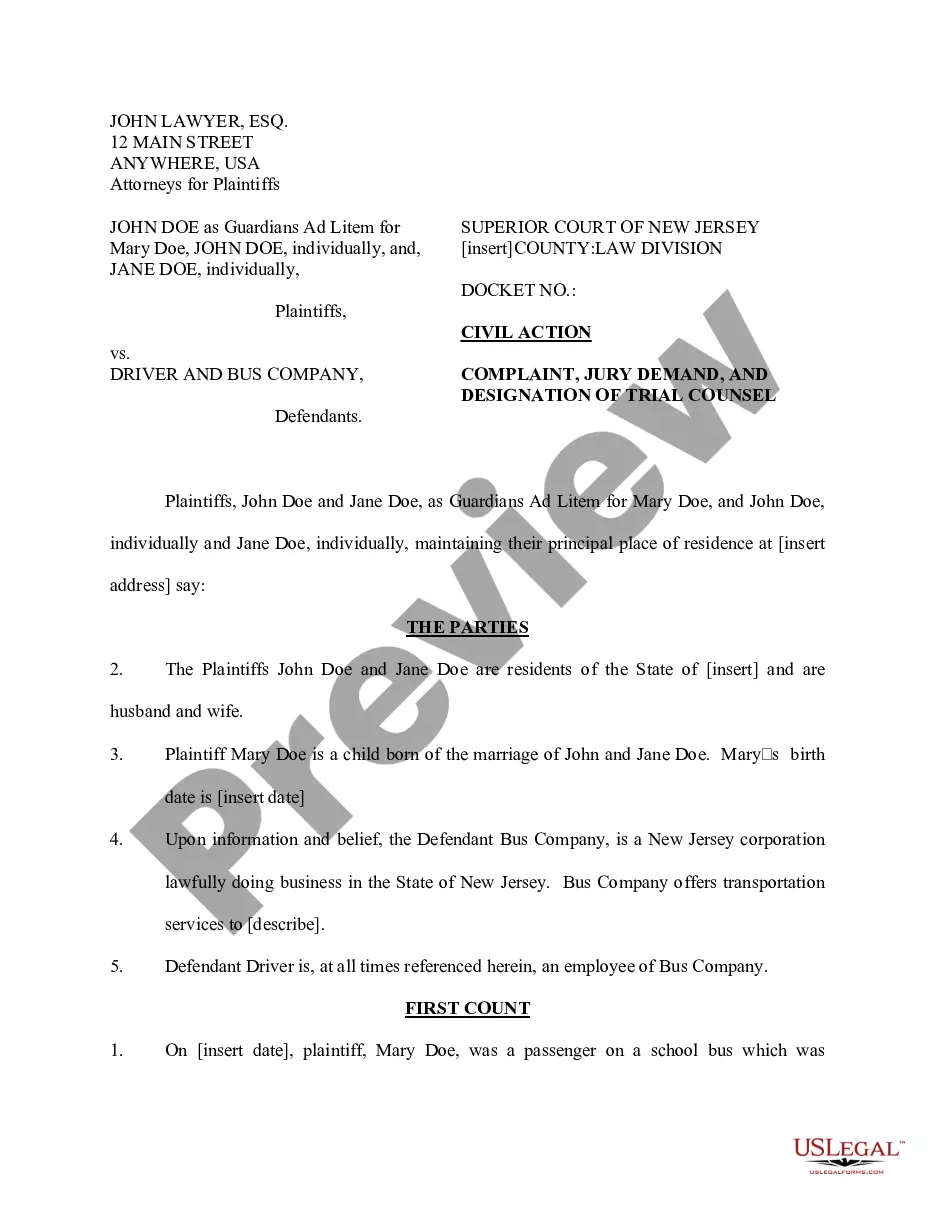

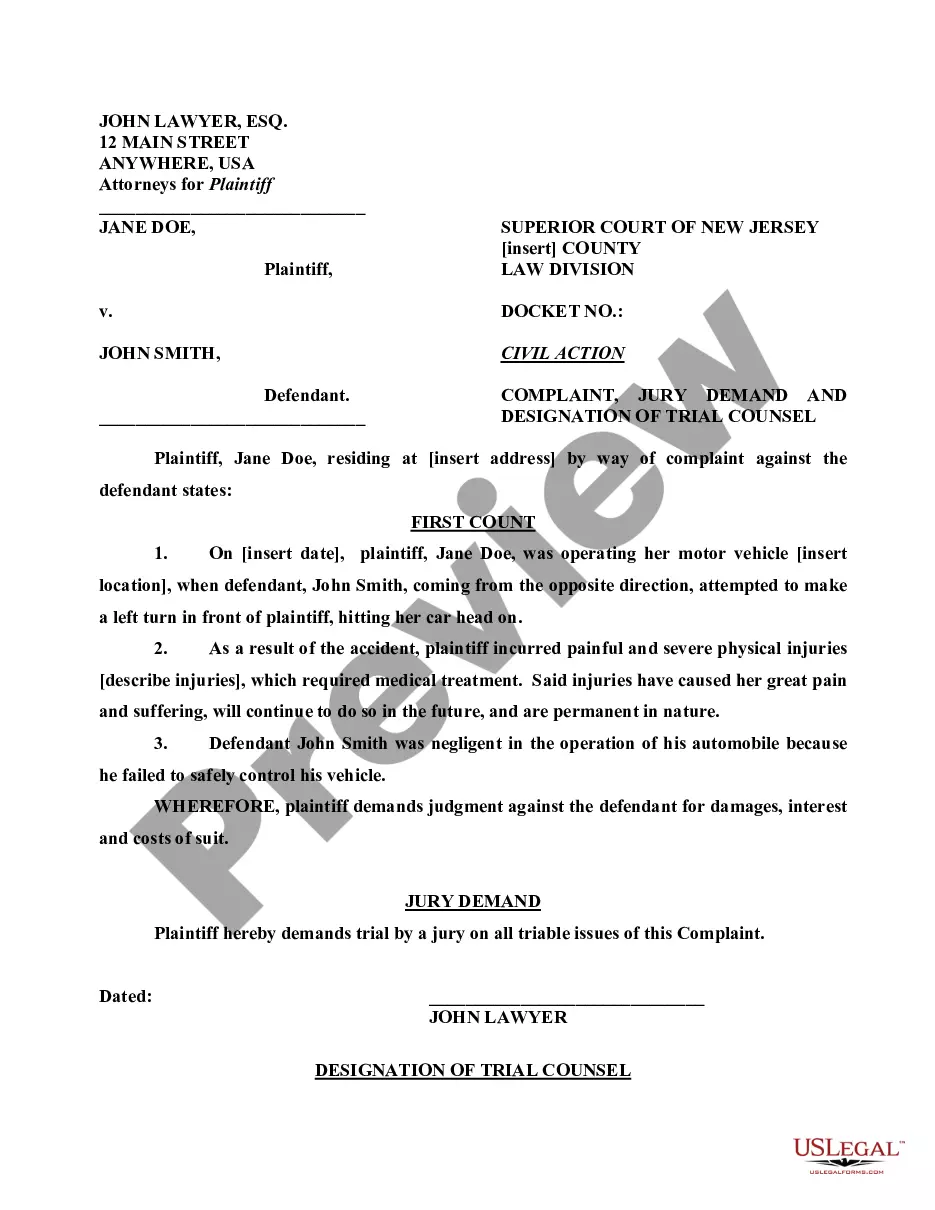

New Jersey Complaint Auto Negligence and Property Damage

Description

How to fill out New Jersey Complaint Auto Negligence And Property Damage?

US Legal Forms is actually a unique platform where you can find any legal or tax document for filling out, such as New Jersey Complaint Auto Negligence and Property Damage. If you’re fed up with wasting time looking for perfect samples and paying money on papers preparation/legal professional service fees, then US Legal Forms is exactly what you’re searching for.

To experience all of the service’s benefits, you don't need to download any software but just select a subscription plan and register an account. If you already have one, just log in and find an appropriate template, save it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Complaint Auto Negligence and Property Damage, check out the guidelines listed below:

- check out the form you’re considering applies in the state you want it in.

- Preview the form and look at its description.

- Click on Buy Now button to access the sign up webpage.

- Pick a pricing plan and proceed registering by entering some information.

- Decide on a payment method to finish the sign up.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, fill out the file online or print out it. If you are unsure regarding your New Jersey Complaint Auto Negligence and Property Damage sample, contact a attorney to analyze it before you send out or file it. Begin without hassles!

Form popularity

FAQ

What is the difference between property damage liability coverage and collision? Property damage liability coverage pays for the cost to repair damage you cause to property owned by someone else. Collision coverage pays to repair your own vehicle less your deductible.

If the property can be repaired, the amount of damages can be set at the amount it costs to repair the property, plus the loss of its use by the owner.In addition to the cost to repair or replace, plus loss of use, interest and loss of profits may also be considered when determining the total value of property damage.

You can sue for up to $10,000, if you are an individual or a sole proprietor. Corporations and other entities are limited to $5,000. In addition, a party (individuals or corporations) can file no more than two claims exceeding $2,500 in any court throughout the State of California during a calendar year.

The Filing Deadline in New Jersey So, any New Jersey property damage lawsuit must be filed within six years of the action that resulted in harm to (or destruction of) the property owner's real or personal property.

Anything that is damaged in a car wreck is considered property damage. While the damage to your vehicle is the main component of property damage, you should also look to see whether there was any personal property that was damaged in the wreck. This might include a GPS system, a phone, a GoPro camera, or even CDs.

You can sue for up to $10,000, if you are an individual or a sole proprietor. Corporations and other entities are limited to $5,000. In addition, a party (individuals or corporations) can file no more than two claims exceeding $2,500 in any court throughout the State of California during a calendar year.

Property damage cases are one of the regular types of lawsuits that come before judges in small claims courts regularlythey're a staple. In most cases, a plaintiff files an action against a defendant claiming that the defendant negligently (accidentally) or intentionally damaged the plaintiff's property.

If your vehicle is damaged in an accident, the responsible driver's insurance company should pay for the cost to repair your vehicle. However, if the responsible driver is uninsured or does not have insurance coverage for property damage, there are a couple options.

To get a reasonable starting number for negotiating general damages, many insurance companies and attorneys multiply the amount of medical special damages by a factor of 1.5 to 5, depending on the severity of the injuries. In extreme cases, a factor of more than 5 may be used.