Colorado Hourly Employee Evaluation

Description

How to fill out Hourly Employee Evaluation?

Are you presently in a circumstance that requires documents for either business or personal purposes almost every day.

There are numerous valid document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms provides thousands of form templates, such as the Colorado Hourly Employee Evaluation, designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Afterward, you can download the Colorado Hourly Employee Evaluation template.

- If you don't have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it corresponds to the correct city/state.

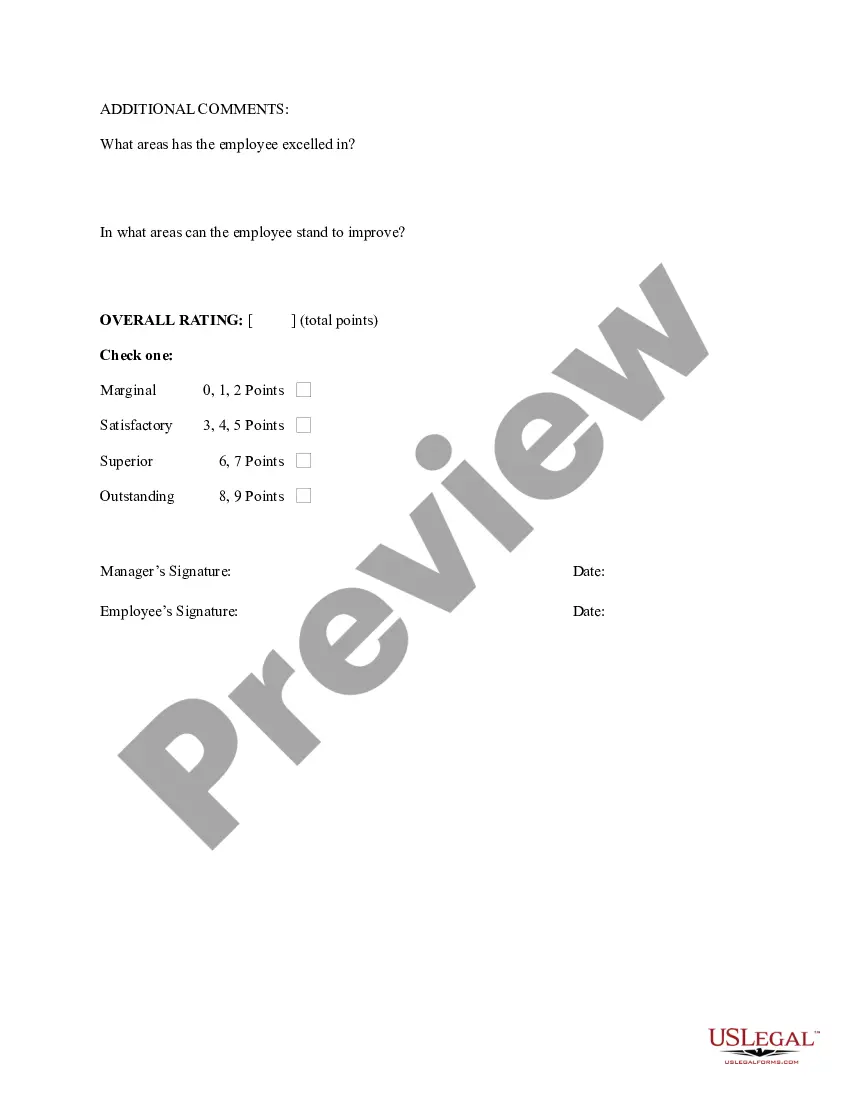

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to locate the form that meets your needs and specifications.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you desire, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Retrieve all of the document templates you have purchased in the My documents section. You can access an additional copy of Colorado Hourly Employee Evaluation whenever you like. Just click on the desired form to download or print the document template.

Form popularity

FAQ

Colorado: Colorado's Equal Pay for Equal Work Act prohibits employers from discriminating on the basis of sex by paying less for substantially similar work. The Act also prevents employers from seeking or relying on an applicant's wage history to make wage decisions.

The right not to be subjected to harassment, such as sexual harassment. The right to be paid proper overtime. The right to be treated fairly regardless of age, disability, gender, national origin, pregnancy, race, and/or religion.

The Colorado Wage Transparency Act, prohibits an employer from taking adverse actions against employees who discuss their wages with others.

Under the Colorado Overtime and Minimum Pay Standards Order (COMPS),an employer may deduct from an employee's wages only charges required by law, permitted by law, or authorized by the employee.

In fact, employees' right to discuss their salary is protected by law. While employers may restrict workers from discussing their salary in front of customers or during work, they cannot prohibit employees from talking about pay on their own time.

No, only if you've agreed to keep your salary secret in your employment contract. While your salary is your personal information, the Privacy Act doesn't require you to keep it confidential.

Reducing pay would be a variation of an employees' contract of employment. Employers cannot unilaterally vary a contract of employment. This decision is therefore one the employees in question would need to consent to. They are not obliged to give their consent, and, could take legal action to prevent such a change.

Under the Colorado Overtime and Minimum Pay Standards Order (COMPS),an employer may deduct from an employee's wages only charges required by law, permitted by law, or authorized by the employee.

Colorado Wage Transparency Act In Colorado's 2008 Wage Transparency Act (S.B. 122), Colorado employers are prohibited from retaliating against employees for sharing wage information and from requiring employees to sign document purporting to deny the right to discuss pay information.

Asking how much money a job candidate previously made is illegal in a growing number of states and municipalities, and in 2021, Colorado. To combat wage discrimination, the Centennial State will begin enforcing a ban on salary history questions on Jan. 1, 2021.