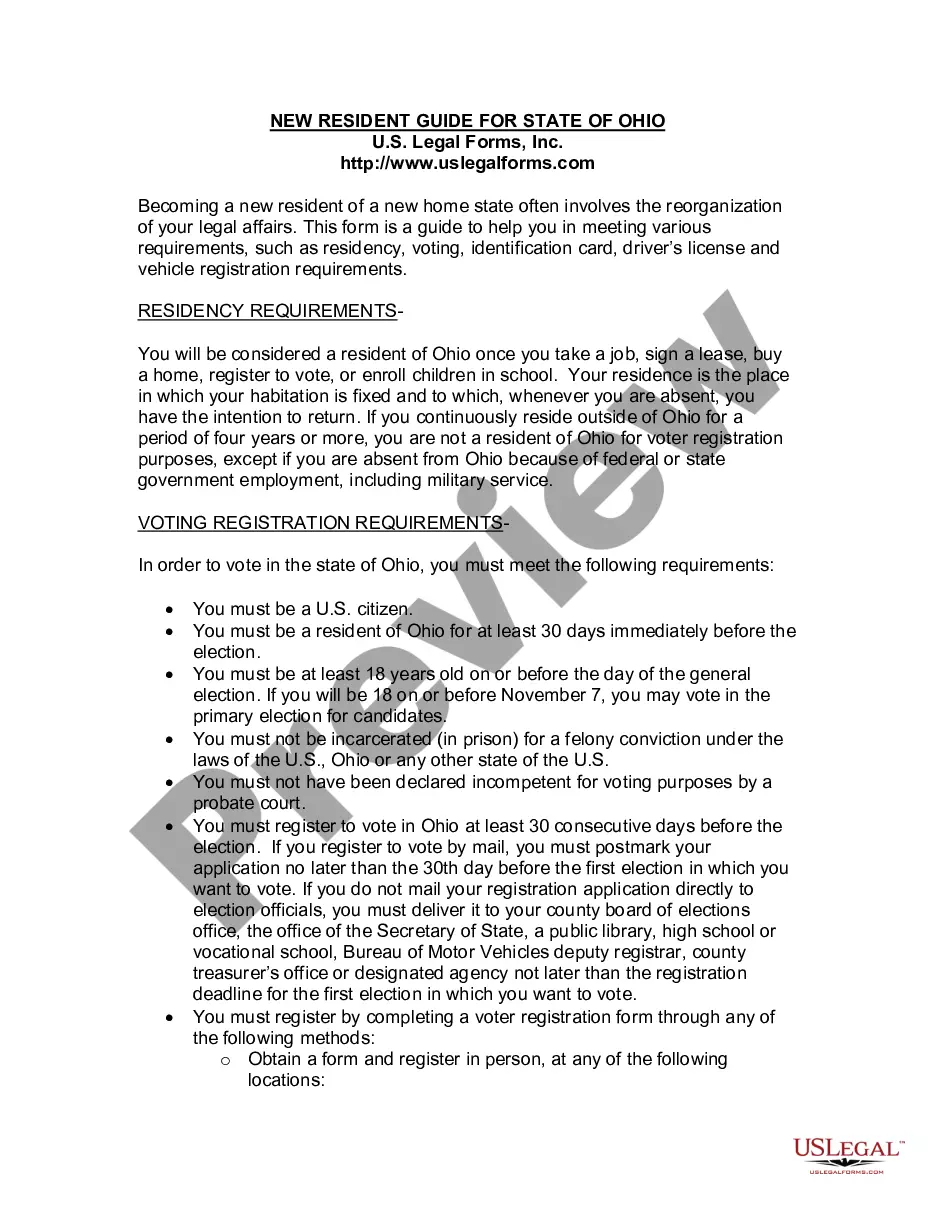

- Make sure the Connecticut Execution for Ejectment Mortgage Foreclosure is applicable in your state.

- Review your choice by reading the description or using the Preview feature if available for the selected document.

Form popularity

FAQ

In Connecticut, typically, lenders begin the foreclosure process after a homeowner misses three consecutive payments. However, this timeline can vary based on lender policies and the specific terms of your mortgage agreement. It is crucial to address any missed payments early to avoid advancing to a Connecticut Execution for Ejectment, Mortgage Foreclosure. Utilizing resources like US Legal Forms can help you navigate this process effectively.

To evict a former owner after a foreclosure in Connecticut, the new owner must file for an execution for ejectment in court. Once granted, the court will issue an order to remove the former owner from the property. Utilizing USLegalForms can streamline this process and ensure that you follow all legal requirements correctly.

The foreclosure process in Connecticut generally takes several months to over a year, depending on various factors such as court schedules and borrower responses. After filing, the lender must wait for the court to approve the foreclosure, leading to eviction proceedings if needed. Being proactive can help you navigate Connecticut execution for ejectment, mortgage foreclosure more effectively.

A strict foreclosure in Connecticut occurs when a lender takes possession of the property without an auction. This process is typically faster and allows the lender to reclaim the property if the borrower fails to redeem it within a specified time. It’s essential to understand this option if you face a Connecticut execution for ejectment, mortgage foreclosure, as it can affect your rights and responsibilities.

A tolling statute of limitations in Connecticut allows the clock to pause on the time limit for bringing a legal action when specific conditions exist. This can occur in cases of pending issues or when a party is disabled from taking action. In the context of Connecticut Execution for Ejectment, Mortgage Foreclosure, understanding tolling can offer you insight into your legal timelines and obligations.

The foreclosure process in Connecticut begins when a lender files a complaint in court. After the complaint, you will receive a notice and have the opportunity to respond within a set timeframe. The process can lead to a judgment, followed by the potential for Connecticut Execution for Ejectment, Mortgage Foreclosure if you do not address the outstanding issues. Understanding this step-by-step process can empower you to navigate your situation effectively.

The redemption period for foreclosure in Connecticut generally lasts six months, but it can extend to one year under specific circumstances if the property is residential and is owner-occupied. This period allows property owners to recover their homes by paying outstanding debts. Knowing the redemption period can aid you in making informed decisions during any Connecticut Execution for Ejectment, Mortgage Foreclosure process.

After a foreclosure, a mortgage company can pursue collection for a deficiency judgment for up to six years in Connecticut. This period depends on the type of agreement you have and whether the lender acts within the stipulated time. Being aware of your financial responsibilities during and after Connecticut Execution for Ejectment, Mortgage Foreclosure is vital to your financial recovery.

In Connecticut, homeowners typically have a redemption period of six months following a foreclosure sale. This allows you to reclaim your property by paying the total amount due. Understanding this timeline is crucial when facing Connecticut Execution for Ejectment, Mortgage Foreclosure, as it provides a final opportunity to resolve your issues before permanent loss.

In Connecticut, the statute of limitations for a foreclosure claim is typically six years. This means lenders must initiate foreclosure action within this timeframe to recover their debts. Knowing this timeline can affect your decisions regarding Connecticut Execution for Ejectment, Mortgage Foreclosure, especially if you feel that your rights are being wrongfully challenged.