Colorado Contractor Agreement

Description

How to fill out Contractor Agreement?

It is feasible to spend time online trying to locate the legal document template that suits the federal and state requirements you will need.

US Legal Forms offers a vast collection of legal templates which can be assessed by professionals.

You can conveniently download or print the Colorado Contractor Agreement from my service.

In order to find another version of the document, utilize the Search field to locate the template that meets your specifications. Once you have found the template you want, click Get now to proceed. Choose the pricing plan you prefer, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make edits to the document if needed. You can fill out, modify, sign, and print the Colorado Contractor Agreement. Acquire and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you have a US Legal Forms account, you may Log In and then click the Acquire button.

- After that, you can fill out, modify, print, or sign the Colorado Contractor Agreement.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If this is your first time on the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for your county/city of choice.

- Check the form description to make sure you have chosen the right template.

Form popularity

FAQ

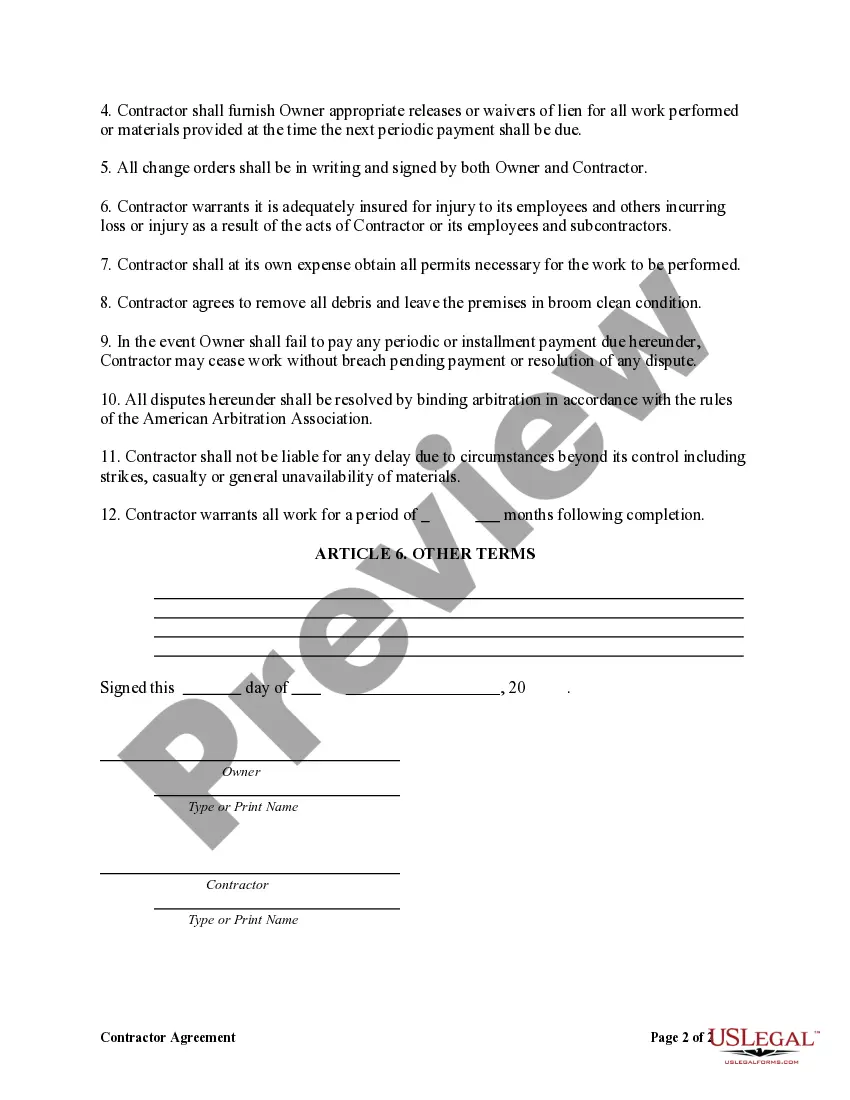

structured Colorado Contractor Agreement should clearly define the scope of work, payment terms, and timelines. It should include contact information for both parties and relevant legal language to protect their rights. Visual clarity, such as headings and bullet points, can enhance readability. This document acts as a professional guide for the work relationship, ensuring everyone is on the same page.

Contractors typically need to complete a Colorado Contractor Agreement, which serves as the foundation for their working relationship with clients. They may also be required to fill out tax forms and any necessary licensing applications. Furthermore, depending on the project, contractors might need to provide proof of insurance or other certifications. Proper paperwork is essential to protect both parties and ensure the project runs smoothly.

An independent contractor in Colorado must comply with state regulations, which include obtaining the appropriate business licenses and permits specific to their trade. They should also have a clear Colorado Contractor Agreement in place that outlines their responsibilities and obligations. Additionally, understanding tax regulations is crucial, as independent contractors must manage their own taxes and insurance. Following these guidelines ensures compliance and facilitates successful contractor-client partnerships.

To write a simple Colorado Contractor Agreement, start by clearly outlining the parties involved, their roles, and the services being provided. Include specific details about payment terms, deadlines, and any relevant legal requirements. Make sure both parties sign the document to ensure its validity. This clarity helps prevent disputes and fosters a smooth working relationship.

Independent contractors in Colorado must comply with various regulations, including licensing and tax obligations. They should provide a clear Colorado Contractor Agreement to outline their terms of service, duties, and compensation. Being transparent about expectations not only fosters trust but also protects against potential legal issues. For an easier way to draft a compliant agreement, consider using platforms like uslegalforms.

A valid contract in Colorado requires an offer, acceptance, consideration, and the intent to create a legal relationship. Furthermore, it must not violate public policy and should be clear in terms. Having a detailed Colorado Contractor Agreement lays the groundwork for a solid contractual relationship and ensures fair dealings between all parties involved.

Colorado does not classify as a no idle state, meaning parties can have their contracts enforced under certain conditions. It is important for independent contractors to stay proactive and fulfill their obligations outlined in their Colorado Contractor Agreement. Being diligent helps maintain strong working relationships and ensures compliance with state laws.

Yes, noncompete clauses can be legal in Colorado, but they have strict limitations. Under Colorado law, these clauses must protect legitimate business interests and cannot be overly broad. When drafting your Colorado Contractor Agreement, consider including enforceable noncompete terms that comply with state regulations. This ensures your agreement is effective and legally sound.

Colorado is not a no notice state. Certain legal situations may require notice to the parties involved. In the context of a Colorado Contractor Agreement, providing notice can outline what a party expects from others, avoiding misunderstandings. It is wise to check local law to ensure compliance with any notice requirements.

No, Colorado is not a no contract state. Contracts are generally enforceable in Colorado, provided they meet certain legal requirements. A proper Colorado Contractor Agreement can clearly define the rights and responsibilities of all parties involved. Utilizing a well-crafted agreement minimizes disputes and protects your interests.