Colorado Telecommuting Application Form

Description

How to fill out Telecommuting Application Form?

You can spend several hours online searching for the legal document template that satisfies the state and federal guidelines you need.

US Legal Forms provides a wide array of legal forms that are reviewed by professionals.

It is straightforward to obtain or print the Colorado Telecommuting Application Form from their service.

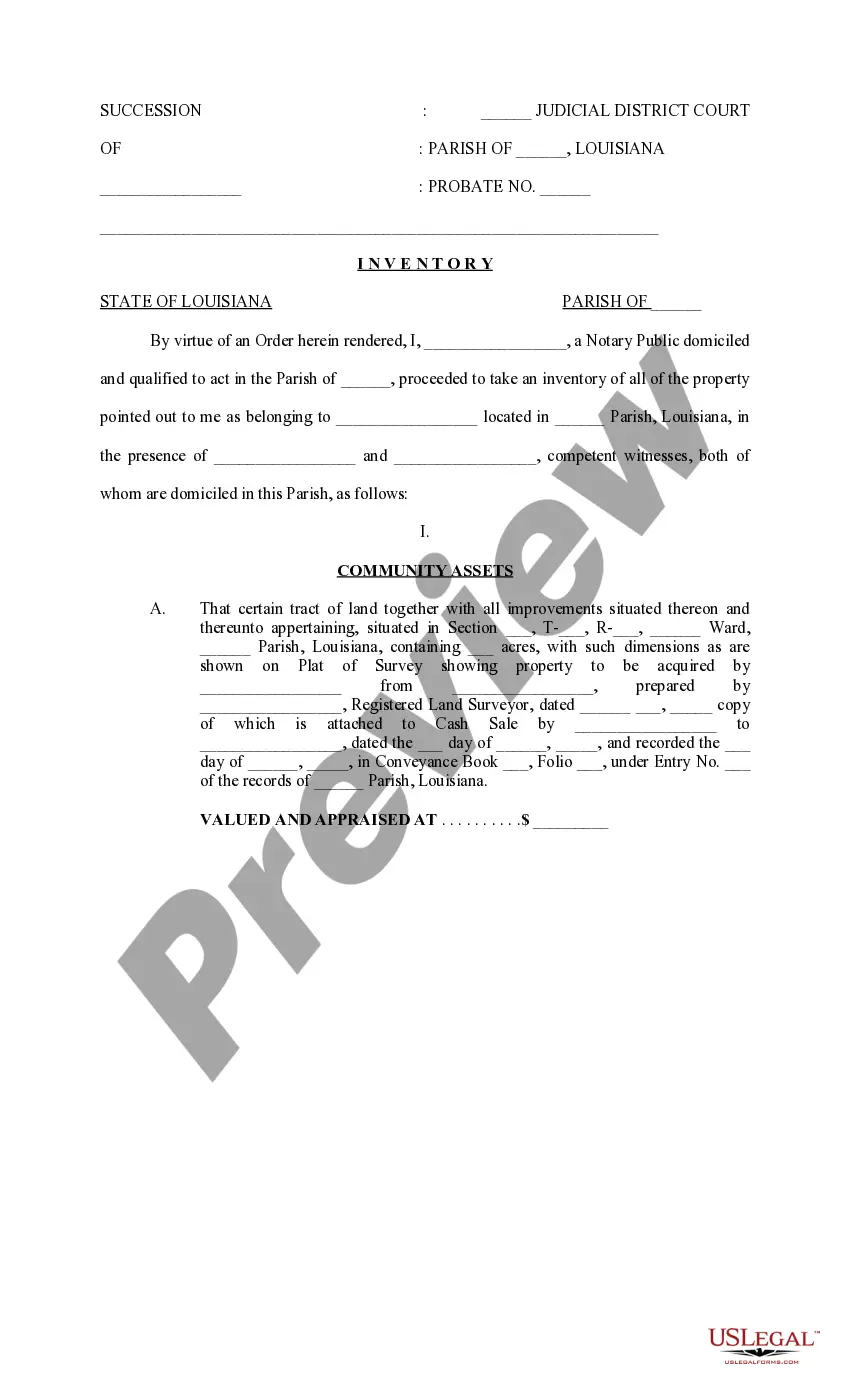

If available, take advantage of the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you may sign in and click the Obtain button.

- Then, you can fill out, modify, print, or sign the Colorado Telecommuting Application Form.

- Every legal document template you purchase is yours forever.

- To retrieve another copy of the acquired form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure you have selected the correct document template for the region/area of your choice.

- Review the form description to confirm you have selected the right document.

Form popularity

FAQ

You can obtain your 1099-G form in Colorado through the Colorado Department of Revenue’s online services or by contacting their office directly. If you have submitted a Colorado Telecommuting Application Form, make sure to access your tax records through the same portal for streamlined service. Having the 1099-G form is essential for reporting income when filing taxes, especially for those working from home.

Any employer who employs at least one person in Colorado is covered by the statute. Therefore, even though remote jobs can be performed anywhere, some companies advertising for such positions have indicated they will not consider applicants living in Colorado.

Yes, as long as you have access to WiFi and don't miss any deadlines you can work remotely from anywhere.

Research the landscape in your industry and organization.Emphasize the benefits to your organization.Create a clear and specific remote work plan.Time your request carefully.Ask in-person, not via email.Come prepared to lead the meeting.Expect some discomfort, but don't be dissuaded.More items...

Though often away from the office, a teleworker is different from a remote employee because there occasionally some in-person office attendance required though this is not always the case. Another key difference is that a teleworker is often geographically closer to the main office location than a remote worker.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live.

Colorado Gov. Jared Polis figures about 20 percent of the state workforce will continue to work from home after the pandemic, saving the state about 1 million square feet of office space.

Teleworkers residing in California working for a company in another state due to COVID-19 will not be taxed in California. Teleworkers residing in Colorado working for a company in another state will be taxed in Colorado.

No. An employer cannot use a choice of law clause to oust the law of the jurisdiction where the worker is physically located and performing the work.

Any employer who employs at least one person in Colorado is covered by the statute. Therefore, even though remote jobs can be performed anywhere, some companies advertising for such positions have indicated they will not consider applicants living in Colorado.