Colorado Telecommuting Agreement

Description

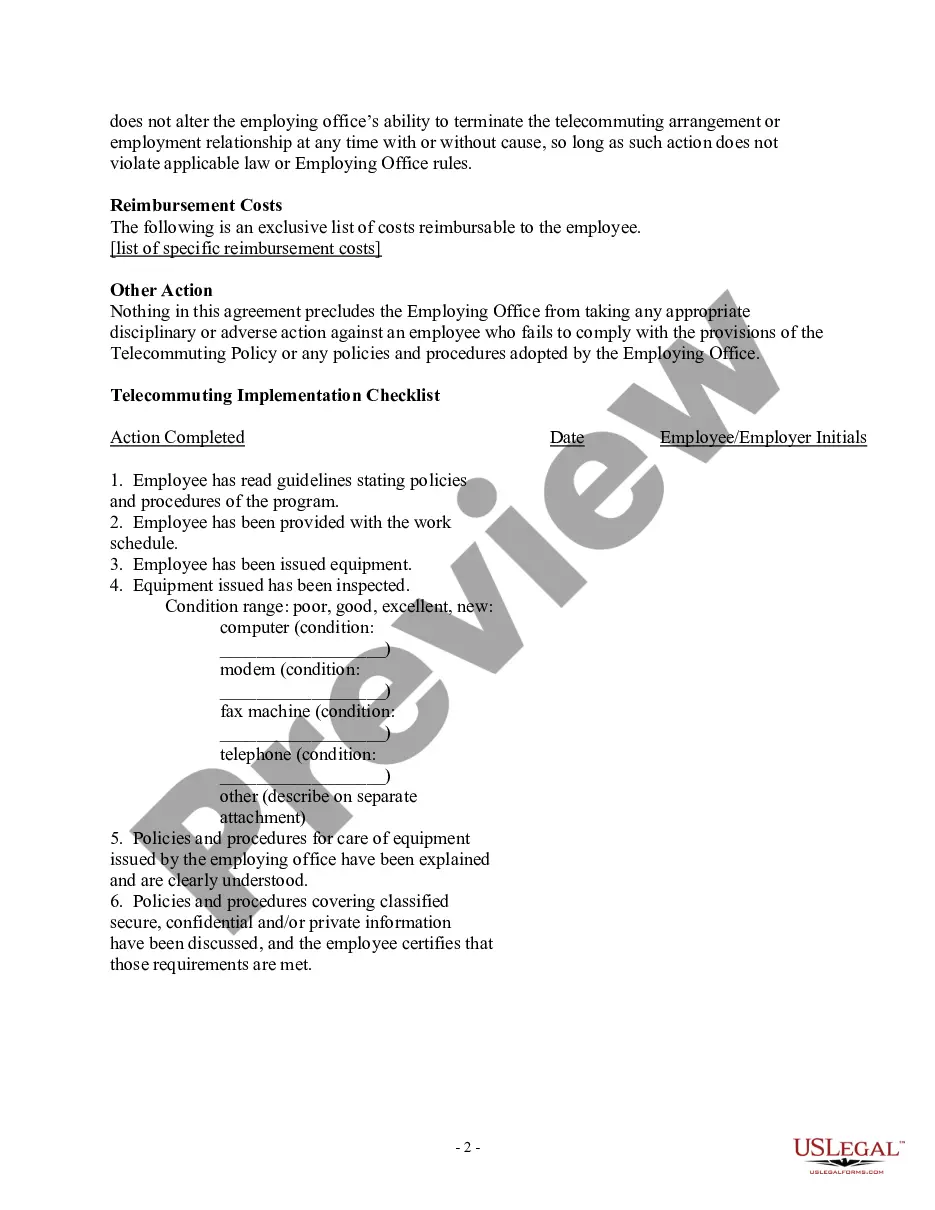

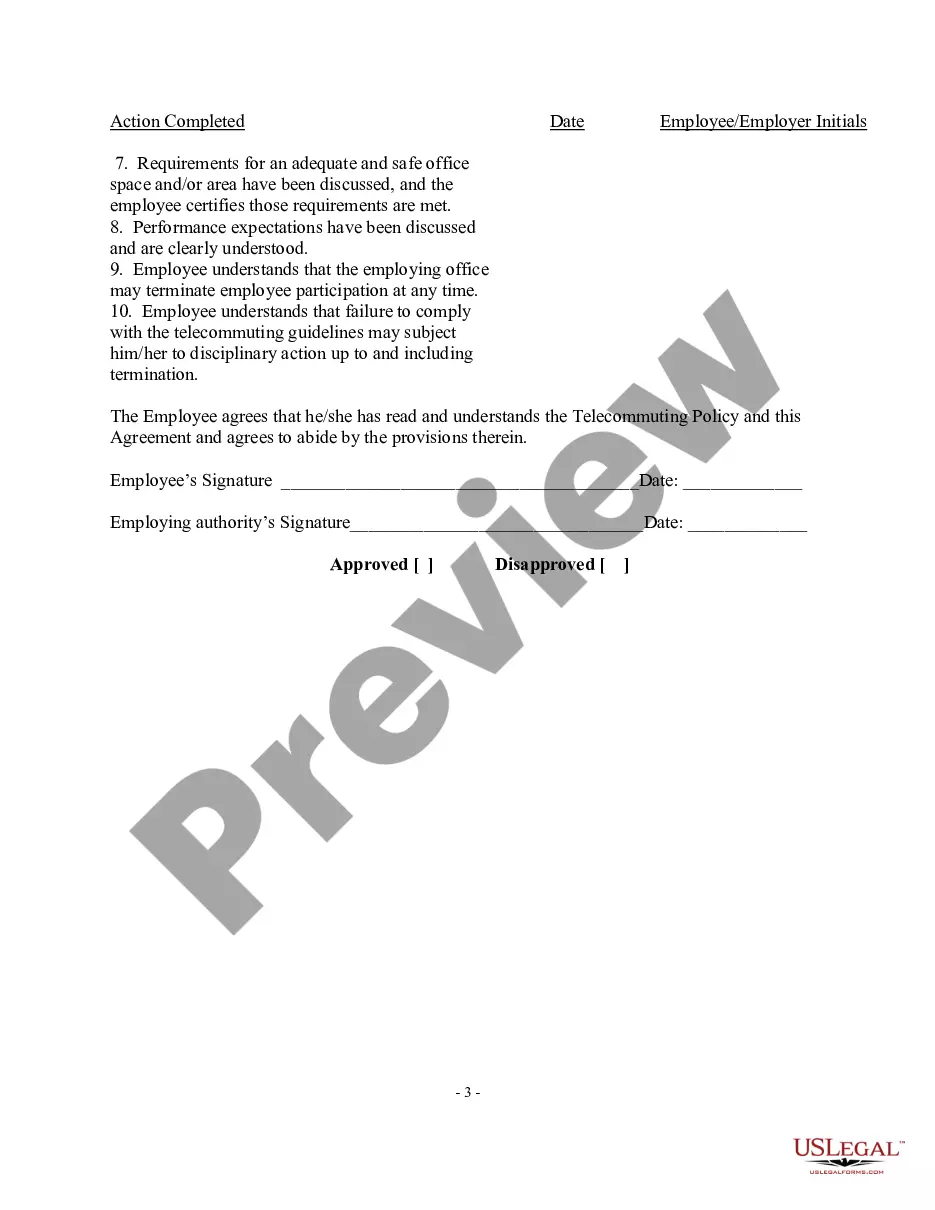

How to fill out Telecommuting Agreement?

Are you presently inside a position the place you require documents for sometimes enterprise or individual functions nearly every working day? There are a lot of authorized document themes accessible on the Internet, but getting versions you can trust is not straightforward. US Legal Forms delivers a huge number of develop themes, like the Colorado Telecommuting Agreement, that are published in order to meet state and federal requirements.

If you are already acquainted with US Legal Forms site and possess a merchant account, merely log in. Next, it is possible to acquire the Colorado Telecommuting Agreement design.

If you do not provide an accounts and need to begin using US Legal Forms, abide by these steps:

- Get the develop you will need and ensure it is for that appropriate city/state.

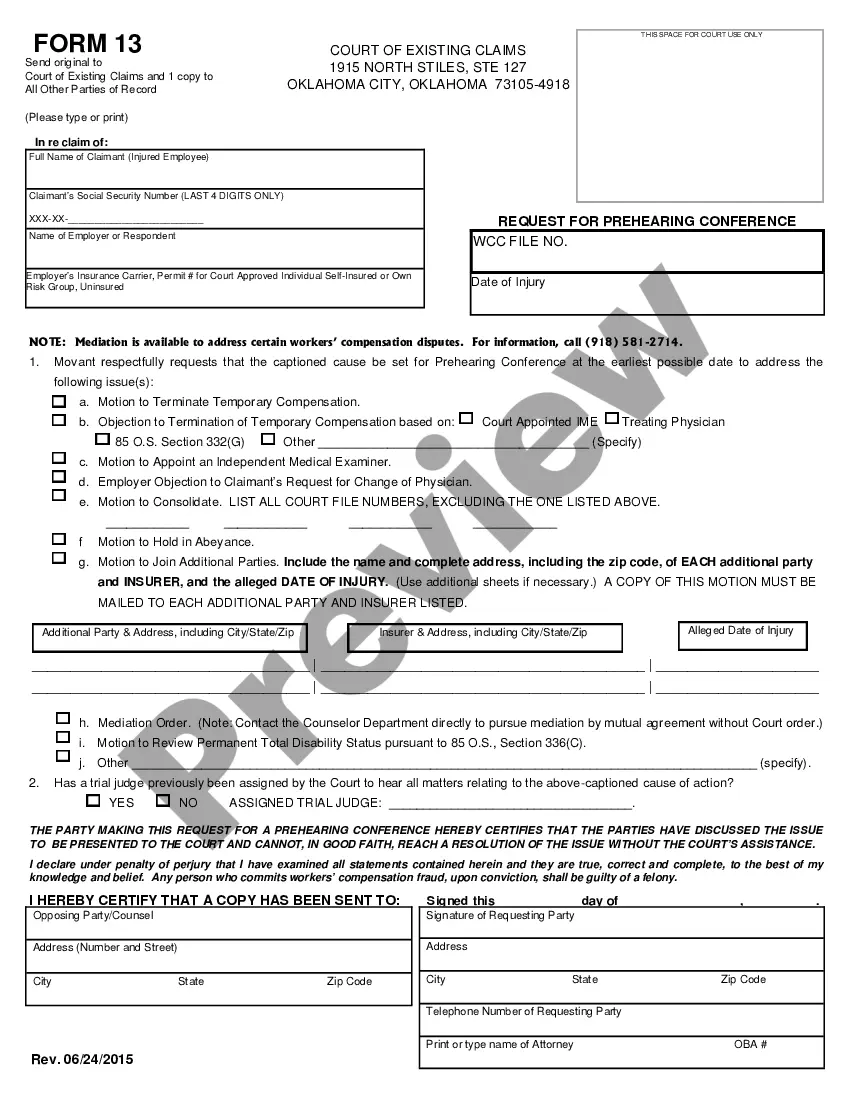

- Use the Review key to analyze the shape.

- Browse the description to ensure that you have selected the appropriate develop.

- When the develop is not what you are looking for, make use of the Search field to get the develop that fits your needs and requirements.

- Whenever you discover the appropriate develop, just click Buy now.

- Pick the rates program you would like, complete the specified details to generate your account, and purchase your order making use of your PayPal or Visa or Mastercard.

- Select a hassle-free file structure and acquire your version.

Locate every one of the document themes you possess purchased in the My Forms menu. You can get a additional version of Colorado Telecommuting Agreement whenever, if necessary. Just go through the essential develop to acquire or printing the document design.

Use US Legal Forms, by far the most comprehensive collection of authorized varieties, to save lots of time as well as avoid mistakes. The assistance delivers expertly created authorized document themes which can be used for a range of functions. Make a merchant account on US Legal Forms and start making your daily life easier.

Form popularity

FAQ

When working on campus, hybrid employees will also have access to a workspace including a work surface and chair, as needed. CU Boulder will not provide any of the following items for remote work by remote or hybrid employees: Internet service or set up. Routers.

Can a remote worker be taxed twice on income? Yes, if the remote employee/contractor is in the US and works for an employer based in a convenience rule state.

Another rule to remember: If you worked remotely in a state for more than 183 days in a year, you may be considered a resident for tax purposes and must file tax returns in two states.

The best states for remote workers are states with no state income tax. With no state income tax obligations, remote workers don't have to worry about being caught in a complex web of tax rules. These states are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Unless you're working as a freelancer or independent contractor, working remotely while traveling is usually governed by your employer. Make sure to review your company's mobility policy before making travel plans.

The general rule is that employees owe state income taxes to the state where they live and work. If those two states are different, figuring out an employee's tax obligation can get more complicated. Though it isn't the case for all remote workers, many employees are able to work from anywhere with a remote job.

The Location Neutral Employment (LONE) Incentive provides companies that will be approved for a Job Growth Incentive Tax Credit with an additional cash incentive for each remote worker employed in an eligible rural county outside the county where the project is based. Each LONE award is capped at $300,000 per company.

Is it legal to work remotely from another country? Although it's legal to work remotely from another country, you should be aware of the 183-day rule, which states that anyone working 183 days (half the year) in another country is considered a resident for tax purposes and subject to taxation laws in both countries.