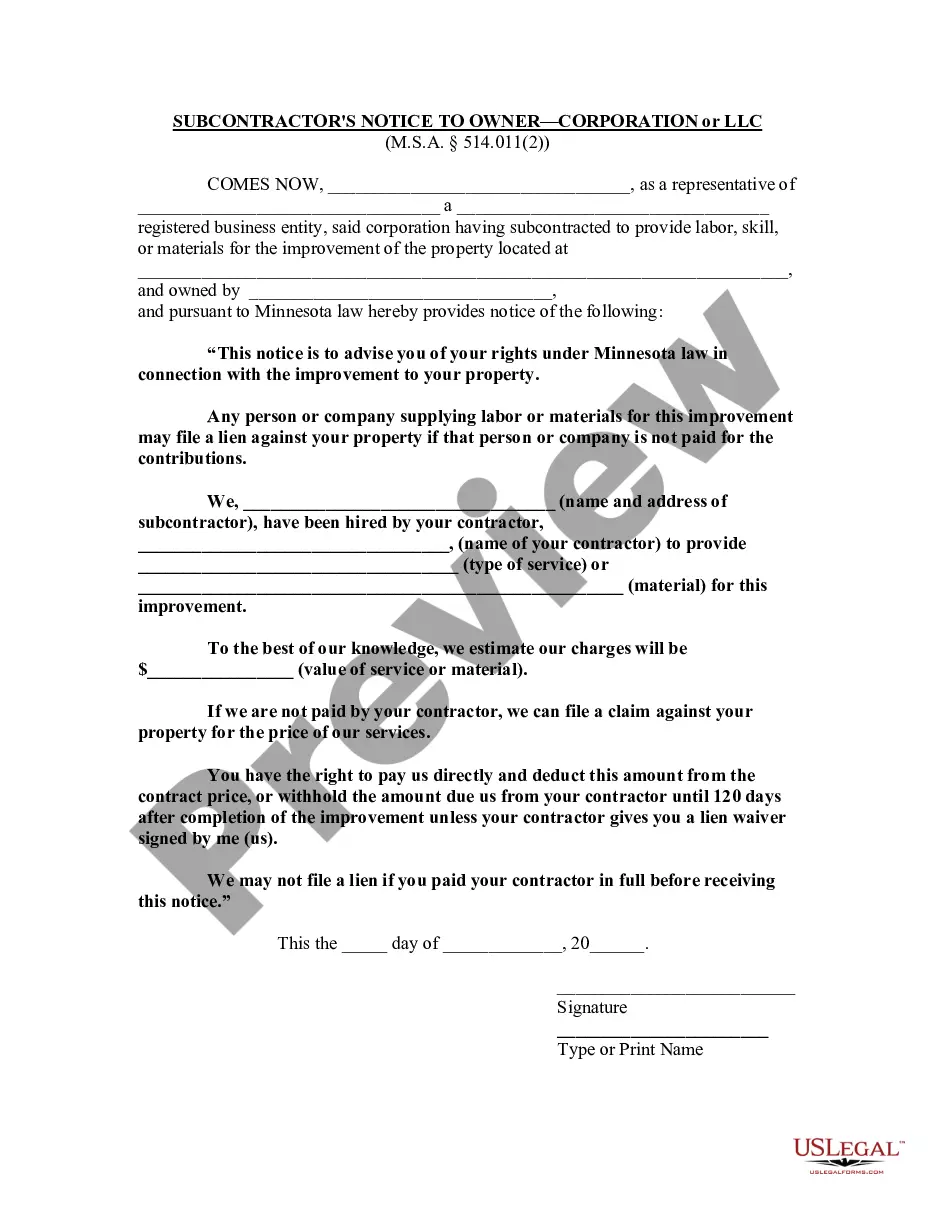

Minnesota statutes require a contractor to supply property owners for whom he provides labor, skill, or material, with a form notice as set out in M.S.A. § 514.011. This form notice serves to make the property owner aware that a lien may result from his work and that the owner may withhold payment for subcontractors and other similar parties. If the contractor has an actual contract with the owner, then the notice must be contained in the contract itself and a copy provided to the owner. If there is no contract, this form can be used to provide the appropriate notice. A contractor who does not provide the required notice may not claim a lien or any other remedies provided by statute.

Minnesota Contractor's Notice to Owner - Corporation or LLC

Description

How to fill out Minnesota Contractor's Notice To Owner - Corporation Or LLC?

Obtain any version from 85,000 legal records including Minnesota Contractor's Notice to Owner - Corporation or LLC online with US Legal Forms. Each template is crafted and revised by state-authorized legal experts.

If you already possess a subscription, Log In. Once you’re on the document’s page, click the Download button and proceed to My documents to gain access to it.

If you have not subscribed yet, follow these instructions: Check the state-specific prerequisites for the Minnesota Contractor's Notice to Owner - Corporation or LLC you wish to utilize. Review the description and preview the template. When you are certain the sample meets your needs, click on Buy Now. Select a subscription plan that suits your budget. Establish a personal account. Make payment using one of two suitable methods: credit card or PayPal. Choose a format to download the file in; two options are available (PDF or Word). Download the document to the My documents section. After your reusable form is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have instant access to the suitable downloadable template. The platform offers access to documents and categorizes them to simplify your search. Utilize US Legal Forms to acquire your Minnesota Contractor's Notice to Owner - Corporation or LLC quickly and effortlessly.

- Obtain any version from 85,000 legal records including Minnesota Contractor's Notice to Owner - Corporation or LLC online with US Legal Forms.

- Each template is crafted and revised by state-authorized legal experts.

- If you already possess a subscription, Log In.

- Click the Download button and proceed to My documents to gain access to it.

- If you have not subscribed yet, follow these instructions.

- Check the state-specific prerequisites for the Minnesota Contractor's Notice to Owner - Corporation or LLC.

- Review the description and preview the template.

- When you are certain the sample meets your needs, click on Buy Now.

- Select a subscription plan that suits your budget.

Form popularity

FAQ

Expected filing schedule (monthly, quarterly, or annual). Accounting method (cash or accrual) Any local or special local taxes that may apply to your business.

A limited liability company (LLC) is a popular business form for small businesses because it protects their owners, called members, from personal liability.Once formed, the company generally exists indefinitely and can operate for as long as desired. When the owners want to close the business, they must dissolve it.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements. File Annual Renewals.

For example, in California an LLC expires when the members unanimously consent to file a certificate of cancellation. After the certificate is filed, registration of the LLC will be canceled and all of its powers, rights and privileges will cease.

Every Minnesota LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Get Started. 2022 Search your LLC. Search for your LLC at the top of the page. Click File Amendment/Renewal. At the top of your LLC's record page, click the File Amendment/Renewal link. Manager. Principal Executive Office Address.

How much does it cost to form an LLC in Minnesota? The Minnesota Secretary of State charges $135 to file the Articles of Organization by mail and $155 to file online or in-person. You can file an LLC name reservation for $50 if filed by mail and $55 if filed online or in-person.

All LLCs doing business in Minnesota must file an Annual Renewal each year.You need to file an Annual Renewal in order to keep your LLC in compliance and in good standing with the state of Minnesota. You can file your LLC's Annual Renewal by mail or online.

200bThe LLC annual fee is an ongoing fee paid to the state to keep your LLC in compliance and in good standing. It's usually paid every 1 or 2 years, depending on the state. This fee is required, regardless of your LLC's income or activity. Said another way: you have to pay this.