Massachusetts Loan Modification Agreement (Fixed Interest Rate)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts Loan Modification Agreement (Fixed Interest Rate)?

Greetings to the most extensive repository of legal documents, US Legal Forms. Here you will discover any prototype such as Massachusetts Loan Modification Agreement (Fixed Interest Rate) models and obtain them (as many as you wish/require). Prepare formal documents in a few hours, instead of days or weeks, without the hefty expenditure of hiring an attorney. Acquire the state-specific template in a few clicks and feel confident knowing it was created by our state-certified legal experts.

If you’re an existing subscribed user, just sign in to your account and then click Download next to the Massachusetts Loan Modification Agreement (Fixed Interest Rate) that you need. Since US Legal Forms is internet-based, you’ll consistently have access to your downloaded files, regardless of the device you're using. Find them within the My documents section.

If you haven't created an account yet, what are you waiting for? Review our instructions below to get started.

Once you’ve completed the Massachusetts Loan Modification Agreement (Fixed Interest Rate), forward it to your lawyer for validation. It’s an additional step, but a crucial one for ensuring that you’re fully protected. Join US Legal Forms today and gain access to a multitude of reusable templates.

- If this is a state-specific document, verify its relevance in the state you reside in.

- Examine the description (if available) to determine if it’s the correct template.

- View more details using the Preview feature.

- If the sample fits your needs, simply click Buy Now.

- To create an account, select a pricing plan.

- Utilize a credit card or PayPal account to subscribe.

- Download the document in your desired format (Word or PDF).

- Print the document and complete it with your or your business's information.

Form popularity

FAQ

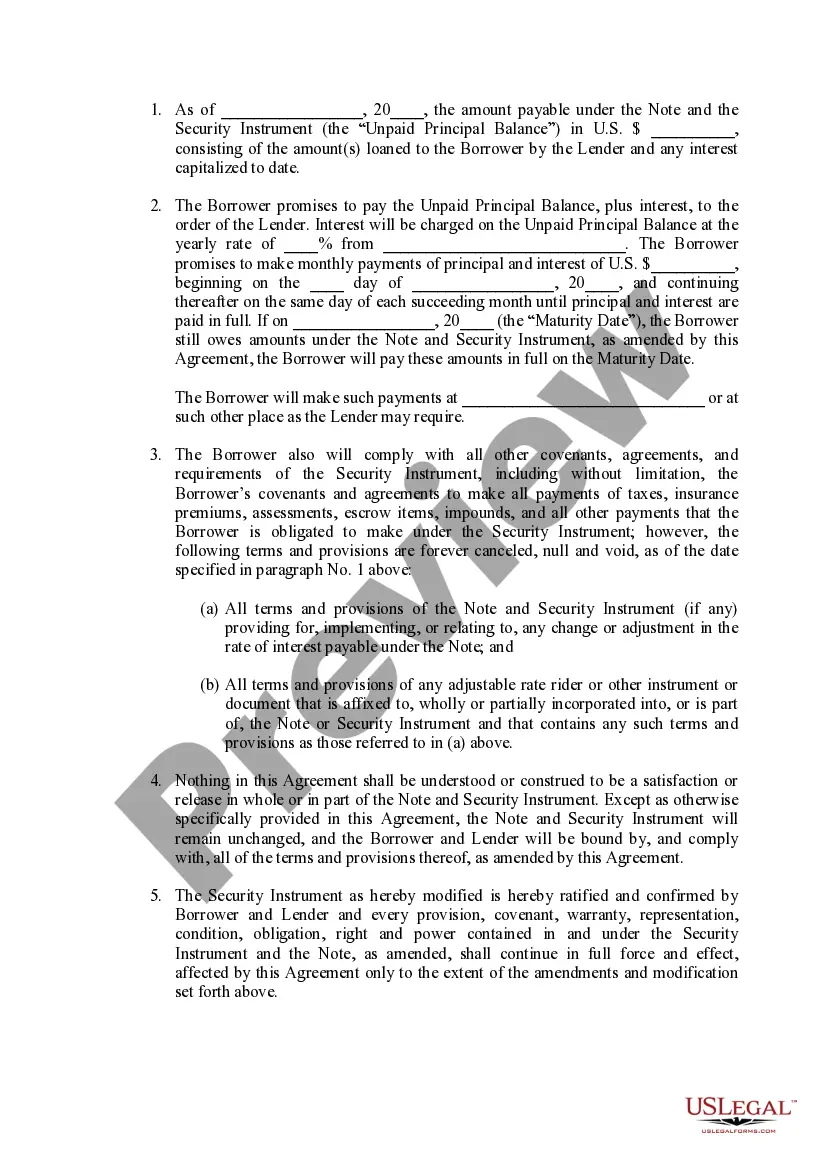

The rules for loan modification can vary, but several key points apply in Massachusetts. A Massachusetts Loan Modification Agreement (Fixed Interest Rate) typically must comply with state and federal laws to be valid. Factors such as borrower eligibility, documentation requirements, and process timelines are crucial. Utilizing platforms like US Legal Forms can help you access the necessary templates and guidance for meeting all legal obligations effectively.

Yes, a loan modification generally needs to be recorded to ensure it is legally recognized. When you enter a Massachusetts Loan Modification Agreement (Fixed Interest Rate), documenting the changes helps protect you and any future buyers or lenders. Recording the modification provides a clear record of current terms, preventing potential future disputes. It's advisable to consult with a professional to navigate this process effectively.

In Massachusetts, the maximum interest rate for a loan largely depends on the type of loan and the lender. Typically, for a Massachusetts Loan Modification Agreement (Fixed Interest Rate), the rate is subject to limits defined by state law. It's essential to review your specific agreement, as rates can significantly impact your financial obligations. Ensuring compliance with these regulations can lead to more manageable payments.

Yes, a mortgage loan modification can change your interest rate. For example, a Massachusetts Loan Modification Agreement (Fixed Interest Rate) typically allows you to secure a fixed interest rate, potentially lower than your original rate. This change can stabilize your monthly payments and provide long-term security. Before proceeding, consider the impact on your overall financial situation.

The 10 percent test for loan modification refers to the standard by which a lender reviews whether the modification will change the payment terms by at least 10%. This metric helps ensure that changes create long-term benefits for both parties. A Massachusetts Loan Modification Agreement (Fixed Interest Rate) that meets this criterion can offer significant advantages, making the payments more feasible and preventing future financial challenges.

The 2% rule for refinancing suggests that you should consider refinancing if the new interest rate is at least 2% lower than your existing rate. Applying this rule can help you save significantly over the loan term. However, when you choose a Massachusetts Loan Modification Agreement (Fixed Interest Rate), you may still achieve a more favorable rate without incurring refinancing costs. This approach allows for financial flexibility while maintaining a manageable payment plan.

Loan modifications are documented through a formal agreement between you and your lender. This documentation outlines the new terms and conditions, ensuring both parties are clear on the revised arrangement. When executing a Massachusetts Loan Modification Agreement (Fixed Interest Rate), it is crucial to retain copies of all documents for your records. This practice protects your interests and provides clarity moving forward.

When you pursue a loan modification, your lender reviews your financial situation. This assessment determines new terms, which may include a reduced interest rate or adjusted payment schedule. A Massachusetts Loan Modification Agreement (Fixed Interest Rate) allows you to settle on a fixed rate that can stabilize your monthly expenses. It's a step towards regaining financial control.

A mortgage loan modification often involves altering the terms of your existing loan to make payments more manageable. For instance, a Massachusetts Loan Modification Agreement (Fixed Interest Rate) may lower your monthly payments or extend the loan term. This change can provide financial relief and help you avoid foreclosure while keeping your home. Overall, it makes your loan more sustainable.

The maximum interest rate allowed by law in Massachusetts can vary based on the type of loan and the borrower's situation. For most consumer loans, Massachusetts law caps the interest rate at 20%. If you are considering a Massachusetts Loan Modification Agreement (Fixed Interest Rate), be sure to discuss interest terms with your lender to ensure compliance with state regulations. This ensures that you remain informed and protected.