Colorado Telecommuting Worksheet

Description

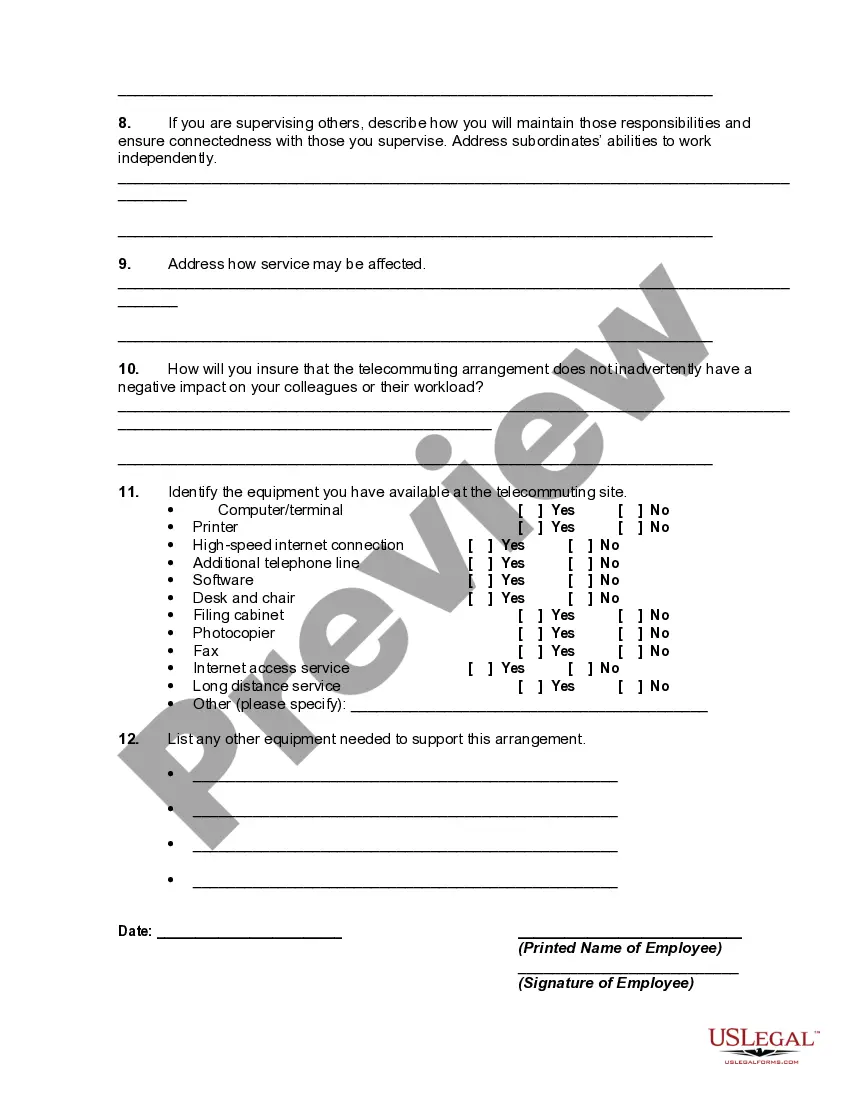

How to fill out Telecommuting Worksheet?

You can invest several hours online searching for the appropriate legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal templates that are reviewed by professionals.

You can obtain or print the Colorado Telecommuting Worksheet from my service.

If available, utilize the Review button to preview the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can fill out, modify, print, or sign the Colorado Telecommuting Worksheet.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form information to confirm you have selected the correct one.

Form popularity

FAQ

As you know, you are required to participate in and complete work search activities each week in order to maintain your eligibility to receive unemployment benefits. This includes showing up and providing accurate information to scheduled job interviews.

Be sure your Connecting Colorado profile is up-to-date, begin the work search requirement and continue to request payment as usual. You are required to complete work search activities every week you receive UI benefits. It is recommended you complete 5 work search activities per week.

Use the Tax Withholding Estimator on IRS.gov. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. They can use their results from the estimator to help fill out the form and adjust their income tax withholding.

You may be eligible to collect partial benefits if you are working fewer than 32 hours per week. However, you must continue to look for work and meet your eligibility requirements. When you work, we can pay part of your weekly benefits, but you must have earned less than the weekly benefit amount.

Domestic violence (you had to leave the area in order to avoid further violence or harassment) personal harassment by the employer or the employer's failure to stop harassment by a coworker. hazardous working conditions, or. a medical condition.

Withholding Formula (Effective Pay Period 05, 2021)Multiply the adjusted gross biweekly wages by the number of pay dates in the tax year to obtain the gross annual wages. Multiply the taxable wages in step 5 by 4.55 percent to determine the annual tax amount.

In order to qualify for benefits, you must:Be unemployed through no fault of your own.Be able, available, and actively seeking work.Have earned $2,500 during your base period.

Any employer who employs at least one person in Colorado is covered by the statute. Therefore, even though remote jobs can be performed anywhere, some companies advertising for such positions have indicated they will not consider applicants living in Colorado.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

Colorado Income Tax Brackets and Rates Colorado has a flat tax rate of 4.5% for 2021, meaning everyone pays the same state income tax regardless of their income.