North Carolina Sample Letter to Union Pension Administrator regarding Request for Plan Description

Description

How to fill out Sample Letter To Union Pension Administrator Regarding Request For Plan Description?

Have you been in the placement that you need to have papers for sometimes organization or person functions almost every day time? There are a variety of lawful record themes accessible on the Internet, but discovering types you can rely on is not effortless. US Legal Forms gives 1000s of kind themes, much like the North Carolina Sample Letter to Union Pension Administrator regarding Request for Plan Description, which can be composed to meet state and federal needs.

Should you be presently acquainted with US Legal Forms site and have an account, simply log in. Afterward, you are able to acquire the North Carolina Sample Letter to Union Pension Administrator regarding Request for Plan Description format.

If you do not come with an profile and wish to start using US Legal Forms, follow these steps:

- Obtain the kind you will need and make sure it is for that appropriate area/area.

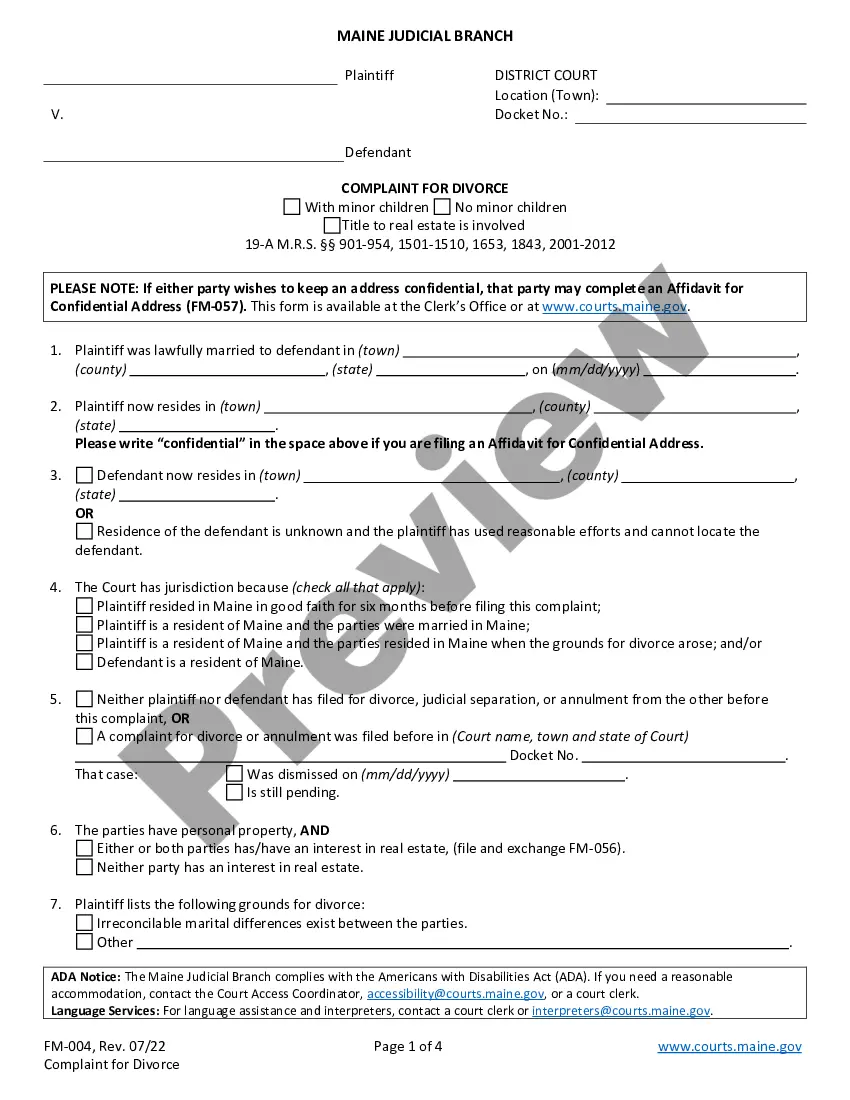

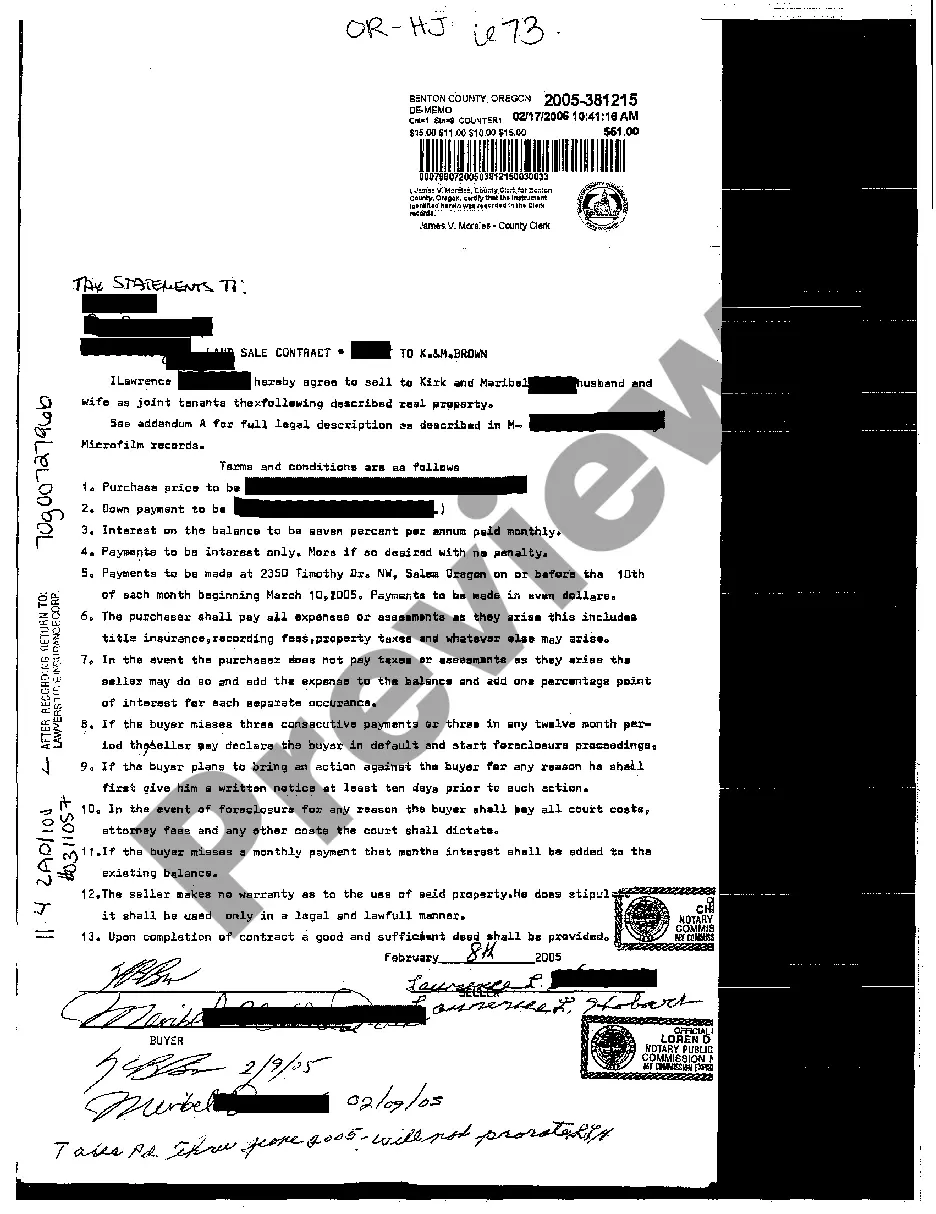

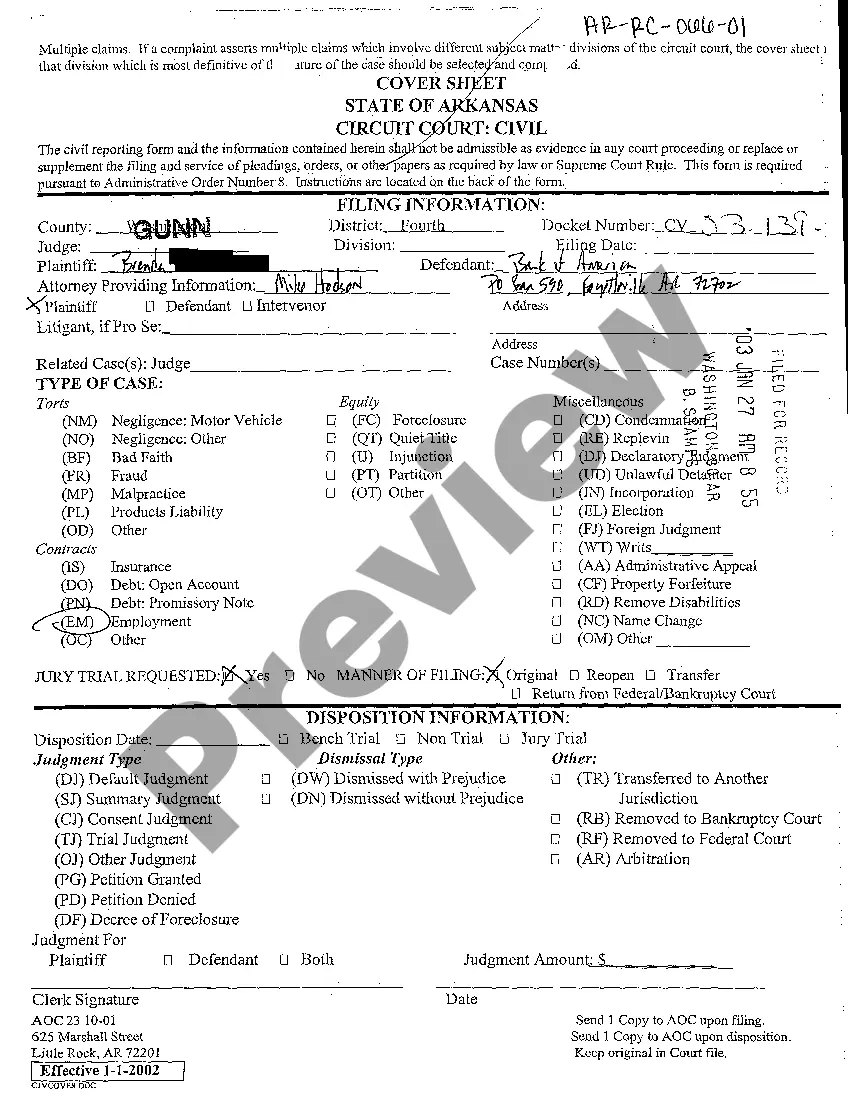

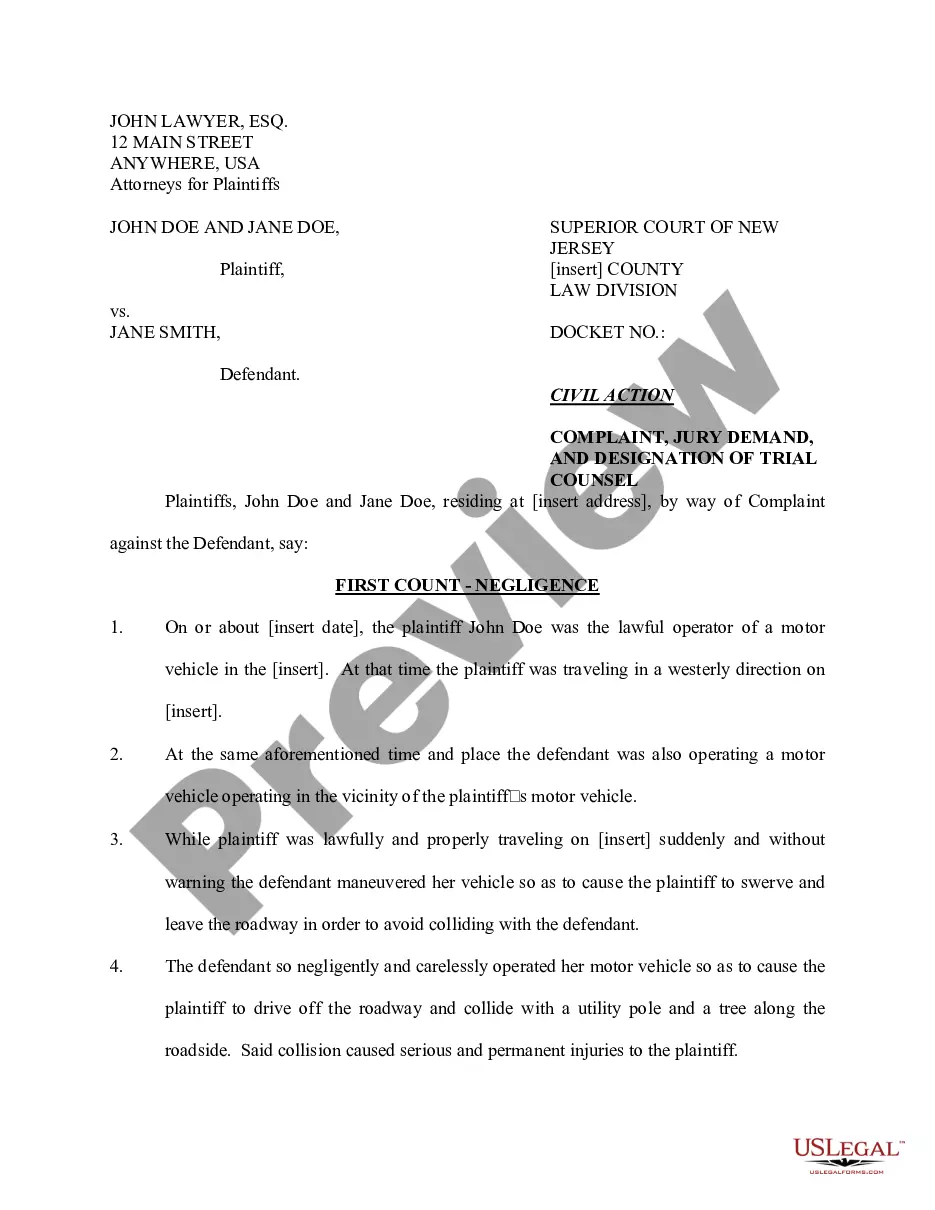

- Utilize the Review switch to examine the form.

- Look at the information to ensure that you have chosen the proper kind.

- In case the kind is not what you are trying to find, take advantage of the Research area to discover the kind that suits you and needs.

- If you get the appropriate kind, click on Purchase now.

- Select the rates prepare you would like, fill out the desired info to create your account, and buy the transaction with your PayPal or bank card.

- Select a convenient file structure and acquire your backup.

Find all of the record themes you may have bought in the My Forms menus. You can aquire a more backup of North Carolina Sample Letter to Union Pension Administrator regarding Request for Plan Description whenever, if necessary. Just click the necessary kind to acquire or produce the record format.

Use US Legal Forms, one of the most considerable variety of lawful forms, to save lots of time as well as prevent mistakes. The support gives professionally created lawful record themes which can be used for an array of functions. Generate an account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

How to create a retirement letter Address the right people. Address your retirement letter to your supervisor. ... Specify the date of your retirement. ... Express appreciation for your experience. ... Offer to assist with the transition. ... Discuss consulting if you're interested. ... Detail your needs regarding retirement.

Pension plan administrators are fiduciaries responsible for prudently managing risks in their pension plans, making decisions in the best interest of pension plan beneficiaries, and administering the plan in ance with the filed plan documents and applicable laws, including the Pension Benefits Act.

PENSION FUND ADMINISTRATORS (PFA) The main functions of the PFA are to open Retirement Savings Account (RSA) for employees; invest and manage pension fund assets; payment of retirement benefits and accounting for all transactions relating to the pension funds under their management.

Upon plan termination, participants must be immediately 100% vested in all accrued benefits. In a 401(k) plan, for example, this means that employer matching and profit-sharing contributions must become fully vested regardless of the vesting schedule in the plan document.

401(k) plan administrators make sure that retirement plans follow the rules and help everybody save for retirement. They work with legal documents, perform analyses and tests, and monitor plan operations.

The Pension Administrator is responsible for the accurate and effective application of pension arrangements for eligible individuals as per the plan design parameters, ensuring clear and concise communications and integrity of the related processes.

Day-to-day tasks use a computer system to check and update records. calculate the amount of money people will receive. process money paid towards a person's pension. transfer benefits from one pension to another.