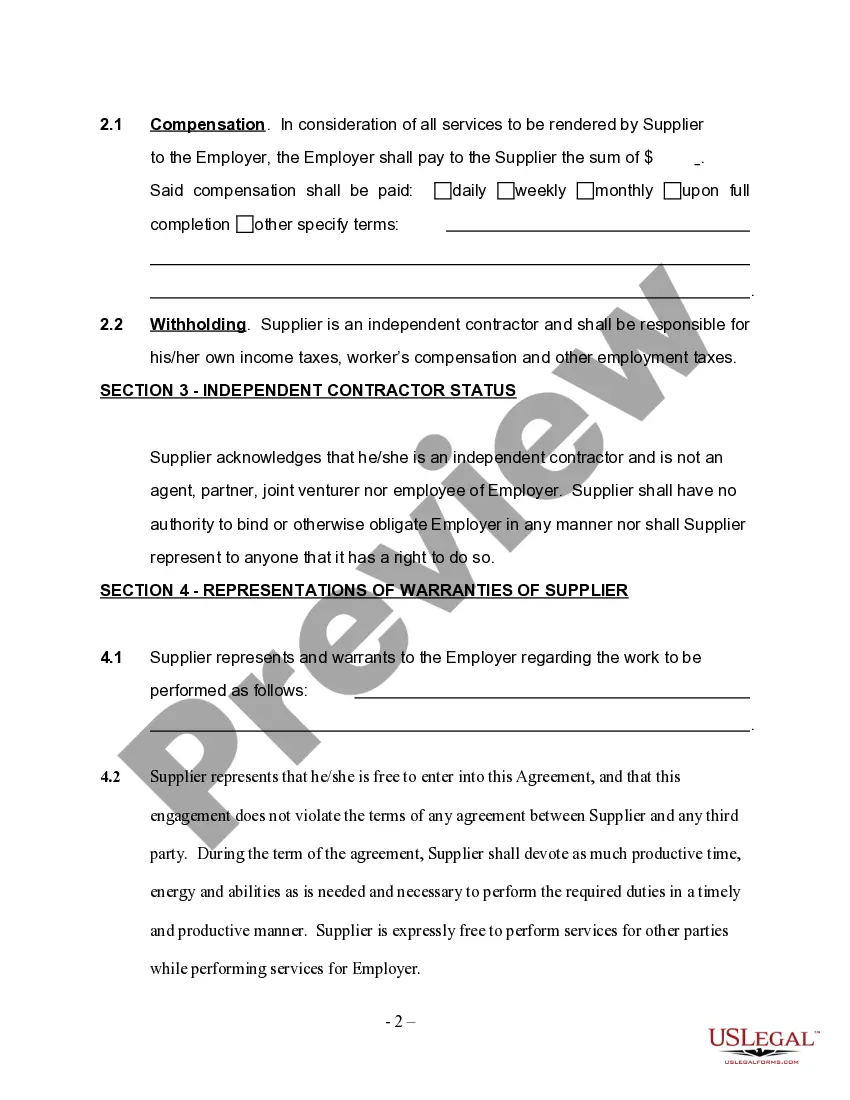

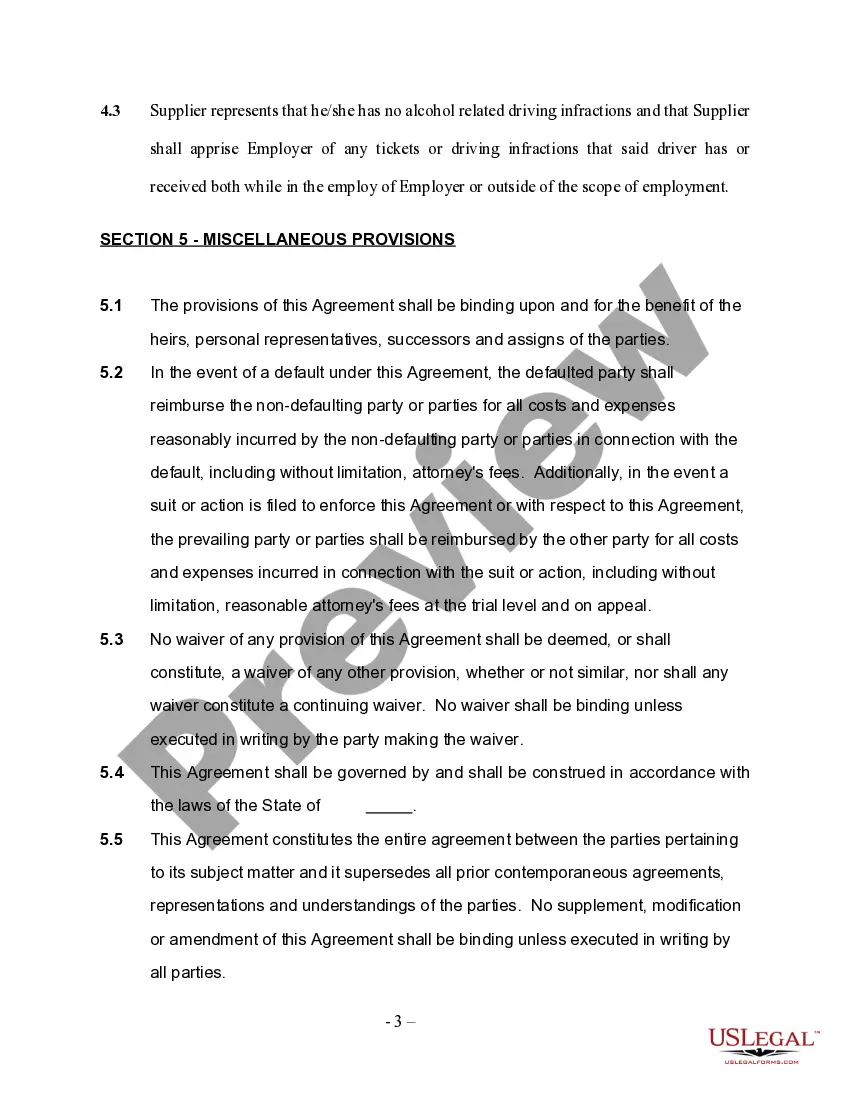

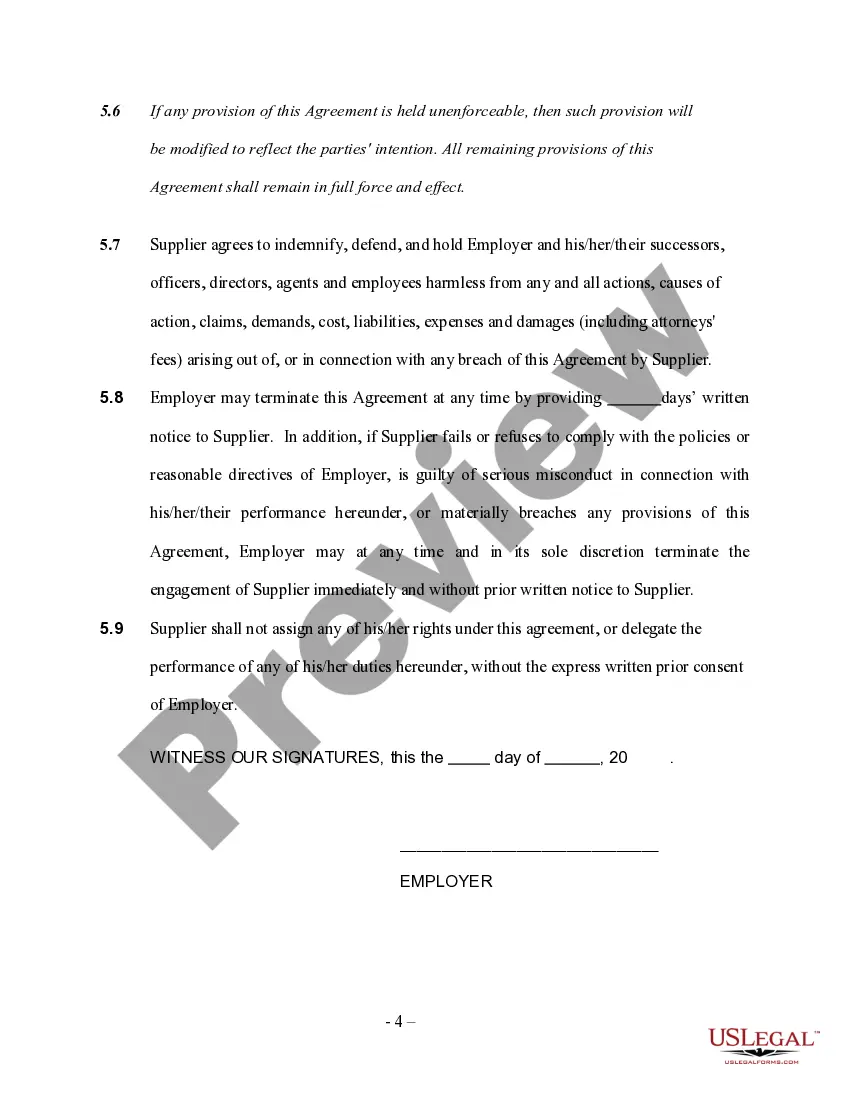

Colorado Self-Employed Supplier Services Contract

Description

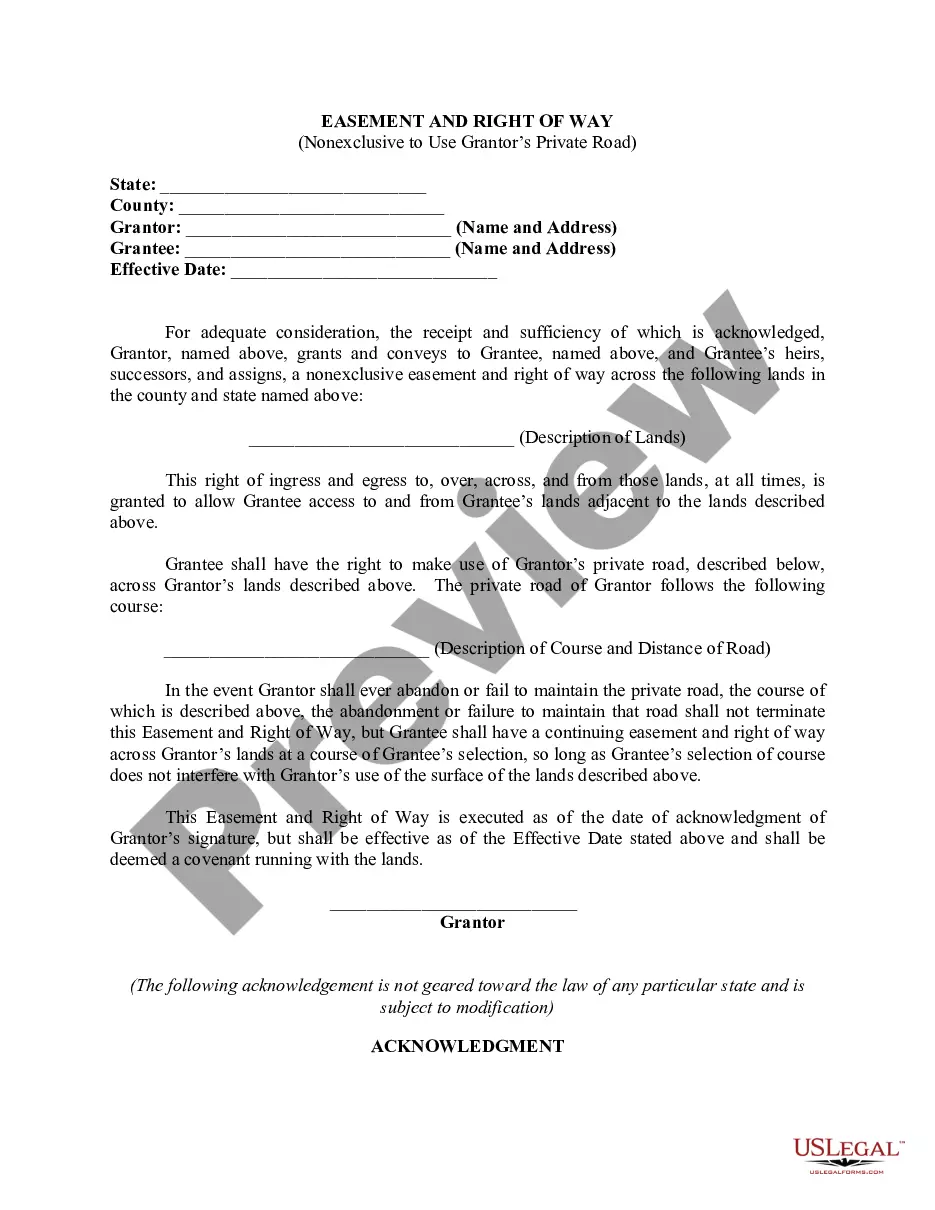

How to fill out Self-Employed Supplier Services Contract?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a range of legal form templates that you can download or print. Through the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Colorado Self-Employed Supplier Services Contract in just a few minutes.

If you already hold a monthly subscription, Log In and obtain the Colorado Self-Employed Supplier Services Contract from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

To use US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your city/state. Click the Preview button to review the details of the form. Check the form description to confirm that you have chosen the right form. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your information to register for an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your system. Make modifications. Fill out, edit, print, and sign the saved Colorado Self-Employed Supplier Services Contract. Each template you add to your account has no expiration date and is yours permanently. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Colorado Self-Employed Supplier Services Contract through US Legal Forms, the most extensive library of legal document templates.

- Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- Download and print forms with ease.

- Ensure accuracy by previewing and reviewing the form information.

- Retain access to all forms forever without expiry.

- Modify forms as needed to fit your specific situation.

Form popularity

FAQ

Setting up as a self-employed contractor involves several steps, starting with registering your business and obtaining any necessary licenses. You should also create a Colorado Self-Employed Supplier Services Contract to define your services and establish a professional relationship with clients. Additionally, consider setting up a separate bank account for your business transactions. Taking these steps will help you build a solid foundation for your self-employment journey.

To qualify as an independent contractor, a vendor must demonstrate that they operate independently and control how they perform their work. Key factors include having a distinct business identity and the ability to set their own hours. Utilizing a Colorado Self-Employed Supplier Services Contract can further clarify the vendor's role and responsibilities. This contract serves as a reference point for both parties, ensuring compliance with legal standards.

Absolutely, having a contract as a self-employed individual is not only possible but highly recommended. A Colorado Self-Employed Supplier Services Contract can provide a clear framework for your business arrangements. This contract outlines your services, payment terms, and deadlines, helping to mitigate disputes. It gives both you and your clients peace of mind.

Filing taxes for independent contract work involves reporting your income on Schedule C of your tax return. You will need to keep track of your earnings and expenses throughout the year, as these can impact your tax liability. Using a Colorado Self-Employed Supplier Services Contract can help you maintain accurate records of contracts and payments received. It’s wise to consult a tax professional to ensure compliance with IRS regulations.

Yes, contract work does count as self-employment. When you take on contract projects, you are essentially running your own business, even if you work for others. Many self-employed individuals utilize a Colorado Self-Employed Supplier Services Contract to define the scope of their work and protect their interests. This arrangement offers flexibility and the potential for diverse income streams.

The terms 'self-employed' and 'contracted' relate to how individuals work and earn income. A self-employed individual operates their own business, while a contracted worker provides services to another business under specific terms. In many cases, those who are self-employed may use a Colorado Self-Employed Supplier Services Contract to formalize their agreements with clients. Understanding this distinction can help you navigate your business relationships more effectively.

Yes, a self-employed person can certainly have a contract. In fact, a Colorado Self-Employed Supplier Services Contract is essential for outlining the terms of work and responsibilities. This contract protects both parties involved and ensures clarity in the business relationship. Establishing a contract can help prevent misunderstandings and legal issues down the line.

Freelancing without a contract is possible but risky. A Colorado Self-Employed Supplier Services Contract protects both you and your client by defining the work scope, payment terms, and deadlines. Without this document, you may encounter payment disputes or misunderstandings about project expectations. It’s best practice to always have a contract in place to secure your freelance work.

While Colorado does not legally require LLCs to have an operating agreement, it is highly advisable. An operating agreement clarifies the management structure and operational processes of your LLC. If you are self-employed, a Colorado Self-Employed Supplier Services Contract can complement your operating agreement by detailing client relationships. This ensures smooth business operations.

Working without a contract can lead to various complications. If disputes arise, it becomes challenging to prove your agreements or expectations. A Colorado Self-Employed Supplier Services Contract can serve as a safeguard, outlining your rights and responsibilities clearly. It's best to avoid ambiguity by having a formal agreement in place.