Colorado Telecommuting Policy

Description

How to fill out Telecommuting Policy?

If you require to aggregate, retrieve, or generate authentic document templates, utilize US Legal Forms, the largest collection of legitimate forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you need.

A variety of templates for business and personal purposes are categorized by types and states, or keywords. Utilize US Legal Forms to access the Colorado Telecommuting Policy with just a few clicks.

Every legal document template you obtain is your property indefinitely.

You can access every form you have downloaded in your account. Click on the My documents section and choose a form to print or download again. Compete and download, and print the Colorado Telecommuting Policy with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal requirements.

- If you are an existing US Legal Forms user, sign in to your account and then click the Download button to obtain the Colorado Telecommuting Policy.

- You can also find forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

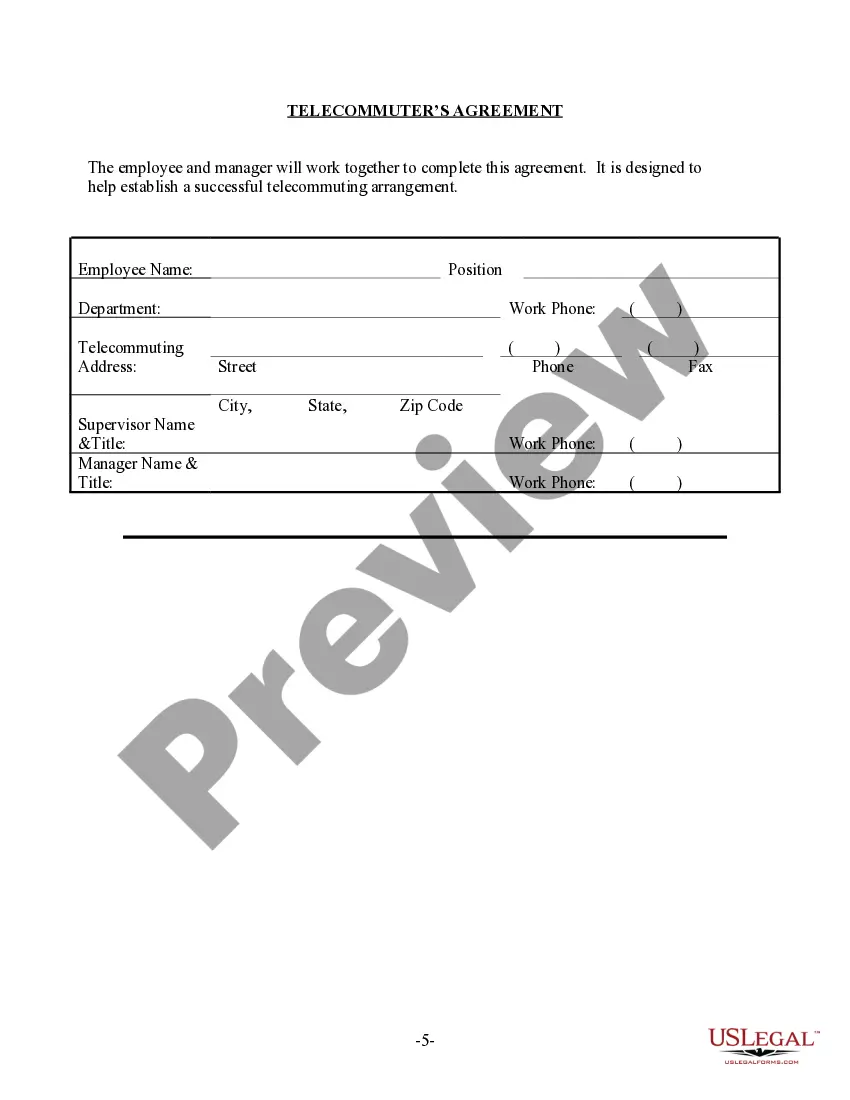

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Utilize the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and produce or sign the Colorado Telecommuting Policy.

Form popularity

FAQ

Telecommuting employees may also trigger income tax withholding obligations. Employees can now perform their work duties remotely, even in states where their respective employers have no physical location.

Set clear deadlines and expectations for remote workers. Your team should know how and when the work is expected.Provide regular feedback to your employees.Track attendance and absences with employee monitoring tools.Web and app usage monitoring using employee monitoring software.

Colorado Gov. Jared Polis figures about 20 percent of the state workforce will continue to work from home after the pandemic, saving the state about 1 million square feet of office space.

100% of wages earned while working remotely in Colorado should be reported as taxable wages in both California and Colorado. Colorado income tax withholding should be withheld on Colorado wages.

In theory, yes - unless you have given them a contract which says otherwise, or have reached a different agreement verbally, or have by your conduct given them reason to think they can work at home indefinitely. It is up to you as employer to decide where the work shall be performed.

Today, a preference for working from home is driving these decisions rather than concerns about the coronavirus. Fully 76% of workers who indicate that their workplace is available to them say a major reason why they are currently teleworking all or most of the time is that they prefer working from home.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

Employers have a duty to reasonably consider the request, but they may refuse it if they have a good reason. The grounds for refusing a request are: Burden of additional costs.

Anywhere remote jobs can be done from anywhere in the world. Remote jobs by state lets you find jobs that you can do from specific states in the U.S.

Any employer who employs at least one person in Colorado is covered by the statute. Therefore, even though remote jobs can be performed anywhere, some companies advertising for such positions have indicated they will not consider applicants living in Colorado.